- Home

- »

- Network Security

- »

-

Network Security Sandbox Market, Industry Report, 2030GVR Report cover

![Network Security Sandbox Market Size, Share & Trends Report]()

Network Security Sandbox Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Enterprise Size (SMEs, Large Enterprises), By End-use (BFSI, Retail, Education, Defense), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-249-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Network Security Sandbox Market Trends

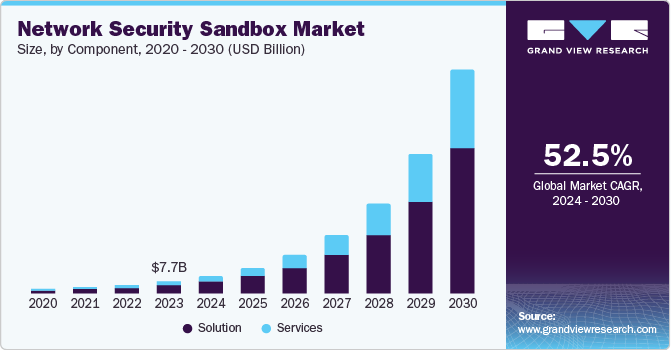

The global network security sandbox market size was valued at USD 7.7 billion in 2023 and is projected to grow at a CAGR of 52.5% from 2024 to 2030. Cyber-attacks are rising exponentially every year in enterprises across the world. With advancements in Artificial Intelligence (AI) and Machine Learning technologies, the need for advanced security systems is expected to increase sharply, ensuring promising growth prospects for the network security sandbox industry.

Sandboxing is an additional and advanced layer of protection used in cyber security that utilizes an isolated environment to detect, study, and block malicious attacks without them getting into the system. Traditional security systems can detect the known pattern of attacks, but when it comes to novel zero-day threats, sandboxing comes into play by protecting the system from such previously unknown threats.

Traditional security systems study the patterns associated with previous attacks and then utilize a reactive approach based on signature detection to deal with them. On the contrary, sandboxing resorts to a proactive approach by providing an advanced security layer against new and advanced persistent threats (APT). The rise of remote and hybrid work models requires robust security solutions that protect distributed workforces. Network security sandboxes offer a centralized approach to analyzing potential threats, regardless of user location or device type.

From governments, defense, and IT to banking, each sector is equally vulnerable to these new attacks in terms of malware, ransomware, and phishing. Furthermore, data breaches and privacy violations are becoming increasingly common, prompting stricter regulations worldwide. Organizations are under immense pressure to safeguard sensitive information. Network security sandboxes empower businesses to comply with data protection mandates by ensuring comprehensive security for incoming and outgoing traffic.

Electronic communication scams and email communication attacks to syphon sensitive information allow perpetrators either install malware on the targeted system or embed spear phishing with the intention of obtaining financial gain, military information, and trade secrets. The adoption and deployment of Network Security Sandboxes (NSS) can eradicate cyber security problems faced by an organization.

Component Insights

The solution component dominated the market with a revenue share of 67.9% in 2023 attributed to the comprehensive nature of components involved in network sandbox, as they come with a core software package, expertise, and analysis tools. Solution providers offer professional support to overcome challenges associated with integrated security solutions, ensuring smooth integration with the existing security architecture. The ability to customize the solution and timely delivery of software updates and threat intelligence feeds attracts demand from a large consumer base, driving segment expansion.

The services component segment held a substantial market share in 2023 and is expected to advance at the fastest growth rate during the forecast period. Services are required to complement the core sandbox software by enhancing the effectiveness and user experience of the solutions. They are generally provided in the form of professional consultation, support in the form of technical assistance, and troubleshooting to ensure smooth operation. The maintenance of system is an essential aspect for keeping vulnerabilities away. Additionally, an effective training program ensures that security personnel in organizations are leveraging these tools efficiently.

Enterprise Size Insights

Large enterprises accounted for 57.9% of the revenue share in the network security sandbox market in 2023. Large enterprises possess a vast collection of sensitive data, making them prime targets for cyberattacks. Additionally, they are subject to stricter data security and privacy regulations from regulatory bodies, compared to smaller businesses. Network security sandboxes offer a robust defense against sophisticated threats and effectively assist with regulatory compliance, justifying the significant investments large enterprises make in this technology. A high assortment of budget for security sandbox enables them to protect their sensitive data from frequent cyberattacks.

Meanwhile, small and medium enterprises (SMEs) are projected to expand at the fastest growth rate of 53.9% during the forecast period. SMEs are increasingly reliant on technology to operate and compete effectively with larger organizations in their respective domains. They utilize cloud platforms, web applications, and mobile devices, which expands their attack surface. Network security sandboxes provide a vital layer of defense in these environments by isolating and analyzing suspicious files and applications before they can compromise critical systems. With emergence of more affordable and scalable solutions, a large number of SMEs are expected to utilize sandbox solutions for their data security operations.

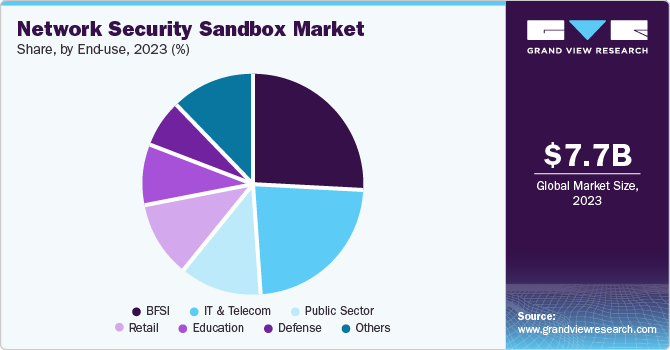

End-use Insights

The Banking, Financial Services, and Insurance (BFSI) segment accounted for the highest revenue share of 26.3% in 2023. The fast-growing BFSI sector is rapidly migrating towards online and mobile banking platforms. This expanded digital footprint exposes such institutions to a wider range of cyber threats, including targeted attacks, phishing scams, and malware designed to steal financial data. Network security sandboxes offer a proactive approach to identifying and mitigating these threats, safeguarding financial institutions and their customers. Additionally, they empower BFSI organizations to proactively manage cyber risks by identifying vulnerabilities before they can be exploited. This proactive approach minimizes the potential for financial losses and reputational damage.

The defense sector is expected to witness the highest CAGR of 58.5% during the forecast period. Modern warfare heavily relies on advanced technologies such as drones, communication networks, and command-and-control systems. Missiles and fighter jets utilize satellite data and networks. These systems are primary targets for cyberattacks that could disrupt military operations or leak sensitive information. Changing geopolitical scenarios across the world requires a proactive approach from the defense sector. Network security sandboxes provide a crucial layer of defense for these critical technologies, ensuring segment growth.

Regional Insights

North America dominated the market with a revenue share of 35.3% in 2023. This region is a major hub for cutting-edge technology and innovation due to the presence of several major organizations, making it a prime target for sophisticated cyberattacks. This heightened threat environment leads to a strong demand for advanced security solutions, including network security sandboxes. Prominent network security sandbox vendors such as McAfee, Fortinet, and Broadcom are headquartered in North America. This proximity provides organizations with easier access to these vendors' expertise, support services, and availability of the latest security innovations at competitive pricing.

U.S. Network Security Sandbox Market Trends

The U.S. accounted for the highest market share in the North American region. Silicon Valley is home to several innovative companies and involves the presence of a well-developed IT infrastructure, including robust networks and advanced computing power. Prominent global players with enormous amounts of data such as Google, YouTube, Meta, and Amazon have their headquarters in the U.S. According to a 2023 data breach report by Identity Theft Resource Center, they are among the most targeted companies by hackers. The changing nature of cyber-attacks and increased frequency at exponential rates has heightened the need for a robust network security system, which results in a strong demand for network security sandboxes.

Europe Network Security Sandbox Market Trends

Europe accounted for a significant market revenue share in 2023. Rising incidences of cyber-attacks in the region have become a major concern for both large organizations and SMEs. According to a report by European DIGITAL SME Alliance, a 57% surge in cyber-attacks was observed during 2022 to 2023 in major regional economies of Germany, Italy, Spain, and France. Europe enforces some of the world's strictest data privacy regulations, such as the General Data Protection Regulation (GDPR), to protect personal information. These regulations mandate organizations to implement robust security measures to safeguard personal data. Network security sandboxes offer a reliable solution for organizations by providing a secure environment to analyze potential threats and mitigate data breaches.

The UK network security sandbox market is increasingly facing the problem of cyber-attacks in the form of ransomwares, phishing attacks, and distributed denial of service (DDoS) attacks. They come with huge financial and administrative losses for organizations. The National Cyber Security Centre (NCSC) in the UK acts as a technical authority for cyber incidents. Key sectors such as finance and healthcare have strict regulatory requirements for data security in the UK. Network security sandboxes offer a valuable tool for organizations in these sectors to ensure compliance with industry-specific regulations.

Asia Pacific Network Security Sandbox Market Trends

Asia Pacific network security sandbox market is expected to witness a significant growth rate as the economies are undergoing rapid digital transformation, characterized by a widespread adoption of cloud computing, mobile technologies, and the Internet of Things (IoT). Consequently, the region is also experiencing a surge in cyberattacks. Businesses are becoming primary targets due to the rapid adoption of technology and the potential for large financial gains for hackers. According to a report by the Financial Services Information Sharing and Analysis Center (FS-ISAC), the region experienced, on an average, 1963 cyber-attacks per week in 2023. This threat scenario necessitates the implementation of robust security solutions in the form of network security sandboxes.

India Network Security Sandbox Market Trends

India is increasingly becoming known for its IT-enabled services. With technological advancements in financial, educational, and healthcare sector, vulnerabilities also tend to increase in proportion. The Indian Computer Emergency Response Team (CERT-In) is a government organization designated to serve as a national agency for incident responses related to cyber-attacks. The agency handled more than 1.39 million cyber-attacks in 2022, with majority of them being phishing. The ‘2023 Cybersecurity Readiness Index’ report published by CISCO revealed that only 4% of Indian companies have a mature infrastructure designed to tackle cyber incidents. A robust network sandbox security infrastructure is thus urgently needed to address these issues, which is expected to aid market growth.

Key Network Security Sandbox Company Insights

Some key companies involved in the network security sandbox market include Check Point Software Technologies Ltd.; McAfee, LLC; and Fortinet, Inc.

-

Check Point Software Technologies Ltd. is a multinational computer software security and hardware company. The company provides a wide range of security products, including firewalls, endpoint security, cloud security, mobile security, data security, and security management tools for businesses and governments around the world. Some of its noteworthy products include Firewall-1, VPN-1, and Check Point Integrity. Its SandBlast Zero-Day Protection provides cyber security protection against external malware threats.

-

McAfee is an American multinational computer security software company that develops digital security products for personal computers, such as McAfee Total Security, McAfee LiveSafe, McAfee Connect VPN, and other related products. McAfee Advanced Threat Defense (ATD) is the company’s sandboxing solution that duplicates the sample under analysis in a controlled environment, undertaking malware detection by leveraging complex Static and Dynamic behavioral analysis.

Key Network Security Sandbox Companies:

The following are the leading companies in the network security sandbox market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco DevNet

- VMware (Broadcom)

- Fortinet, Inc.

- McAfee, LLC

- Palo Alto Networks

- Trend Micro Incorporated

- Forcepoint

- Juniper Networks, Inc.

- Check Point Software Technologies Ltd.

- Sophos Ltd.

Recent Developments

-

In June 2024, Fortinet announced the imminent acquisition of Lacework, a data-based cloud security organization. Lacework offers and advanced AI-powered cloud security platform that integrates vital CNAPP services seamlessly. Fortinet has developed the FortiGuard AI-based Inline Malware Prevention Service sandboxing solution that helps in the detection and analysis of zero-day malware and advanced file-based threats.

-

In March 2024, Check Point Software Technologies Ltd. entered into a partnership with NVIDIA, an American multinational software company, to enhance the security of AI-based cloud infrastructure. The new solution is expected to be more resilient towards advanced cyber-attacks on the network as well as host level.

-

In January 2024, Trend Micro Incorporated announced the launch of Trend Micro Email Security, an advanced cybersecurity solution leveraging a combination of cross-generational threat techniques such as sandbox analysis, machine learning, data loss prevention, and various other techniques to stop email-based security threats. The solution has been hosted in the United Arab Emirates for the complete Middle East and Africa region.

Network Security Sandbox Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.1 billion

Revenue Forecast in 2030

USD 140.1 billion

Growth rate

CAGR of 52.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, enterprise size, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, Australia, South Korea, India, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Cisco DevNet; VMware (Broadcom); Fortinet, Inc.; McAfee, LLC; Palo Alto Networks; Trend Micro Incorporated; Forcepoint; Juniper Networks, Inc.; Check Point Software Technologies Ltd.; Sophos Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Network Security Sandbox Market Report Segmentation

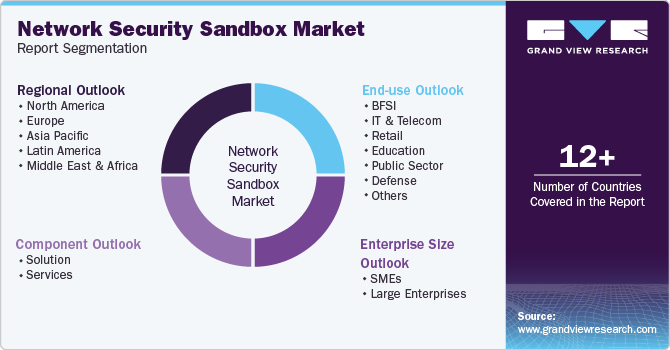

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global network security sandbox market report based on component, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

Professional Consulting

-

Support and Maintenance

-

Product Subscription

-

Training and Education

-

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Retail

-

Education

-

Public Sector

-

Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.