- Home

- »

- Biotechnology

- »

-

Next-generation Sequencing Data Analysis Market Report, 2030GVR Report cover

![Next-generation Sequencing Data Report]()

Next-generation Sequencing Data Analysis Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Services, NGS Commercial Software), By Workflow (Primary, Secondary), By Mode, By Read Length, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-065-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Next-generation Sequencing Data Analysis Market Summary

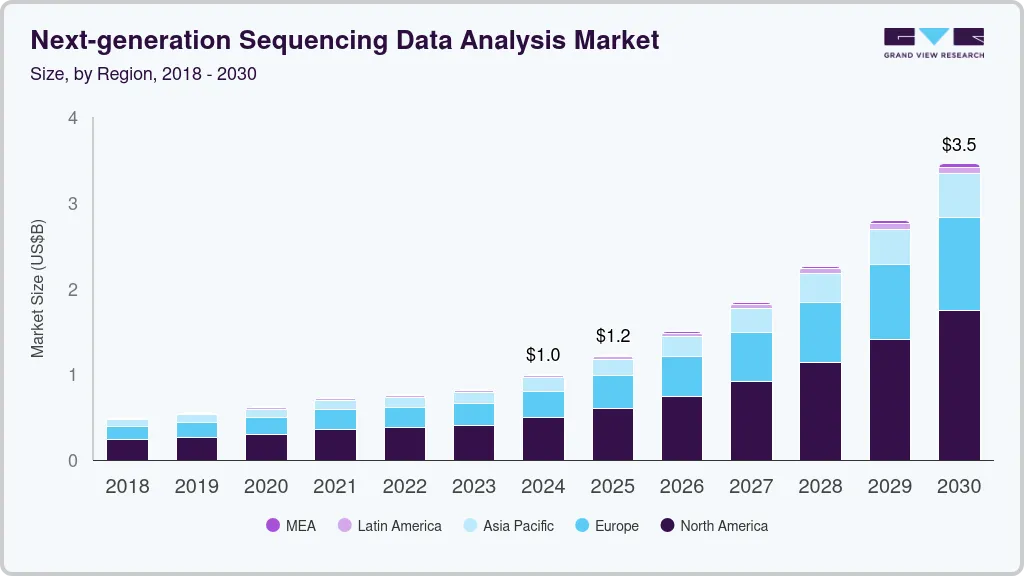

The global next-generation sequencing data analysis market size was estimated at USD 999.4 million in 2024 and is projected to reach USD 3.45 billion by 2030, growing at a CAGR of 23.10% from 2025 to 2030. The increasing use of sequencing platforms in clinical diagnosis, due to reduced installation costs, is anticipated to drive the growth of the industry.

Key Market Trends & Insights

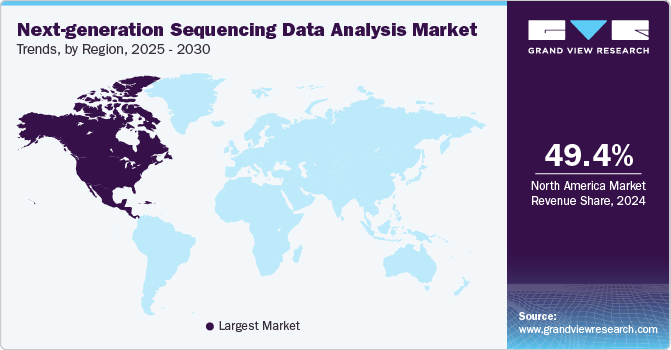

- North America next-generation sequencing data analysis industry dominated the global market with a share of 49.38% in 2024.

- The next-generation sequencing data analysis market in the U.S. is expected to grow over the forecast period.

- Based on the product, the services segment accounted for the largest revenue share in 2024.

- Based on workflow, NGS tertiary data analysis dominated the market in 2024 with a revenue share of 49.66%.

- Based on mode, in-house data analysis dominated the NGS data analysis market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 999.4 Million

- 2030 Projected Market Size: USD 3.45 Billion

- CAGR (2025-2030): 23.10%

- North America: Largest market in 2024

Easier access to genomic and proteomic data is also expected to create significant growth opportunities. Additionally, the affordability of sequencing technologies has led to greater adoption of NGS. The COVID-19 pandemic boosted the next-generation sequencing (NGS) data analysis industry by increasing the demand for genomic tools to track virus mutations, develop diagnostics, and support vaccine research. Governments and companies invested heavily in NGS technologies to speed up treatment and vaccine development. This raised awareness of NGS's role in public health, driving adoption and growth during and after the pandemic.In addition, the advancements in large-scale services and cloud-based bioinformatics platforms are expected to drive industry growth. Tools like Bina, BaseSpace, LifeScope, DNAnexus, SevenBridges, and GeneSifter are widely used for sequencing data analysis. NGS protocols are increasingly being applied in precision oncology, especially for breast and lung cancer. Companies are also working on affordable genome sequencing solutions to enhance their market performance.

Furthermore, NGS enables insights into epigenomics and genomic patterns critical to various biological processes. However, challenges in managing, storing, and accessing large data volumes present opportunities for R&D to enhance data handling solutions, driving market growth. High-throughput sequencer users rely on Laboratory Information Management Systems (LIMS) for efficient data management. Meanwhile, cloud-based platforms are gaining traction for their scalable and cost-effective solutions to handle the complex computational needs of NGS data analysis, improving accessibility and operational efficiency for businesses and researchers alike.

Product Insights

Based on the product, the services segment accounted for the largest revenue share in 2024. Cost-effective NGS data analysis services are driving adoption, especially for companies lacking data management and interpretation infrastructure. For example, ArrayGen Technologies Pvt. Ltd. provides diverse NGS analysis services in cancer genomics, disease studies, agricultural biotechnology, and personalized medicine. Similarly, Thermo Fisher Scientific offers a range of NGS data analysis solutions.

The commercial NGS software segment is expected to grow significantly due to rising demand and increased awareness of sequencing techniques. Managing the vast data NGS generates has created a high demand for specialized algorithms. Companies are developing tools to simplify data interpretation, such as QIAGEN's CLC Genomics Workbench, an all-in-one toolkit for metagenomics, transcriptomics, epigenomics, and genomics.

Workflow Insights

Based on workflow, NGS tertiary data analysis dominated the market in 2024 with a revenue share of 49.66%. This dominance is due to the critical role of tertiary analysis in interpreting and visualizing complex genomic data, enabling more accurate insights for clinical and research applications. The growing demand for detailed data interpretation and improved decision-making in areas like personalized medicine and disease research is driving the adoption of tertiary analysis in the NGS workflow.

The NGS secondary data analysis segment is projected to witness the fastest growth rate over the forecast period. This surge is driven by the increasing need for efficient data processing and filtering to refine raw sequencing data. As genomic research and clinical diagnostics become more advanced, secondary analysis is crucial in ensuring accurate and actionable results. The rising adoption of NGS technologies in personalized medicine, oncology, and rare disease diagnostics further fuels the demand for secondary data analysis solutions. Thus, propelling the growth of the segment over the forecast period.

Mode Insights

Based on mode, in-house data analysis dominated the NGS data analysis market in 2024. This growth is due to its ability to provide better control over sensitive data, faster turnaround times, and cost savings for organizations with the necessary infrastructure. Many companies prefer in-house solutions to meet specific research needs and streamline workflows, reducing dependence on external service providers. In-house data analysis is popular because it gives companies more control, faster results, and reduces costs. It also allows for customized solutions that fit specific needs and ensures better data security. As a result, more companies are investing in internal systems for managing NGS data analysis.

The outsourced data analysis segment is projected to witness the fastest growth rate over the forecast period. This surge is driven by the increasing demand for cost-effective solutions, the need for specialized expertise, and the ability to scale operations without heavy investment in infrastructure. Outsourcing allows companies to access advanced data analysis capabilities while focusing on their core business functions. Thus, propelling the growth of the segment over the forecast period.

Read Length Insights

Based on read length, short-read sequencing dominated the NGS data analysis market with a share of 71.77% in 2024. This dominance can be attributed to its high accuracy, cost-effectiveness, and ability to quickly generate large volumes of data. Short-read sequencing is widely used in applications like genome sequencing and disease research, making it the preferred choice for many organizations. Additionally, the mature technology and well-established workflows of short-read sequencing contribute to its widespread adoption, further solidifying its dominant market position.

The very long-read sequencing segment is projected to witness the fastest growth rate of 27.59% over the forecast period. This rapid growth is driven by improvements in sequencing technologies, which allow for more accurate and detailed genomic analysis, especially in complex regions. The increasing need for high-resolution data in areas like cancer research, rare disease diagnosis, and personalized medicine further fuels this demand. Thus, propelling the growth of the segment over the forecast period.

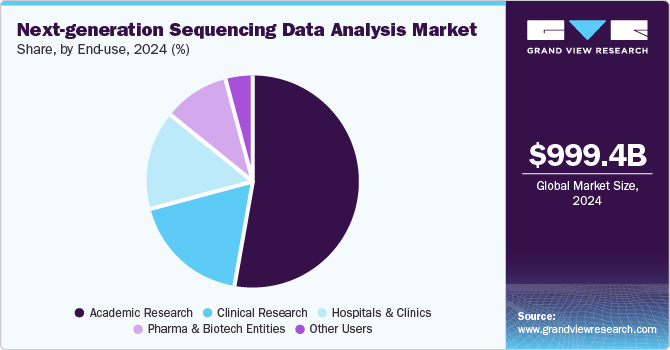

End Use Insights

Based on end use, the academic research segment dominated the market and accounted for the largest revenue share of 53.19% in 2024. This is attributed to the growing demand for advanced genomic tools in research projects, the increasing number of academic studies in genetics, oncology, and microbiology, and the availability of funding for academic institutions to invest in NGS technologies for groundbreaking discoveries.

The pharma & biotech entities segment is expected to witness the fastest growth rate over the forecast period. This growth is driven by the increasing use of NGS in drug discovery, personalized medicine, and biomarker identification. As pharmaceutical and biotechnology companies focus on developing targeted therapies and improving clinical outcomes, the demand for advanced genomic analysis tools is rising, fueling rapid market expansion in this sector.

Regional Insights

North America next-generation sequencing data analysis industry dominated the global market with a share of 49.38% in 2024. This is attributed to strong investments in the healthcare and biotechnology sectors, a high concentration of key market players, and significant government funding for research initiatives. Additionally, the region benefits from advanced infrastructure, widespread adoption of cutting-edge technologies, and a robust regulatory environment, making it a hub for NGS-related research and development.

U.S. Next-generation Sequencing Data Analysis Market Trends

The next-generation sequencing data analysis market in the U.S. is expected to grow over the forecast period. The growing adoption of NGS in clinical diagnostics and drug development is expected to fuel continued growth in the U.S. market.

Europe Next-generation Sequencing Data Analysis Market Trends

The next-generation sequencing data analysis industry in Europe is experiencing significant growth, driven by increasing investments in genomics research, advancements in personalized medicine, and the rising demand for precision therapies. The growing number of collaborations between academic institutions, biotech companies, and healthcare providers, along with supportive government policies and funding for research, are further boosting market expansion.

The UK next-generation sequencing data analysis market is expected to grow over the forecast period. This growth is driven by increasing government support for genomics research, the rise in personalized medicine applications, and advancements in healthcare technologies.

The next-generation sequencing data analysis market in France is expected to grow over the forecast period. The rising demand for NGS applications in oncology, rare diseases, and genetic disorders is further fueling the market's growth in the country.

Germany next-generation sequencing data analysis market is expected to grow over the forecast period. Germany's leadership in biotechnology and its well-established academic and research institutions foster innovation and adoption of NGS technologies.

Asia Pacific Next-generation Sequencing Data Analysis Market Trends

The next-generation sequencing data analysis industry in Asia Pacific is anticipated to grow significantly at 22.22% over the forecast period. This growth is primarily attributed to the increasing investments in healthcare and biotechnology, rapid advancements in genomic research, and the rising demand for personalized medicine. The region's expanding healthcare infrastructure, growing adoption of next-generation sequencing (NGS) technologies, and rising prevalence of chronic diseases such as cancer are key factors driving market growth.

China next-generation sequencing data analysis market is expected to grow over the forecast period. The growing demand for NGS applications in cancer research, genetic testing, and infectious disease diagnostics is expected to contribute to the continued growth of the country's market.

The next-generation sequencing data analysis market in Japan is expected to grow over the forecast period. The increasing demand for personalized medicine, advancements in genomics research, and the adoption of NGS technologies in clinical diagnostics and drug development.

Middle East & Africa Next-generation Sequencing Data Analysis Market Trends

The next-generation sequencing data analysis industry in the Middle East & Africa is expected to experience substantial growth over the forecast period. The collaborations between international organizations and regional research institutions, along with improvements in healthcare infrastructure, are helping drive market expansion in the region.

Kuwait next-generation sequencing data analysis market is expected to grow over the forecast period. The rising prevalence of genetic diseases and cancer in the region, along with collaborations between academic institutions and private sector players, is expected to fuel the adoption of NGS technologies in Kuwait.

Key Next-generation Sequencing Data Analysis Company Insights

The market players are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Next-generation Sequencing Data Analysis Companies:

The following are the leading companies in the next-generation sequencing data analysis market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- QIAGEN

- Agilent Technologies Inc.

- Bio-Rad Laboratories, Inc.

- Pacific Biosciences of California, Inc.

- Eurofins Scientific

- Partek Incorporated

- F. Hoffmann-La Roche Ltd.

- Illumina, Inc.

- DNASTAR, Inc.

Recent Developments

-

In July 2024, Thermo Fisher Scientific announced the partnership to advance clinical research and treatment of myeloid cancers by utilizing Next-Generation Sequencing (NGS) technology. This collaboration is anticipated to leverage NGS to improve the understanding of myeloid cancer genetics, enabling more precise diagnostics and targeted therapies. The use of NGS technology in cancer research highlights its growing role in the healthcare industry, driving demand for advanced data analysis solutions and boosting the overall NGS data analysis market.

-

In May 2023, Pfizer and Thermo Fisher Scientific have partnered to expand access to Next-Generation Sequencing (NGS)-based testing for lung and breast cancer patients in over 30 countries across Latin America, Africa, the Middle East, and Asia. This collaboration aims to provide advanced genomic testing in regions where such services were previously limited, driving the growth of the NGS data analysis market by increasing demand for more accessible, accurate cancer diagnostics.

Next-generation Sequencing Data Analysis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.22 billion

Revenue forecast in 2030

USD 3.45 billion

Growth Rate

CAGR of 23.10% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, workflow, mode, read length, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; QIAGEN; Agilent Technologies Inc.; Bio-Rad Laboratories, Inc.; Pacific Biosciences of California, Inc.; Eurofins Scientific; Partek Incorporated; Hoffmann-La Roche Ltd.; Illumina, Inc.; DNASTAR, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Next-generation Sequencing Data Analysis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global next-generation sequencing data analysis market report based on product, workflow, mode, read length, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Services

-

NGS Commercial Software

-

Platform OS/UI

-

Analytical Software

-

QC/Pre-processing Tools

-

Alignment Tools & Software

-

DNA Sequencing Alignment

-

RNA Sequencing Alignment

-

Protein Sequencing Alignment

-

-

Others

-

-

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary

-

Secondary

-

Read Mapping

-

Variant Alignment & Variant Calling

-

-

Tertiary

-

Variant Annotation

-

Application Specific

-

Targeted Sequencing/Gene Panel

-

Exome

-

RNA Sequencing

-

Whole Genome

-

Chip Sequencing

-

Others

-

-

-

-

Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourced

-

-

Read Length Outlook (Revenue, USD Million, 2018 - 2030)

-

Short Read Sequencing

-

Long Read Sequencing

-

Very Long Read Sequencing

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharma & Biotech Entities

-

Other Users

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global next-generation sequencing data analysis market size was estimated at USD 999.4 million in 2024 and is expected to reach 1.22 billion in 2025.

b. The global next-generation sequencing data analysis market is expected to grow at a compound annual growth rate of 23.10% from 2025 to 2030 to reach USD 3.45 billion by 2030.

b. Services dominated the next-generation sequencing data analysis market with a share of 54.10% in 2024. This is attributable to the cost-effective NGS data analysis services.

b. Some key players operating in the NGS data analysis market include Golden Helix, Inc; Bio-Rad Laboratories, Inc.; SciGenom Labs Pvt. Ltd.; DNAnexus Inc.; Genuity Science; Fabric Genomics, Inc.; Congenica Ltd.; QIAGEN; DNASTAR, Inc.; Pacific Biosciences of California, Inc.; Eurofins Scientific; Partek Incorporated; Precigen Bioinformatics Germany GmbH; PierianDx; Agilent Technologies, Inc.; F. Hoffmann-La Roche Ltd.; Illumina, Inc.; Verily Life Science, and Thermo Fisher Scientific, Inc.

b. Key factors that are driving the NGS data analysis market growth include the demand for efficient algorithms and tools for the analysis of large amounts of data generated by sequencers, the introduction of technological advancements in cloud computing and data integration, increasing penetration of the NGS technology in personalized medicine and precision diagnosis, and rising academic research based on NGS protocols.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.