Next-generation Sequencing Library Preparation Market Size, Share & Trends Analysis Report By Sequencing Type (Targeted Genome Sequencing, Whole Genome Sequencing), By Product, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-003-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

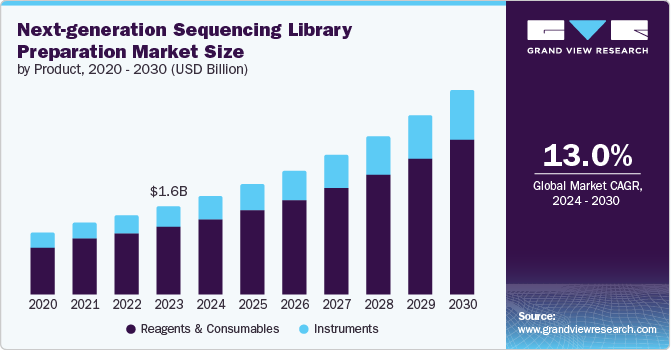

The global next-generation sequencing library preparation market size was estimated at USD 1.57 billion in 2023 and is expected to grow at a CAGR of 13.0% from 2024 to 2030. Rapid advancements in sequencing technology and bioinformatics have enabled the identification of DNA variations. With the widespread application of NGS and Whole-Genome Sequencing (WGS), a wide range of genes can be examined in a single platform simultaneously, which expands the utility of DNA sequencing in clinical diagnosis applications. These factors are expected to boost the market over the forecast period.

The NGS library preparation market faced significant impacts from the COVID-19 pandemic, experiencing both immediate operational difficulties and enduring shifts. The pandemic disrupted the NGS market's supply chain with lockdowns, travel constraints, and reduced manufacturing output throughout 2020 and 2021. This resulted in delays in the distribution of sequencing equipment, consumables, and reagents, impacting research schedules and ongoing projects.

Advancements in sequencing technologies have transformed genomics and profoundly influenced the healthcare sector. A critical aspect of these advancements is the remarkable enhancement in sequencing velocity. Next-generation sequencing (NGS) platforms, exemplified by Illumina's innovations, have drastically amplified the pace at which genetic data can be decoded. These platforms leverage parallel processing, enabling simultaneous analysis of multiple DNA fragments. This acceleration in sequencing speed carries extensive implications, empowering researchers and clinicians to handle vast amounts of genomic data with unprecedented efficiency. For instance, in March 2023, Illumina, Inc. launched its Connected Insights cloud-based software aimed at streamlining tertiary analysis for clinical NGS data. Such initiatives are anticipated to drive market expansion in the foreseeable future.

However, the complexity of genomic data adds another layer of challenge. Analyzing and interpreting genetic information demands sophisticated bioinformatics tools and expertise. Researchers and clinicians require the computational infrastructure for data storage and access to skilled professionals capable of extracting meaningful insights from genomic data. The shortage of bioinformatics expertise in some settings can hinder the effective translation of sequencing data into actionable clinical information and impede the market growth.

Moreover, high-throughput sequencing technologies have reduced errors, improved base calling accuracy, and increased the reliability of genomic data. This heightened precision is crucial in applications such as clinical diagnostics, where accurate identification of genetic variants is paramount for understanding disease etiology & guiding personalized treatment strategies. For instance, in December 2021, Roche introduced the AVENIO Edge System, providing researchers with a preanalytical program designed for sequencing library preparation, target enrichment, and qualification steps. The AVENIO Edge System ensures reliable results throughout the process by offering integrated, end-to-end control.

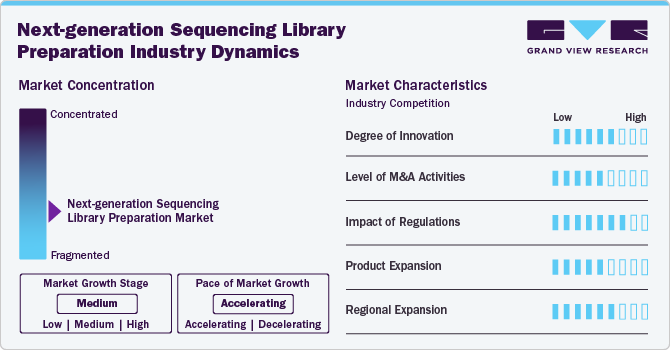

Industry Dynamics

The development of advanced NGS tools has revolutionized therapeutic development and disease detection by enabling easier cell isolation. This has led to numerous industry players introducing technologically advanced and innovative products.

The industry features a notable level of merger and acquisition activities among key players, driven by various factors such as enhancing competitive positioning and consolidating in a swiftly expanding market. For instance, in January 2024, BD disclosed a partnership with Hamilton to pioneer automated applications for high-throughput, single-cell multiomics studies. This collaboration seeks to standardize these experiments and minimize human errors in NGS library preparation through the automation of tasks like pipetting and thermal cycling.

The development and application of next generation sequencing library preparation technologies are subject to stringent regulations to ensure safety, efficacy, and ethical considerations. Ethical considerations also play a significant role in regulating NGS technologies. Many countries have bioethical committees or advisory boards assessing the ethical implications of NGS tools.

The industry has seen significant growth in recent years, driven by the increasing number of new products launched for NGS technology. In April 2022, OPENTRONS expanded its product lineup with the launch of four new OT-2 workstations, which can be used across various applications, such as NGS, PCR, and protein purification. The NGS workstation features automated library preparation capabilities, making it easier for customers to streamline their workflows.

The industry is experiencing high regional expansion, driven by an increasing customer base for NGS products. Additionally, companies are entering into license agreements to access new market regions.

Sequencing Type Insights

Targeted genome sequencing segment held the largest market share of 63.8% in 2023 and is anticipated to grow at the highest CAGR from 2024 to 2030. This can be attributed to the advancements in sequencing technologies that enhance accuracy & efficiency, increasing applications in personalized medicine & disease diagnostics, and growing investments in genomic research.

The whole genome sequencing segment is anticipated to grow at a significant CAGR during the forecast period. One of the major factors contributing to growth is the increased use of WGS to combat COVID-19. For instance, in March 2022, an article published in Frontiers stated that WGS has the potential to detect SARS-CoV-2 infection. Moreover, it helped differentiate community-acquired infection from hospital-acquired infection among pediatric oncology patients.

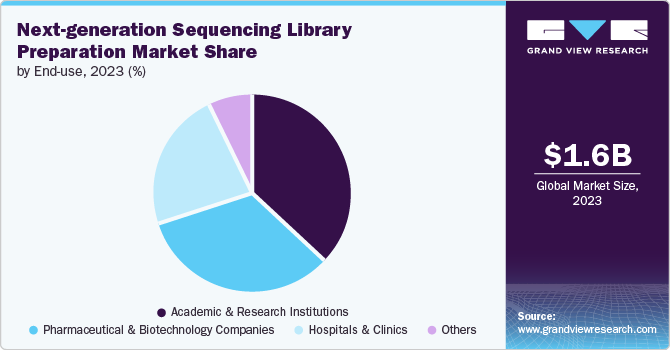

End Use Insights

On the basis of end use, the academic & research institutions segment held the largest market share of 36.65% in 2023. The extensive use of NGS technologies in academic settings for fundamental research, genome sequencing projects, and translational research aimed at understanding diseases and developing new therapies is anticipated to propel the segment over the forecast period.

The pharmaceutical & biotechnology companies segment is anticipated to grow at the fastest CAGR of 14.3% during the forecast period. This can be attributed to the increasing adoption of companion diagnostics & personalized medicines. For instance, in May 2022, Genes2Me launched NGS-based clinical panels for personalized medicine, hereditary diseases, and oncology in India. Similarly, in September 2021, Thermo Fisher Scientific Inc., along with AstraZeneca, collaborated to develop an NGS-based companion diagnostic that aims to accelerate the development of targeted precision medicine therapies for patients.

Product Insights

On the basis of the product, the reagents & consumables segment dominated the market with the largest share in 2023. This can be attributed to several factors, including the increasing demand for reliable & high-quality reagents for sample preparation, the rising number of genomic research projects & clinical diagnostics utilizing NGS, and continuous advancements in reagent technologies that improve efficiency & accuracy.

The instruments segment is anticipated to grow at the fastest CAGR of 13.98% over the forecast period. Rise in technological advancements in NGS sequencing instruments, growing R&D investment, and an increase in the application of instruments for clinical diagnostics & drug discovery are some of the major factors influencing growth of the NGS sequencing instruments segment. In recent years, several platforms & systems, such as Illumina’s Solexa, Thermo Fisher’s SOLiD systems, and Ion Torrent series, and PacBio’s PacBio Sequel, have offered unique prospects for high-throughput functional genomic research and impose an incredible influence on genomic research. Thus, boosting the segment growth.

Application Insights

On the basis of application, the drug & biomarker discovery segment dominated the market with a share of 64.12% in 2023 and is anticipated to grow at highest CAGR over the forecast period. Several factors, including the increasing focus on personalized medicine & targeted therapies, which rely heavily on genomic data for drug development, are anticipated to contribute to the growing segment in the coming decade.

The disease diagnostics segment is anticipated to grow at a significant CAGR of 11.89% during the forecast period. The decreasing cost of technology has significantly increased the utilization of data analysis platforms and NGS software by numerous academic institutions and research centers for their projects requiring data interpretation. Moreover, the number of experienced professionals has gradually grew in research centers for handling computational tools and data analysis software, which is anticipated to boost the revenue of this segment.

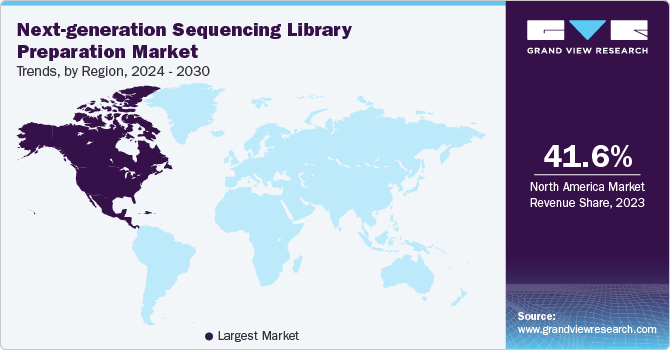

Regional Insights

In 2023, North America held the largest share of 41.6% of the global market. The market growth in the region can be mainly attributed to extensive disease-based research studies sponsored by academic research institutes and pharmaceutical giants. Moreover, the growing investments in R&D, technological developments by key players, and advanced healthcare infrastructure are further fueling the market growth in the region.

U.S. Next-generation Sequencing Library Preparation Market Trends

The next-generation sequencing library preparation market in the U.S. is anticipated to grow over the forecast period due to growth in government funding & growing focus on cell studies, and the rising prevalence of diseases. Moreover, increasing research in the fields of drug discovery, personalized medicine, and targeted therapies is further anticipated to fuel market growth.

Europe Next-generation Sequencing Library Preparation Market Trends

Next-generation sequencing library preparation market in Europe is anticipated to grow over the forecast period. Europe has been actively involved in genome research, contributing to its growth in the region. Moreover, as more companies invest in research and development, focusing on applications such as disease treatment, personalized medicine, further propels market growth.

UK next-generation sequencing library preparation market is experiencing robust growth, driven by advancements in medical research and the increasing emphasis on personalized medicine. The UK's strong healthcare infrastructure, combined with its world-class research institutions and biotechnology sector, provides a fertile ground for the development and application of cutting-edge next generation sequencing technologies.

The next-generation sequencing library preparation market in Germany is expected to grow over the forecast period due to the growing incidence and prevalence of genetic disorders,favorable government policies supporting research activities and the introduction of new drugs and therapies by key players.

France next-generation sequencing library preparation market is expected to grow over the forecast period due to extensive government initiatives boosting the adoption of NGS solutions in the country. Since 2013, the French National Cancer Institute (INCa) has supported the implementation of targeted NGS as part of routine clinical practice. In addition, France implemented a national plan, the 2025 France Genomic Medicine Initiative, to ensure adequate access to genomic medicine for all patients. This initiative is dedicated to introducing genome sequencing to the care pathway.

Asia Pacific Next-generation Sequencing Library Preparation Market Trends

The Asia Pacific next-generation sequencing library preparation market is expected to experience rapid growth, with a projected CAGR of 15.07% from 2024 to 2030. This is attributed to the increasing incidence of chronic diseases, growing government support for genomic research and development, and a rising preference for next generation sequencing library preparation technologies in therapeutics.

Next-generation sequencing library preparation market in China is witnessing rapid growth, underpinned by the country's robust healthcare reforms, burgeoning biotechnology sector, and significant government investments in biomedical research and innovation. China's focus on advancing precision medicine and developing innovative therapies for cancer and other chronic diseases drives substantial demand for cutting-edge NGS technologies.

Japan next-generation sequencing library preparation market is expected to witness a rapid growth over the forecast period. The healthcare and clinical research service providers in Japan have been integrating NGS technologies for the past couple of years. They are expected to account for a considerable share of the Asia Pacific market’s revenue share. Ongoing developments in HLA and prenatal NGS testing coupled with international collaborations with U.S. & European companies are expected to fuel the growth of Japan next-generation sequencing library preparation market during the forecast period.

The next-generation sequencing library preparation market in India is anticipated to grow at a rapid rate over the forecast period. India is anticipated to be a high-potential market for NGS in Asia Pacific, owing to the presence of a large target population. Continuous government support and funding have enhanced the scope of NGS in the country. In July 2019, a state-of-the-art NGS facility was launched at the Centre for Cellular and Molecular Biology in Hyderabad, India. In April 2019, the Council of Scientific and Industrial Research (CSIR) initiated the IndiGen program.

Middle East & Africa Next-generation Sequencing Library Preparation Market Trends

The next-generation sequencing library preparation market in the Middle East and Africa is poised to grow in the near future, as increasing applications of biotechnology in healthcare are contributing to its expansion.

Saudi Arabia next-generation sequencing library preparation market is expected to grow over the forecast period due to increasing investments in healthcare innovation and research. The country’s focus on advancing biotechnology, coupled with the rising awareness of personalized medicine, is driving the expansion of the next-generation sequencing library preparation market in Saudi Arabia.

The next-generation sequencing library preparation market in Kuwait is anticipated to witness growth over the forecast period owing to the escalating investment in scientific research and development by both governmental and private entities. This investment is propelling advancements in NGS technologies, consequently presenting opportunities for developing novel and enhanced NGS tools and application.

Key Next-Generation Sequencing Library Preparation Company Insights

Key players operating in the next-generation sequencing library preparation market are undertaking various initiatives to strengthen their market presence and increase the reach of their products. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Next-generation Sequencing Library Preparation Companies:

The following are the leading companies in the next-generation sequencing library preparation market. These companies collectively hold the largest market share and dictate industry trends.

- Illumina, Inc.

- Agilent Technologies, Inc.

- F. Hoffmann-La Roche AG, Inc.

- Danaher Corporation

- BD

- Merck KGaA

- Oxford Nanopore Technologies

- New England Biolabs Inc.

- Revvity, Inc.

- QIAGEN N.V.

- Pacific Biosciences of California, Inc.

- Thermo Fisher Scientific Inc.

- Tecan Group Ltd.

Recent Developments

-

In January 2023, Agilent strengthened its position in the life sciences industry with the acquisition of Avida Biomed, a company that has developed cutting-edge target enrichment workflows for clinical researchers using NGS in cancer research. The acquisition complements Agilent's SureSelect portfolio, which now offers a comprehensive range of solutions for library preparation and target enrichment, enabling fast & efficient assay results.

-

In April 2022, OPENTRONS expanded its product lineup with the launch of four new OT-2 workstations, which can be used across various applications, such as NGS, PCR, and protein purification. The NGS workstation features automated library preparation capabilities, making it easier for customers to streamline their workflows.

-

In March 2021, IDT, a Danaher subsidiary, acquired Swift Biosciences, a leading provider of NGS library preparation solutions. The deal involved integrating Swift's personnel and products into IDT's portfolio while maintaining the existing operations at Swift's Ann Arbor, Michigan facilities.

Next-generation Sequencing Library Preparation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.75 billion |

|

Revenue forecast in 2030 |

USD 3.64 billion |

|

Growth rate |

CAGR of 13.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, sequencing type, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Illumina Inc.; Agilent Technologies, Inc.; Danaher (Integrated DNA Technologies and Beckman Coulter Inc.); F. Hoffmann-La Roche AG, Inc.; BD; Merck KGaA; Oxford Nanopore Technologies; New England Biolabs Inc.; Revvity, Inc.; QIAGEN N.V.; Pacific Biosciences of California, Inc.; Thermo Fisher Scientific Inc.; Tecan Group Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Next-generation Sequencing Library Preparation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global next-generation sequencing library preparation market report based on sequencing type, product, application, end-use, and region.

-

Sequencing Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Targeted Genome Sequencing

-

Whole Genome Sequencing

-

Whole Exome Sequencing

-

Other Sequencing Types

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents & Consumables

-

DNA Library Preparation Kits

-

Library Preparation Kits

-

RNA Library Preparation Kits

-

Other Reagents & Consumables

-

-

Instruments

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug & Biomarker Discovery

-

Disease Diagnostics

-

Cancer Diagnostics

-

Reproductive Health Diagnostics

-

Infectious Disease Diagnostics

-

Other Disease Diagnostic Applications

-

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Academic and Research Institutions

-

Pharmaceutical and Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global next-generation sequencing library preparation market size was estimated at USD 1.57 billion in 2023 and is expected to reach USD 1.75 billion in 2024.

b. The global next-generation sequencing library preparation market is expected to grow at a compound annual growth rate of 12.97% from 2023 to 2030 to reach USD 3.64 billion by 2030.

b. North America dominated the next-generation sequencing library preparation market with a share of 41.58% in 2023. This is attributable to extensive disease-based research studies sponsored by academic research institutes and pharmaceutical giants.

b. Some key players operating in the next-generation sequencing library preparation market include Agilent Technologies, Inc., Integrated DNA Technologies, F. Hoffmann-La Roche AG, Inc., Illumina, Inc., Beckman Coulter Inc. (now part of Danaher Corporation), Becton, Merck KGaA, Dickinson and Company, New England Biolabs, Inc., PerkinElmer Inc., QIAGEN N.V., Pacific Biosciences of California, Inc., Thermo Fisher Scientific Inc., and Tecan Group Ltd.

b. Key factors that are driving the market growth include rise in sequencing and increasing awareness of genomics amongst the healthcare professionals. Additionally, there have been more research and development projects utilizing NGS technologies, a rise in the use of NGS for clinical diagnostics, and applications for discovery that require NGS technology

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."