Non-vascular Stents Market Size & Trends

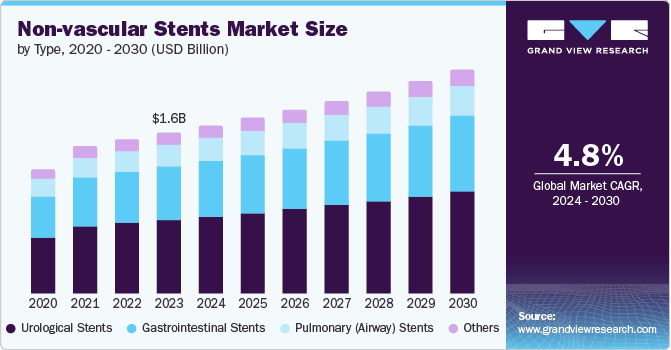

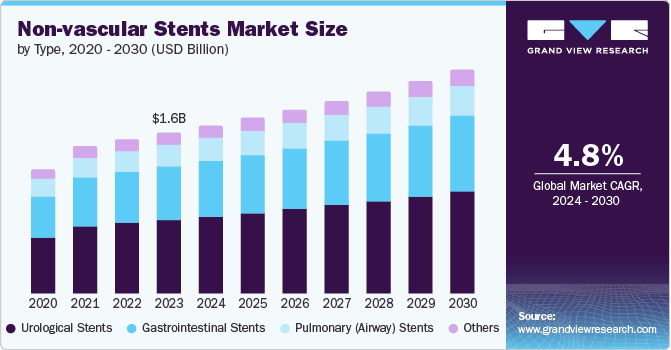

The global non-vascular stents market size was valued at USD 1.63 billion in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2030. The growth is fueled by the rising elderly population and the high occurrence of chronic and other illnesses, along with advancements in non-vascular stent technology. Elderly individuals are at high risk of acquiring chronic conditions like colon/colorectal cancer, pancreatic cancer, lung cancer, gallbladder cancer, asthma, Chronic Obstructive Pulmonary Disease (COPD), prostate cancer, chronic pancreatitis, and glaucoma, leading to an anticipated rise in the need for non-vascular stents in the future.

There is a continual increase in the number of clinical trials being conducted globally, for instance there has been significant growth in the number of registered clinical trials in past years. By April 15, 2024, more than 491 thousand clinical studies had been registered worldwide. There has been a substantial increase in the quantity of clinical studies since the year 2000, when only 2,119 were registered. Furthermore, every year, over 400,000 surgeries are done to repair ventral hernias. The American Cancer Society's predictions indicate that roughly 81,610 new cases of kidney cancer (52,380 in males and 29,230 in females) may be identified in 2024. This is largely due to the rising prevalence of long-term illnesses and subsequent increase in healthcare costs. As per the report by CDC in the U.S. in 2000, there were more than 120 million individuals with more than one chronic condition. This number is expected to experience an annual increase of more than 1% until 2030.

Type Insights

Biliary stents dominated the market in 2023 due to increasing occurrence of liver and bile duct diseases such as cholangiocarcinoma and gallstones resulting in a rising need for less invasive methods to deal with blockages. Biliary stents provide an efficient method to maintain the openness of bile ducts, alleviating symptoms and enhancing the quality of life for patients. Additionally, improvements in stent technology, specifically in self-expanding metal stents (SEMS), offer benefits such as longer patency period and increased durability against collapsing in comparison to plastic stents. This makes them perfect for dealing with cases of malignancy.

Esophageal stents are expected to register the fastest CAGR during the forecast. The increasing prevalence of esophageal cancer, which frequently leads to dangerous obstructions, requires the implementation of esophageal stents to allow for the passage of food and medication. For instance, around 22,370 new esophageal cancer cases are diagnosed and around 16,130 deaths occur from esophageal cancer as per the American Cancer Society Report. Additionally, the increasing elderly demographic is at a higher risk for harmless esophageal issues such as strictures, which can be effectively treated with stents. Moreover, placement of a stent in the esophagus is a faster procedure with quicker recovery times, which appeals to both patients and healthcare providers. Innovations such as biodegradable materials and improved designs in esophageal stents research and development are enhancing functionality and comfort for patients.

End Use Insights

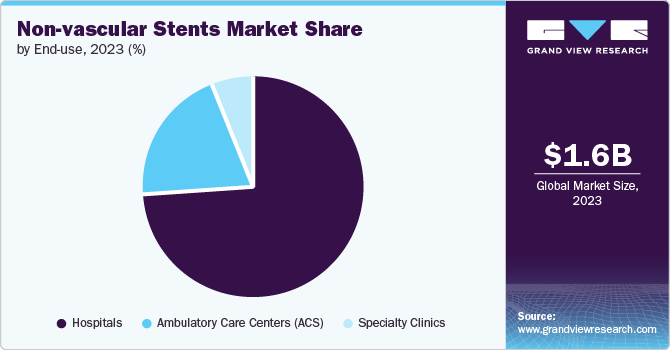

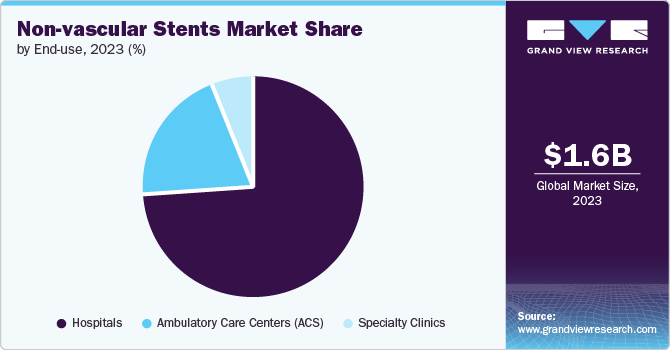

Hospitals dominated the market in 2023. This is mainly due to the higher number of surgeries occurring worldwide due to the growing elderly population. The increasing emphasis on enhancing patient results due to the presence of advanced technologies in these settings are expected to propel market growth.

Ambulatory Care Centers (ACS) are expected to register the fastest CAGR during the forecast period. ASCs provide a convenient and affordable option for specific stent procedures compared to hospitals. These centers are designed for surgical procedures for patients who do not require overnight stay, resulting in shorter wait times and potentially reduced expenses.

Regional Insights

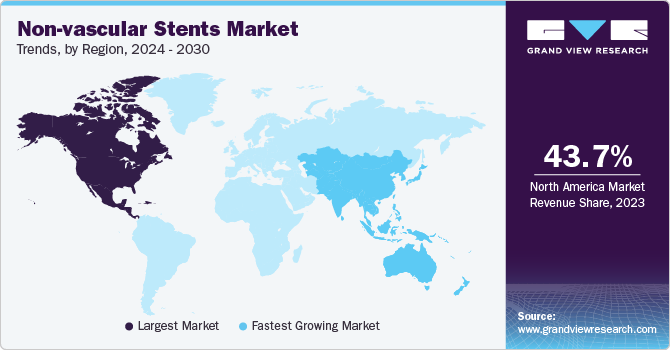

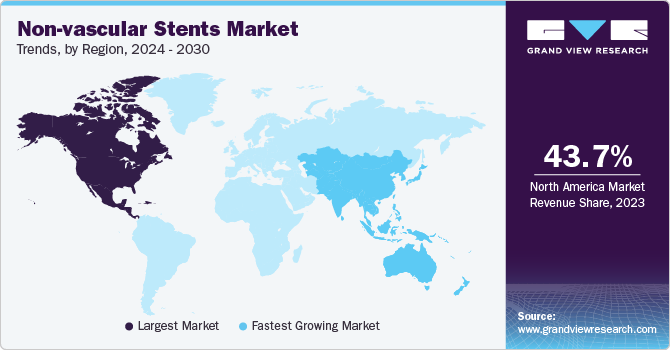

North America non-vascular stents market dominated the market in 2023. The increasing number of diseases is driving market expansion. Abdominal wall hernias are one of the most prevalent surgical issues. The American College of Surgeons (ACS) indicated that there are four million abdominal surgeries carried out annually in the U.S.

U.S. Non-vascular Stents Market Trends

The U.S. non-vascular stents market dominated the North America in 2023. The rise in healthcare spending is expected to drive market growth in the region. Health care spending in the U.S. increased by more than 3% in 2022 to about USD 3 trillion.

Europe Non-vascular Stents Market Trends

Europe non-vascular stents market was identified as a lucrative region in 2023 due to increasing geriatric population in the region. The UK non-vascular stents market is expected to grow rapidly in the coming years. The older population in the UK is at a higher risk for cancer, and chronic obstructive pulmonary disease that necessitates non-vascular stents surgeries.

Asia Pacific Non-vascular Stents Market Trends

Asia Pacific non-vascular stents market is anticipated to witness significant growth during the forecast period due to the increasing disposable income in the region. The China non-vascular stents market held a substantial market share in 2023 driven by demographic shifts and changes in lifestyle.

Key Non-vascular Stents Company Insights

Some of the key companies in the non-vascular stents market include Boston Scientific Corporation, HOBBS MEDICAL, INC, Glaukos Corporation and TAEWOONG. To obtain a competitive advantage in the market, businesses are concentrating on growing their customer base. As a result, important players are pursuing a number of calculated risks, including partnerships and mergers and acquisitions with other major companies.

Key Non-vascular Stents Companies:

The following are the leading companies in the non-vascular stents market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- BD

- Boston Scientific Corporation

- ELLA - CS, s.r.o.

- CONMED Corporation

- HOBBS MEDICAL, INC

- Cook

- TAEWOONG

- Glaukos Corporation

Recent Developments

-

In March 2024, Cook Medical and Getinge signed a commercial distribution contract for iCast covered stent system in the U.S. This agreement is expected to ensure that iCast covered stent system reaches the optimum number of patients who would benefit from the system in the U.S.

-

In March 2024, BD (Becton, Dickinson and Company), a worldwide medical technology corporation, announced the first patient enrollment in "AGILITY", an investigational device exemption (IDE) study. This study will evaluate the effectiveness and safety of the BD Vascular Covered Stent, for treating Peripheral Arterial Disease (PAD).

Non-vascular Stents Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 1.71 billion

|

|

Revenue forecast in 2030

|

USD 2.27 billion

|

|

Growth Rate

|

CAGR of 4.8% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

September 2024

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, end use, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, KSA, UAE, Kuwait, South Africa

|

|

Key companies profiled

|

Medtronic; BD; Boston Scientific Corporation; ELLA - CS, s.r.o.; CONMED Corporation; HOBBS MEDICAL, INC; Cook; TAEWOONG, Glaukos Corporation

|

|

Customization scope

|

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

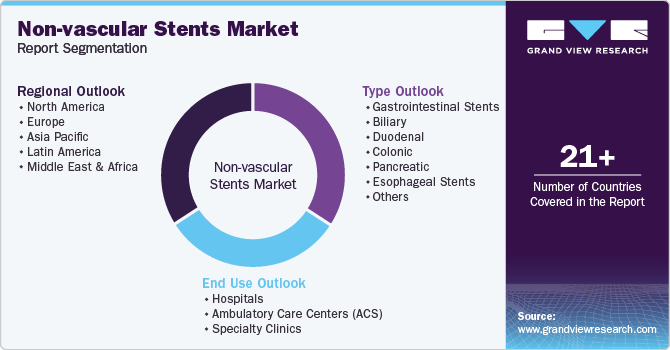

Global Non-vascular Stents Market Report Segmentation

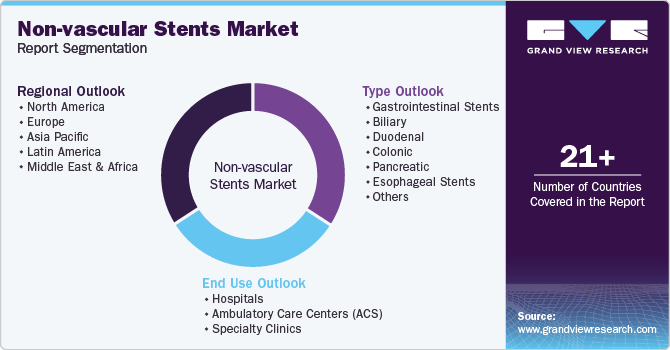

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global non-vascular stents market report based on type, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)