- Home

- »

- Communication Services

- »

-

Network As A Service Market Size & Share Report, 2022-2030GVR Report cover

![Network As A Service Market Size, Share & Trends Report]()

Network As A Service Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (WANaaS, LANaaS), By Enterprise Size, By Application (Cloud & SaaS Connectivity, Bandwidth On Demand), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-972-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Network As A Service Market Summary

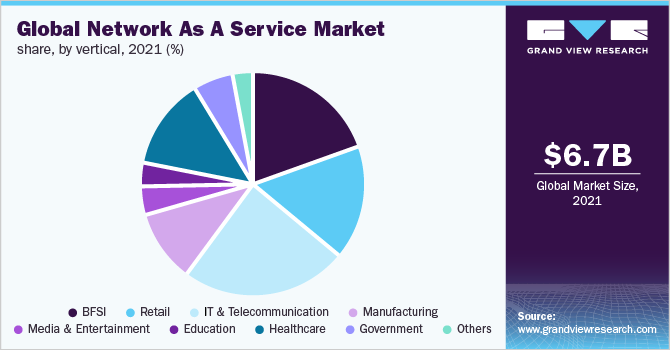

The global network as a service market size was valued at USD 6.67 billion in 2021 and is anticipated to reach USD 81.82 billion by 2030, growing at a compound annual growth rate (CAGR) of 32.9% from 2022 to 2030. The growth is attributed to the rising deployment of Network-as-a-service (NaaS), as it is low cost and provides greater scalability.

Key Market Trends & Insights

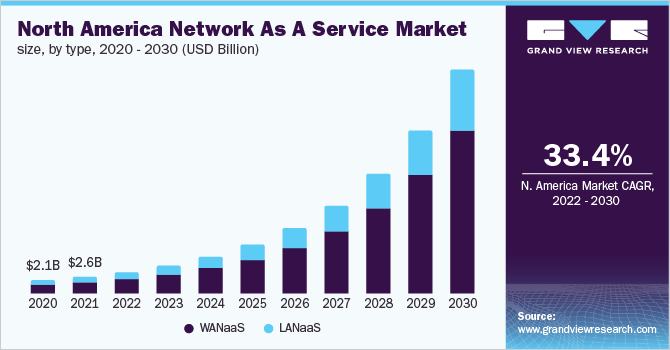

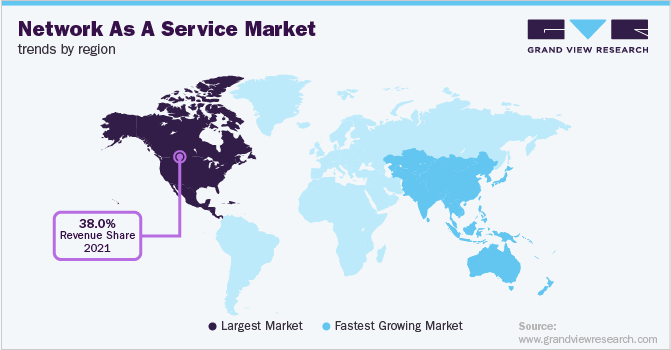

- North America led with the largest revenue share of more than 38.0% in 2021, attributed to the rapid adoption of network-as-a-service solutions.

- By type, the WANaaS segment held the largest revenue share of around 65.0% in 2021.

- By enterprise size, the large enterprise's segment dominated with the largest revenue share of more than 52.0% in 2021.

- By application, the cloud and SaaS connectivity segment held the largest revenue share of more than 24% in 2021.

- By vertical, the information technology (IT) & telecommunication segment held the largest revenue share of 24.0% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 6.67 Billion

- 2030 Projected Market Size: USD 81.82 Billion

- CAGR (2022-2030): 32.9%

- North America: Largest market in 2021

Rising demand for widespread and high-speed network coverage and increasing adoption and implementation of the cloud for data storage are some of the factors fueling the growth. The rising deployment of public NaaS in several verticals such as BFSI, manufacturing, retail, manufacturing, and transportation & logistics, are contributing positively to the NaaS market growth.

The industry is expanding at a tremendous growth rate due to technological innovations and users’ inclination toward cloud-managed network services. Vertical organizations are adopting network services to enable efficient resource utilization, minimize capital investment, improve service quality, and increase uptime. NaaS allows users/customers to rent networking services from cloud providers. It is a cloud model providing networking services through the internet on a (pay-per-use) subscription model.

Networking services are offered by network service providers and cloud providers for networking and network security resources such as VPN, WAN, and firewall, among others. It enables customers to manage and operate on their network without the need to maintain network infrastructure and optimize resource allocations and computing resources as a single unified module. It delivers services in a subscription-based business model to deliver enterprise-wide area network (WAN) services. It comprises integrated hardware, software, licenses, and managed services.

NaaS allows businesses and organizations with subscription hardware, managed services, and full/true NaaS. It is a framework that leverages open application programming interface (APIs), network transformation, service lifecycle automation, and model-driven abstraction. With NaaS, users can streamline new services, automate the order-to-service process, and technology introduction. Additionally, it eliminates manual intervention from the service fulfillment process, improves customer experience by providing error-free service activation, and reduces time to remediate issues.

NaaS enables incessant delivery of features, new fixes, and capabilities, automates multiple processes, optimizes for maximum performance, and orchestrates. It provides security policy enforcement and network monitoring, applications and underlying infrastructure modeling, and firewall and packet capabilities inspection. Additionally, it offers AI-driven capabilities and the ability to proactively route the application traffic to address issues and improve user experience.

NaaS provides businesses and organizations with low latency connectivity, global coverage, and negligible packet loss enabled by a global point of presence (POP) backbone while connecting to a platform-as-a-service, software-as-a-service, infrastructure-as-a-service applications, or branch office. These services can be deployed, ordered, and co-managed. It ranges from network access solutions and managed services, including unified communication services on virtualized customer premise equipment (vCPE) or public cloud.

COVID-19 Impact

The COVID-19 pandemic has severely impacted customer behavior & preference. The pandemic had highly affected service industries such as BFSI, manufacturing, retail, and transportation. The gradual shift from conventional business practices to online platforms resulted in establishing enterprise network services and solutions for efficient centralized management. Therefore, the IT sector played a pivotal role in supporting digital infrastructure.

The global demand for NaaS has surged due to work from home during the pandemic. The augmented demand has contributed considerably to the development of cloud networking services leading to increased NaaS market growth during the pandemic. Moreover, licensing and software management components of enterprise networking drive the market growth via subscription.

NaaS has an affordable cost structure and offers a greater degree of operational automation, providing opportunities to create new services and better capabilities to architect the network. It has gradually shifted from a Capex to Opex model enabling numerous benefits such as flexibility in making changes to the network, maintenance and management of software and hardware upgrades, easy integration of networking services and security services, viz. firewalls, global interconnection, and scalability.

Network-as-a-service also minimizes operational risks allowing organizations to deploy state-of-the-art product functions and features. The advancing technological landscape is propelling the need for more flexible consumption models. The COVID-19 pandemic has augmented the adoption of as-a-service offerings, therefore, accelerating the growth of the market.

Type Insights

The WANaaS segment held the largest revenue share of around 65.0% in 2021. It is expected to register the fastest CAGR of 33.6% over the forecast period. It is a cloud-based wide area network (WAN) model designed to replace legacy WAN, which relied on hardware. It utilizes connectivity protocols such as multiprotocol label switching (MLPS), which are difficult to manage. WANaaS replaces hardware appliances as it is offered via the cloud. The Verticals can configure WAN with a simple internet connection and software. WANaaS is a specialized managed service suitable for large to mid-size enterprises as it enables rapid deployments, optimizes user productivity and experience, and reduces costs.

The LANaaS segment is anticipated to witness a CAGR of 31.6% during the forecast period. LANaaS is a networking business model and integrates LAN with the frequently altering enterprise/business requirements. It provides a scalable infrastructure at reduced hardware costs without complex processes, multi-vendor support, comprehensive monitoring, and multi-site Ethernet and Wi-Fi support. LANaaS simplifies and secures the local network, enhances user experience, and ensures optimally wired and wireless connections with zero-touch deployment using applications.

Enterprise Size Insights

The large enterprise's segment dominated with the largest revenue share of more than 52.0% in 2021. It is expected to expand at a CAGR of 31.3% throughout the forecast period. The growth is attributed to the rapid adoption of cloud services such as PaaS, SaaS, PaaS, and IaaS. Large enterprises are implementing cloud services for data storage and data centers for workload mobility. Additionally, emerging demand for a subscription-based business model in cloud computing, NFV, and SDN has propelled the adoption of NaaS among large enterprises.

The SMEs segment is anticipated to register a CAGR of 34.5% in the forecast period. NaaS allows SMEs to organize their networks, maintain security systems, and monitor employees. SMEs focus on digital transformation to achieve reliable, fast, and secure networks and eliminate hardware connectivity appliances on-premises. The adoption of NaaS is higher in SMEs as it improves the quality of services (QoS) and ensures the security of networks. Moreover, emerging technologies such as SDN, IoT, and cloud-based services are higher in demand due to affordable cloud services and the emergence of the as-a-service model.

Application Insights

The cloud and SaaS connectivity segment held the largest revenue share of more than 24% in 2021. It is expected to grow at a CAGR of 33.6% during the forecast period. The growing use of technology and consumer propensity toward the cloud propel the adoption of cloud-based solutions. Cloud-based services and solutions enable the Verticals to access the data from remote areas. It allows scalability, migration, mobility, and data recovery and increases effectiveness. The organizations can achieve enhanced scaling, network assurance, and time-to-value at affordable costs resulting in the rapid adoption of cloud-based solutions across enterprises.

The Bandwidth on Demand (BoD) segment is anticipated to witness a CAGR of 34.6% during the forecast period. Bandwidth on Demand provides the necessary bandwidth to enhance the user experience, simplifies the interface to create service requests, and allows the application developer to integrate QoS resources. It increases agility with automated provisioning and optimized network capacity planning. It also reduces network operations' complexity and cost, offering competitive services on an optimized and scalable transport software-defined network. BoD meets service-level agreements, identifies and resolves issues, maintains procedures, and provides faster network configuration.

Vertical Insights

Information technology (IT) & telecommunication held the largest revenue share of 24.0% in 2021. It is expected to reveal a CAGR of 33.1% in the forecast period. The growth is attributed to increasing use-cases and the adoption of cloud services and IT infrastructure. Network infrastructure plays a significant role in the IT & telecommunication sector as it minimizes the digital divide by delivering quick network services and addressing the concerns of bandwidth scarcity at affordable costs.

The shared active and passive infrastructure allows high-speed internet access and empowers networks to expand profitably. Network-as-a-service solutions are major building blocks of the 5G network, and the telecommunication sector is anticipated to witness considerable adoption of the NaaS platform.

The manufacturing segment is anticipated to grow at a considerable CAGR of 34.9% throughout the forecast period. The market for the manufacturing segment is growing as players in this segment are deploying NaaS solutions to attain maximum benefits and focus on their primary activities than on complex networking infrastructure. The demand for reliable and secure networking solutions is increasing the adoption of NaaS in this segment.

Regional Insights

North America led with the largest revenue share of more than 38.0% in 2021, attributed to the rapid adoption of network-as-a-service solutions. The key driving factor is the presence of significant players such as Palo Alto, Amdocs, Megaport, Akamai, and Cisco Systems Inc among others, which have propelled the market growth. Significant companies are investing heavily in the research and development of data centers, and network infrastructure is contributing to the growth.

Furthermore, considerable adoption of IoT and cloud-based services are fueling the network-as-a-service market growth. Businesses and organizations are refining their traditional network infrastructure to advanced IT infrastructure, network virtualization solutions, and cloud computing services. The cloud providers and telecommunication service providers are adopting and implementing cloud platforms to eliminate the complex network setup management.

Asia Pacific is anticipated to expand at a considerable CAGR of 34.1% throughout the forecast period. The growth is attributed to the increasing penetration of cloud computing services emergence of start-ups adopting cloud services such as SaaS, PaaS, and NaaS in the region. India and China have an extensive and distributed customer base driving the demand and creating new opportunities for NaaS. The growth is prominently driven by improving network infrastructure and increasing requirements to reduce CAPEX and government initiatives across the region.

Furthermore, the region's untapped potential is generating new investment opportunities for technological trends and advancements such as bring your own device (BYOD) technology. Moreover, multinational companies are expanding their presence across the APAC region, resulting in a broad customer base and internet subscribers that provides lucrative growth opportunities.

Key Companies & Market Share Insights

The market is consolidated and is anticipated to witness increased competition due to several players' presence. Major players are spending heavily on R&D activities to integrate advanced technologies network infrastructure and cloud-based services have intensified the competition among these players. Some prominent industry players include Cisco Systems Inc., Cloudfare, AT&T Inc., Amdocs, Palo Alto, and Akamai. These companies are also collaborating with telecom operators and local & regional players to gain a competitive edge over their peers and capture a significant share.

Players operating in the NaaS market are adopting different key strategies and developments to occupy a substantial market share in the market. For instance, in May 2022, Orange Business Services launched the service manage-watch, a supervision solution for applications and network services. It ensures end-to-end monitoring, optimal performance of security at the edge, equipment, user experience, and application to meet consumers’ requirements. Some prominent players in the global network as a service market include:

-

Palo Alto

-

Amdocs

-

Megaport

-

Akamai

-

Cisco Systems Inc.

-

Cloudflare

-

AT&T Inc.

-

Verizon Communications Inc.

-

DXC Technology Company

-

Synnex Corporation

-

NEC Corporation

-

Hewlett Packard Enterprise Co.

-

IBM Corporation

Network As A Service Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 8.39 billion

Revenue forecast in 2030

USD 81.82 billion

Growth rate

CAGR of 32.9% from 2022 to 2030

Base year for estimation

2021

Historical year

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, enterprise size, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; China; India; Japan; Brazil; Mexico

Key companies profiled

Palo Alto; Amdocs; Megaport; Akamai; Cisco Systems Inc.; Cloudflare; AT&T Inc.; Verizon Communications Inc.; DXC Technology Company; Synnex Corporation; NEC Corporation; Hewlett Packard Enterprise Co.; IBM Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Network As A Service Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global network as a service market report based on type, enterprise size, application, vertical, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

WANaaS

-

LANaaS

-

-

Enterprise size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

UCaaS/Video Conferencing

-

Cloud and SaaS Connectivity

-

Virtualized Private Network (VPN)

-

Bandwidth on Demand

-

Multi-Branch Connectivity

-

WAN Optimization

-

Secure Web Gateway

-

Network Access Control

-

Other Applications

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Retail

-

IT & Telecommunication

-

Manufacturing

-

Media and Entertainment

-

Education

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global network as a service market is expected to grow at a compound annual growth rate of 32.9% from 2022 to 2030 to reach USD 81.82 billion by 2030.

b. The WANaaS segment accounted for the largest revenue share of over 65.0% in 2021 in the network as s service market due to the increased adoption of cloud-based wide area network (WAN) model across the globe.

b. Some key players operating in the network as s service market include Palo Alto, Amdocs, Megaport, Akamai, Cisco Systems Inc., Cloudflare, AT&T Inc., Verizon Communications Inc., DXC Technology Company, Synnex Corporation, NEC Corporation, Hewlett Packard Enterprise Co., IBM Corporation

b. The rising deployment of Network-as-a-service (NaaS), as it is low cost and provides greater scalability. Additionally, growing demand for widespread and high-speed network coverage and increasing adoption and implementation of the cloud for data storage are some of the factors fueling the growth

b. The global network as a service market size was valued at USD 6.67 billion in 2021 and is expected to reach USD 8.39 billion in 2022.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.