- Home

- »

- Medical Devices

- »

-

Neuromodulation Devices Market Size, Industry Report, 2033GVR Report cover

![Neuromodulation Devices Market Size, Share & Trends Report]()

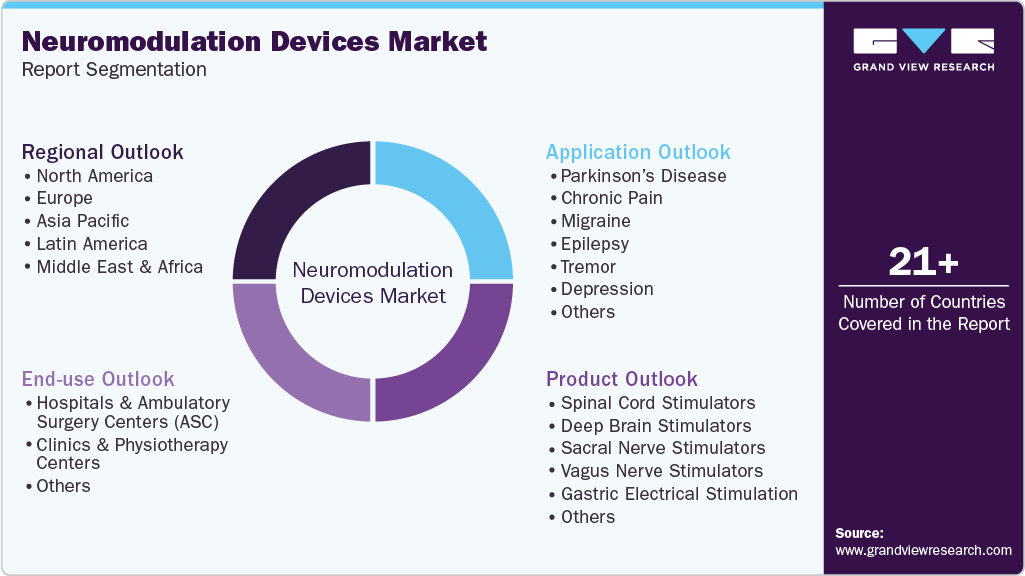

Neuromodulation Devices Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Spinal Cord Stimulators, Deep Brain Stimulators, Sacral Nerve Stimulators), By Application (Migraine, Epilepsy, Chronic Pain, Depression), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-958-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Neuromodulation Devices Market Summary

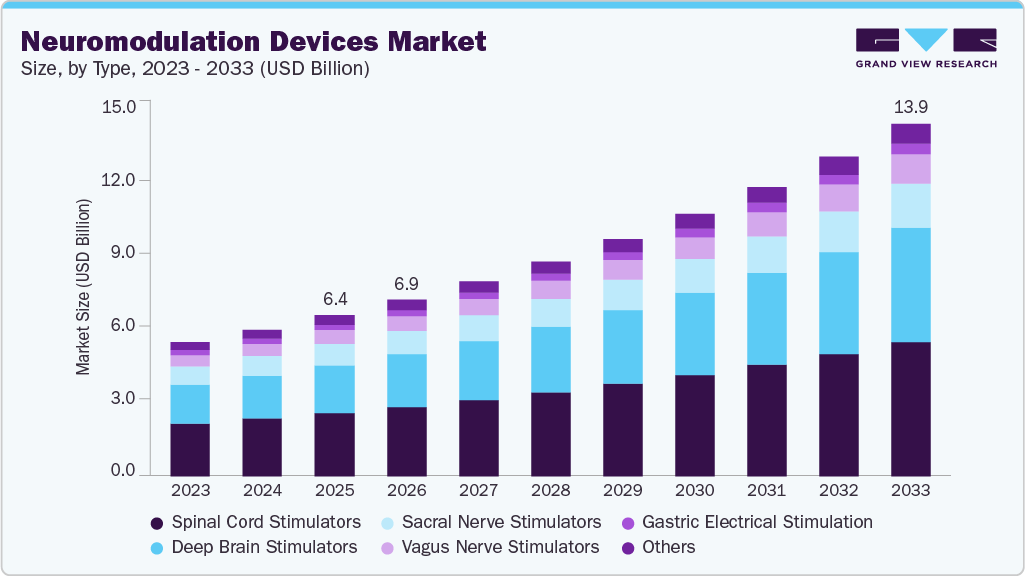

The global neuromodulation devices market size was estimated at USD 6.37 billion in 2025 and is projected to reach USD 13.93 billion by 2033, growing at a CAGR of 10.35% from 2026 to 2033. The rising government funding for R&D activities in these devices, increasing prevalence of neurological disorders and technological advancements in these devices are driving the market growth.

Key Market Trends & Insights

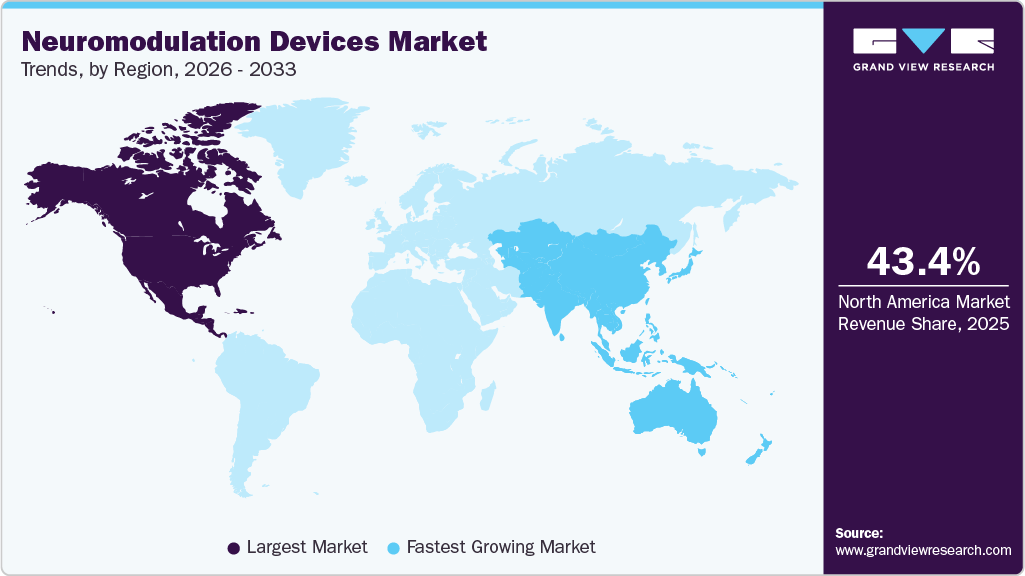

- North America dominated the neuromodulation devices market with the largest revenue share of 43.37% in 2025.

- The neuromodulation devices market in the U.S. accounted for the largest market revenue share in North America in 2025.

- By product, the spinal cord stimulators segment led the market with the largest revenue share of in 2025.

- By application, the parkinson’s disease segment led the market with the largest revenue share in 2025.

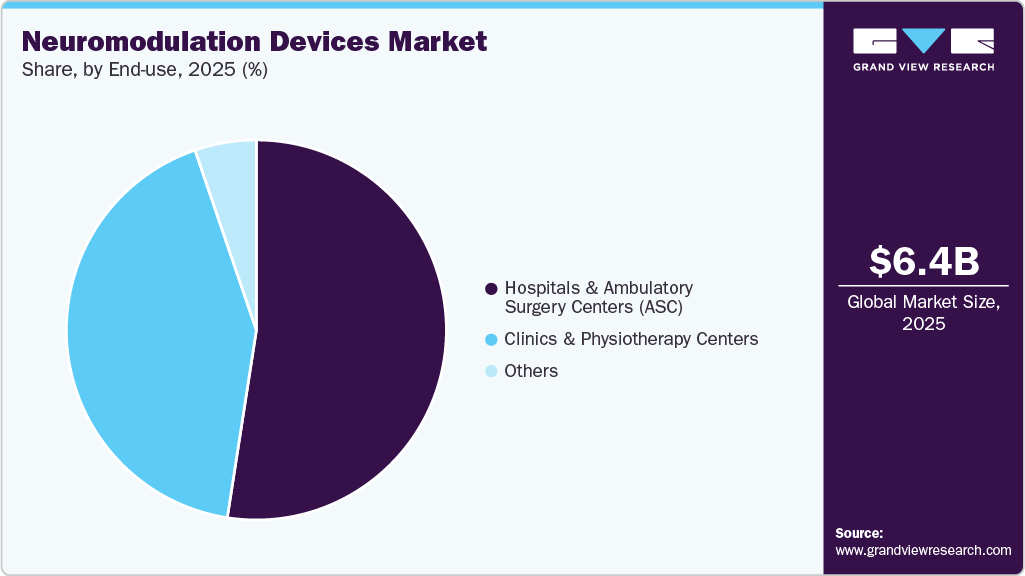

- By end-use, the hospitals & ambulatory surgery centers (ASC) segment led the market with the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 6.37 Billion

- 2033 Projected Market Size: USD 13.93 Billion

- CAGR (2026-2033): 10.35%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

For instance, according to the Parkinson’s Foundation, around 1 million people are living with Parkinson’s disease in the U.S., which is further expected to increase to 1.2 million by 2030. The incidence of neurological disorders is on the rise, leading to an increased need for innovative treatment solutions, including neuromodulation devices. For instance, according to the World Health Organization (WHO) in February 2024, around 5 million people are diagnosed with epilepsy, which is around 49 people per 100,000 population. Moreover, conditions such as Parkinson's disease, essential tremor, dystonia, and medically refractory epilepsy are increasingly being addressed through techniques such as Deep Brain Stimulation (DBS) and other implantable neurostimulation systems. Thus, the increasing prevalence of these conditions significantly increases the demand for advanced neuromodulation devices.

Technological advancements, particularly the continuous introduction of next-generation internal neuromodulation devices, are a major driving force behind the growth of the neuromodulation devices market. Innovations such as miniaturized implantable systems, closed-loop stimulation, AI-driven programming, and wireless or rechargeable platforms are significantly improving device precision, patient comfort, and long-term therapy outcomes. New product launches also expand clinical indications, enabling treatment of chronic pain, movement disorders, epilepsy, depression, and emerging neuropsychiatric conditions with greater efficacy. As companies introduce devices with longer battery life, personalized stimulation algorithms, and enhanced connectivity for remote monitoring, both clinicians and patients are adopting these solutions at a faster pace, supporting broader market expansion and accelerating the global shift toward advanced neuromodulation therapies.

New Product Launch & Regulatory Approvals

Company

Verticals

KOLs

Mainstay Medical

In July 2024, Mainstay Medical Holdings plc has received regulatory approvals in the European Union, the UK, and Australia for full-body MRI conditional labeling of the ReActiv8 Restorative Neurostimulation system. As a result, all existing and future ReActiv8 patients in Europe and Australia with commercially available 45 cm leads can now safely undergo 1.5T full-body MRI scans.

“These MRI approvals will allow us to significantly broaden access to ReActiv8 for patients in Europe and Australia who may require (or develop the need for) MRI imaging post-implantation, complementing our earlier approval of MRI labeling in the United States,” stated Jason Hannon, Chief Executive Officer of Mainstay Medical.

Medtronic

In April 2024, Medtronic plc has announced that the U.S. FDA approved the Inceptiv closed-loop rechargeable spinal cord stimulator for managing chronic pain. Inceptiv is the first Medtronic SCS device to feature a closed-loop system that detects biological signals along the spinal cord and automatically adjusts stimulation in real time, ensuring the therapy remains aligned with everyday movements.

"Pain is intensely personal, and stimulation therapy should meet the needs of every patient, moment to moment," said Dr. Krishnan Chakravarthy, M.D., Ph.D., Director of Innovative Pain Treatment Solutions and Surgery Center, VA San Diego Healthcare, and Chairman of the Empower You Chronic Pain Foundation. "Inceptiv listens to what the body is saying and, more quickly than you can blink, it seamlessly adjusts. This represents an important leap forward for the treatment of chronic pain."

Boston Scientific Corporation

In February 2024, Boston Scientific Corporation announced that the U.S. FDA has approved an expanded indication for the WaveWriter SCS System, allowing it to be used for treating chronic low back and leg pain in individuals without a history of back surgery, commonly known as Non-Surgical Back Pain (NSBP).

″Diagnosing and treating chronic low back pain can be challenging,″ said James North, M.D. Carolinas Pain Institute and principal investigator of the SOLIS trial. ″The new indication for NSBP expands the use of the WaveWriter SCS Systems to patients who have had limited options for treating their lower back pain.″

Source: Company Websites, Grand View Research Analysis.

Furthermore, the rising prevalence of Parkinson’s disease is significantly driving growth in the neuromodulation devices market, as increasing patient numbers heighten the need for advanced, long-term treatment options beyond conventional medication. According to the Parkinson’s Foundation (2025), approximately 1.1 million people in the U.S. are living with Parkinson’s disease, a number expected to reach 1.2 million by 2030, with around 90,000 new diagnoses each year and more than 10 million people affected globally. As symptoms progress and medications become less effective, demand for therapies such as deep brain stimulation (DBS) continues to expand. Neuromodulation devices are instrumental in improving motor control, reducing reliance on drug therapy, and enhancing quality of life for patients with moderate to advanced Parkinson’s disease. With an aging population contributing to rising incidence, the adoption of neuromodulation solutions is accelerating, firmly supporting market growth.

Moreover, government funding initiatives for studying neurological disorders are driving the market by enabling increased research, clinical trials, and development of advanced neuromodulation and therapeutic devices. Such financial support accelerates innovation, reduces development costs for manufacturers, and fosters public-private partnerships, ultimately expanding the global adoption of neurological solutions.

Some of the major government funding initiatives to study neurological disorders in recent years are:

Sr. No.

Organization

Year

Funding (USD Million)

Focused Areas

1

Government of Canada

2024

80

- Dementia

- Amyotrophic Lateral Sclerosis (ALS)

- Multiple sclerosis

- Brain and spinal cord injuries

- Brain cancer

- Stroke

2

Parkinson's Foundation

2024

3

- Parkinson’s disease

3

American Brain Foundation

2023

10

- Parkinson’s disease

- Encephalitis

- Multiple sclerosis

- Alzheimer’s disease

- Brain trauma

- Autism

- Others

4

Parkinson's Foundation

2023

2.8

- Parkinson disease

5

Department of Health and Social Care UK

2021

515.82

- Pick’s Disease

- Fronto-temporal dementia

- Wernicke-korsakoff

- Parkinson’s disease dementia

- Lewy Body dementia

- Alzheimer’s disease

- Mild cognitive impairment

6

Australian Government

2020

21.8

- Alzheimer’s disease

- Autism

- Encephalitis

Source: Environment and Climate Change Canada, Commonwealth of Australia, GOV.UK, Parkinson's Foundation, Grand View Research

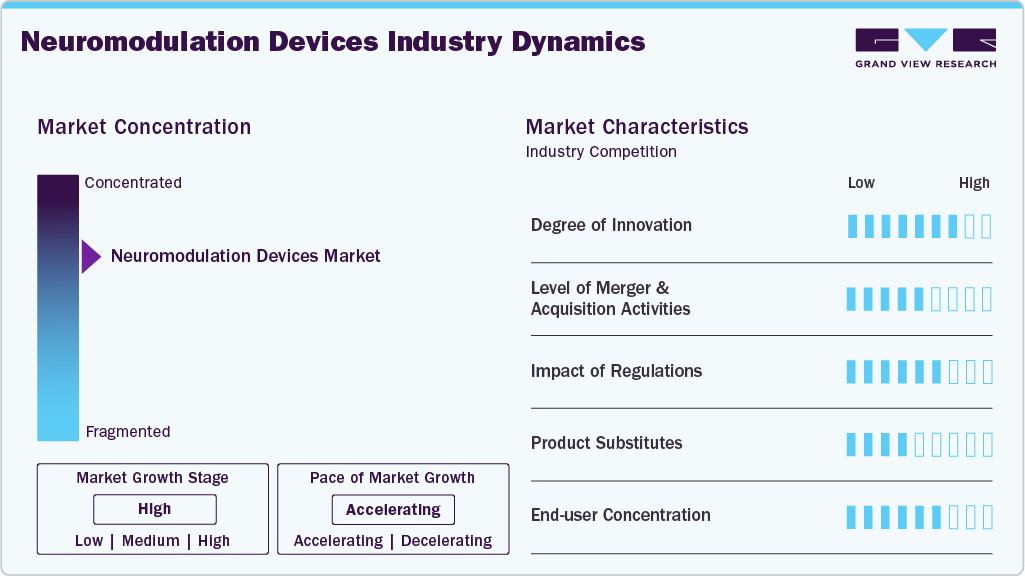

Market Concentration & Characteristics

Innovation in the neuromodulation devices market is significantly high, focusing on enhancing patient outcomes, increasing the applications of neuromodulation devices and development of technologically advanced devices. For instance, in September 2024, Abbott launched a pivotal clinical trial named the TRANSCEND study to assess the efficacy of its DBS system in managing Treatment-resistant Depression (TRD), a severe form of major depressive disorder. The U.S. FDA has awarded Abbott Breakthrough Device designation for this research under its Breakthrough Devices Program, which accelerates the review process for innovative technologies that have the potential to significantly enhance the lives of individuals with life-threatening or irreversibly debilitating conditions.

The neuromodulation devices market has experienced a steady increase in mergers and acquisitions (M&A) activity as companies strive to enhance their technological capabilities, broaden their therapeutic portfolios, and accelerate global market penetration. Leading manufacturers are acquiring innovative start-ups specializing in targeted neurostimulation, closed-loop systems, and novel implant platforms to enhance product differentiation and stay competitive. M&A deals also enable firms to diversify into high-growth segments such as spinal cord stimulation, deep brain stimulation, and peripheral nerve stimulation while gaining access to proprietary software, AI algorithms, and minimally invasive delivery systems. For Instance, in October 2025, Boston Scientific Corporation announced that it has signed a definitive agreement to acquire Nalu Medical, Inc., a privately held medical technology company specializing in innovative, minimally invasive solutions for the treatment of chronic pain.

The neuromodulation devices market continued to be significantly shaped by stringent regulatory frameworks governing product safety, clinical efficacy, and post-market performance. Regulatory bodies, such as the U.S. FDA, the European Medicines Agency (EMA), and Health Canada, have enforced strong standards for device approvals, including requirements for long-term clinical data, cybersecurity validation for connected implants, and rigorous biocompatibility testing. These regulations increased development timelines and compliance costs for manufacturers but also enhanced patient confidence and clinical adoption by ensuring high safety and reliability. Additionally, updates in reimbursement policies and value-based care models influenced market competitiveness, compelling companies to demonstrate not only clinical benefits but also cost-effectiveness.

End user concentration in the neuromodulation devices market is relatively high, with demand primarily dominated by hospitals, specialty neurology and pain management centers, and ambulatory surgical centers (ASCs). Hospitals account for the largest share due to their advanced surgical infrastructure, skilled neurosurgeons, and ability to manage complex implantation procedures such as spinal cord stimulators and deep brain stimulators. Specialty clinics, including neurology, orthopedics, and pain rehabilitation centers, represent a rapidly growing user base as minimally invasive neuromodulation procedures shift toward outpatient settings. ASCs also contribute significantly, driven by lower procedural costs, shorter hospital stays, and an increasing volume of elective neuromodulation surgeries. This concentration among a few high-capacity end users impacts purchasing behavior, often leading to bulk procurement agreements, long-term service contracts, and strong vendor-provider relationships, thereby influencing competitive dynamics within the market.

Product Insights

The spinal cord stimulators segment dominates the neuromodulation devices market in 2025. These advanced devices are designed to improve the overall quality of life and sleep for individuals suffering from chronic pain, while also significantly reducing their reliance on pain medications. The increasing acceptability of these devices to treat a wide range of conditions, coupled with the rising development of advanced devices, is driving the segment growth. For instance, in April 2024, Medtronic plc has announced that the U.S. FDA approved the Inceptiv closed-loop rechargeable spinal cord stimulator for managing chronic pain. Inceptiv is the first Medtronic SCS device to feature a closed-loop system that detects biological signals along the spinal cord and automatically adjusts stimulation in real time, ensuring the therapy remains aligned with everyday movements.

The deep brain stimulators segment is anticipated to grow at the fastest CAGR in the neuromodulation devices market. Deep brain stimulation (DBS) is an effective treatment for movement disorders such as Parkinson’s disease, dystonia, and essential tremor, particularly when medications are insufficient. The increasing availability of these devices, coupled with increasing R&D initiatives in these devices, are expected to drive the segment growth. For instance, in January 2024, the FDA approved the Medtronic Percept RC Deep Brain Stimulation (DBS) system for treating Parkinson’s disease and other movement disorders such as essential tremor, epilepsy, and dystonia. This technology, featuring exclusive BrainSense capabilities, aims to improve patients' quality of life by controlling debilitating tremors and facilitating daily activities.

Application Insights

Parkinson’s disease dominated the application segment in 2025. The rising prevalence of Parkinson's disease, coupled with the increasing acceptance of deep brain stimulation as an effective treatment option, is expected to drive segment growth. As per data published by the Parkinson’s Foundation in 2025, an estimated 1.1 million people in the U.S. were living with Parkinson’s disease (PD), highlighting the growing burden of neurological disorders. This number is projected to increase further, reaching approximately 1.2 million by 2030, underscoring the rising demand for advanced neuromodulation therapies for symptom management. Moreover, as the global population ages, the incidence of this condition is expected to rise, thereby driving the demand for effective therapies to manage symptoms.

The chronic pain segment is expected to grow at the fastest CAGR in the neuromodulation devices market. Chronic pain, along with discomfort lasting more than three months, affects millions globally, significantly impacting quality of life, and has a significantly high prevalence among adults. For instance, according to the UK Pain Messages 2024, chronic pain affected around 8 million adults in the country, with significantly higher prevalence in the elderly population aged 75 years and above, with around 62% reporting symptoms of chronic pain. The high prevalence of chronic pain has prompted healthcare providers to explore alternative therapies, particularly neuromodulation techniques, which utilize electrical impulses to regulate nerve activity, thereby contributing to the segment's growth.

End-use Insights

Hospitals & ambulatory surgical centers (ASCs) dominated the product segment in 2025 and are expected to witness the fastest growth over the forecast period. Hospitals are increasingly adopting advanced neuromodulation techniques to address conditions such as chronic pain, epilepsy, and treatment-resistant depression, where traditional pharmacological approaches are not giving effective outcomes. In May 2024, AiM Medical Robotics partnered with Brigham and Women's Hospital to conduct the first human clinical study using MRI-guided device placement for deep brain stimulation (DBS) in Parkinson's patients. This collaboration aims to validate their innovative MRI-compatible surgical robot, which previously demonstrated successful results in cadaver trials by precisely delivering DBS leads while addressing brain shift issues. Such collaborative efforts between the hospitals and companies operating in the market are contributing to the segment growth.

Clinics and physiotherapy centers are increasingly adopting neuromodulation devices due to their enhanced outcomes compared to traditional treatment options. This trend is significantly influenced by the limitations of medications, which often fail to provide satisfactory results for patients, leading healthcare providers to seek innovative alternatives. By focusing on patient-centered care, these facilities are well-equipped to incorporate advanced therapies, enabling them to create personalized treatment plans that improve patient outcomes and overall satisfaction.

Regional Insights

The neuromodulation devices market in North America held the largest share and accounted for 43.37% of global revenue in 2025. This can be attributed to the rising prevalence of neurological disorders such as Alzheimer’s disease, Parkinson’s disease, and epilepsy, along with a growing demand for minimally invasive neurological procedures. Additionally, rapid technological advancements, the presence of leading manufacturers in the region, increased research and development investments, and enhanced government funding and initiatives further contribute to this market growth.

U.S. Neuromodulation Devices Market Trends

The neuromodulation devices market in the U.S. held the largest share in North America's neuromodulation devices market in 2025. According to the Brain Aneurysm Foundation in September 2025, approximately 1 in 50 individuals in the U.S. has an unruptured brain aneurysm, and more than 30,000 aneurysm ruptures occur each year. This rising incidence of neurological disorders is expected to drive market growth in the country. Additionally, a favorable reimbursement framework and increasing healthcare expenditures are key factors contributing to the growth of the neuromodulation devices market in the U.S.

Europe Neuromodulation Devices Market Trends

Europe is recognized as one of the most advanced regions globally, characterized by its advanced technologies and infrastructure, which contribute to exceptional healthcare facilities and high-quality patient care. The growing incidence of acute ischemic strokes, an increase in sedentary lifestyles, and the introduction of advanced technological products are key factors driving the neuromodulation devices market in the region. For instance, in December 2023, Medtronic obtained a CE mark for its rechargeable Percept deep brain stimulation (DBS) device, which combines brain signal capture technology with a rechargeable battery, minimizing the need for device replacements. This device is designed for patients with Parkinson’s disease, essential tremor, and primary dystonia.

The UK neuromodulation devices market in 2025 is shaped by strong growth driven by rising cases of chronic pain, Parkinson’s disease, epilepsy, and other neurological disorders, coupled with an aging population that requires long-term, effective treatment options. Adoption is further enhanced by rapid technological advancements, including miniaturized implants, wireless connectivity, and adaptive or closed-loop stimulation systems, which improve therapeutic outcomes and patient comfort. Spinal cord stimulation remains the dominant segment, supported by increasing preference for minimally invasive, outpatient-based procedures across the National Health Service (NHS).

The neuromodulation devices market in France is witnessing strong growth in 2025, driven by the increasing prevalence of chronic pain, Parkinson’s disease, epilepsy, and other neurological disorders, along with a rapidly aging population requiring long-term therapy. The adoption of spinal cord stimulation (SCS) remains the highest, supported by improved device safety, miniaturization, and next-generation technologies such as wireless systems and closed-loop stimulation. France is also witnessing a rise in demand for minimally invasive and implantable neurostimulation procedures as patients and clinicians shift away from long-term pharmacological treatments.

Asia Pacific Neuromodulation Devices Market Trends

The neuromodulation devices market in Asia-Pacific is set for significant growth, driven by several key factors such as the presence of numerous local players in countries such as China and Japan, as these companies introduce innovative products tailored to regional needs, increasing competition and accessibility. Additionally, rising awareness about treatment options for neurological diseases is further expected to propel market growth. Moreover, organizations such as the Asia-Pacific Centre for Neuromodulation (APCN), which focuses on research and promoting the benefits of stimulation surgeries, are also anticipated to contribute positively to demand of these devices.

The neuromodulation devices market in China is expanding rapidly, driven by the rising prevalence of chronic pain, Parkinson’s disease, epilepsy, and other neurological conditions, along with a large aging population that increasingly requires long-term therapeutic solutions. Market growth is further supported by strong government investment in healthcare infrastructure, wider availability of advanced neurology departments, and increasing awareness of non-pharmacological treatment options.

Latin America Neuromodulation Devices Market Trends

The neuromodulation devices market in Latin America is expanding steadily, fueled by rising cases of chronic pain, epilepsy, Parkinson’s disease, depression, and other neurological disorders, along with a growing elderly population requiring long-term treatment. Increasing investment in healthcare infrastructure, wider access to specialized neurology and pain management centers, and gradual improvements in reimbursement mechanisms are supporting stronger adoption across major countries, such as Brazil and Argentina.

Middle East & Africa (MEA) Neuromodulation Devices Market Trends

The MEA neuromodulation market is gaining momentum due to the growing burden of neurological disorders, increasing healthcare investments, expanding private hospital infrastructure, and greater health insurance penetration, particularly in Gulf countries and parts of Africa. The market is forecast to grow strongly, with spinal-cord stimulators remaining the largest segment, while sacral-nerve and other stimulators show the fastest growth.

Key Neuromodulation Devices Company Insights

Neuromodulation devices market is competitive and consists of several major players. In terms of market share, few major players currently dominate the market. However, with technological advancements and product modernizations, mid-size to smaller firms are increasing their market presence by launching new products and reducing the side effects of the procedures. The players in the market are striving to maintain their potential market share. Growing competition by means of technological improvements and new product developments leading to a reduction in the cost of the product is projected to boost the market.

Key Neuromodulation Devices Companies:

The following are the leading companies in the neuromodulation devices market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott (St. Jude Medical)

- Medtronic

- Boston Scientific Corporation

- Aleva Neurotherapeutics

- Nexstim

- LivaNova PLC

- Neuropace Inc.

- Mainstay Medical

- Saluda Medical Pty Ltd

- Biotronik

- electroCore, Inc.

- MicroTransponder Inc.

- tVNS Technologies GmbH

- Laborie

Recent Developments

-

In September 2025, Medtronic plc announced that its Altaviva device had received U.S. FDA approval. The device delivers minimally invasive implantable tibial neuromodulation (ITNM) therapy, which is implanted near the ankle and intended for the treatment of urge urinary incontinence.

-

In May 2024, Nexstim Plc announced that Nexstim, Inc. had entered into a nonexclusive strategic alliance agreement with Inomed Inc. This agreement aims to enhance collaboration in marketing, sales, and application support between the two companies in the U.S.

-

In April 2024, Medtronic plc announced that the U.S. FDA approved the Inceptiv closed-loop rechargeable spinal cord stimulator for managing chronic pain. Inceptiv is the first Medtronic SCS device to feature a closed-loop system that detects biological signals along the spinal cord and automatically adjusts stimulation in real time, ensuring the therapy remains aligned with everyday movements.

Neuromodulation Devices Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 6.99 billion

Revenue forecast in 2033

USD 13.93 billion

Growth Rate

CAGR of 10.35% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Abbott (St. Jude Medical); Medtronic; Boston Scientific Corporation; Aleva Neurotherapeutics; Nexstim; LivaNova PLC; Neuropace Inc.; Mainstay Medical; Saluda Medical Pty Ltd; Biotronik; electroCore, Inc.; MicroTransponder Inc.; tVNS Technologies GmbH; Laborie

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Neuromodulation Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global neuromodulation devices market report on the basis of product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Spinal Cord Stimulators

-

Deep Brain Stimulators

-

Sacral Nerve Stimulators

-

Vagus Nerve Stimulators

-

Gastric Electrical Stimulation

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Parkinson’s Disease

-

Chronic Pain

-

Migraine

-

Epilepsy

-

Tremor

-

Depression

-

Urinary & Faecal Incontinence

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Ambulatory Surgery Centers (ASC)

-

Clinics & Physiotherapy Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global neuromodulation devices market size was estimated at USD 6.37 billion in 2025 and is expected to reach USD 6.99 billion in 2026.

b. The global neuromodulation devices market is expected to grow at a compound annual growth rate of 10.35% from 2026 to 2033 to reach USD 13.93 billion in 2033.

b. The spinal cord stimulators segment dominated the market with a share of 39.53% in 2025 due to the increased use of spinal cord stimulators for treating chronic pain and nerve pain.

b. Some of the key players in the global neuromodulation devices market are Abbott (St. Jude Medical); Medtronic; Boston Scientific Corporation; Aleva Neurotherapeutics; Nexstim; LivaNova PLC; Neuropace Inc.; Mainstay Medical; Saluda Medical Pty Ltd; Biotronik; electroCore, Inc.; MicroTransponder Inc.; tVNS Technologies GmbH; Laborie

b. The rise in the prevalence of lifestyle diseases such as chronic pain and depression increased investment by private players for research and development of neurological disorders, and the increasing number of neurological diseases are some of the factors driving the growth of the global neuromodulation devices market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.