- Home

- »

- Consumer F&B

- »

-

Non-alcoholic RTD Beverages Market Size Report, 2030GVR Report cover

![Non-alcoholic RTD Beverages Market Size, Share & Trends Report]()

Non-alcoholic RTD Beverages Market Size, Share & Trends Analysis Report By Product (Carbonated Soft Drinks, RTD Tea & Coffee, Functional Beverages, Juices), By Distribution Channel (Food Service, Retail), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-256-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Non-alcoholic RTD Beverages Market Trends

The global non-alcoholic RTD beverages market size was estimated at USD 931.18 billion in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030. The global market is experiencing robust growth, driven by several key factors. Firstly, the increasing consumer awareness and preference for healthier beverage options are contributing significantly to the market expansion. With a rising focus on overall well-being, consumers are seeking alternatives to traditional sugary sodas and prefer non-alcoholic ready-to-drink (RTD) beverages that often offer natural ingredients and functional benefits. Moreover, the convenience factor plays a pivotal role in propelling the market forward.

Busy lifestyles and the need for on-the-go refreshments have fueled the demand for RTD options. The accessibility and ease of consumption make non-alcoholic RTD beverages a preferred choice for consumers who are looking for quick and convenient refreshment solutions, whether at home, in the office, or while traveling. The diversification of product offerings within the non-alcoholic RTD beverages category also acts as a driver. The market is witnessing a proliferation of innovative and unique formulations, including carbonated soft drinks, RTD tea and coffee, functional beverages, juices, dairy-based beverages, and more.

This diverse range of choices caters to a wide array of consumer preferences, contributing to the overall market growth. Furthermore, the growing retail landscape and rapid globalization of brands have facilitated the market's reach across different regions. The product availability in various distribution channels, including foodservice and retail outlets, enhances consumer access and contributes to market expansion. Retail partnerships, promotional strategies, and effective marketing campaigns are also playing a crucial role in driving the adoption of these beverages.

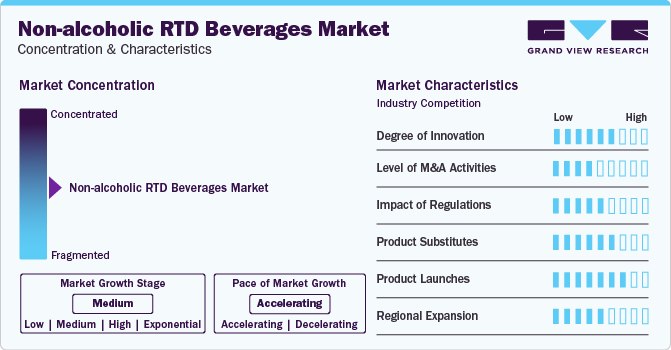

Market Concentration & Characteristics

The non-alcoholic RTD beverages market exhibits notable market characteristics, including a high degree of innovation. With consumer preferences evolving towards healthier and more diverse beverage options, manufacturers are actively engaged in developing innovative formulations and introducing new products.

This innovation extends across various segments within the market, such as carbonated soft drinks, RTD tea and coffee, functional beverages, juices, and dairy-based beverages. Companies are focusing on incorporating natural ingredients, functional benefits, and novel flavors to stay ahead in the competitive landscape, driving a continuous cycle of product innovation.

In terms of merger and acquisition activities, the market is experiencing a moderate to high level of strategic transactions. Companies are engaging in acquisitions, mergers, and collaborations to strengthen their market presence, expand their product portfolios, and leverage synergies.

M&A activities in the market are often aimed at gaining a competitive edge, entering new markets, or acquiring innovative technologies and formulations. This trend underscores the dynamic nature of the industry, with companies actively seeking strategic partnerships to enhance their market position.

The impact of regulations on the market is substantial and multifaceted. Regulatory frameworks related to food safety, labeling requirements, and health claims play a crucial role in shaping the market landscape. Stringent regulations often necessitate compliance with quality standards and ingredient specifications, ensuring consumer safety and trust.

In addition, evolving regulations related to sugar content, nutritional labeling, and environmental sustainability are influencing product formulations and packaging strategies within the market. Companies need to navigate these regulatory landscapes adeptly to ensure compliance while also adapting to changing consumer expectations, thereby shaping the market dynamics.

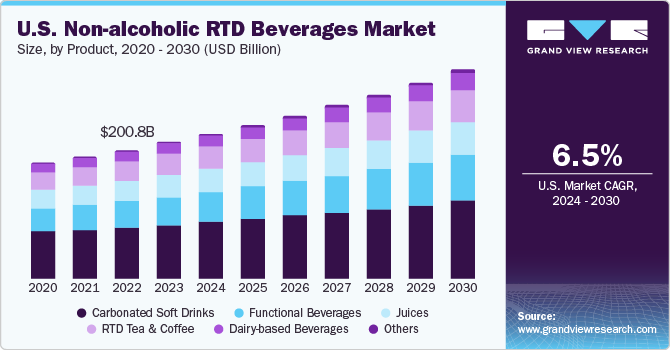

Product Insights

The carbonated soft drinks segment accounted for a share of 38.1% in 2023 due to the wide range of flavor options available in the market. The industry has consistently introduced new and innovative flavors attracting a broad demographic. Moreover, the carbonation element itself plays a crucial role in the appeal of these beverages. The effervescence and fizziness provide a unique sensory experience. This sets carbonated soft drinks apart from other non-alcoholic beverages, contributing to their sustained market share.

The functional beverages segment is expected to witness a CAGR of 7.8% from 2024 to 2030. Functional beverages, which often contain ingredients promoting health benefits, such as vitamins, minerals, antioxidants, and other bioactive compounds, align with the growing demand for products that support overall well-being. Another contributing factor is the rising awareness of preventive healthcare, prompting consumers to opt for functional beverages that offer specific health benefits, such as immune system support, energy enhancement, or stress reduction.

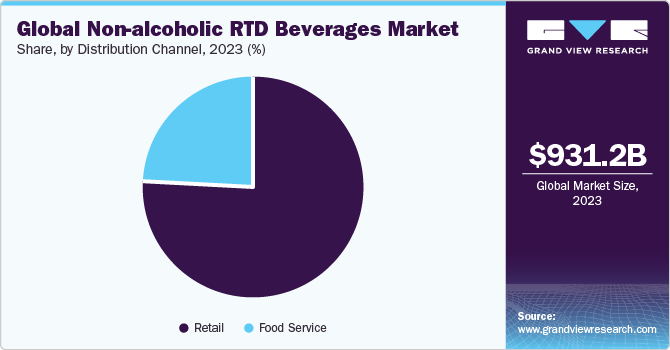

Distribution Channel Insights

In 2023, the retail distribution channel segment dominated the market with a revenue share of 75.6%. Consumers often prefer the ease of purchasing non-alcoholic RTD beverages during their routine shopping trips to supermarkets, hypermarkets, convenience stores, and other retail establishments. The widespread availability of these beverages in retail channels ensures that consumers can easily find and purchase their preferred options, contributing significantly to the overall segment growth.

The foodservice distribution channel segment is expected to grow at a CAGR of 6.2% from 2024 to 2030. As consumers seek convenient and on-the-go options, RTD beverages fit well with the fast-paced nature of the foodservice environment, making them a natural choice for both quick-service and casual dining establishments. The expansion of menu offerings within the foodservice sector, including a diverse range of ready to drink beverages, is another factor contributing to segment growth. This diversification of beverage options enhances the overall dining experience, contributing to the projected growth in distribution through the foodservice channel.

Regional Insights

The North America non-alcoholic RTD beverages market is expected to witness a CAGR of 6.3% from 2024 to 2030. As health and wellness continue to be at the forefront of consumer choices, the demand for non-alcoholic ready to drink (RTD) beverages, especially those offering functional benefits and natural ingredients, is expected to grow. Consumers in this region seek alternatives to traditional sugary sodas, creating opportunities for innovative and health-focused RTD beverages.

The U.S. Non-alcoholic RTD Beverages Market Trends

The non-alcoholic RTD beverages market in the U.S. is expected to grow at a CAGR of 6.5% from 2024 to 2030. With a rising awareness of the impact of diet on overall well-being, there is a growing demand for products with natural ingredients & less sugar content that offer functional benefits and align with healthier lifestyle choices. The market's expansion is also fueled by the surge in consumer interest in convenient and on-the-go beverage options. The fast-paced lifestyles, coupled with the need for immediate refreshment solutions, have led to an increased demand for non-alcoholic RTD beverages that are easily accessible and portable. This convenience factor makes these beverages suitable for various occasions, including commuting, work breaks, and outdoor activities.

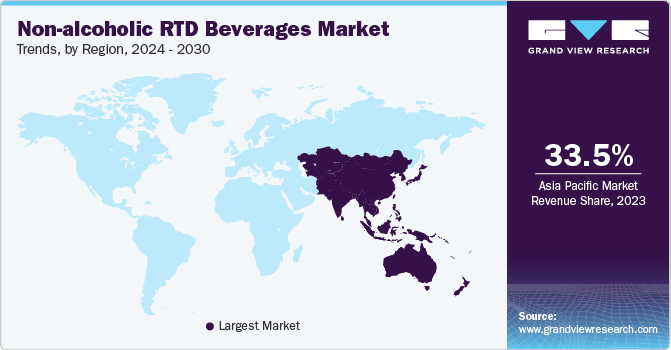

Asia Pacific Non-alcoholic RTD Beverages Market Trends

The Asia Pacific non-alcoholic RTD beverages market captured a revenue share of over 33.5% in 2023. With a growing middle-class population and rapid urbanization in the region, there is a rising demand for convenient and on-the-go beverage options. Non-alcoholic RTD beverages, with their diverse product offerings, appeal to the varied tastes and preferences of consumers across different demographics in the region. The changing lifestyle and consumption patterns also contribute to the regional market growth. Fast-paced lifestyles in many Asian countries result in high demand for convenient and time-saving products, such as non-alcoholic RTD beverages.

Key Non-alcoholic RTD Beverages Company Insights

The competitive landscape includes companies offering a diverse range of products, including carbonated soft drinks, RTD tea and coffee, functional beverages, juices, and more. Diversification allows companies to cater to a broad consumer base and adapt to changing preferences. Many companies engage in strategic collaborations, partnerships, and acquisitions to expand their product portfolios, enhance distribution networks, and gain a competitive edge. These moves contribute to the dynamic nature of the market.

Key Non-alcoholic RTD Beverages Companies:

The following are the leading companies in the non-alcoholic RTD beverages market. These companies collectively hold the largest market share and dictate industry trends.

- PepsiCo, Inc.

- Nestlé S.A.

- Keurig Dr. Pepper Inc.

- The Coca-Cola Company

- Danone S.A.

- Suntory Beverage & Food Ltd.

- Asahi Group Holdings, Ltd.

- Red Bull GmbH

- Monster BevCorp

- Unilever PLC

Recent Developments

-

In February 2024, The Coca-Cola Company launched Coca-Cola Spiced in North America. The drink is available in two variants-Coca-Cola Spiced and Coca-Cola Spiced Zero Sugar

-

In January 2023, PepsiCo, Inc. launched the new and improved Pepsi Zero. This drink uses new sweeteners and has a more refreshing taste. This product release reflects the company's commitment to staying relevant in the ever-evolving beverage industry, meeting consumer preferences, and addressing the demand for innovation

Non-alcoholic RTD Beverages Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 988.91 billion

Revenue forecast in 2030

USD 1,442.94 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; South Korea; Australia & New Zealand; India; Brazil; South Africa

Key companies profiled

PepsiCo, Inc.; Nestlé S.A.; Keurig Dr. Pepper Inc.; The Coca-Cola Company; Danone S.A.; Suntory Beverage & Food Ltd.; Asahi Group Holdings, Ltd.; Red Bull GmbH; Monster BevCorp.; Unilever PLC

Customization scope

Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-alcoholic RTD Beverages Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the non-alcoholic RTD beverages market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbonated Soft Drinks

-

RTD Tea & Coffee

-

Functional Beverages

-

Juices

-

Dairy-based Beverages

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Service

-

Retail

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Department Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

Australia & New Zealand

-

South Korea

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global non-alcoholic RTD beverages products market size was estimated at USD 931.18 billion in 2023 and is expected to reach USD 988.91 billion in 2024.

b. The global non-alcoholic RTD beverages products market is expected to grow at a compounded growth rate of 6.5% from 2024 to 2030 to reach USD 1,442.94 billion by 2030.

b. In 2023, North America captured a revenue share of over 42.6% in the non-alcoholic RTD beverages market. The presence of a robust retail infrastructure and the popularity of e-commerce contribute to the accessibility of non-alcoholic RTD beverages. Consumers can easily find a diverse range of options in supermarkets, convenience stores, and online platforms, enhancing the market's reach and potential for growth.

b. Some key players operating in the market include PepsiCo, Inc., Nestlé S.A., Keurig Dr. Pepper Inc., The Coca-Cola Company, Danone S.A, Suntory Beverage & Food Ltd., Asahi Group Holdings, Ltd., Red Bull GmbH, Monster BevCorp, and Unilever PLC

b. The expanding retail landscape and increasing globalization of brands have facilitated the market's reach across different regions. The availability of non-alcoholic RTD beverages in various distribution channels, including food service and retail outlets, enhances consumer access and contributes to market expansion.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."