- Home

- »

- Food Safety & Processing

- »

-

Natural Food Preservatives Market Size, Share Report, 2030GVR Report cover

![Natural Food Preservatives Market Size, Share & Trends Report]()

Natural Food Preservatives Market Size, Share & Trends Analysis Report By Product (Edible Oil, Rosemary Extracts, Natamycin, Vinegar, Chitosan), By Function (Antimicrobial, Antioxidant), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-259-1

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Natural Food Preservatives Market Trends

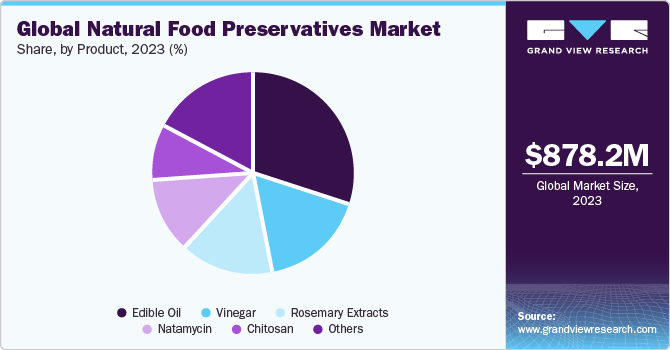

The global natural food preservatives market size was estimated at USD 878.2 million in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. The demand for natural food preservatives is primarily driven by the health and wellness trends, and the clean-label movement. Consumers are becoming increasingly conscious of the ingredients used in their food and are seeking alternatives to synthetic preservatives that are perceived as artificial or potentially harmful.

This growing awareness has fueled the demand for natural preservatives, which are perceived as safer and more wholesome options for food preservation. As a result, manufacturers are responding to consumer preferences by reformulating products with natural preservatives and emphasizing their natural origins in marketing strategies.

The clean-label movement, characterized by a desire for transparency and simplicity in food ingredients, has reshaped consumer preferences and purchasing behavior. Consumers are scrutinizing ingredient lists and avoiding artificial additives and preservatives. Natural food preservatives align with the clean-label ethos by offering recognizable and minimally processed alternatives to synthetic preservatives.

As per Innova's Health and Nutrition Survey (2022), about two-thirds of consumers indicate that clean label claims play a significant role in influencing their purchasing decisions. Moreover, nearly half of global consumers are open to paying a premium for products featuring clean labels, with Asian consumers showing an even greater inclination to do so. Despite the impact of inflation, a substantial 78% of global consumers express their willingness to spend extra on products with clean label attributes. This finding highlights consumer’s unwavering commitment to transparency and natural ingredients, even amid economic uncertainties.

Natural preservatives not only extend the shelf life of food products but also help preserve flavor, texture, and nutritional content. Consumers value products that maintain freshness and quality without compromising on taste or sensory attributes. Natural preservatives, such as plant extracts and antioxidant-rich ingredients, contribute to flavor retention and product stability.

Increasing awareness of environmental issues has prompted consumers to prioritize sustainability in their purchasing decisions. Natural food preservatives, sourced from renewable and eco-friendly ingredients, resonate with environmentally conscious consumers who seek products that minimize environmental impact throughout the supply chain.

Market Concentration & Characteristics

The degree of innovation in the market is high, as manufacturers are constantly innovating, improving, and diversifying their product offerings to meet the changing demands of consumers worldwide. Increasing consumer demand for clean-label, minimally processed foods drives innovation in natural food preservatives. Consumers seek products with recognizable and natural ingredients, prompting manufacturers to explore innovative solutions that meet these preferences. Advances in food science and technology have enabled the development of new and improved natural preservatives. Innovations in extraction techniques, formulation methods, and ingredient sourcing are allowing manufacturers to create preservatives that are more effective, stable, and versatile.

For instance, in November 2022, Prinova Europe introduced PlantGuard AM, a powerful plant-based antimicrobial designed to combat the growth of yeasts, molds, and bacteria. This innovative solution caters to the rising demand for natural preservatives in the food industry. As the newest member of Prinova Europe's botanical-derived preservative range, PlantGuard AM offers manufacturers a clean-label solution to reduce food waste.

Companies focus on strategic acquisitions to expand their presence overseas and reinforce their position in the market. Over the next few years, internationally reputed companies are likely to acquire small-and medium-sized companies operating in the industry in a bid to facilitate regional expansion.

Regulatory agencies' close examination of synthetic preservatives and their focus on natural and clean-label ingredients are significant drivers of innovation in the market. Manufacturers are compelled to adhere to regulatory standards while simultaneously addressing consumer demands for safe, natural, and transparent food products. This regulatory scrutiny prompts manufacturers to explore alternative preservation methods and ingredients that align with consumer preferences and regulatory guidelines. As a result, there is a growing emphasis on the development of natural preservatives derived from plant extracts, essential oils, and other natural sources.

Function Insights

Based on function, the antimicrobial segment led the market with the largest revenue share of 64.91% in 2023. Consumers are increasingly concerned about the potential health risks associated with synthetic preservatives, such as butylated hydroxyanisole (BHA) and butylated hydroxytoluene (BHT). Natural antimicrobial preservatives offer a safer alternative, as they are derived from plants, herbs, spices, and essential oils, and are generally recognized as safe (GRAS) by regulatory agencies.

Antimicrobial food preservatives, derived from natural sources such as herbs, spices, essential oils, and plant extracts, are highly valued for their ability to inhibit the growth of bacteria, molds, and yeasts in food products. These preservatives play a crucial role in maintaining product safety and quality by preventing spoilage and reducing the risk of foodborne illnesses. Antimicrobial agents like rosemary extract, oregano oil, cinnamon, and citrus extracts are widely used in various food products to extend shelf life while meeting consumer demand for clean-label and minimally processed foods.

The antioxidant segment is anticipated to grow at the fastest CAGR of 7.3% from 2024 to 2030. Natural antioxidant food preservatives, while also derived from natural sources such as tocopherols (vitamin E), rosemary extract, and other plant extracts, primarily function to inhibit oxidation and prevent rancidity in fats and oils. While antioxidants are essential for maintaining the quality and freshness of food products, they may not always be as prominently featured as antimicrobial preservatives in the natural food preservatives market, especially considering the paramount importance of microbial safety and shelf-life extension.

Product Insights

The edible oils segment held the market with the largest revenue share of 29.9% in 2023. Edible oils are versatile and can be used in various food products, including dressings, marinades, sauces, baked goods, snacks, and more. Their ability to blend seamlessly into different types of food formulations makes them highly popular among manufacturers. Many edible oils contain natural antioxidants that help prevent oxidation and spoilage in food products. These antioxidants, such as tocopherols (vitamin E), help extend the shelf life of foods by inhibiting the degradation of fats and oils. In addition to their preservative properties, edible oils offer functional benefits such as flavor enhancement, texture improvement, and mouthfeel enhancement. They can also contribute to the nutritional profile of food products, making them attractive ingredients for manufacturers.

The Rosemary extract segment is projected to grow at the fastest CAGR of 8.1% from 2024 to 2030. Rosemary extract is recognized for its antimicrobial properties, which inhibit the growth of bacteria, molds, and yeasts in food products. Its ability to effectively control microbial spoilage makes it a valuable natural preservative for a wide range of food applications. The clean-label trend, which emphasizes transparency and simplicity in ingredient lists, has led to a growing demand for natural preservatives like rosemary extract. Consumers perceive rosemary extract as a safer and more wholesome alternative to synthetic additives, driving its adoption by food manufacturers seeking clean-label solutions.

Application Insights

Based on application, the seafood, meat, and poultry segment led the market with the largest revenue share of 24.9% in 2023. Meat and poultry products are highly perishable and prone to microbial spoilage due to their high moisture content and nutrient-rich composition. Natural preservatives help inhibit the growth of bacteria, molds, and yeasts, extending the shelf life and maintaining the quality of these products.

The beverages segment is expected to grow at the fastest CAGR of 8.2% from 2024 to 2030. Beverages, especially those with high water content like fruit juices and sports drinks, are prone to microbial contamination. Preservatives help inhibit the growth of bacteria, molds, and yeasts, thereby extending the shelf life of the beverage and ensuring microbial stability. Consumers are increasingly seeking healthier beverage options, including natural and clean-label products. Natural food preservatives allow beverage manufacturers to meet consumer demand for safer and more transparent ingredients, driving the market growth of this segment.

The bakery segment is anticipated to grow at the fastest CAGR of 6.8% from 2024 to 2030. Many bakery products, such as bread, cakes, pastries, and muffins, have a relatively short shelf life due to their high moisture content and susceptibility to microbial spoilage. Natural preservatives help extend the shelf life of bakery items by inhibiting the growth of mold, yeast, and bacteria, thereby maintaining freshness and quality over a longer period.

Regional Insights

North America dominated the natural food preservatives market with the largest revenue share of 33.80 % in 2023. Regulatory agencies in North America have increasingly scrutinized synthetic preservatives, leading to a shift towards natural alternatives. The regulatory landscape has encouraged the adoption of natural food preservatives among manufacturers operating in the region. North America is home to advanced research and development facilities focused on food science and technology. These advancements have enabled the development of effective and innovative natural preservatives for various food applications.

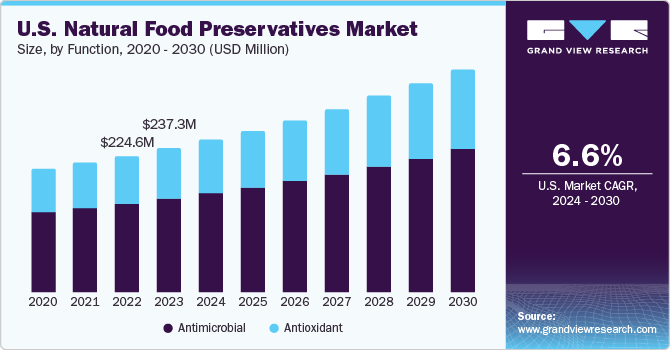

U.S. Natural Food Preservatives Market Trends

The natural food preservatives market in the U.S. is expected to grow at the fastest CAGR of 6.6% from 2024 to 2030. Increasing health awareness among U.S. Consumers has led to a growing preference for clean-label and natural food products. This demand is a significant driver for the adoption of natural food preservatives in the U.S. market. Many U.S. food manufacturers and industry players are proactively investing in research and development to develop innovative natural preservatives. These initiatives contribute to the market growth and expansion in U.S.

Asia Pacific Natural Food Preservatives Market Trends

The natural food preservatives market in Asia Pacific is anticipated to grow at the fastest CAGR of 7.9% from 2024 to 2030. The rapid growth of the food and beverage industry in the Asia Pacific region, coupled with increasing urbanization and changes in lifestyle, is driving the demand for natural preservatives. Manufacturers are responding to consumer demands by introducing a wider range of natural preservative options. Consumers in the Asia Pacific region is becoming more health-conscious and are increasingly seeking food products that are free from synthetic additives and preservatives. This shift in consumer preferences is driving the demand for natural food preservatives. China market is expected to grow at the fastest CAGR of 6.9% from 2024 to 2030.

Key Natural Food Preservatives Company Insights

The market for natural food preservatives is highly competitive, with a range of companies offering various types. Many big players are increasing their focus on new types of launches, partnerships, and expansion into new markets to compete effectively.

Key Natural Food Preservatives Companies:

The following are the leading companies in the natural food preservatives market. These companies collectively hold the largest market share and dictate industry trends.

- Naturex S.A

- Handary S.A.

- Cargill, Incorporated

- Danisco

- Kalsec Inc.

- Ita Food Improvers

- DSM

- Kerry Group Plc.

- Tate & Lyle PLC

- Kemin Industries, Inc.

Recent Developments

-

In June 2023, Chinova Bioworks, a Canadian startup specializing in natural preservatives derived from upcycled mushroom stalks, announced that it is scaling up its production capacity four-fold. This expansion aims to support international growth and meet increasing demand, particularly in rapidly expanding markets like non-alcoholic beer. The company plans to penetrate new markets, starting with Australia and New Zealand through a distribution partnership, followed by expansion into Asia and South America. This strategic move underscores Chinova Bioworks' commitment to providing sustainable and effective natural preservatives while capitalizing on emerging opportunities in the global food and beverage industry

-

In January 2022, Florida Food Products (FFP) launched a new clean label antioxidant ingredient, VegStable Fresh, at the International Production & Processing Expo. This plant-based solution aims to address the growing demand for natural food preservatives in the meat and poultry industry. With benefits such as extended shelf life and rancidity prevention, VegStable Fresh reflects the trend towards cleaner, more natural ingredients in the food preservatives industry

-

In June 2021, Kerry Group, an Irish ingredients company, acquired Niacet, a specialist in clean-label, low-sodium preservatives, from private investment firm SK Capital for approximately USD 1 billion. With the completion of the transaction, Niacet joins Kerry's global food protection and preservation platform

Natural Food Preservatives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 932.4 million

Revenue forecast in 2030

USD 1.39 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment covered

Products, function, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; Australia; Indonesia; Brazil; South Africa; Saudi Arabia

Key companies profiled

Naturex S.A; Handary S.A.; Cargill, Incorporated; Danisco; Kalsec Inc.; Ita Food Improvers; DSM; Kerry Group Plc.; Tate & Lyle PLC; Kemin Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Food Preservatives Market Report Segmentation

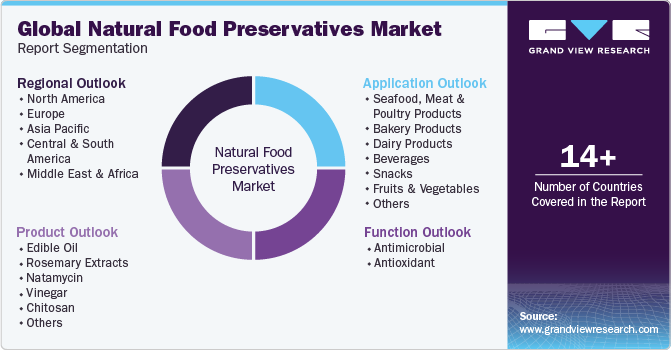

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global natural food preservatives market report based on products, function, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Edible Oil

-

Rosemary Extracts

-

Natamycin

-

Vinegar

-

Chitosan

-

Others

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Antimicrobial

-

Antioxidant

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Seafood, Meat & Poultry Products

-

Bakery Products

-

Dairy Products

-

Beverages

-

Snacks

-

Fruits & Vegetables

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global natural food preservatives market size was estimated at USD 878.2 million in 2023 and is expected to reach USD 932.4 million in 2024.

b. The global natural food preservatives market is expected to grow at a compounded growth rate of 6.9% from 2024 to 2030 to reach USD 1.39 billion by 2030.

b. Seafood, meat, and poultry products as end applications accounted for a revenue share of more than 24.9% in 2023. Meat and poultry products are highly perishable and prone to microbial spoilage due to their high moisture content and nutrient-rich composition. Natural preservatives help inhibit the growth of bacteria, molds, and yeasts, extending the shelf life and maintaining the quality of these products.

b. Some key players operating in the natural food preservatives market include Naturex S.A; Handary S.A.; Cargill, Incorporated; Danisco; Kalsec Inc.; Ita Food Improvers; DSM; Kerry Group Plc.; Tate & Lyle PLC; Kemin Industries, Inc.

b. Key factors that are driving the market growth include demand for natural food preservatives is primarily driven by the health and wellness trends, and the clean-label movement. Consumers are becoming increasingly conscious of the ingredients used in their food and are seeking alternatives to synthetic preservatives that are perceived as artificial or potentially harmful.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."