- Home

- »

- Medical Devices

- »

-

Neuralgia Treatment Market Size And Share Report, 2030GVR Report cover

![Neuralgia Treatment Market Size, Share & Trends Report]()

Neuralgia Treatment Market (2025 - 2030) Size, Share & Trends Analysis Report By Treatment (Drug Based, Surgery), By End Use (Hospital & Clinics, Ambulatory Surgery Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-022-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Neuralgia Treatment Market Size & Trends

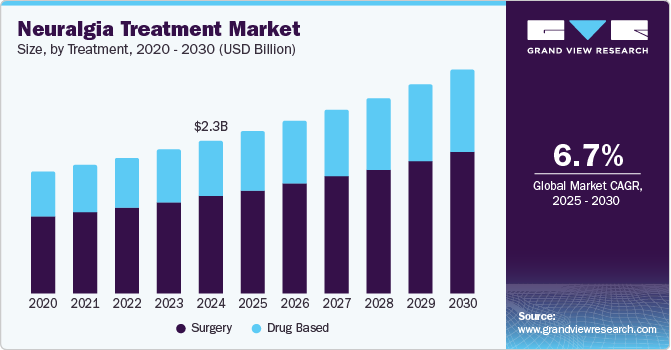

The global neuralgia treatment market size was valued at USD 2.34 billion in 2024 and is projected to grow at a CAGR of 6.7% from 2025 to 2030. The neuralgia treatment market is growing due to increased healthcare spending and government support for pain management programs, along with rising cases of diabetes and trigeminal neuralgia. In addition, conditions such as multiple sclerosis, where the immune system damages the myelin sheath, contribute to the demand for treatment. These factors create a favorable environment for market expansion.

In June 2024, the Australian Government announced a USD 19.6 million investment through the Medical Research Future Fund to enhance primary health care, focusing on chronic pain and multidisciplinary care. Key projects include supporting rural communities and adapting lifestyle programs to reduce disability. USD 8.8 million was allocated to initiatives aiding chronic pain sufferers, with the aim to bolster healthcare access and outcomes, especially in underserved regions. This funding aligns with efforts to modernize Medicare and improve care for chronic conditions.

The increasing prevalence of diabetes contributes to a higher risk of nerve damage, leading to conditions such as neuralgia, thereby boosting the demand for treatment options. In addition, rising cases of trigeminal neuralgia, a chronic pain disorder, are driving the market as more patients seek effective management. These trends emphasize the growing need for innovative and comprehensive neuralgia treatments. According to the Lancet, over half a billion people globally are estimated to be living with diabetes, impacting individuals of all ages and genders across every nation. This figure was expected to surge to 1.3 billion within the next 30 years, with every country experiencing an increase in cases.

Conditions such as multiple sclerosis (MS), which involve the immune system attacking the myelin sheath increase the prevalence of nerve damage and chronic pain. This leads to a rising demand for effective treatments targeting neuropathic pain management. Consequently, the neuralgia treatment market experiences growth as healthcare providers seek advanced therapies to address these conditions. For instance, a 2024 MS Society study reported that over 150,000 people in the UK live with MS, a rise attributed to better diagnosis and longer lifespans rather than increased risk. The prevalence varies by region: around 123,000 in England (1 in 450), 6,100 in Wales (1 in 500), 5,300 in Northern Ireland (1 in 350), and 17,400 in Scotland (1 in 300). Annually, over 7,100 new cases are diagnosed, averaging about 135 weekly.

Treatment Insights

The surgery segment dominated the market and accounted for a share of 64.8% in 2024. The growing demand for precise, non-invasive treatment options, such as robotic radiosurgery, is a key driver for the segment. These advanced methods offer targeted pain relief, minimizing the need for traditional medications or invasive surgeries. Robotic radiosurgery allows for high accuracy and minimal damage to surrounding tissues, improving patient outcomes. This shift towards less invasive treatments drives the market as patients seek safer, more effective alternatives. For instance, in December 2021, Japan's Ministry of Health, Labor, and Welfare approved the CyberKnife robotic radiosurgery system for treating trigeminal neuralgia (TN). This system delivers precise, non-surgical stereotactic radiosurgery (SRS), offering an outpatient treatment option for patients who may not benefit from medications or surgeries. The CyberKnife was proven effective in providing rapid and long-lasting pain relief for TN patients. This approval expanded its use in Japan, enhancing treatment options for individuals with this debilitating condition.

The drug-based segment is expected to grow at the fastest CAGR of 7.0% over the forecast period. The segment is driven by the need for more effective treatments for moderate-to-severe acute and neuropathic pain. These therapies focus on targeting specific pain pathways, offering precision in pain management. Advancements aim to improve patient outcomes by reducing side effects. This specialized approach enhances the overall efficacy of treatments for individuals suffering from neuralgia. For instance, in April 2024, Vertex Pharmaceuticals Incorporated announced advancements in its suzetrigine (VX-548) pain treatment program.

The FDA granted a rolling New Drug Application for moderate-to-severe acute pain, with submission expected to complete in 2024. Positive Phase 2 results for diabetic peripheral neuropathy (DPN) pain were shared, with Phase 3 trials set for later in 2024. Suzetrigine also received FDA Breakthrough Therapy designation for DPN. The company continues progressing its Phase 2 trial in lumbosacral radiculopathy and plans further developments in NaV1.8 and NaV1.7 inhibitors for acute and neuropathic pain.

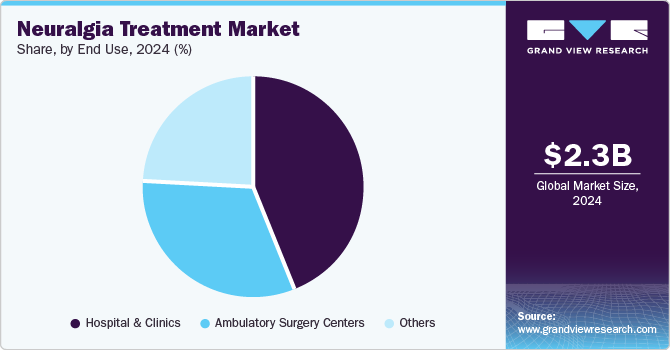

End Use Insights

The hospital & clinics segment accounted for the largest market revenue share in 2024. Adopting advanced, non-invasive technologies in hospitals and clinics drives the market by providing more accurate and targeted treatments. These technologies minimize the need for invasive procedures, leading to faster recovery times and reduced patient discomfort. Healthcare providers can deliver better outcomes with improved precision, enhancing overall patient satisfaction. This shift to less invasive options boosts the demand for advanced neuralgia treatments. For instance, in March 2024, Apollo Hospitals Group in Chennai introduced the Zap-X Gyroscopic Radiosurgery Platform, an advanced technology for treating brain tumors. This platform allows precise radiation treatment using a 360-degree rotating system, enabling better accuracy and fewer side effects than traditional methods. The Zap-X system was expected to improve patient outcomes, offering non-invasive treatment with faster recovery times. This technology strengthens the hospital's position in providing cutting-edge medical solutions for neurological disorders.

The ambulatory surgery centers segment is expected to grow at the fastest CAGR over the forecast period. The growing demand for minimally invasive treatments in the neuralgia market drives the success of ambulatory surgery centers (ASCs). These procedures offer faster recovery times, reduced risk of complications, and improved patient satisfaction. ASCs are increasingly preferred for their ability to provide cost-effective, efficient care outside of traditional hospital settings.

This shift aligns with the growing focus on non-surgical options that minimize patient downtime. For instance, in August 2024, Stryker, a medical technology company, agreed to acquire Vertos Medical, Inc., which specializes in minimally invasive solutions for chronic lower back pain caused by lumbar spinal stenosis. This condition, which involves the compression of spinal nerves, causes significant pain and mobility issues. Vertos Medical's mild procedure is designed to treat this condition by removing thickened ligament tissue to alleviate nerve pressure. The procedure is minimally invasive, requiring only a small incision and quicker recovery times than traditional surgery. The acquisition aligns with Stryker's strategy to expand its interventional pain management solutions portfolio. It also positions the company to serve better the growing demand for non-surgical treatments in ambulatory surgery centers.

Regional Insights

North America neuralgia treatment market held the largest share of 37.9% in 2024 attributable to the increasing prevalence of chronic pain conditions such as painful diabetic neuropathy (PDN) among diabetic patients is driving the demand for non-invasive, effective treatment options. For instance, in January 2024, the U.S. FDA approved Neuralace Medical's Axon Therapy, a non-invasive treatment for painful diabetic neuropathy (PDN). This approval marks a significant advancement in pain management for diabetic patients who suffer from nerve pain in their limbs. Axon Therapy is a neurostimulation technology that uses low-voltage electrical pulses to stimulate nerves, aiming to reduce pain without requiring drugs or invasive procedures. The therapy is designed to offer a safer and more accessible treatment option, which could benefit a large number of patients dealing with chronic neuropathic pain associated with diabetes.

U.S. Neuralgia Treatment Market Trends

The U.S. neuralgia treatment market held a dominant position in 2024 due to the growing prevalence of neurological conditions, coupled with the increasing demand for advanced treatment options and specialized care. For instance, in 2021, over 3 billion people worldwide were affected by neurological conditions, which are now the leading cause of ill health and disability globally. Since 1990, disability-adjusted life years (DALYs) due to neurological disorders have increased by 18%. The burden is disproportionately higher in low- and middle-income countries, where access to neurological professionals is significantly lower than in high-income countries.

Europe Neuralgia Treatment Market Trends

The Europe neuralgia treatment market was identified as a lucrative region in 2024. The region’s growth is attributed to the increasing demand for innovative, patient-convenient formulations which enhance treatment compliance and reduce administration frequency. For instance, in July 2024, Adalvo Limited launched the Pregabalin Extended-Release (ER) tablets in Europe, targeting neuropathic pain treatment. This formulation offers the benefit of reduced dosing frequency, improving patient convenience and compliance. The product was initially available in Germany and Spain, with plans for expansion across Europe.

The UK neuralgia treatment market is expected to grow rapidly in the coming years due to the strategic investment in innovative clinical trials to repurpose existing drugs for more effective treatment options. For instance, in April 2023, the UK launched a significant trial, called Octopus, to explore if existing drugs can be repurposed to slow the progression of multiple sclerosis (MS), a condition affecting over 130,000 people in the country. Funded by USD 16.78 million from the MS Society, the multi-arm, multi-stage trial aims to test multiple drugs simultaneously, starting with metformin and alpha lipoic acid. The approach, using MRI for early insights, seeks to accelerate the availability of new treatments for progressive MS patients. The trial, led by UCLH, plans to recruit 1,200 participants across up to 30 UK sites.

The Germany neuralgia treatment market held a substantial market share in 2024 owing to the growing adoption of advanced, minimally invasive procedures for effective chronic pain management. For instance, in July 2024, Germany-based NEW4MED GmbH introduced basivertebral nerve ablation (BVNA) therapy in Europe. This minimally invasive procedure targets the basivertebral nerve to alleviate chronic lower back pain using radiofrequency energy. The process takes about 30 minutes and involves a probe that destroys the nerve, preventing pain signal transmission.

Asia Pacific Neuralgia Treatment Market Trends

The Asia Pacific neuralgia treatment market is anticipated to grow at the fastest CAGR over the forecast period. This growth is attributed to the regulatory approvals and expansion of innovative treatment solutions enhancing surgical options for nerve repair across the region. For instance, in October 2024, Orthocell Ltd, a regenerative medicine company, received regulatory approval from Singapore's Health Sciences Authority (HSA) for its peripheral nerve repair product, Remplir, paving the way for sales to commence in Q1 of CY25. This approval extended Remplir's availability beyond Australia and New Zealand, where it had already been authorized and was distributed by Device Technologies, a well-known supplier of medical devices. Remplir is a collagen wrap designed to enhance nerve repair surgery.

The Japan neuralgia treatment market is expected to grow rapidly in the coming years due to the growing demand for advanced, non-invasive treatment options offering precise and effective alternatives to traditional therapies. For instance, in October 2022, Accuray Incorporated's CyberKnife System received reimbursement approval from Japan's Ministry of Health, Labor, and Welfare for treating trigeminal neuralgia, offering a precise, non-invasive alternative to the Gamma Knife system. This approval provides a new treatment option for the 5,000 people suffering from this debilitating condition in Japan.

Key Neuralgia Treatment Company Insights

Some of the key companies in the global neuralgia treatment market include GSK plc., Pfizer Inc., Novartis AG, Biogen, Zydus Group (Cadila Healthcare Limited), and H. Lundbeck A/S. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

GSK plc. is a healthcare company that develops and markets pharmaceuticals, vaccines, and consumer healthcare products across various therapeutic areas. Its portfolio includes treatments for diseases such as HIV, respiratory conditions, and cancer and vaccines for various infectious diseases.

-

Pfizer Inc. is a global biopharmaceutical company that is discovering, developing, and manufacturing medicines for various conditions, including cardiovascular, cancer, and immune disorders. It also offers sterile injectables, biosimilars, active pharmaceutical ingredients (APIs), and contract manufacturing services. Pfizer aims to improve health outcomes through innovative treatments and solutions.

Key Neuralgia Treatment Companies:

The following are the leading companies in the neuralgia treatment market. These companies collectively hold the largest market share and dictate industry trends.

- GSK plc.

- Pfizer Inc.

- Novartis AG

- Biogen

- Zydus Group (Cadila Healthcare Limited)

- H. Lundbeck A/S

Recent Developments

-

In January 2024, Zydus Lifesciences received final approval from the U.S. Food and Drug Administration for its generic Gabapentin tablets for managing postherpetic neuralgia (PHN). The approval covers 300 mg and 600 mg once-daily dosages, a drug used for pain relief following shingles.

-

In July 2023, Novartis AG announced its acquisition of DTx Pharma to strengthen its neuroscience pipeline and enhance its capabilities in xRNA platform technologies. This move aimed to advance the development of RNA-targeted therapies, particularly in neurodegenerative and psychiatric disorders.

Neuralgia Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.49 billion

Revenue forecast in 2030

USD 3.43 billion

Growth Rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Denmark, Sweden, Norway, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

GSK plc.; Pfizer Inc.; Novartis AG; Biogen; Zydus Group (Cadila Healthcare Limited); H. Lundbeck A/S

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Neuralgia Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global neuralgia treatment market report based on product, technology, and region.

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Based

-

Anticonvulsant Medicines

-

Tricyclic Antidepressants

-

-

Surgery

-

Radiofrequency Thermal Lesioning

-

Stereotactic Radiosurgery

-

Microvascular Decompression

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital & Clinics

-

Ambulatory Surgery Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.