- Home

- »

- Pharmaceuticals

- »

-

New York Cannabis Market Size Report, 2030GVR Report cover

![New York Cannabis Market Size, Share & Trends Report]()

New York Cannabis Market Size, Share & Trends Analysis Report By Product (Flowers, Oils and Tinctures), By Source (Hemp, Marijuana), By End Use (Medical, Recreational, Industrial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-420-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Report Overview

The New York cannabis market size was valued at USD 544.2 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 16.9% from 2024 to 2030. The MRTA act has established a framework for the legal sale of adult-use cannabis, encompassing licensing, taxation, and distribution requirements. This framework is not limited to recreational purposes, but also defines the conditions for market development. Furthermore, programs aimed at licensing individuals from affected communities will promote participation and inclusivity in the market.

The authorized retailers’ growth in 2024 is expected to increase the accessibility of cannabis products, thereby posing a threat to the black market. As the number of dispensaries increases, consumers will be redirected to the legal markets, driven by the availability of a wider range of products. Moreover, the constant efforts by state authorities to crack down on unauthorized outlets will further legitimize the market, leading to increased sales in legal markets.

In New York, where cannabis has been legal for some time, the acceptance of cannabis for medical and recreational use has been growing. This cultural shift is likely to increase the number of cannabis users, provided that such processes are not banned by law. The framework of medical marijuana can serve as a basis for establishing the recreational market, with many licensed operators already active in medical marijuana sales poised to transition to adult-use sales.

The cannabis industry is expected to generate significant revenue and employment opportunities. Non-flower products such as edibles, oils, and tinctures cater to different consumer segments and usage patterns. The industry’s growth will also generate taxes that can be allocated to state projects that benefit the public. Furthermore, the industry is expected to create substantial employment opportunities in manufacturing, processing, marketing, and production sectors. For instance, in 2023, the New York State Supreme Court authorized the launch of 23 cannabis stores, while the Office of Cannabis Management reported the presence of 161 adult-use dispensaries in the state in 2023. As the industry continues to evolve, it is essential for retailers and manufacturers to adapt to changing consumer trends and regulatory frameworks to remain competitive.

Product Insights

The oils and tinctures segment dominated the market with a revenue share of 52.1% in 2023. Cannabis oils, including tinctures and vape oils, are a preferred method of consumption due to their discreet nature. New consumers, in particular, may prefer these options over traditional smoking methods. Oils can be ingested in various ways, appealing to a broader range of consumers. CBD oil is particularly popular for its wellness benefits, as it does not produce a psychoactive effect.

Flowers are expected to register significant growth with a CAGR of 16.8% over the forecast period. Flower is the oldest and most traditional form of cannabis consumption, appealing to first-time buyers and those familiar with traditional marijuana products. This method offers versatility, allowing users to consume it through smoking, vaping, or culinary use. Flower products enable users to select strains with varying cannabinoid profiles, catering to individual preferences and needs, including high-THC, high-CBD, or balanced options.

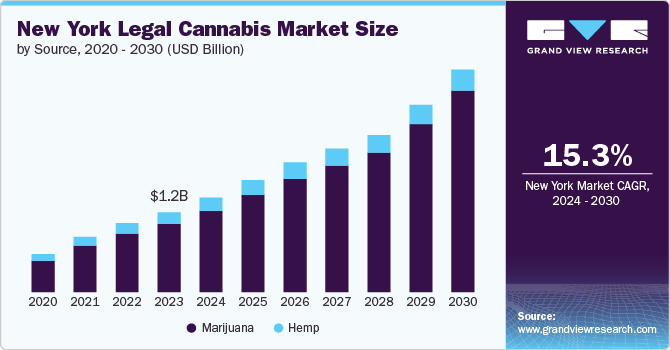

Source Insights

The marijuana source segment dominated the New York cannabis market with a revenue share of 83.8% in 2023. The New York State Office of Cannabis Management has established a regulatory framework for the marijuana source segment, prioritizing equity and access for small businesses and marginalized communities. The licensing process ensures quality control and safety, limiting the number of growers and retailers to establish a trusted source segment that provides consumers with reliable, high-quality, and safe products.

The hemp segment is anticipated to witness rapid growth with a CAGR of 15.1% over the forecast period. The legalization of hemp cultivation, enabled by the U.S. Department of Agriculture’s 2018 Farm Bill, has led to increased popularity in the market. In New York, farmers are now legally permitted to grow hemp, resulting in a boosted supply. Hemp, characterized by its 0.3% THC content, is a safer and more appealing option for consumers who prioritize non-psychoactive products. As a result, the industry is experiencing significant growth, driven by increased demand for this low-THC alternative.

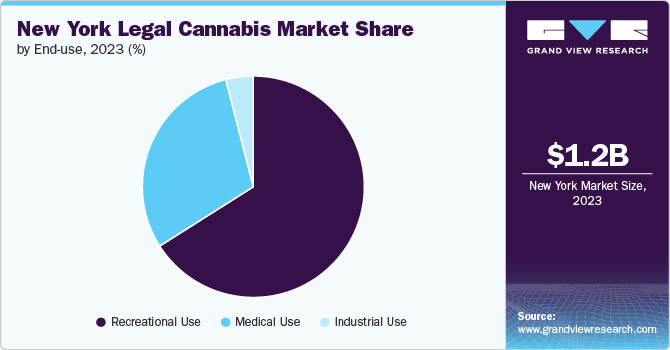

End Use Insights

Medical end use dominated the market with a revenue share of 74.9% in 2023. New York’s legalization of adult-use cannabis has built upon the existing framework for medical cannabis, established through the Compassionate Care Act of 2014. This legislation allows individuals with qualifying conditions to access medical marijuana, including topical applications for chronic pain, anxiety, epilepsy, and cancer. As a result, patient enrollment in the Medical Marijuana Program (MMP) is increasing, driven by growing demand for alternative treatments. For instance, in February 2024, RIV Capital and Etain, a medical cannabis company, opened the first adult-use dispensary in White Plains, New York, relocating Etain’s medical-only dispensary from Yonkers. The new store features a curated product menu, integrative wellness offerings, and a unique retail experience.

The recreational end use segment is expected to register the fastest CAGR of 21.8% in the forecast period. The recreational segment of the cannabis market holds significant potential for both state revenue and local entrepreneurship. Legal sales generate taxes, which can be reinvested in programs, infrastructure, and education. A variety of products, including flowers, edibles, concentrates, and infused beverages, cater to customers’ demands and stimulate creative use of this product model.

Key Companies & Market Share Insights

Some key companies in the New York cannabis market include Etain; Acreage Holdings; The Cannabist Company; Cresco Labs Inc.; and Curaleaf; among others. Owing to increasing competition, market participants have been implementing tactics and strategies such as new product launches, enhanced distribution, new product launches, geographical expansion and more.

-

Acreage Holdings LLC is a prominent player in the cannabis industry, primarily based in the New York. The company operations embody various factors of the cannabis supply chain, including cultivation, processing, distribution, and retail sales.

-

The Cannabist Company, previously called Columbia Care, is a prominent participant within the cannabisindustry headquartered in New York, focusing on the cultivation, manufacturing, and distribution of cannabis products.

Key New York Cannabis Companies:

- Etain

- Acreage Holdings

- The Cannabist Company

- Cresco Labs Inc.

- Curaleaf

- Hemp Farms of New York

- iAnthus Capital Holdings, Inc.

- PharmaCann Inc.

- VIREO HEALTH INTERNATIONAL, INC.

- NOWAVE

Recent Developments

-

In August 2024, Curaleaf announced the appointment of Executive Chairman Boris Jordan as Chairman and CEO, replacing outgoing CEO Matt Darin, who will retire but remain as a special advisor until year-end.

-

In July 2024, New York Governor Kathy Hochul announced the state’s efforts to boost the cannabis industry, issuing 109 additional licenses for adult use and reforming regulations to promote responsible growth.

-

In January 2024, iAnthus Capital Holdings, Inc. partnered with Grön Edibles to bring the renowned, woman-owned edible brand to the New Jersey market, launching Grön’s Sugar-Coated Pearl gummies in state dispensaries.

-

In January 2024, Acreage Holdings launched its adult-use operations in New York, making its “The Botanist” products available for wholesale purchase to eligible dispensaries.

New York Cannabis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 660.3 million

Revenue forecast in 2030

USD 1.7 billion

Growth rate

CAGR of 16.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, end use

Key companies profiled

Etain; Acreage Holdings; The Cannabist Company; Cresco Labs Inc.; Curaleaf; Hemp Farms of New York; iAnthus Capital Holdings, Inc.; PharmaCann Inc.; VIREO HEALTH INTERNATIONAL, INC.; NOWAVE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the New York cannabis market report based on product, source, and end use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flowers

-

Oils and Tinctures

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemp

-

Marijuana

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Recreational

-

Industrial

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."