- Home

- »

- Clinical Diagnostics

- »

-

Newborn Screening Market Size, Industry Report, 2033GVR Report cover

![Newborn Screening Market Size, Share & Trends Report]()

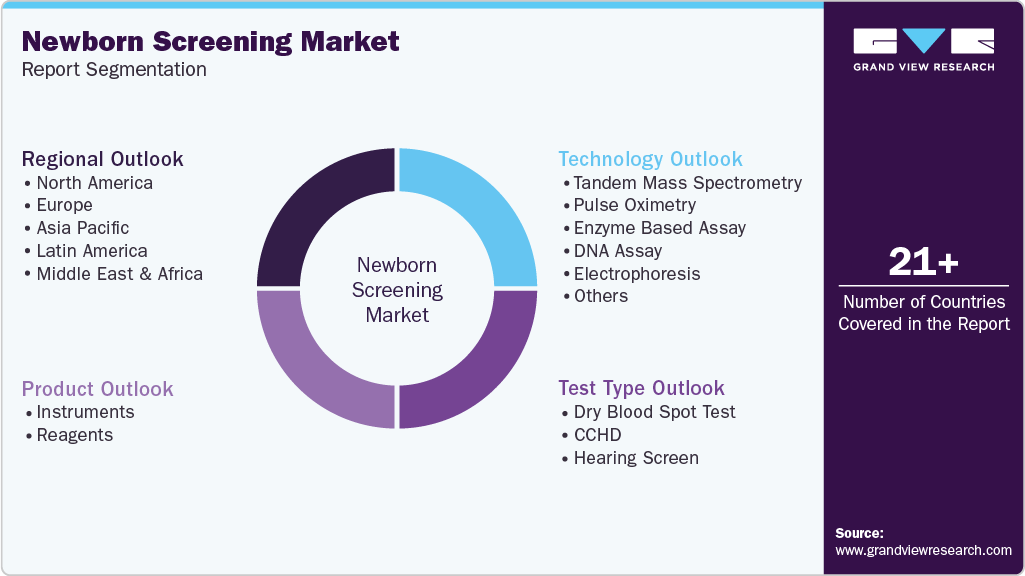

Newborn Screening Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Instruments and Reagents & Assay Kits), By Technology (Tandem Mass Spectrometry, Pulse Oximetry, Enzyme-Based Assays, DNA Assays, Electrophoresis), By Test Type, By Region, and Segment Forecasts

- Report ID: 978-1-68038-490-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Newborn Screening Market Summary

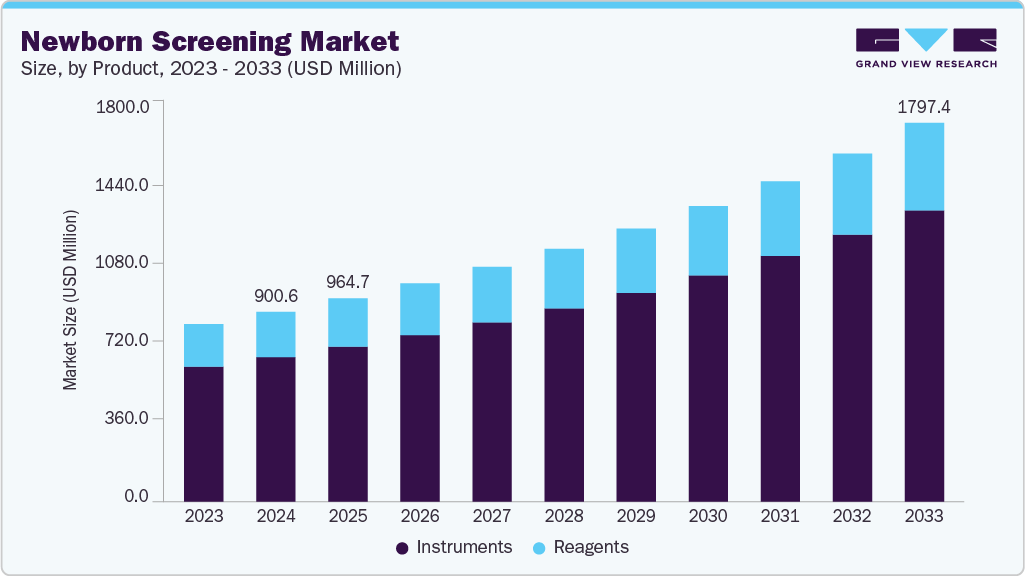

The global newborn screening market size was estimated at USD 900.63 million in 2024 and is projected to reach USD 1,797.38 million by 2033, growing at a CAGR of 8.1% from 2025 to 2033. The rising neonatal population, increasing cases of congenital diseases in newborns, growing consumer awareness, and favorable initiatives & support from various governments, which are organizing several programs & legislations, are factors estimated to propel the market over the forecast period.

Key Market Trends & Insights

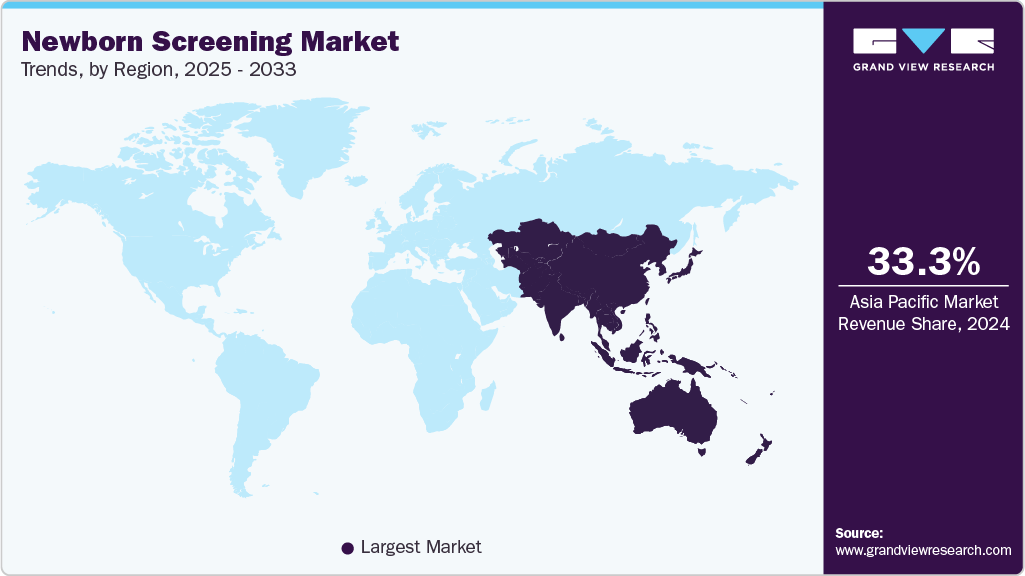

- Asia Pacific newborn screening market dominated the global market and accounted for the largest revenue share of 33.30% in 2024.

- China led the Asia Pacific market and held the largest revenue share in 2024.

- By product, the instrument segment dominated the market with the largest revenue share of 76.09% in 2024.

- By technology, the tandem mass spectrometry segment held the largest revenue share of 24.77% in 2024.

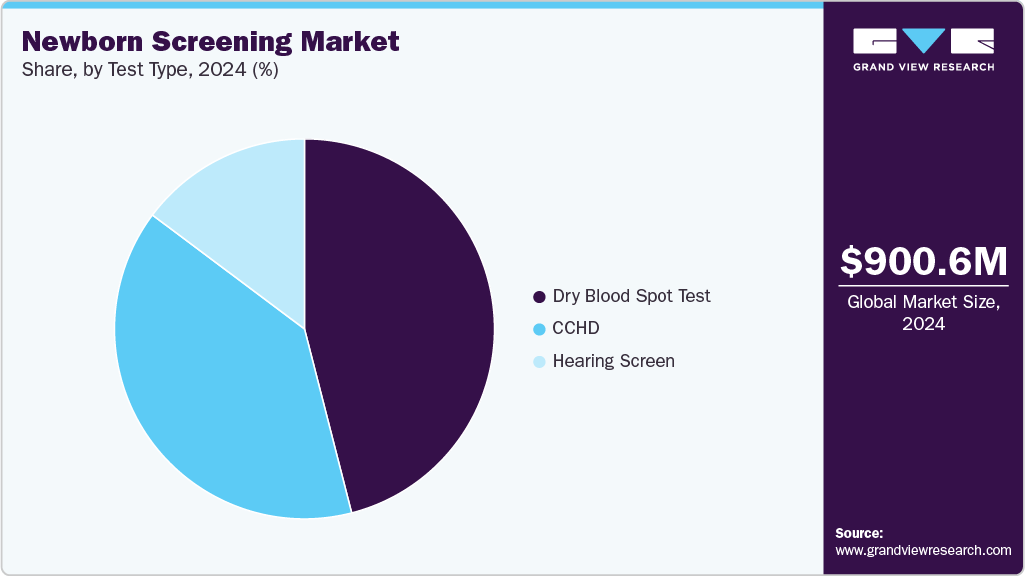

- By test type, dry blood spot tests segment held the largest revenue share of 46.01% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 900.63 Million

- 2033 Projected Market Size: USD 1,797.38 Million

- CAGR (2025-2033): 8.1%

- Asia Pacific: Largest market in 2024

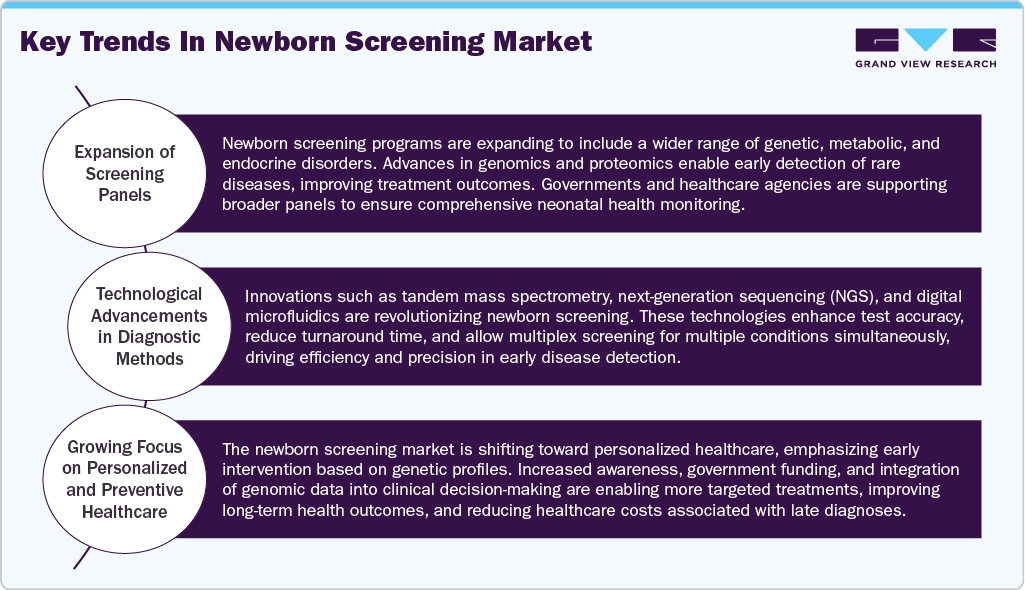

According to the United Nations Department of Economic and Social Affairs (UN DESA) World Population Prospects 2024, the global number of births remains high, with an estimated 132.4 million babies born worldwide in 2024. Moreover, according to the World Health Organization (WHO), congenital disorders - structural or functional anomalies that occur during intra-uterine life - affect an estimated 6% of all births worldwide. In a more detailed assessment, a global, regional, and national epidemiology study of congenital disabilities found that in 2021, about 31.64 million children (aged 0-14 years) were living with congenital disabilities, representing a 6.68% increase since 1990. In addition, technological advancements in screening methodologies are also expected to boost the market. For instance, in November 2023, Revvity, Inc. (US) launched its EONIS Q system, a CE-IVD declared platform enabling laboratories in countries that accept the CE marking to adopt molecular testing for spinal muscular atrophy (SMA) and severe combined immunodeficiency (SCID) in newborns.

Furthermore, extensively increasing prevalence of congenital diseases in newborns is expected to have a positive impact on the newborn screening market growth. According to data published by WHO in February 2023, an estimated 240,000 newborns within 28 days of birth die each year globally due to congenital diseases. Congenital disorders are further responsible for an estimated 170, 000 child deaths in the age group of 1 month to 5 years. In addition, according to information from Indian Pediatrics, congenital hypothyroidism occurs in 2.1 out of every 1,000 infants in India, and the prevalence of inborn metabolic abnormalities ranges from 2 to 7.8%. Such a substantial occurrence of congenital diseases amongst newborns is likely to increase the adoption of tests, which is expected to accelerate the market growth by 2030.

In addition, the introduction of government programs and legislation is also expected to offer a favorable environment for newborn screening market growth. Programs around the globe bring newborn screening into the Genome Era. For instance, in 2023, an anticipated 100,000 infants participated in an NGS newborn screening pilot program. Illumina has participated in at least nine large-scale national and international genomic NBS investigations, screening up to 40,000 babies. This includes GUARDIAN in the U.S., Generation Study in the United Kingdom, BabyScreen+ in Australia, and BabyDetect in Belgium.

The demand for newborn procedures is expected to be influenced by the introduction of new technologies and the availability of treatment options enabling the diagnosis of about 29 possible disorders, such as galactosemia (GS), phenylketonuria (PKU), hearing disorders, and congenital hypothyroidism (CH) in neonates. In March 2023, a group of scientists at the Division of Laboratory Sciences, CDC, announced the introduction of improved tests that offer advanced technology for the diagnosis of genetic diseases.

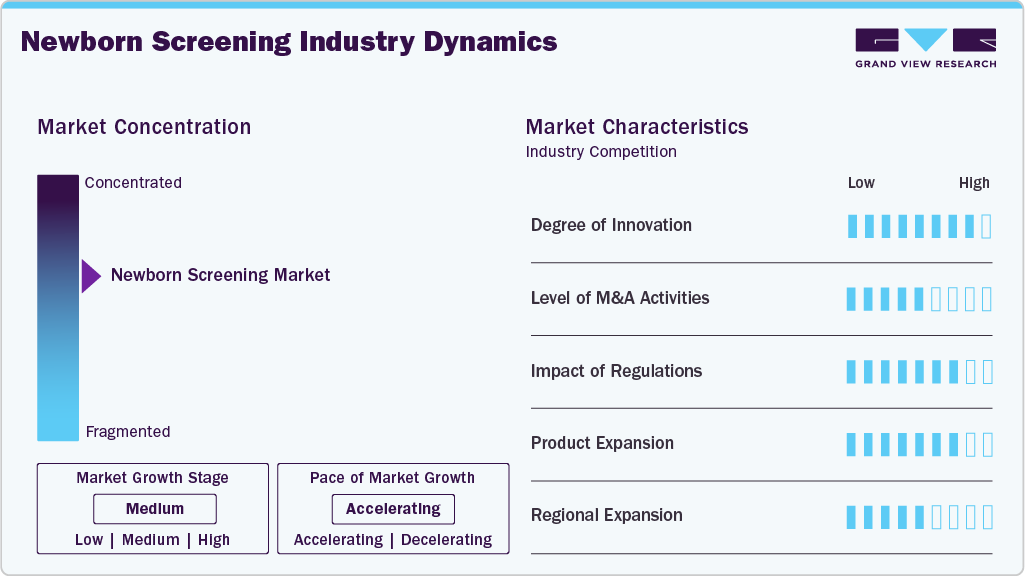

Market Concentration & Characteristics

The newborn screening market is experiencing significant technological advancements. In 2024, PerkinElmer (US) launched the NeoGram Phenylalanine Test System, which received FDA 510(k) clearance. This comprehensive system is designed to identify phenylketonuria (PKU) and includes a reagent kit, application software, and tandem mass spectrometry equipment. In addition, Agilent Technologies (US) introduced a suite of mass spectrometry-based solutions tailored for newborn screening applications, allowing for the simultaneous analysis of multiple metabolites from a single blood sample, significantly improving the efficiency and accuracy of metabolic disorder screenings. These innovations reflect a trend toward decentralization, multiplex capacity increases, and enhanced data connectivity, aiming to screen over 50 million newborns via portable or rapid platforms by 2025.

Mergers and acquisitions (M&A) within the newborn screening landscape can change the competitive landscape and broaden the market reach. Nonetheless, the impact of M&A actions is modest compared to innovation. In any event, pursuing targeted acquisitions enables companies to expand their product portfolio and gain access to advanced and new technologies, while also accelerating their availability in the marketplace. For instance, a company acquiring a firm that specializes in developing screening technology can quickly augment its technology and procedures without the need to invest lengthy periods of R&D time and resources. In addition, mergers and acquisitions support economies of scale, more effective distribution networks, and better bargaining leverage with suppliers and healthcare providers. However, M&A activities often are cost prohibitive and require regulatory approval, which can delay execution. M&A improves competitiveness and accelerates market penetration; however, it does not drive speed in the research and creation of technology or clinical adoption, therefore, the overall impact of M&A activities in the market is moderate rather than disruptive.

Regulations significantly impact the global newborn screening market, ranking it as a high-impact factor. Regulatory guidelines, safety standards, and reimbursement policies shape how newborn screening tests are used and reimbursed in clinical settings. Regulatory review processes ensure that kits are safe and reliable, and regulatory review will relate to how screening kits enter and expand a market. For example, the FDA or the EMA have stringent guidelines that slow the process to commercialization for new innovative technologies. Likewise, government-supported policy initiatives and newborn screening programs may accelerate the pathway to market adoption. The same regulation and compliance process is distinctly different depending on developed and developing markets. As a result, regulatory frameworks will define market strategy for companies navigating compliance across multiple countries. Trends in regulation, such as the expansion of screening panels, expedited approval pathways for innovative tests, and the standardization of protocols, serve as a foundation for shaping investment decisions, market strategies, and growth plans. Regulation thus remains a critical factor in defining both market size and long-term sustainability, as it influences product development, commercialization, and future pipeline strategies.

Increasing product offerings in the newborn screening space moderately influences overall growth. A company can strengthen its market position with greater clinical utility by offering new tests for additional genetic, metabolic, or endocrine disorders. Expanding one’s product lines allows differentiation from competitors and new revenue streams. In addition, product expansion can improve relationships with hospitals, clinics, and public health programs, increasing adoption. However, adding new products does not guarantee growth unless backed by regulatory approval, awareness in the market, and technological innovation. Furthermore, the financial and operational resources required to develop, validate, and disseminate new infant screening products can be substantial. And the overall success of adding new products is based on clinical demand and reimbursement support. Therefore, while product expansion is an essential growth strategy, the impact is expected to moderate compared to regulatory impact or technology innovation.

While expanding regionally in the newborn screening market is generally less impacted than innovation and regulation, regional expansion can lead to increased revenue opportunities and more brand presence, especially if the new geography is in an emerging economy and is experiencing rapid rates of screening adoption. Future regional expansion is often limited by local healthcare systems, regulatory environments, reimbursement policies, and whether the public is informed about newborn screening, among many other factors. It should also be noted that successful penetration in the newborn screening market hinges on investments in distribution channels, training, and marketing. However, even with these investments, market penetration alone is unlikely to result in substantial revenue growth. While long-term regional expansion may represent a form of market diversification and risk mitigation, it does not necessarily translate into technological advancement or clinical adoption. Therefore, the influence of regional expansion on the overall market trajectory remains limited when compared to the impact of innovation and regulatory developments.

Product Insights

The instrument segment held the largest share of 76.09% of the newborn screening market in 2024, owing to the growing number of newborn screening procedures, increasing investments, and rising awareness about early disease detection, which are estimated to drive the instrument segment during the forecast period. For instance, the Australian Government invested USD 107.3 million from 2022-23 to 2027-28 to support expansion. In addition, the USD 39 million funding committed from Budget 2022-23 includes funding of USD 25.3 million for states and territories. Also USD 68.3 million committed from Budget 2024-25, including funding of USD 43.3 million (announced through MYEFO 2024-25) for states and territories.

Moreover, reagent segment is projected to register a significant CAGR during the forecast period. Growing emphasis on early disease identification in infants, particularly in developing nations, and rising demand for newborn screening are creating a favorable environment for market expansion. For instance, some infants may be born with congenital metabolic abnormalities, which can cause serious disease or impairment if not treated. To address this, KM Biologics Co., Ltd., part of the Meiji Group, has been screening newborns for decades and is now working with Kumamoto University to develop enhanced screening procedures. Japan launched newborn screening for congenital and other metabolic disorders in 1977 as a government initiative, and the country today publicly funds tests for 20 ailments. KM Biologics stands out as the only private company that has consistently participated in the program from its beginning, screening almost three million infants to date.

Currently, the company screens approximately 60,000 babies per year in Kumamoto, Fukuoka, and Saga prefectures, as commissioned by local governments. Director Shinichiro Yoshida highlights that newborn screening is a core activity of KM Biologics, protecting baby health and quality of life while also contributing to social sustainability and public well-being.

Technology Insights

Tandem mass spectrometry dominated the newborn screening market in 2024, with a 24.77% share due to its cost-effectiveness, increased application, and technological advancements. Its cost-effectiveness, which enables the simultaneous screening of several metabolic diseases in a single test, is primarily responsible for this leadership. In addition, the accuracy, sensitivity, and speed of detection have increased due to its expanding use in diagnostic labs and hospitals as well as ongoing technological improvements. The method's broad acceptance and dominant position in the global newborn screening market can be attributed to its capacity to detect a variety of congenital and metabolic disorders at an early age, which has made it a preferred alternative for medical professionals.

Electrophoresis is expected to witness significant growth during the forecast period. This growth is anticipated due to rising demand and early detection techniques. Growing number of collaborations amongst market players is expected to accelerate segment growth. For instance, in January 2024, Agilent Technologies Inc. (U.S.) introduced a new automated parallel capillary electrophoresis system for protein analysis, the Agilent ProteoAnalyzer system, at the 23rd Annual PepTalk Conference, held from January 16 to 19 in San Diego. The study of complex protein mixtures, a crucial step in analytical workflows in the pharmaceutical and biotech industries, is made easier and more efficient by this new platform.

Since capillary electrophoresis (CE) provides quick, high-resolution analysis with little sample consumption, become an essential tool for protein separation. Demand for CE solutions is predicted to rise as a result of biopharma's growing interest in monoclonal antibodies and other protein targets with potential therapeutic applications.

Test Type Insights

Dry blood spot tests dominated the newborn screening market, accounting for over 46.01% of revenue in 2024, and are expected to grow at the fastest CAGR over the forecast period. The DBS test is used for the detection of over 50 conditions that are associated with newborn screening. A growing number of initiatives by government authorities are also projected to accelerate the segment growth during the forecast period. For instance, in April 2025, Quanterix Corporation (US) launched a new dried blood spot extraction (DBS) kit as part of their industry-leading Simoa assay kits at the International Conference on Alzheimer’s and Parkinson’s Diseases and Related Neurological Disorders (AD/PD) in Vienna, Austria. This new extraction kit enables researchers to measure low-concentration biomarkers from dried blood spots using a more cost-effective and less invasive method.

Furthermore, the hearing screen segment is expected to register a substantial CAGR during the forecast period. Increasing prevalence of hearing conditions in newborns is estimated to accelerate segment growth during the forecast period. According to a study published by the University of Manchester in 2023, one in 1000 newborn babies suffers from hearing conditions in the UK.

Regional Insights

North America newborn screening market is the second fastest growing market during the forecast period, owing to the growing prevalence of congenital disorders and enforced testing in all the states of the U.S. The screening programs are diligently followed in all the states of North America. Some of the programs include the Newborn Screening Program in Texas, the California Newborn Screening Program, and the New York State Newborn Screening Program.

U.S. Newborn Screening Market Trends

Newborn screening market in the U.S. generated the highest revenue in 2024, fueled by advances in science and technology, policy innovation, and increased awareness of the long-term benefits of early disease detection. Newborn screening programs in the U.S., organized on a national level, aim to identify genetic, metabolic, and endocrine disorders in all newborns as early as possible after birth to avoid preventable chronic illness and the associated risk of multigenerational effects. New trends include the utilization of advanced molecular diagnostic tests, an increased number of conditions, including rare and treatable conditions, and greater use of automation and data management systems in clinical practice and public health settings. Migration toward collective efforts between federal agencies, professional healthcare providers, and diagnostic companies likely to improve the efficiency, accuracy, and accessibility of newborn screening in the U.S.

Europe Newborn Screening Market Trends

Europe newborn screening market is growing steadily, fueled by growing healthcare initiatives, technological advancements, and greater public health policies. Many European countries are expanding their newborn screening panels to include additional metabolic, genetic, and endocrine conditions. This change represents a regional movement towards a more comprehensive model of preventive care. The adoption of advanced diagnostic technologies, including molecular testing and mass spectrometry, aims for improved accuracy and efficiency. Government, healthcare institutions, and diagnostic manufacturers are also working together in new ways to drive innovation, standardization, and equitable access; and thus, helping Europe to be a worldwide leader in newborn screening development and implementation.

Newborn screening market in the UK is undergoing a significant transformation, due to genomic advancements and a new paradigm towards personalized healthcare. Newborns are currently screened using a heel-prick test to check for a small number of conditions, but the NHS has recently announced that within the next decade, whole genome sequencing is expected to be conducted for every baby born in England. Whole genome sequencing enables the early detection of hundreds of diseases, allowing for preventative and personalized care, as part of a broader plan to shift the NHS from a reactive service toward a predictive health system. The UK newborn screening landscape is evolving through the expansion of screening panels, the use of artificial intelligence to interpret data, and to support the focus of regional programs on rare and treatable diseases.

Newborn screening market in Germany is witnessing consistent growth, supported by advances in diagnostic technology and a strong focus on preventive healthcare. Screening programs across the country allow for timely identification of metabolic, genetic, and endocrine disorders in approximately every newborn in the country and is an indicator of the nation’s commitment to child health. All indications are that the implementation of molecular and mass spectrometry-based screening methods, the expansion of early screening panels to include additional rare diseases, and the integrated digitalization of screening workflows are underway. With ongoing advances in these practices and continued government support, Germany is recognized as a leader in newborn screening in Europe.

Asia Pacific Newborn Screening Market Trends

Asia Pacific newborn screening market accounted for the largest share of 33.30% in 2024, due to improving infrastructure and healthcare plans and the availability of new opportunities for expansion are expected to play a major role in driving demand over the forecast period. Moreover, owing to the high population density, higher birth rate, and the soaring prevalence of congenital diseases, Asia Pacific is expected to be the fastest-growing market for newborn screening techniques.

Newborn screening market in the Japan is experiencing robust growth, due to increased technology and a foundation of strong public health systems and infrastructure. The country has allowed screening beyond the initial screening for phenylketonuria (PKU) into a broader screening program for various metabolic, genetic, and endocrine disorders. Significant technologies, including tandem mass spectrometry and electrophoresis, are at the center of these advances, increasing the accuracy and efficiency of screenings. The use of molecular diagnostics and digital health solutions is also improving data management and streamlining workflows. Altogether, these efforts reflect Japan's dedication to early disease detection and preventative healthcare.

Newborn screening market in China is rapidly expanding, driven by technological advancements and expanding healthcare infrastructure. The country has progressively expanded its screening programs beyond the initial focus on phenylketonuria (PKU) and congenital hypothyroidism to include a broader range of metabolic, genetic, and endocrine disorders. Key technologies such as tandem mass spectrometry and electrophoresis are central to these advancements, enhancing the accuracy and efficiency of screenings. Additionally, the integration of molecular diagnostics and digital health solutions is streamlining workflows and improving data management. This comprehensive approach reflects China's commitment to early disease detection and preventive healthcare.

Latin America Newborn Screening Market Trends

Latin American newborn screening market is experiencing significant growth, due to public health efforts and advancements in technology. Countries such as Brazil, Argentina, and Chile are also expanding their screening programs to include a wider variety of metabolic, genetic, and endocrine disorders. The advancement and wider utilization of tandem mass spectrometry and electrophoresis are important technologies which help to improve accuracy and efficiency. The introduction of molecular diagnostics and digital health solutions help streamline workflows and improve data collection and management. This overall process presents the commitment Latin America has to early disease detection, and preventative medicine.

Middle East and Africa Newborn Screening Market Trends

Middle East and Africa newborn screening market is expanding steadily, boosted by enhanced government initiatives, rapid advancements in technology, and increased recognition of the importance of early disease identification. In nations within the Gulf Cooperation Council (GCC) such as Saudi Arabia, the UAE, and Qatar, mandated screening programs often include screening for primary disorders, such as hypothyroidism, G6PD deficiency, and hemoglobinopathies, and many of these newborn health initiatives benefit from advanced digital registries that help track newborn health. Sub-Saharan African countries such as Kenya, Nigeria, and South Africa are beginning to explore pilot programs for screening, using dried blood spot testing and partnership with private laboratories. Notable challenges exist that include a limited number of trained staff, inadequate infrastructure, and sometimes inconsistent policy coordination. The utilization of mobile health solutions, regional laboratory hubs, and international collaboration likely to increase the access to and the accuracy of appropriate screening, allowing the region to grow steadily in providing newborn screening services.

Key Newborn Screening Company Insights

The newborn screening market is extremely competitive, and market participants engage in tactics such technological breakthroughs, acquisitions, new product launches, strategic partnerships, and regional growth. For instance, in March 2025, LaCAR MDx Technologies acquired Baebies, Inc.'s Newborn Screening Division in the U.S. LaCAR MDx technology, a business that specializes in automated newborn screening solutions, has announced the strategic purchase of Baebies, Inc.'s Newborn Screening division, a US-based firm noted for its unique neonatal diagnostic technology. This acquisition is part of LaCAR's plan to expand its product portfolio and accelerate its entry into the US market.

Key Newborn Screening Companies:

The following are the leading companies in the newborn screening market. These companies collectively hold the largest market share and dictate industry trends.

- Bio-Rad Laboratories

- Agilent Technologies

- Masimo

- Waters Corporation

- Natus Medical

- Trivitron Healthcare

- GE Lifesciences

- PerkinElmer Inc

- AB SCIEX

- Demand A/S

- Parseq LAB

- Otodynamics

- Zentech

- Centogene

Recent Development

-

January 2025, QIAGEN N.V. (Germany) partnered with Genomics England to support the Initiative to Sequence Genomes of 100,000 Newborns With Expert-Curated Genomic Content. In order to screen for more than 200 specific illnesses and enable early detection and treatment of rare conditions, this first-of-its-kind project intends to sequence the genomes of 100,000 infants in England. QIAGEN will be the only firm to offer clinically relevant variant content for genes that are part of the point-of-care sequencing test through its Clinical Knowledge Base. This content will be utilized to facilitate quick variant interpretation and reporting of sequencing data now that testing has started.

-

In October 2025, Quantabio launched sparQ Lysis Kit. The company's extensive newborn screening methodology for sequencing dried blood spots now includes this product as the newest addition. Next week in Providence, Rhode Island, Quantabio will exhibit the whole sparQ DBS-seq procedure, including lysis, library preparation, and quantification, at booth #406 at the 2025 Association of Public Health Laboratories (APHL) Newborn Screening Symposium.

-

In August 2024, Masimo’s (U.S.) signal extraction technology pulse oximetry - industry-leading, clinically proven, and used by top hospitals everywhere - continues to overcome the limitations of conventional pulse oximetry and offers unrivaled accuracy through ongoing innovation. As of 2024, all ten of the best hospitals in the United States use Masimo's groundbreaking SET technology as their main pulse oximetry tool, which is used to monitor over 200 million patients annually worldwide.

Newborn Screening Market Report Scope

Report Attribute

Details

Market size in 2025

USD 964.69 million

Revenue forecast in 2033

USD 1,797.38 million

Growth rate

CAGR of 8.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, test type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bio-Rad Laboratories; Agilent Technologies; Masimo; Waters Corporation; Natus Medical; Trivitron Healthcare; GE Lifesciences; PerkinElmer Inc; AB SCIEX; Demand A/S; Parseq LAB; Otodynamics; Zentech; Centogene

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Newborn Screening Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the newborn screening market based on product, technology, test type, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Reagents

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Tandem mass spectrometry

-

Pulse oximetry

-

Enzyme based assay

-

DNA assay

-

Electrophoresis

-

Others

-

-

Test Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Dry blood spot test

-

CCHD

-

Hearing screen

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global newborn screening market size was estimated at USD 900.63 million in 2024 and is expected to reach USD 964.69 million in 2025.

b. The global newborn screening market is expected to grow at a compound annual growth rate of 8.09% from 2025 to 2033 to reach USD 1,797.38 million by 2033.

b. Instruments dominated the newborn screening market with a share of 76.09% in 2024. This is attributable to the high market penetration of instruments with respect to adoption and price.

b. Some key players operating in the newborn screening market include Agilent Technologies Inc., Natus Medical Inc., Covidien Plc, Trivitron Healthcare, GE Healthcare, Masimo Corp., AB Sciex LLC, Waters Corp., PerkinElmer Inc. and Bio-Rad Laboratories Inc.

b. Key factors that are driving the market growth include introduction of laws and guidelines on implementing newborn screening programs as a mandate program across the globe coupled with technology advanced products to conduct newborn screening.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.