- Home

- »

- Green Building Materials

- »

-

Natural Fiber Composites Market Size, Industry Report, 2033GVR Report cover

![Natural Fiber Composites Market Size, Share & Trends Report]()

Natural Fiber Composites Market (2026 - 2033) Size, Share & Trends Analysis Report By Raw Material (Wood, Cotton, Flax), By Matrix (Inorganic Compound, Natural Polymer, Synthetic Polymer), By Technology, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-890-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Natural Fiber Composites Market Summary

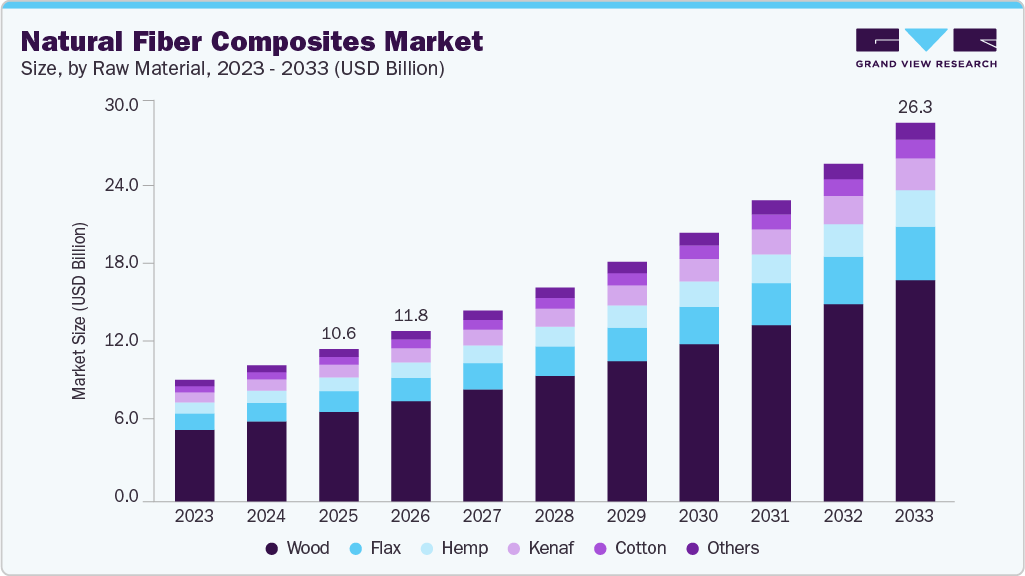

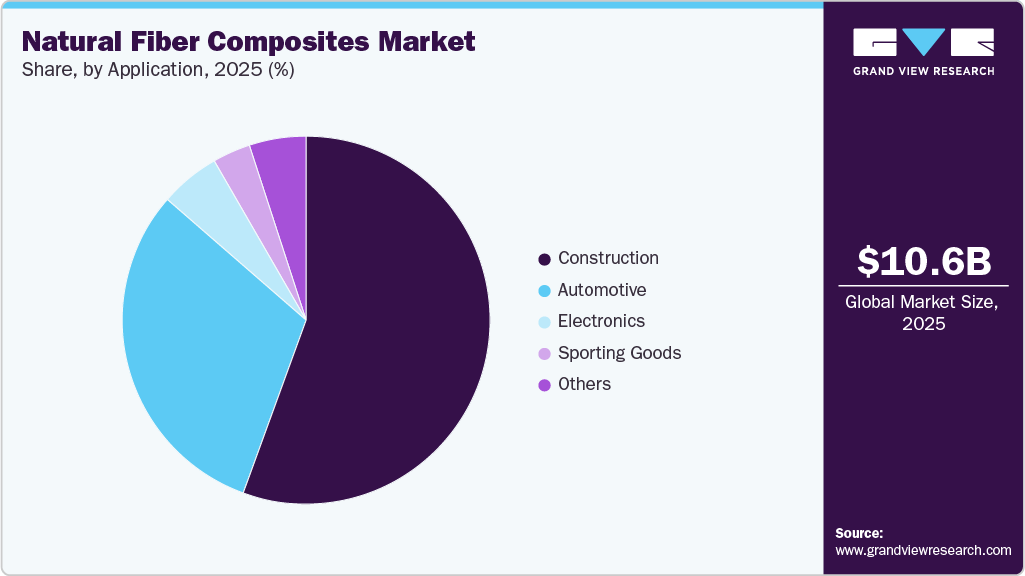

The global natural fiber composites market size was estimated at USD 10.57 billion in 2025 and is projected to reach USD 26.31 billion by 2033, growing at a CAGR of 12.1% from 2026 to 2033. Chief among market drivers is the heightened focus on sustainability and environmental awareness. As consumers and industries prioritize reducing their ecological impact, the demand for eco-friendly materials has risen significantly.

Key Market Trends & Insights

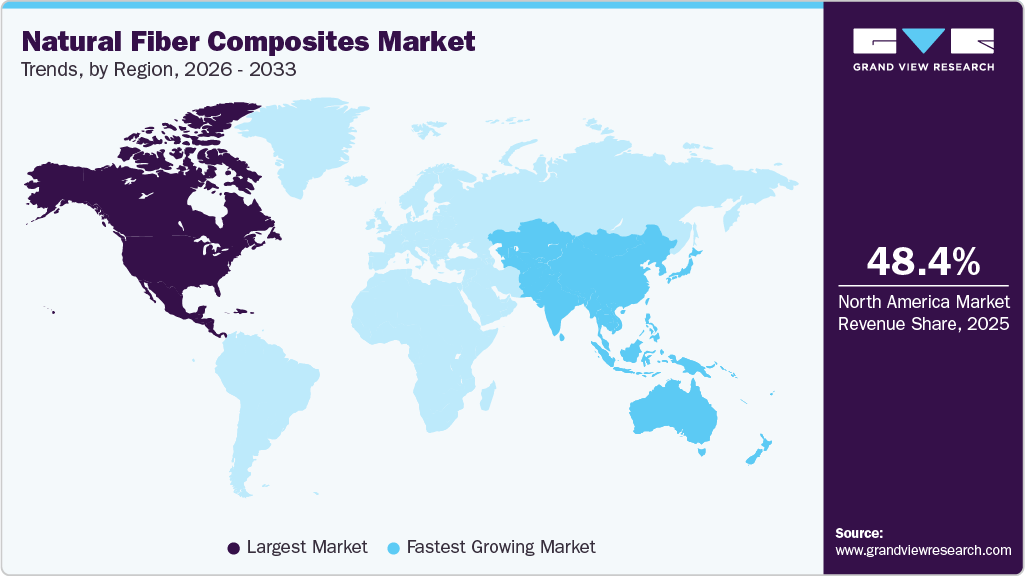

- North America dominated the natural fiber composites (NFC) market with the largest revenue share of 48.4% in 2025.

- By raw material, the hemp segment is expected to grow at the fastest CAGR of 12.9% over the forecast period.

- By matrix, the natural polymer segment is expected to grow at the fastest CAGR of 12.5% over the forecast period.

- By technology, the injection molding segment is expected to grow at the fastest CAGR of 12.8% over the forecast period.

- By application, the sporting goods segment is expected to grow at the fastest CAGR of 13.8% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 10.57 Billion

- 2033 Projected Market Size: USD 26.31 Billion

- CAGR (2026-2033): 12.1%

- North America: Largest market in 2025

- Asia Pacific: Fastest market in 2025

Natural fibers, being biodegradable and renewable, offer a compelling alternative to less sustainable traditional synthetic composites, enhancing the appeal of natural fiber composites (NFC) across various sectors.Governments worldwide have implemented stricter environmental regulations and launched initiatives to promote sustainable manufacturing practices. This policy framework is particularly influential in industries such as automotive and construction, where compliance with environmental standards is paramount. These regulations incentivize the use of natural fiber composites and reinforce the market’s momentum as companies seek to align their operations with evolving legal requirements.

With superior strength, stiffness, and excellent thermal and acoustic insulation, NFCs are well-suited for a variety of applications, ranging from automotive parts to construction materials and consumer goods. Manufacturers are keen to leverage these attributes, knowing that integrating natural fiber composites into their product offerings can enhance performance while maintaining a commitment to sustainability.

Natural fibers often offer a more economical option than synthetic alternatives, enabling manufacturers to balance performance with budgetary constraints. This economic advantage is particularly pertinent as the automotive industry pivots towards lightweight materials to enhance fuel efficiency and reduce emissions. Coupled with rising consumer preferences for sustainable products, the natural fiber composites market stands poised for continued expansion, reflecting both an evolution in material preferences and a commitment to environmentally responsible practices.

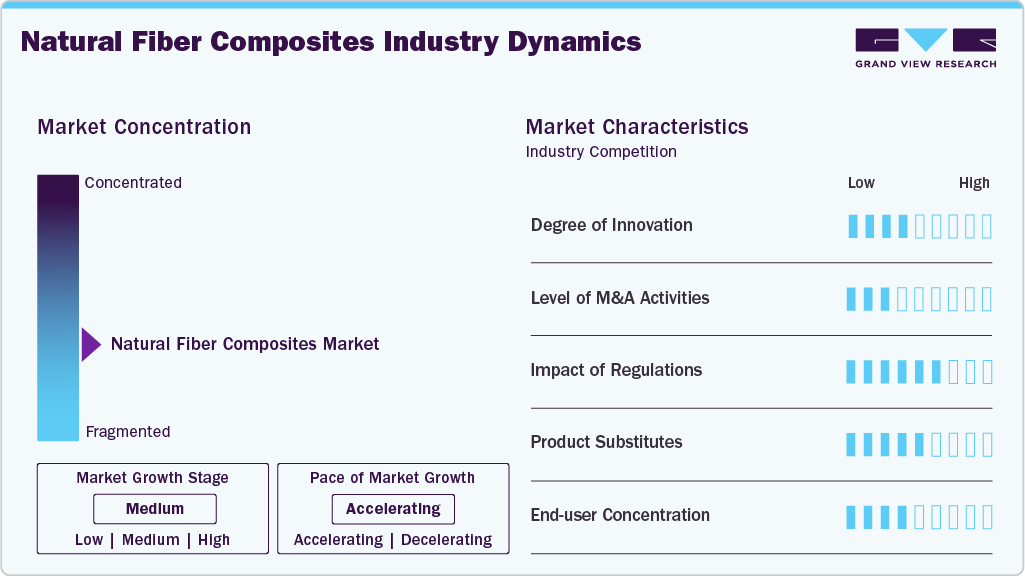

Market Concentration & Characteristics

The NFC market exhibits moderate concentration, with a mix of global leaders and smaller innovative players shaping competitive dynamics. Major companies like FlexForm, UPM, TECNARO, and Trex hold notable market shares, especially in regions with high sustainability demand. However, the industry remains open to new entrants due to diverse raw material sources and growing global adoption. North America historically has the largest share, supported by strong manufacturing infrastructure and early adoption of bio-composites, while the Asia Pacific is rapidly gaining ground due to expanding automotive and construction activity.

The principal substitutes for natural fiber composites are synthetic fiber composites (e.g., glass fiber and carbon fiber) and traditional materials such as metals and plastics. While synthetic composites often outperform NFCs in absolute mechanical strength, their higher environmental impact and regulatory challenges create opportunities for NFC adoption. The threat from substitutes persists primarily in high-performance applications where durability and uniformity are critical. Nonetheless, ongoing innovations in NFC formulations and hybrid composites are steadily narrowing this performance gap, reducing the substitution threat over time.

Raw Material Insights

Wood dominated the market and accounted for a share of 58.8% in 2025, owing to its abundant availability, cost-effectiveness, and favorable mechanical properties. As a renewable resource, wood composites are increasingly preferred in the construction and automotive sectors due to their superior strength-to-weight ratio, appealing to both environmentally conscious consumers and manufacturers.

Hemp is expected to grow at the fastest CAGR of 12.9% over the forecast period, driven by hemp’s exceptional strength, lightweight characteristics, and eco-friendliness. Its versatility enables broad applications in the automotive and construction industries, while heightened consumer awareness of sustainable materials further accelerates hemp’s adoption as a leading natural fiber composite.

Matrix Insights

Inorganic compounds held the largest revenue share of 41.8% in 2025 due to superior thermal stability and mechanical strength, which are essential in demanding applications within the construction and automotive sectors. These characteristics underscore their preference in industries where performance and durability are critical.

Natural polymer is expected to register the fastest CAGR of 12.5% over the forecast period, driven by its biodegradability and compatibility with diverse natural fibers. As industries increasingly seek sustainable alternatives to synthetic polymers, natural polymers present an attractive solution that satisfies regulatory requirements while advancing environmental sustainability.

Technology Insights

Compression molding led the market with a revenue share of 76.4% in 2025, owing to its efficiency in producing complex shapes with minimal waste. This method enables high-volume production while maintaining consistent quality, making it particularly appealing for manufacturers aiming to meet the escalating demand across various applications, especially in the automotive and construction sectors.

Injection molding is expected to register the fastest CAGR of 12.8% over the forecast period. Injection molding helps produce intricate designs with high precision and reduced cycle times. As manufacturers increasingly adopt this innovative technology for sustainable product development, injection molding emerges as the preferred choice for creating high-performance components across diverse industries.

Application Insights

The construction segment dominated the market with a substantial share in 2025. Natural fiber composites provide exceptional thermal insulation while minimizing the environmental impact of construction projects, aligning with green building certifications that encourage the use of eco-friendly materials, thereby enhancing their market position.

Sporting goods are projected to grow at the fastest rate over the forecast period. Natural fiber composites offer lightweight and durable options for various sporting applications, attracting environmentally conscious athletes and manufacturers seeking to enhance product performance while reducing ecological footprints.

Regional Insights

The North America natural fiber composites (NFC) industry dominated the global market with a revenue share of 48.4% in 2025, driven by early adoption of sustainable materials and strong environmental awareness. The region benefits from well-established manufacturing infrastructure and advanced research capabilities in composite technologies. Automotive manufacturers actively use NFCs to achieve lightweighting targets and improve fuel efficiency. The construction sector also contributes to demand, particularly in green building applications. Regulatory pressure to reduce plastic usage and carbon emissions further accelerates NFC integration. Continuous innovation and partnerships between material suppliers and OEMs support long-term market growth.

U.S. Natural Fiber Composites (NFC) Market Trends

The U.S. natural fiber composites (NFC) industry is driven by strong demand from the automotive, building materials, and consumer goods sectors. Manufacturers are increasingly utilizing natural fiber composites to fulfill their sustainability commitments and enhance product lifecycle performance. Green building standards and eco-label certifications encourage the use of renewable composite materials in construction applications. The presence of leading composite manufacturers and material innovators supports steady technological advancements. Additionally, increasing consumer preference for environmentally responsible products boosts NFC adoption. Ongoing R&D investments aim to enhance the durability and moisture resistance of natural fiber composites.

Europe Natural Fiber Composites (NFC) Market Trends

The natural fiber composites (NFC) industry in Europe remains a mature and innovation-driven market for natural fiber composites, supported by strict environmental regulations and circular economy policies. Automotive manufacturers extensively use NFCs in interior panels, trims, and structural components to meet emission reduction targets. The construction sector is increasingly incorporating NFCs into insulation and structural applications due to sustainability benefits. Strong collaboration between research institutes and industry players drives continuous material innovation. Rising focus on bio-based and recyclable materials further strengthens market demand. Europe’s regulatory landscape plays a critical role in accelerating NFC adoption.

The Germany natural fiber composites (NFC) industry is a key contributor to the Europe market, primarily driven by its strong automotive and engineering industries. German automakers are actively adopting natural fiber composites to reduce vehicle weight and enhance their sustainability performance. The country’s advanced R&D ecosystem supports innovation in fiber treatment and composite processing technologies. Strict environmental compliance requirements further encourage the shift toward bio-based materials. Additionally, Germany’s focus on sustainable industrial practices boosts NFC usage in construction and industrial applications. Continuous investments in high-performance natural composites sustain long-term market growth.

Asia Pacific Natural Fiber Composites (NFC) Market Trends

The natural fiber composites (NFC) industry in the Asia Pacific is expected to register the fastest CAGR of 13.9% over the forecast period due to rapid industrialization, rising automotive production, and increasing emphasis on sustainable materials across manufacturing sectors. Countries such as China, India, and Japan benefit from the abundant availability of natural fibers, including jute, bamboo, and kenaf, which support localized and cost-effective production. Growing construction activity and infrastructure development further drive demand for eco-friendly composite materials. Automotive OEMs in the region are increasingly adopting NFCs to reduce vehicle weight and meet fuel efficiency standards. Supportive government initiatives promoting renewable materials also strengthen market expansion. The presence of low-cost labor and expanding processing capacities further enhances the Asia Pacific’s leadership position.

The China natural fiber composites (NFC) industry represents a key growth engine for the NFC market, supported by a strong government focus on sustainability and green manufacturing practices. The country’s automotive sector is increasingly integrating natural fiber composites into interior components to comply with lightweighting and emission-reduction mandates. Rapid urbanization and large-scale infrastructure projects are boosting demand for sustainable construction materials. China’s extensive agricultural base ensures a steady supply of natural fibers, thereby reducing reliance on imported raw materials. Ongoing investments in material processing technologies and composite R&D are improving product performance. As a result, NFC adoption is steadily expanding across automotive, construction, and consumer goods applications.

Latin America Natural Fiber Composites (NFC) Market Trends

The natural fiber composites (NFC) industry in Latin America is gradually expanding, driven by increasing construction activity and growing awareness of sustainable materials. Countries with strong agricultural sectors benefit from abundant natural fiber availability, supporting local composite production. The automotive sector is showing growing interest in lightweight, eco-friendly components. Infrastructure development and urban housing projects further contribute to demand growth. However, the limited processing infrastructure slightly restrains faster adoption. Ongoing industrial development and sustainability initiatives are expected to improve market penetration over time.

Middle East & Africa Natural Fiber Composites (NFC) Market Trends

The natural fiber composites (NFC) industry in the Middle East & Africa region is an emerging market, supported by rising infrastructure development and growing sustainability awareness. Construction activities in urban and commercial projects create potential demand for eco-friendly composite materials. The availability of natural fibers in certain African countries provides raw material advantages. Governments are increasingly promoting green building practices, creating opportunities for NFC adoption. However, limited technical expertise and processing facilities currently restrict large-scale usage. With growing investment in sustainable construction and manufacturing, demand for NFC is expected to increase steadily.

Key Natural Fiber Composites (NFC) Company Insights

Some key companies operating in the market include Flexform SpA, Procotex, TECNARO GMBH, and UPM, among others. Companies are prioritizing strategic initiatives, including product innovation, sustainability enhancement, and expanded manufacturing capabilities, to address increasing demand from the automotive and construction sectors while complying with environmental regulations.

-

TECNARO GMBH specializes in bio-based composite materials, particularly natural fiber composites from renewable resources, developing innovative and sustainable solutions for automotive and construction applications that replace conventional plastics while ensuring high performance and reduced environmental impact.

-

Trex Company, Inc. is a leading manufacturer of composite decking and outdoor products crafted from recycled materials, including natural fibers. Their wood-plastic composites enhance durability and weather resistance, catering to eco-conscious consumers seeking sustainable, high-performance solutions for landscaping and construction.

Key Natural Fiber Composites (NFC) Companies:

The following key companies have been profiled for this study on the natural fiber composites market.

- Flexform SpA

- Procotex

- TECNARO GMBH

- UPM

- Trex Company, Inc.

- Bcomp

- Polyvlies Franz Beyer GmbH

- Green Dot Bioplastics

Recent Developments

-

In May 2024, CUPRA integrated Bcomp’s innovative natural fiber composites into the CUP Bucket seats of the Born VZ electric vehicle, achieving a 49% reduction in CO2 emissions compared to previous models.

-

In March 2024, UPM launched its UPM Solargo biostimulant product range, providing a sustainable alternative to traditional fertilizers, enhancing crop yield, and reducing reliance on nitrogen, phosphorus, and potassium-based products.

Natural Fiber Composites (NFC) Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 11.83 billion

Revenue forecast in 2033

USD 26.31 billion

Growth rate

CAGR of 12.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Raw material, matrix, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India

Key companies profiled

Flexform SpA; Procotex; TECNARO GMBH; UPM; Trex Company, Inc.; Bcomp; Polyvlies Franz Beyer GmbH; Green Dot Bioplastics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Fiber Composites Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global natural fiber composites (NFC) market report based on raw material, matrix, technology, application, and region:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Wood

-

Cotton

-

Flax

-

Kenaf

-

Hemp

-

Others

-

-

Matrix Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Inorganic Compound

-

Natural Polymer

-

Synthetic Polymer

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Injection Molding

-

Compression Molding

-

Pultrusion

-

Others (Extrusion, SMC, RTM)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Electronics

-

Sporting Goods

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The compression molding segment led the market, accounting for a 76.4% revenue share in 2025, due to its efficiency in producing complex shapes with minimal waste.

b. Some of the key players operating in the natural fiber composites (NFC) market include Flexform SpA, Procotex, TECNARO GmbH, UPM, Trex Company, Inc., Bcomp, Polyvlies Franz Beyer GmbH, and Green Dot Bioplastics.

b. The global natural fiber composites market size was estimated at USD 10.57 billion in 2025 and is expected to reach USD 11.83 billion in 2026.

b. The global natural fiber composites market is expected to grow at a compound annual growth rate of 12.1% from 2026 to 2033 to reach USD 26.31 billion by 2033.

b. Rising demand for sustainable, lightweight, and low-carbon materials, driven by stringent environmental regulations, automotive lightweighting requirements, and growing green construction adoption, is the key factor driving the natural fiber composites (NFC) market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.