- Home

- »

- Next Generation Technologies

- »

-

Network Management System Market Size Report, 2030GVR Report cover

![Network Management System Market Size, Share & Trends Report]()

Network Management System Market Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment (On-premise, Cloud-based), By Enterprise, By Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-027-9

- Number of Report Pages: 170

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global network management system market size was estimated at USD 8.25 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.1% from 2023 to 2030. Network management system (NMS) provide several benefits to companies and their users including network visibility, downtime detection, performance optimization, and fault detection among others. The growing investments made in IT network infrastructure, continuous 5G rollouts, and growing use of networks for the organization’s internal and external operations are expected to drive the market’s growth over the forecast period.

Network management is a process of managing and administering computer networks within an enterprise. Some of the key functions provided by network management systems include performance management, fault management, security management, and account management. The key role of network management systems is to ensure the smooth functioning of the network and to ensure that users have access to network resources efficiently, effectively, and quickly. It leverages various component solutions to optimize the network’s health. The growing use of network management systems for network optimization is driving the market’s growth.

Network management systems are cost-effective as they automate the process and reduce overhead IT costs. IT staff can be freed up to do other tasks, which can significantly increase the efficiency of an enterprise. Moreover, since NMS automates the process, enterprises can save time and additional costs, which leads to more productivity in an enterprise. Additionally, the network management systems reduce downtime and improve flexibility. These are some of the prominent benefits provided by NMS, which are contributing to the growing demand in the market.

The overall IT infrastructure sector is witnessing a huge investment inflow, which is contributing to innovations in the network management systems market. Software-Defined Networking (SDN) is one of such innovative emerging technologies in NMS, which is getting popular among enterprises all over the globe. SDN uses software-based controllers to communicate with underlying hardware infrastructure and direct the traffic on the network. Spiraling demand for SDN monitoring tools can be attributed to their ability to prevent unplanned failures and provide fault detection and correction management capabilities in real-time. Such innovations are expected to drive the market’s growth over the forecast period.

A survey conducted by the Oracle Corporation in 2022 suggests that, out of the total number of respondents, 76% said network complexities were one of the management’s biggest challenges. Companies are adopting network management systems to overcome these challenges. However, there are some restraints related to the deployment and maintenance of network management software. NMS are complex to deploy and learning how to operate the software can take time. Additionally, the initial costs of deployment of network management software are high. However, enterprises are looking at it as an initial investment, as it yields high benefits in the future.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic is expected to play a vital role in driving the network management systems market’s growth. The COVID-19 pandemic led to fundamental changes in business models and pushed them to adopt more digitized models, which was long overdue. The digital transformation led by the pandemic is expected to continue over the forecast period. With this overdue transformation. The pandemic accelerated remote working, customer demand for online shopping, use of advanced technologies in operations, migration of assets to the cloud, spending on data security, use of fast networks, and use of advanced technologies in business decision-making. All of these transformations require a robust network system which entails the use of network management systems.

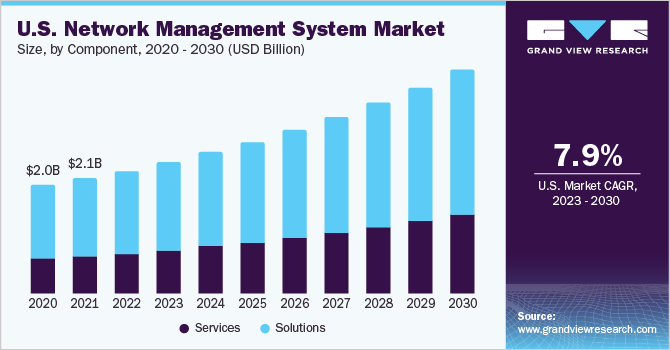

Component Insights

The solutions segment dominated the market in 2022 and accounted for a revenue share of more than 68.0%. The solutions segment is further bifurcated into configuration management, performance management, security management, fault management, and account management. The launch of standalone solutions and customizable offerings that can be tailored to client requirements are projected to contribute to the growth of the segment. Rising concerns over the security of data are prompting enterprises to opt for solutions such as network security management, which can secure their network from data breaches and cyber-attacks, thereby fueling the demand for network management solutions over the forecast period.

The services segment is anticipated to register the fastest growth over the forecast period. The services segment is further bifurcated into consulting, integration & implementation, and training, support & maintenance. Deployment of network management systems is a complex process and it often requires professional assistance. Network management services take care of the deployment, integration, maintenance, and upgradation of the software. These services can reduce the enterprise’s burden of software deployment, and they can make sure that the software is compatible with the organization’s existing system. The ease of use provided by network management services is expected to drive the segment’s growth over the forecast period.

Deployment Insights

The on-premise deployment segment dominated the market in 2022 and accounted for a revenue share of more than 66.0%. On-premise deployment allows better customization and control of the software according to the company’s needs. Moreover, deploying the software on-premise cuts access to the network for any third parties, thus increasing the security of the network. However, internal management of the software can require additional IT staff and resources, and as the software ages, the company needs to upgrade or replace it. The security and customization offered by the on-premise deployment of the network management system have contributed to the dominant share of the segment in the market.

The cloud-based deployment segment is anticipated to register the fastest growth over the forecast period. Cloud software deployment removes the deployment, maintenance, and upgradation hassle for the enterprise’s internal IT staff, which frees them from other tasks, thus improving the overall productivity of the enterprise. Additionally, for cloud deployment, network management system providers provide additional services, which take care of deployment, maintenance, and upgradation. Additionally, the cloud can allow access to network information from many locations, and all applications can be viewed from one, comprehensive, robust platform. The flexibility, loss prevention, and cost savings offered by cloud deployment are expected to drive the segment’s growth over the forecast period.

Enterprise Insights

The large enterprises segment dominated the market in 2022 and accounted for a revenue share of more than 61.0%. Large enterprises have a larger network of devices and employees. Often, large enterprises have their offices at multiple locations which need to be connected to the company's server. For such companies, NMS is a viable solution to keep networks intact. Network downtime adversely affects revenue and can result in a decrease in employee productivity. Adopting NMS can reduce revenue loss and increase employee productivity. Moreover, factors such as a reduction in human errors, the ability to identify and resolve the root cause of network malfunctioning, and reducing security risks because of fewer manual processes meaning fewer configuration errors are some of the crucial benefits due to which large enterprises are adopting network management systems.

The small and medium enterprises segment is anticipated to register the fastest growth over the forecast period. Even though small and medium enterprises have a smaller network as opposed to large enterprises, security threats target organizations of all sizes, making SMEs vulnerable to security threats. In such instances, network security management (a component of network management systems) plays a crucial role in SMEs' networks. Additional security provided by NMS for SMEs is driving the adoption, thereby propelling the segment’s growth.

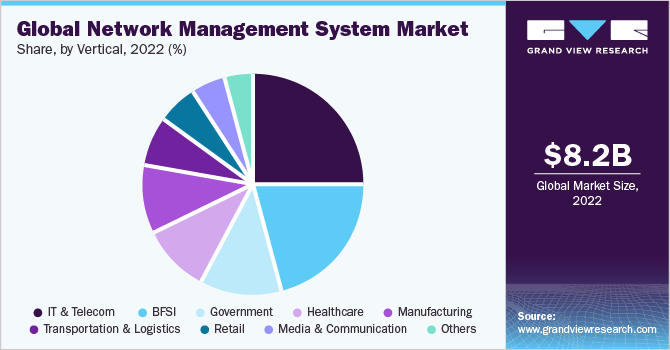

Vertical Insights

The IT & telecom segment dominated the market in 2022 and accounted for a revenue share of over 25.0%. IT & Telecommunication companies need a strong network infrastructure to carry out their day-to-day operations. The industry needs to transmit data, signals, and messages through a reliable network means. Network management systems ensure the smooth functioning of the network, enhance security, and detect faults at early stages preventing network downtime, which results to cost reduction and enhanced productivity. Additionally, IT & Telecom industry verticals use large networks which are next to impossible to keep track of. Hence, automating the tracking, updating, maintenance, and problem-solving capabilities by deploying NMS is essential, which is driving the segment’s growth.

The healthcare segment is anticipated to register significant growth over the forecast period. The healthcare industry is increasingly leveraging machine-to-machine connectivity to obtain patient information effectively and accurately in real-time. NMS solutions can be a part of the overall healthcare systems to ensure uninterrupted connectivity and enhance service delivery efficiency. Implementation of new regulations, such as the Health Information Technology for Economic and Clinical Health (HITECH) Act, which addresses privacy and security issues associated with the electronic exchange of health-related data, is compelling the key players in the healthcare industry to adopt better security measures. Such acts bode well for the growth of the healthcare segment.

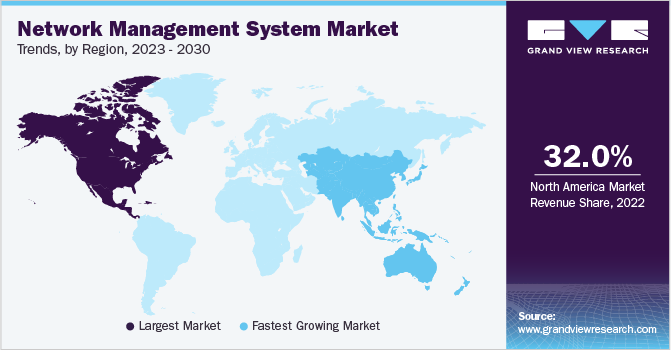

Regional Insights

North America dominated the network management systems market in 2022 and accounted for a revenue share of more than 32.0%. North American region houses several modern businesses and many multi-national companies that use large networks to facilitate their customers' services and maintain intra-department communication. To carry out these operational functions effectively, companies are deploying network management systems across North America. Moreover, the growing demand for fault management, security management, account management, and performance management is expected to drive the market's growth over the forecast period.

Asia Pacific is anticipated to register the fastest growth over the forecast period. Asia Pacific has been witnessing rapid growth in the deployment of Long-term Evolution (LTE) infrastructure. Meanwhile, several governments in the region have been undertaking initiatives to promote digitalization in line with rapid urbanization and the subsequent proliferation of the internet. Moreover, some of the countries in APAC, such as India, China, and Japan, are also bracing for the launch of 5G. The overall aggressive investment in network infrastructure is poised to pave the way for the aggressive adoption of network management systems across the region and create significant opportunities for NMS vendors over the forecast period.

Key Companies & Market Share Insights

The network management systems market is fragmented, characterized by the strong presence of multiple players. The vendors operating in the network management systems market are mainly adopting partnerships and product launches as a strategy to cater to the increased demand. The demand can be attributed to the ability of network management systems to enhance basic connectivity, quality, continuity of service, and enhanced collaboration.

Vendors are focusing on launching new innovative solutions. For instance, in February 2023, D-Link Corporation launched two new versions of its recent network management system D-View 8. The two new versions, Enterprise Edition (DV-800E), and The Standard Edition (DV-800S) offer exhaustive network management solutions. These versions are aimed at making network management more accessible and user-friendly by providing traffic management and high-precision network monitoring solutions. Such innovative solutions are harnessing the market’s growth. Some prominent players in the global network management system market include:

-

SolarWinds Worldwide, LLC.

-

International Business Machines Corporation

-

Broadcom, Inc.

-

Riverbed Technology, Inc.

-

Cisco Systems, Inc.

-

BMC Software, Inc.

-

Nokia Corporation

-

Oracle Corporation

-

Paessler AG

-

Viavi Solutions Inc.

-

NetScout Systems, Inc.

-

Colasoft, Inc.

-

Huawei Technologies Co., Ltd.

-

Hewlett Packard Enterprise Company

-

Dell Technologies, Inc.

Network Management System Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.03 billion

Revenue forecast in 2030

USD 17.67 billion

Growth rate

CAGR of 10.1% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; Italy; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

SolarWinds Worldwide, LLC.; International Business Machines Corporation; Broadcom, Inc.; Riverbed Technology, Inc.; Cisco Systems, Inc.; BMC Software, Inc.; Nokia Corporation; Oracle Corporation; Paessler AG; Viavi Solutions Inc.; NetScout Systems, Inc.; Colasoft, Inc.; Huawei Technologies Co., Ltd.; Hewlett Packard Enterprise Company; Dell Technologies, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Network Management Systems Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global network management system market report based on component, deployment, enterprise, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solutions

-

Configuration management

-

Performance management

-

Security management

-

Fault management

-

Accounting management

-

-

Services

-

Consulting

-

Integration & Implementation

-

Training, Support & Maintenance

-

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

On-Premises

-

Cloud-Based

-

-

Enterprise Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

IT & Telecom

-

BFSI

-

Government

-

Manufacturing

-

Healthcare

-

Transportation & Logistics

-

Retail

-

Media & communication

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global network management system market size was estimated at USD 8.25 billion in 2022 and is expected to reach USD 9.03 billion in 2023.

b. The global network management system market is expected to grow at a compound annual growth rate of 10.1% from 2023 to 2030 to reach USD 17.67 billion by 2030.

b. North America dominated the network management system market with a share of 32.6% in 2022. This is attributable to a rapid rollout of 5G infrastructure, significant investments in building new data centers, and a growing broadband penetration rate.

b. Some key players operating in the network management system market include SolarWinds Inc.; IBM Corporation; Broadcom, Inc. (CA Technology); Riverbed Technologies, Inc.; Cisco Systems, Inc.; BMC Software, Inc.; Nokia Corporation; Oracle Corporation; Paessler AG; VIAVI Solutions, Inc.; NetScout Systems, Inc.; Colasoft, Inc.; Huawei Technologies Co. Ltd.; HPE; and Juniper Networks, Inc.

b. Key factors that are driving the market growth include continued roll out of 5G mobile infra in developed countries and aggressive investments made in building new data centers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."