- Home

- »

- Next Generation Technologies

- »

-

Neobanking Market Size, Share And Growth Report, 2030GVR Report cover

![Neobanking Market Size, Share & Trends Report]()

Neobanking Market (2023 - 2030) Size, Share & Trends Analysis Report By Account Type (Business, Savings), By Application (Enterprises, Personal), By Region (Asia Pacific, Europe), And Segment Forecasts

- Report ID: GVR-4-68039-324-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Neobanking Market Summary

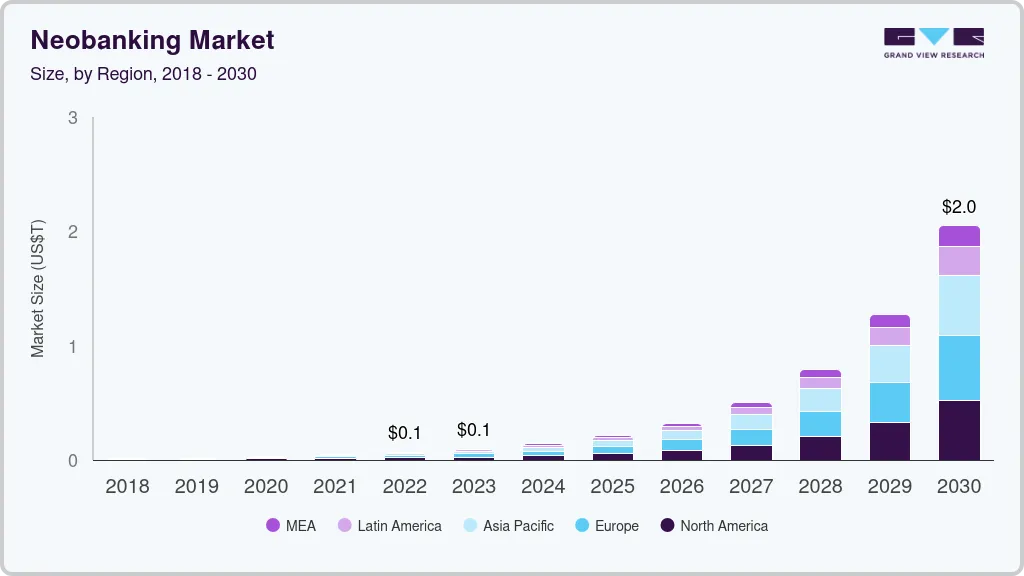

The global neobanking market size was valued at USD 66.82 billion in 2022 and is projected to reach USD 2,048.53 billion by 2030, growing at a compound annual growth rate (CAGR) of 54.8% from 2023 to 2030. The rising demand for convenience among customers in the banking sector is expected to drive market growth.

Key Market Trends & Insights

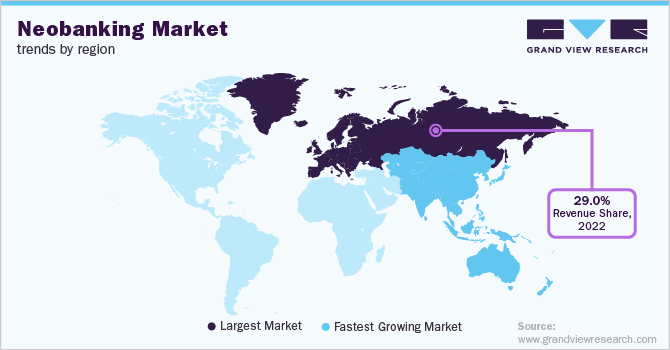

- The Europe region dominated the global market in 2022 and accounted for over 29.0% share of the global revenue.

- Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period.

- On the basis of account type, the business account segment dominated the market in 2022 and held the largest revenue share of more than 65.0%.

- On the basis of account type, the savings account segment is expected to witness the fastest CAGR over the forecast period.

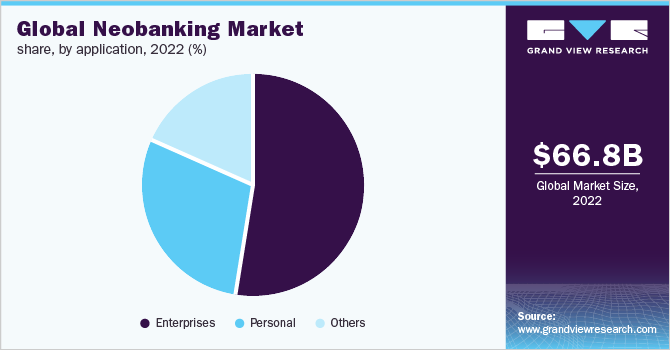

- On the basis of applications, the enterprises' segment dominated the market in 2022 and accounted for more than 51.0% share of the global revenue.

Market Size & Forecast

- 2022 Market Size: USD 66.82 Billion

- 2030 Projected Market Size: USD 2,048.53 Billion

- CAGR (2023-2030): 54.8%

- Europe: Largest market in 2022

- Asia Pacific: Fastest growing market

Neobanks offer banking solutions without the need for physical branches or offices. They help users validate their service offerings in real-time through online channels and mobile sites. In addition, the growing adoption of smartphones and the internet across the world for online banking is expected to further accelerate the demand for neobank platforms.

The increasing number of partnerships of banks and organizations to launch neobanks platforms is also accelerating the market growth. Such partnerships are aimed toward providing a better customer experience and enhanced safety and stability. For instance, in April 2021, Google pay co-creators announced the launch of Fi, a neobank, in partnership with the Federal Bank to provide an instant savings account with debit cards for salaried millennials. Technological advancements and the notable increase in internet penetration globally allow financial service providers to offer novel digital services to customers. Moreover, the growth in digital wallets has also been driving the demand for online banking platforms.

According to Visa, a multinational financial service company, there are more than one billion mobile money wallets worldwide. Many financial service providers are collaborating with mobile money wallet providers to offer affordable money transfer services. Neobanking is gaining popularity among retail customers and Small- and Medium-sized Enterprises (SMEs). Free debit cards, digitized account opening, personal finance advisory, instant payments, e-bill generation, invoice management, account integration, and GST-compliant invoicing are some of the key features propelling retail customers and SMEs to adopt neobanks over traditional banks and use the digital services offered by them efficiently.

Furthermore, the neobanking model also offers a low-cost structure, easy accessibility, and advanced services. Its cost efficiency is primarily driven by the low real estate & distribution costs, less complex IT systems, and streamlined operating models. Venture capitalists and equity investors are focusing on the market opportunities and investing in neobanks. For instance, according to the MEDICI India Fintech report 2020, India’s neobank startups raised more than USD 200 million in 2020. However, neobanks offer a limited range of product offerings compared to traditional banks, which is expected to hinder market growth. Profitability is another issue faced by neobanks as they offer services at a reduced cost to attract new customers.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic is expected to create new growth opportunities for the market owing to the rising dependency on online banking services. A myriad of social, political, and economic challenges has become apparent across the globe in the wake of the pandemic. These challenges are affecting both financial service providers and investors. On the contrary, numerous SMEs relied on neobanks to fulfill their working capital needs during the pandemic, thereby driving the growth of the market.

Account Type Insights

On the basis of account type, the market has been segmented into a business account and savings account. The business account segment dominated the market in 2022 and held the largest revenue share of more than 65.0%. Various businesses across the globe are adopting neobanking as the preferred way of payment for bulk payouts. Moreover, the ability of the neobank platforms to offer simplicity and ease of processes in disbursals to vendors and other stakeholders by reducing human intervention is expected to further drive the growth of the segment. The savings account segment is expected to witness the fastest CAGR over the forecast period.

Numerous health tech companies are entering into partnerships with fintech companies to develop and launch products and services to cater to the growing demand for the product. For instance, in November 2021, Fedo, a health tech company, announced the launch of a health savings account named Fedo HSA in partnership with Open, a neobank. Through this partnership, Fedo HSA planned to offer combined accounts that help customers meet their required spendings through a combination of insurance, smart savings, and line of credit bundled in savings accounts with health credit and debit card features.

Application Insights

On the basis of applications, the market has been divided into enterprises, personal, and others. The enterprises' segment dominated the market in 2022 and accounted for more than 51.0% share of the global revenue. These platforms offer enterprise-related services, such as credit management, transaction management, and asset management. Various neobank service providers for SMEs are making efforts to enhance their product portfolio through acquisitions aimed toward providing a better customer experience. For instance, in December 2021, Open, an SME Neobanking platform provider, announced the acquisition of Finin, a consumer Neobanking platform, for USD 10 million in cash and stock deal.

This acquisition was aimed at strengthening Open’s cloud-native enterprise offering named BankingStack, through which, Open has deployed SME banking platforms for 17 banks. The personal application segment is anticipated to witness the fastest growth over the forecast period. The high penetration rate of smartphones has enabled customers to widely opt for neobanking services owing to convenience and ease of use. The services are offered using mobile app interfaces, which further enable money transfers and payments through the app. The convenience of opening and operating accounts effectively is anticipated to fuel the adoption of neobanking in this segment over the forecast period.

Regional Insights

The Europe region dominated the global market in 2022 and accounted for over 29.0% share of the global revenue. The regional market growth can be attributed to the development of multiple innovative technologies and the early adoption of new technologies. Moreover, companies are focused on launching product platforms and entering into partnerships to strengthen their market position. Various neobanks in the region have launched brick-and-mortar distribution channels to establish an O2O type of distribution, thereby creating market growth opportunities.

Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period. The growing adoption of internet services, coupled with the increased use of smartphones, is expected to accelerate the market growth. In addition, factors such as easy and convenient banking services and the rise in digital-only banks across countries including Japan, India, and China, are expected to further contribute to the regional market growth. Additionally, the young demographics of the region are expected to be an additional benefit for the adoption of neobanks.

Key Companies & Market Share Insights

Vendors are focusing on launching their mobile app-based banks. The major banks have been slower in terms of the adaptation to new technologies and changing customer needs; however, start-up digital banks have been amassing a large user base actively using their services. Moreover, these start-ups are focusing on developing services that can be easily integrated with business processes. Neobanks are challenging the universal banking model with their personalized insights, lower costs, user-friendly interfaces, predictive intelligence, easy accessibility, and simplified processes.

These banks are prioritizing customer needs and structuring their services and products in a way that is strengthening their foothold in the market. Market players are particularly focusing on mergers & acquisitions, partnerships, collaborations, and product launches to strengthen their foothold in the market. For instance, N26 announced the extension of its partnership with TransferWise, a technology leader for international payments, to offer international money transfers in over 30 currencies through the N26 app. Some prominent players in the global neobanking market include:

-

Atom Bank PLC

-

Fidor Bank Ag

-

Monzo Bank Ltd.

-

Movencorp Inc.

-

Mybank

-

N26

-

Revolut Ltd.

-

Simple Finance Technology Corp.

-

Ubank Limited

-

Webank, Inc.

Neobanking Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 96.14 billion

Revenue forecast in 2030

USD 2,048.53 billion

Growth rate

CAGR of 54.8% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share analysis, competitive landscape, growth factors, and trends

Segments covered

Account type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

Atom Bank PLC; Fidor Bank Ag; Monzo Bank Limited; Movencorp Inc.; Mybank; N26; Revolut Ltd.; Simple Finance Technology Corporation; Ubank Limited; and Webank, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Neobanking Market SegmentationThe report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global neobanking market report based on account type, application, and region:

-

Account Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Business Account

-

Savings Account

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Enterprises

-

Personal

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global neobanking market size was estimated at USD 66.82 billion in 2022 and is expected to reach USD 96.14 billion in 2023.

b. The global neobanking market is expected to grow at a compound annual growth rate of 54.8% from 2023 to 2030 and is expected to reach USD 2,048.53 billion by 2030.

b. Europe dominated the neobanking market with a share of 29.93% in 2022. This is attributable to the development of a large number of innovative technologies coupled with the early adoption of new technologies.

b. Some key players operating in the neobanking market include Atom Bank PLC, Fidor Bank AG, Monzo Bank Limited, Mybank, N26, Revolut Ltd., Simple Finance Technology Corporation, and Ubank Limited.

b. Key factors driving the neobanking market growth include convenience offered to customers and the best interest rates offered over traditional banks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.