- Home

- »

- Next Generation Technologies

- »

-

Neuromorphic Computing Market Size, Industry Report 2030GVR Report cover

![Neuromorphic Computing Market Size, Share & Trends Report]()

Neuromorphic Computing Market (2024 - 2030) Size, Share & Trends Analysis Report By Application, By End-use, By Deployment, By Component (Hardware, Software, Services), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-066-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Neuromorphic Computing Market Summary

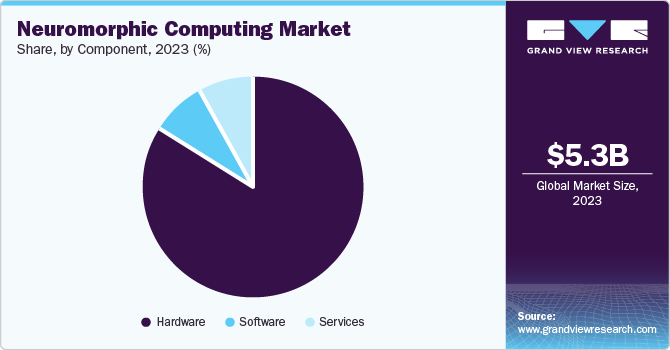

The Global Neuromorphic Computing Market size was estimated at USD 5,277.2 million in 2023 and is projected to reach USD 20,272.3 million by 2030, growing at a CAGR of 19.9% from 2024 to 2030. The increasing use of neuromorphic technology in deep learning applications, transistors, accelerators, next-generation semiconductors, and autonomous systems, such as robotics, drones, self-driving cars, and artificial intelligence, have propelled market growth.

Key Market Trends & Insights

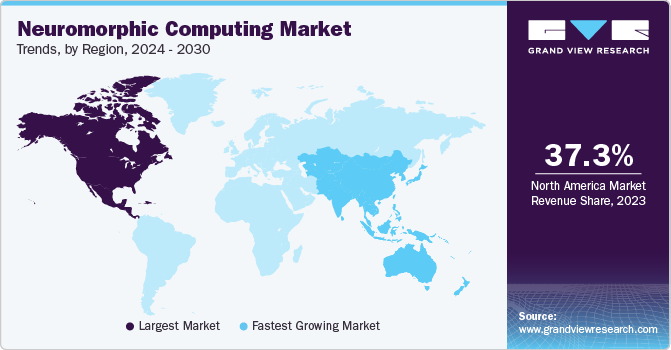

- North America neuromorphic computing market led the market with 37.3% of the revenue share in 2023.

- The U.S. neuromorphic computing market held a significant share of the regional market in 2023.

- By application, the image processing segment led the market with a revenue share of 45.5% in 2023.

- By deployment, edge deployment accounted for the largest market share in 2023.

- By component, the hardware segment accounted for a dominant revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5,277.2 Million

- 2030 Projected Market Size: USD 20,272.3 Million

- CAGR (2024-2030): 19.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

For instance, in August 2022, a multidisciplinary research team led by engineers at UC San Diego developed NeuRRAM, a neuromorphic chip designed to manage AI applications at higher accuracy and lower energy than other platforms. The increasing demand for faster and efficient neuromorphic chips for real-time and parallel processing capabilities is expected drive the market growth.

Chip design and fabrication advancements also fuel market growth, allowing for more efficient and scalable neuromorphic computing architectures. For instance, in September 2022, Intel announced the launch of its Kapoho Point development board, based on the Loihi 2 research chip and the Lava software framework to accelerate neuromorphic computing. New tools such as the 8-chip Kapoho Point board facilitate large-scale workloads and low-latency sensing, with significant speed and energy improvements over previous generations. Moreover, they bring neuromorphic technology to commercial applications by providing developers with a scalable platform for building AI models and solving complex problems more efficiently. Expanding applications in edge computing, IoT devices, and autonomous systems are leveraging neuromorphic computing's low-power and real-time processing capabilities.

Neuromorphic technology, combined with artificial intelligence (AI) and machine learning, can be used in defense systems to enhance processing power and give analytical results to speed up wartime decision-making. Moreover, this technology is much more energy efficient and can improve the mobility, endurance, and portability of technologies that soldiers can bring to the field. Furthermore, key companies in this market undertake continuous investments in research & development processes and launch innovative products to advance new research technology. For instance, in December 2022, Polyn Technology, an Israel-based Fabless semiconductor company, declared the accessibility of neuromorphic analog signal processing models for Edge Impulse, a machine learning development platform for edge devices addressing ultra-low power on sensor solutions for wearables and the Industrial Internet of Things (IIoT).

Application Insights

The image processing segment led the market with a revenue share of 45.5% in 2023. This can be attributed to the rising deployment of computer vision in numerous industries, including automotive, healthcare, and media & entertainment, among others. For instance, medical imaging is a vital image processing application. Advancements in image sensors and other processing technologies are expected to drive revenue growth in this segment during the forecast period. The primary objective of image processing is to achieve the least possible amount of visual information to solve complex tasks, such as image recognition, which can make the entire process more efficient. The development of neuromorphic image processing is expected to vastly improve computers' ability to interpret and analyze data. Moreover, artificial neural network models are gaining popularity in image processing, where speedy computation and parallel architectures are essential.

The data processing segment is expected to register a notable CAGR over the forecast period. This is owing to the increasing demand for efficient and adaptive processing of large datasets. As the volume and complexity of data continue to grow, traditional computing architectures are facing limitations in terms of processing speed and energy efficiency. Neuromorphic computing, with its ability to simulate human brain functions, offers a significant advantage in processing complex data patterns, enabling real-time insights and decision-making. The adoption of neuromorphic computing in data processing applications, such as data analytics, machine learning, and natural language processing, has been driven by its ability to handle large-scale datasets, reduce processing time, and improve energy efficiency.

Deployment Insights

Edge deployment accounted for the largest market share in 2023. The increasing application of edge computing in identifying body gestures for touchless interfaces, automobiles with sensitive voice controls, and internal intelligence for assistant robots contribute to this segment’s growth. The expansion of wireless networking has driven interest in the rapidly emerging computer model of edge computing, which drives the development of this segment. Moreover, neuromorphic computing supports low-power applications and on-device adaptability in the edge computing sector, which is fueling market expansion worldwide.

The cloud segment is expected to register a faster CAGR during the forecast period. This is owing to its multiple technological advantages, such as being a one-stop platform to securely store and deliver large volumes of data for any enterprise. There are several advantages to using neuromorphic computing in the cloud, including the ability to scale resources up or down as needed, reduced upfront costs for hardware and software, and the ability to access resources from anywhere with internet connectivity. However, there are also some potential challenges to consider, such as latency and security concerns. Neuromorphic computing systems have greater on-device processing power and operate independently without data centers, propelling segment expansion.

Component Insights

The hardware segment accounted for a dominant revenue share in 2023. This is attributed to the increasing demand for specialized neuromorphic chips and systems that can efficiently process complex data patterns. The development of custom hardware, such as neuromorphic processors and memristor-based chips, has been crucial in enabling the adoption of neuromorphic computing in various applications. These hardware components are designed to mimic the human brain's synaptic plasticity and adaptive learning capabilities, allowing for real-time processing and improved energy efficiency. As a result, hardware is considered a vital part of neuromorphic computing, thus accounting for the largest market share.

On the other hand, the software segment is anticipated to register the fastest growth from 2024 to 2030. As the adoption of neuromorphic computing grows, demand for software that can program, optimize, and integrate neuromorphic chips and systems is also accelerating. The development of software frameworks, such as Intel's Lava and IBM's TrueNorth, has enabled developers to create applications that can harness the power of neuromorphic computing, driving innovations in areas such as AI, machine learning, and edge computing. Moreover, the increasing importance of software in enabling the scalability and flexibility of neuromorphic computing systems is expected to further lead to a steady growth rate for this segment.

End-use Insights

Consumer electronics accounted for the highest revenue share in 2023. Increasing sales of electronic devices, including laptops, PCs, and tablets, are leading to a progressive increase in demand for neuromorphic chips from the consumer electronics industry. Moreover, strategic partnerships among hardware and software solutions companies to develop advanced products contribute to segment growth. For instance, in February 2023, Prophesee announced its partnership with Qualcomm to bring neuromorphic vision technology to Snapdragon-based mobile devices. The collaboration will optimize Prophesee's Event-based Metavision sensors for use with these platforms, offering developers a faster and more efficient way to improve camera performance, especially in dynamic scenes and low-light conditions. Consumer preference for smaller and less expensive products requires the miniaturization of integrated circuits, which is attributed to the growth of the consumer electronics segment in this industry.

The automotive segment is anticipated to register the fastest growth rate from 2024 to 2030. This is attributed to the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles. The ability of neuromorphic computing to simulate human brain functions enables the real-time processing of complex data from various sensors, facilitating enhanced safety features, improved navigation, and autonomous decision-making. As the automotive industry continues to move towards Level 5 autonomy, the demand for neuromorphic computing's adaptive and efficient processing capabilities is accelerating, driving growth in this segment. Additionally, the integration of neuromorphic computing with computer vision, machine learning, and edge computing is enhancing vehicle-to-everything (V2X) communication, further fueling its adoption in the automotive sector.

Regional Insights

North America neuromorphic computing market led the market with 37.3% of the revenue share in 2023. This is owing to the presence of a robust technological infrastructure, leading technology companies, and significant investments in research and development activities in this region. Additionally, the region's strong startup ecosystem, government funding initiatives, and academic institutions have contributed to the growth of this market. The widespread adoption of AI, machine learning, and Internet of Things (IoT) technologies in industries such as healthcare, finance, and automotive has also fueled the demand for neuromorphic computing in North America.

U.S. Neuromorphic Computing Market Trends

The U.S. neuromorphic computing market held a significant share of the regional market in 2023. The country is well-known worldwide for its early adoption of advanced technologies and the presence of a robust IT services infrastructure in areas such as Silicon Valley. Prominent technology companies such as IBM and Intel have invested substantially towards research and development efforts in neuromorphic hardware and software solutions, which in turn has propelled the demand for these advanced technology solutions from various sectors such as consumer electronics, defense, and automotive.

Europe Neuromorphic Computing Market Trends

Europe accounted for a notable share of the global market in 2023. This is attributed to the region's strong focus on research and development, government initiatives, and a diverse ecosystem of startups and established companies. The European Union's funding for neuromorphic computing projects, such as the Human Brain Project, has accelerated innovations and adoption in the region. Additionally, countries such as the UK, Germany, and France have established themselves as hubs for AI and machine learning research, creating a strong base for neuromorphic computing. The region's emphasis on industrial automation, automotive, and healthcare has driven demand for neuromorphic computing's efficient and adaptive processing capabilities.

The UK neuromorphic computing market held a substantial share of the European market in 2023. This is attributed to its strong research and development ecosystem, extensive government support, and presence of leading technology companies, which have created a favorable environment for the demand and growth of advanced technologies such as neuromorphic computing. Moreover, a strong focus on industries such as healthcare, finance, and automotive, which are poised to benefit from neuromorphic computing's efficient processing capabilities, has also contributed to its notable share in the European market.

Asia Pacific Neuromorphic Computing Market Trends

Asia Pacific neuromorphic computing market is expected to register the fastest CAGR during the forecast period. This high growth rate is driven by the rapid adoption of artificial intelligence, machine learning, and Internet of Things (IoT) technologies in regional economies such as China, Japan, and South Korea. The region's growing demand for smart devices, autonomous vehicles, and industrial automation has created a surge in the need for efficient and adaptive processing capabilities, which neuromorphic computing offers. Additionally, regional governments have launched initiatives to support the development of AI and neuromorphic computing, such as China's ‘Made in China 2025’ plan, which is aimed at positioning the economy as a global manufacturing hub for advanced technologies. Such developments have led to steady regional growth.

The India neuromorphic computing market is expected to grow significantly over the forecast period. This is attributed to its strong technological capabilities, growing research ecosystem, and the presence of several government initiatives aimed at this technology. The country's large workforce of skilled engineers and researchers, coupled with its increasing focus on AI and machine learning, has created a favorable environment for the development and adoption of neuromorphic solutions. Additionally, government support through research funding and policy initiatives has played a crucial role in fostering innovations and driving market growth. The Department of Electronic Systems Engineering (DESE) at the Indian Institute of Science, a public institution, has established the NeuRonICS (Neurally-Inspired Reconfigurable Intelligent Circuits & Systems) lab to research brain computation principles and apply this knowledge in developing intelligent systems.

Key Neuromorphic Computing Company Insights

Some key companies involved in the neuromorphic computing market include IBM, Intel Corporation, and Brain Corp., and others.

-

IBM is a multinational computer hardware, software, and IT solutions company. The company is developing and offering neuromorphic computing solutions, focusing on creating chips and systems that mimic the human brain's efficiency and adaptability. IBM's TrueNorth chip, developed with the backing of the Defense Advanced Research Projects Agency (DARPA), is a low-power, neuromorphic processor that simulates 1 million neurons and 256 million synapses, enabling real-time processing in applications such as image and speech recognition. Additionally, the company’s Neural Architecture is designed to support scalable, low-latency processing, and its software frameworks, such as Corelet, enable developers to create and deploy neuromorphic applications.

-

Intel Corporation is a multinational semiconductor, software, hardware, and AI solutions company. It is a prominent player in neuromorphic computing, offering a range of solutions that mimic the human brain's efficiency and adaptability. Intel's Loihi chip is a self-learning neuromorphic processor that simulates 128 million neurons and 64 billion synapses, catering to applications such as autonomous vehicles, robots, and smart home devices. Additionally, the Intel Neuromorphic Research Community (INRC) supports research and development in neuromorphic computing through collaborations with academia and industry partners. Intel's neuromorphic offerings, such as Hala Point and Kapoho Point, aim to revolutionize industries including healthcare, finance, and transportation by enabling more efficient, adaptive, and intelligent processing capabilities. The company’s latest offering, Loihi 2, further advances the field with improved performance and efficiency.

Key Neuromorphic Computing Companies:

The following are the leading companies in the neuromorphic computing market. These companies collectively hold the largest market share and dictate industry trends.

- Brain Corporation

- CEA-Leti

- General Vision Inc.

- Hewlett Packard Enterprise Development LP

- HRL Laboratories, LLC

- IBM

- Intel Corporation

- Knowm Inc.

- Qualcomm Technologies, Inc.

- SAMSUNG

- Vicarious

Recent Developments

-

In April 2024, Intel unveiled the largest neuromorphic system in the world, code-named Hala Point. This system is built using Intel's Loihi 2 processor and is designed to support research in brain-based AI while addressing the limitations of current AI technologies. Hala Point represents a significant advancement over Intel's previous system, Pohoiki Springs, offering an increase in neuron capacity by over ten times and around 12 times better performance. Hala Point has been shown to support up to 20 quadrillion operations per second with an efficiency of more than 15 trillion 8-bit operations per second per watt (TOPS/W) while carrying out conventional deep neural networks.

-

In October 2023, IBM announced that results from its new chip architecture for neural inference, named NorthPole, had been published in Science. The company states that NorthPole can run AI-based image recognition applications more efficiently and with lower latency than existing chips in the market and is 4,000 times faster than its predecessor, the TrueNorth chip. The development of the NorthPole chip has been carried out at IBM Research’s California lab and is expected to transform how advanced AI hardware systems can scale up efficiently.

Neuromorphic Computing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.81 billion

Revenue Forecast in 2030

USD 20.27 billion

Growth Rate

CAGR of 19.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Application, end-use, deployment, component, region

Regional scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Brazil

Key companies profiled

Brain Corporation; CEA-Leti; General Vision Inc.; Hewlett Packard Enterprise Development LP; HRL Laboratories, LLC; IBM; Intel Corporation; Knowm Inc.; Qualcomm Technologies, Inc.; SAMSUNG; Vicarious

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Neuromorphic Computing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global neuromorphic computing market report based on application, end-use, deployment, component, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Signal Processing

-

Image Processing

-

Data Processing

-

Object Detection

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Edge

-

Cloud

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Automotive

-

Healthcare

-

Military & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.