- Home

- »

- Consumer F&B

- »

-

Nootropics Market Size And Share, Industry Report, 2033GVR Report cover

![Nootropics Market Size, Share & Trends Report]()

Nootropics Market (2026 - 2033) Size, Share & Trends Analysis Report By Form (Capsules/ Tablets, Powder, Drinks), By Distribution Channel (Online, Offline), By Region (North America, Europe, Asia Pacific, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-914-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nootropics Market Summary

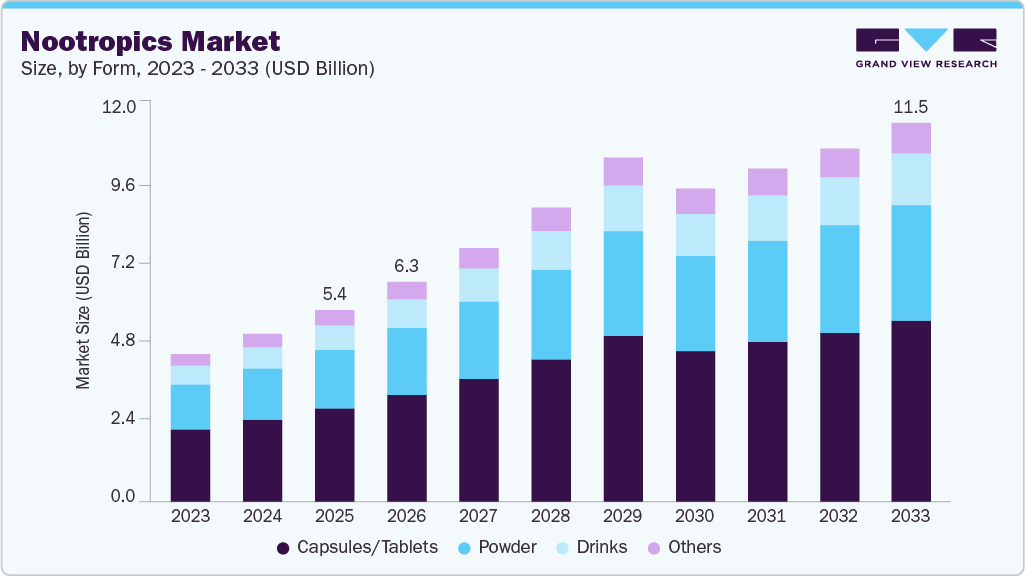

The global nootropics market size was valued at USD 5.45 billion in 2025 and is anticipated to reach USD 11.48 billion by 2033, growing at a CAGR of 9.1% from 2026 to 2033. The industry is expected to expand at a rapid pace over the forecast period on account of technological advancements as well as modernization in the field.

Key Market Trends & Insights

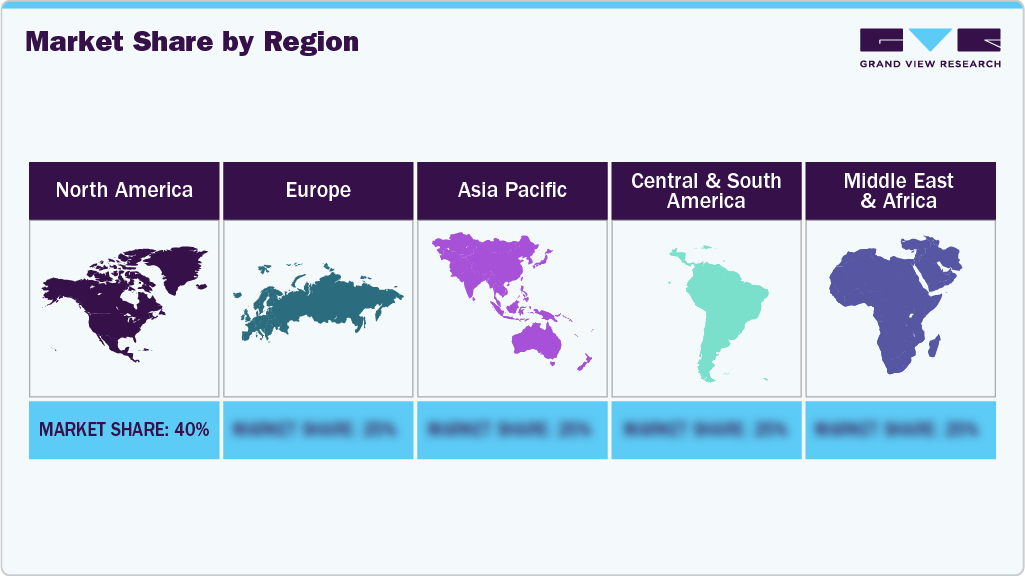

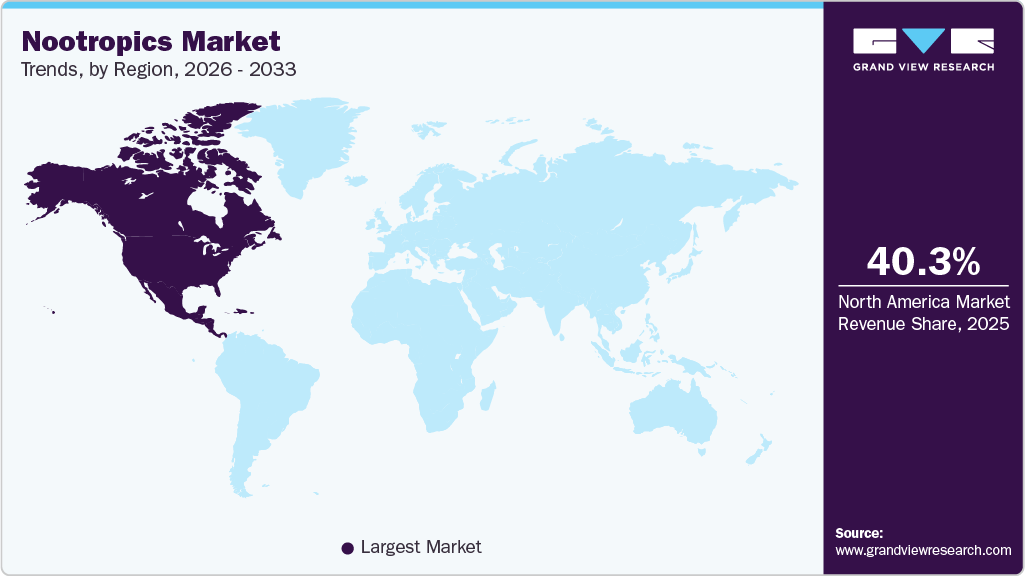

- North America led the market with a share of 40.3% in 2025.

- By form, capsules/tablets led the market and accounted for a share of 48.8% in 2025.

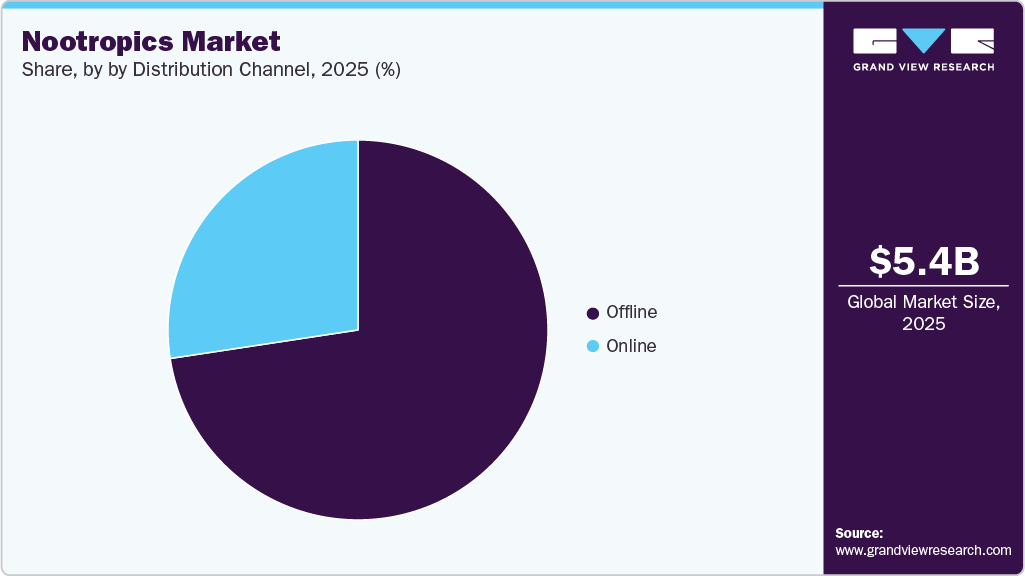

- By distribution channel, the offline segment led the market and accounted for a share of 72.6% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.45 Billion

- 2033 Projected Market Size: USD 11.48 Billion

- CAGR (2026-2033): 9.1%

- North America: Largest market in 2025

Rising consumer spending on various healthcare as well as wellness products is expected to fuel industry growth over the forecast period. In addition, cost-effectiveness as well as easy accessibility to these products are further expected to boost product needs among consumers.The demand for natural and plant-based nootropics has increased with growing interest in holistic health. These compounds are recommended because they are sourced from plants and are in line with natural, sustainable, and ethical wellness practices. In keeping with the holistic health concept, they are viewed as a means of improving cognitive performance while encouraging balance between the mind and body. This market surge is a result of the rising consumer focus on health and wellness. With the increasing number of students attending college as well as a workforce that demands better qualifications due to the low unemployment rate, prospective candidates have been seeking natural ways to gain a competitive advantage and improve their performance.

The rising trend of cognitive enhancement among healthy consumers for academic and professional advantage is expected to fuel the need for nootropics over the next six years. In addition, the growing use of the product among athletes and sports professionals, as well as among consumers for personal improvement, will have a positive impact on the market over the forecast period.

The growing geriatric population, coupled with the rising occurrence of various brain-related diseases, including dementia and other issues such as arthritis, has increased the need for nootropics. Moreover, these products are employed for the treatment of other cognitive and age-related disorders, including hyperactivity, as well as Parkinson's disease. Numerous consumers across the globe have been undergoing depression as well as other mood and emotional disorders. Thus, rising demand for mood enhancers is also expected to stimulate industry growth over the next six years.

Manufacturers are responding to the rising demand for nootropics by focusing on research and development, as well as new product launches, quality control, vegan and plant-based options, and specialized products for various niches. For instance, in August 2025, Unconform, formerly Impact Coffee, launched a nootropic-enhanced cold brew RTD coffee line designed to improve mental clarity, cognitive longevity, digestive, and immune health without typical caffeine side effects. The 250ml cans come in three flavors: Flat White (with Ashwagandha, Ginkgo Biloba & Vitamin B12), Salted Caramel Latte (with Inulin and Turmeric), and Mocha (with Niacin & Biotin), priced at £2.50 each. Additionally, Unconform offers Smart Sticks-neutral-flavored sachets that boost immunity, mental clarity, gut health, or beauty, priced at £7.99 for a box of 10 sachets.

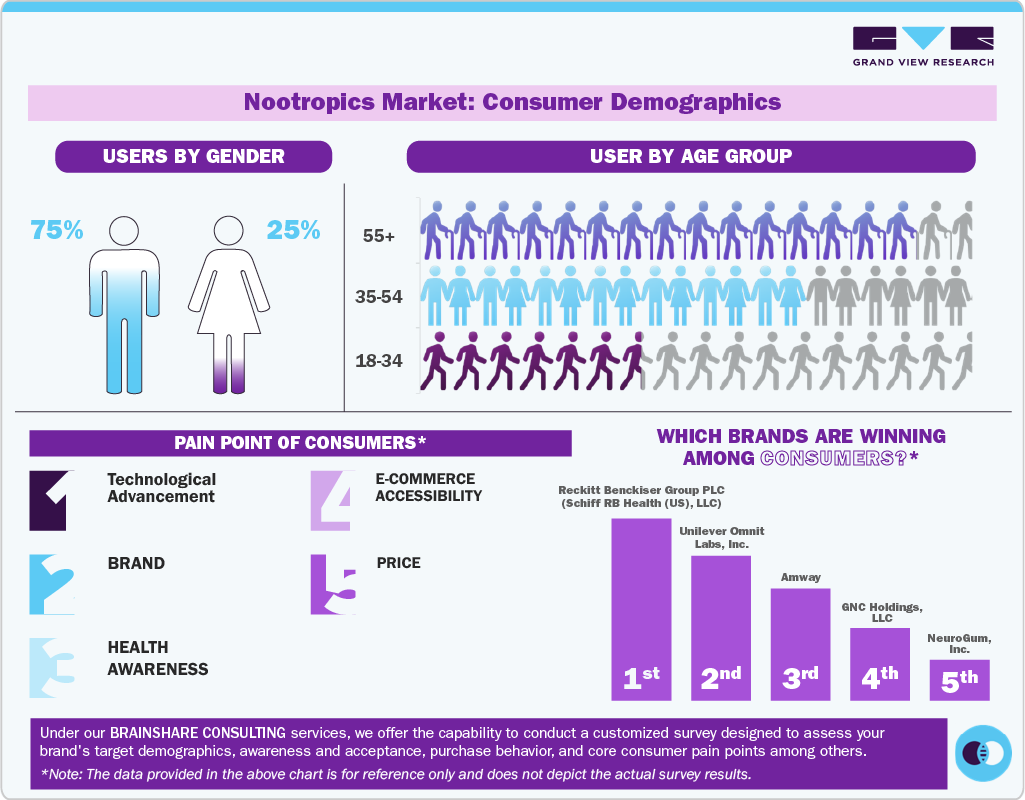

Consumer Insights

The nootropics industry has seen a significant surge in interest over recent years, driven by a growing consumer focus on cognitive enhancement and overall mental well-being. This trend is largely fueled by the increasing awareness of mental health issues, alongside the rise of the wellness movement. Consumers, particularly millennials and Gen Z, are actively seeking solutions to enhance focus, memory, and productivity.

One key trend is the shift toward natural and plant-based nootropics. Consumers are becoming more health-conscious, prioritizing products with clean labels and minimal artificial additives. Ingredients such as Rhodiola rosea, ginkgo biloba, and Bacopa monnieri are gaining traction due to their perceived safety and efficacy. For instance, according to the data published in Bacopa, utilization in the nootropics market in the U.S. accounted for 11%.

Plant-based nootropics, such as Ginkgo Biloba, Rhodiola Rosea, and Bacopa Monnieri, have gained traction due to their historical use in traditional medicine and the increasing interest in ethnobotany. These ingredients are believed to offer cognitive enhancement benefits such as improved memory, focus, and stress reduction without the side effects that sometimes accompany synthetic nootropics. For instance, according to the National Library of Medicine data published in March 2023, bacopa monnieri (also known as Brahmi) is described as a calming cognitive enhancer and known as an effective nootropic in improving cognitive performance, memory acquisition, and reducing anxiety.

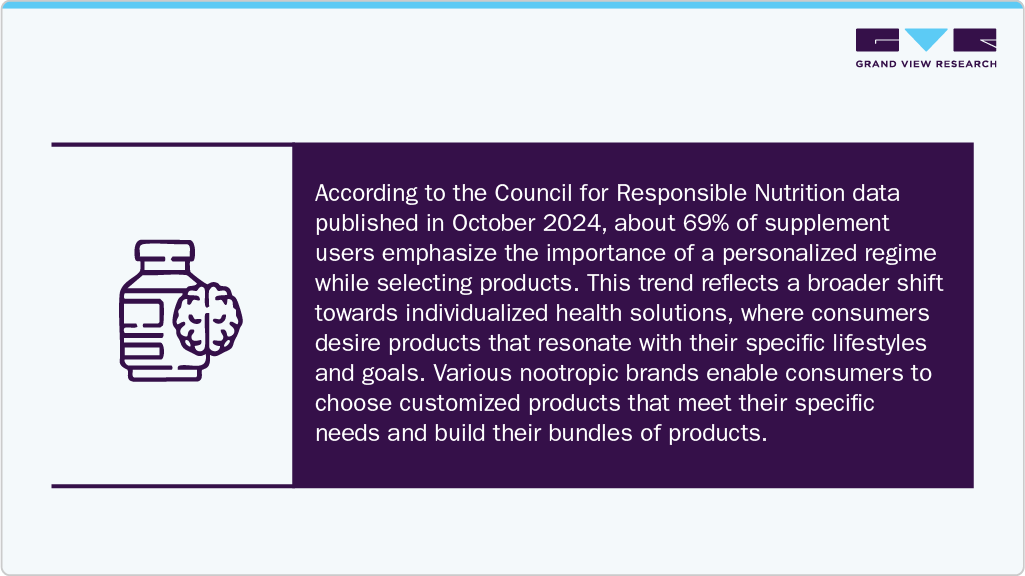

Another notable preference among consumers is the desire for personalized supplements. With advancements in technology, including DNA and microbiome testing, there’s a growing interest in tailored nootropic stacks that cater to individual cognitive profiles and needs. Companies such as Thesis offer customized nootropics, helping consumers boost their cognitive ability and enhance productivity.

In addition, personalization has emerged as another vital trend within the nootropics market. As consumers seek tailored solutions to address their unique cognitive needs, brands that offer customized formulations or targeted blends are gaining traction.

Furthermore, the online retail landscape plays a crucial role in shaping consumer trends within the nootropics market. E-commerce platforms and social media marketing have made it easier for consumers to access a wide variety of products and information. The convenience of online shopping also allows for greater experimentation with different nootropic formulations, leading to a more dynamic and evolving market.

Form Insights

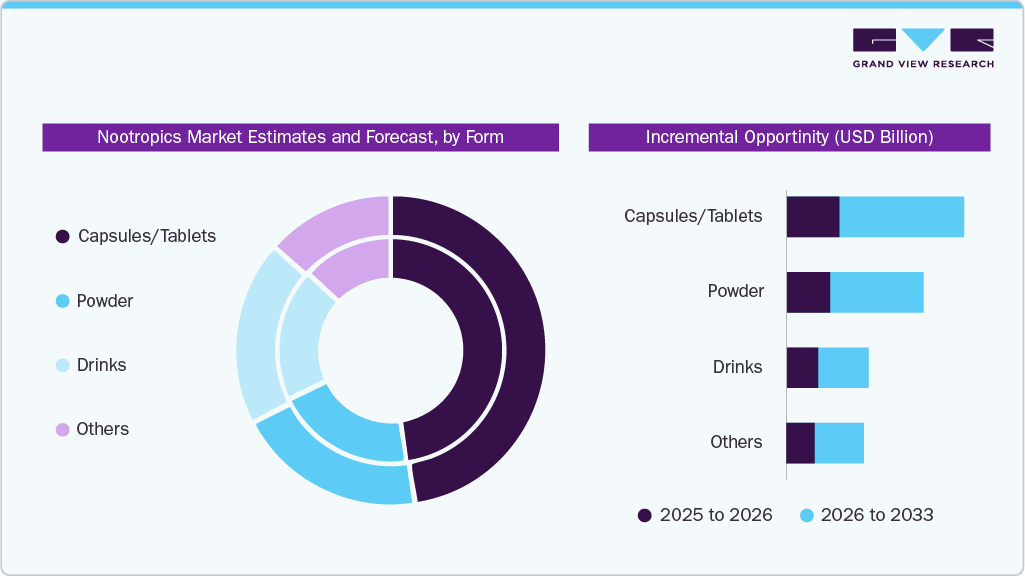

Capsule/ tablets nootropics accounted for a share of 48.8% in the global market in 2025. Capsules offer consumers a convenient and precise way to deliver a consistent dose of nootropic ingredients. Furthermore, unlike the powdered or liquid forms, capsules eliminate the need for measuring and mixing, saving time and simplifying the consumption process. As a result, capsules will continue to remain the dominant form during the forecast period.

Nootropic drinks are expected to grow at a CAGR of 10.0% from 2026 to 2033. Nootropics in liquid form are gaining popularity due to their ability to be digested more quickly than food, allowing them to boost the brain instantly compared to other forms. Secondly, the inclusion of natural elements such as ginseng and ashwagandha in nootropic drinks resonates with the escalating consumer enthusiasm for natural remedies, which further propels the preference for drinkable nootropics. These natural elements are acknowledged for their ability to combat fatigue, bolster immunity, and improve mood.

Distribution Channel Insights

The sales of nootropics through offline channels accounted for a 72.6% share in 2025. Traditional retail outlets like hypermarkets, supermarkets, pharmacies & drugstores, and convenience stores maintain a strong presence in many regions, providing consumers with easy access to these products. Moreover, companies are focusing on increasing product awareness among retailers and customers regarding the ingredients and suitability of the product. As a result, offline channels will continue to be the dominant sales platform for the market during the forecast period.

The online segment is expected to grow at a CAGR of 10.5% from 2026 to 2033. Online channels are time-saving when compared to visiting physical stores, providing a convenient way to order. The industry is largely attributed to the convenient shopping experience provided by online platforms like Amazon, iHerb, and Vitacost, among others. These online platforms, often operated by third-party sellers, offer a wide range of products from major manufacturers as well as local producers. They have established robust supply chains that transcend geographical boundaries.

Regional Insights

The North America nootropics market held a major share of 40.3% in 2025. The demand for nootropics in this region has increased, which can be attributed to the growing health and wellness trend. This trend has led consumers to explore natural and holistic approaches to self-care, and nootropics, derived from natural compounds, align with these trends. Furthermore, the increasing presence of key players in this market and their continuous product launches have contributed to the popularity of nootropics in the region, further driving their demand during the forecast period.

Europe Nootropics Market Trends

The nootropics market in Europe is anticipated to grow with a CAGR of 9.4% from 2026 to 2033. Nootropics were first synthesized in Europe. Increasing consumer preference for naturally derived nootropics over synthetic supplements is expected to create growth opportunities for key market players. Furthermore, a growing choice of smart drugs among students to cope with the stress of examinations is anticipated to boost the market growth. Increasing investments in the nootropics industry are also aiding companies in widening their offerings. In August 2021, Mindscopic, a Belgium-based start-up company specializing in nootropics, experienced a significant boost in its production capabilities following a successful funding round. As a result, the company was able to increase the production of its nootropic products, catering to the growing demand from consumers seeking cognitive enhancement and improved mental clarity.

Asia Pacific Nootropics Market Trends

The nootropics market in Asia Pacific is anticipated to grow with a CAGR of 10.2% over the forecast period. Demand for nootropics is rising in Asia Pacific as consumers increasingly prioritize cognitive performance, stress management, and mental well-being in fast-paced urban environments. Rapid digitalization, academic competitiveness, and demanding work cultures in countries such as China, South Korea, Japan, and Singapore have accelerated interest in supplements that support focus, memory, energy, and mood regulation. Additionally, growing awareness of ingredients like L-theanine, ginseng, citicoline, bacopa, and omega-3s combined with a strong regional preference for functional, natural, and herbal remedies has boosted adoption.

Central & South America Nootropics Market Trends

The nootropics market in Central & South America is anticipated to grow with a CAGR of 8.6% over the forecast period. Growing academic and professional competition, combined with higher awareness of brain health, has encouraged the adoption of supplements that support focus, memory, and stress management. The region’s expanding middle class and increased access to digital health information have also accelerated interest in natural and plant-based nootropics aligned with local wellness traditions.

Middle East & Africa Nootropics Market Trends

The nootropics market in the Middle East and Africa is expected to grow at a CAGR of 13.1% from 2026 to 2033. Rising urbanization, longer working hours, and academic pressure particularly among young professionals and students are driving interest in supplements that support focus, memory, and sustained energy. Additionally, greater awareness of brain health through digital channels, combined with the region’s growing wellness culture, has accelerated the adoption of natural, plant-based, and clinically supported nootropic ingredients.

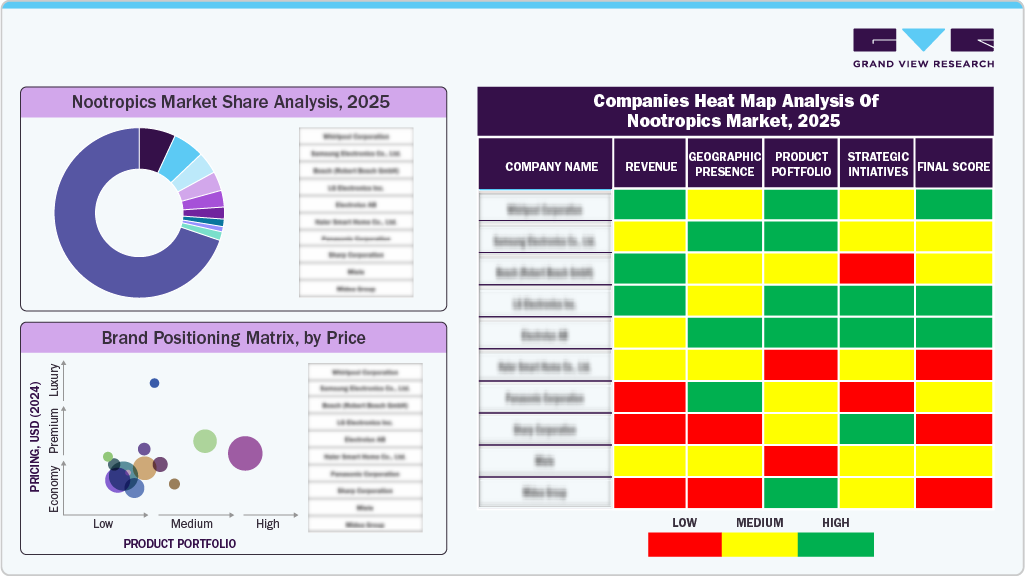

Key Nootropics Companies Insights

Key players operating in the nootropics market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Nootropics Companies:

The following are the leading companies in the nootropics market. These companies collectively hold the largest market share and dictate industry trends.

- Onnit Labs, Inc.

- Reckitt Benckiser Group PLC

- Mental Mojo, LLC

- NooCube

- Mind Lab Pro (Performance Lab Group Ltd)

- TruBrain

- Neu Mind, LLC

- Nooflux LLC

- Zhou Nutrition

- Kimera Koffee

Recent Developments

-

In July 2025, BioAdaptives announced the national launch of NeuroRush, a new adaptogenic nootropic aimed at improving mental clarity, focus, and stress resilience. The product features six clinically studied ingredients and will be available in both caffeinated and caffeine-free versions, with commercial release set for August/September 2025.

-

In November 2024, ADVANZ PHARMA acquired the rights to the medicines Nootropil (piracetam) and Atarax (hydroxyzine dihydrochloride) from UCB for Europe and selected countries in LATAM and APAC, strengthening its specialty brands portfolio and expanding its commercial reach in these regions.

-

In July 2024, 1 Shot Energy has expanded its partnership with the Disc Golf Pro Tour (DGPT) for the rest of the 2024 season. Players can win prize packs by hitting an ace on 1 Shot-sponsored baskets at DGPT events, and fans can use code "DGPT" for a 25% discount at 1shotenergy.com. The partnership promotes 1 Shot’s energy and focus chews as well as voice drops, aiming to energize players and fans while boosting excitement at disc golf events.

Nootropics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 6.22 billion

Revenue forecast in 2033

USD 11.48 billion

Growth rate

CAGR of 9.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Onnit Labs, Inc.; Reckitt Benckiser Group PLC; Mental Mojo, LLC; NooCube; Mind Lab Pro (Performance Lab Group Ltd); TruBrain; Neu Mind, LLC; Nooflux LLC; Zhou Nutrition; Kimera Koffee.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nootropics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global nootropics market report on the basis of form, distribution channel, and region:

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Capsules/Tablets

-

Powder

-

Drinks

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global nootropics market size was estimated at USD 3.75 billion in 2022 and is expected to reach USD 4.23 billion in 2023.

b. The global nootropics market is expected to grow at a compounded growth rate of 14.6% from 2023 to 2030 to reach USD 11.17 billion by 2030.

b. Capsule/tablet nootropics accounted for the largest share of 49.2% in the global market in 2022. Capsules offer consumers a convenient and precise way to deliver a consistent dose of nootropic ingredients.

b. Some key players operating in the nootropics market are Onnit Labs, Inc., Reckitt Benckiser Group PLC, Mental Mojo, LLC, NooCube, Mind Lab Pro (Performance Lab Group Ltd), TruBrain, Neu Mind, LLC, Nooflux LLC, Zhou Nutrition, and Kimera Koffee

b. The rising consumer spending on various healthcare as well as wellness products is expected to fuel industry growth over the forecast period. In addition, cost-effectiveness, as well as easy accessibility to these products, is further expected to boost product needs among consumers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.