- Home

- »

- Consumer F&B

- »

-

Nootropics Market Size, Share And Trends Report, 2030GVR Report cover

![Nootropics Market Size, Share & Trends Report]()

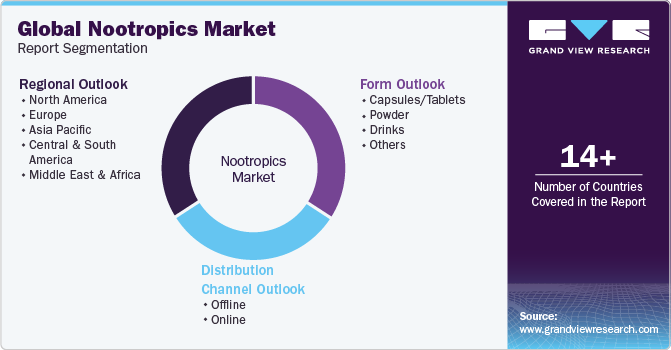

Nootropics Market Size, Share & Trends Analysis Report By Form (Capsules/ Tablets, Powder, Drinks), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-914-3

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Nootropics Market Size & Trends

The global nootropics market size was estimated at USD 3.75 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 14.6% from 2023 to 2030. The market is expected to expand at a rapid pace over the forecast period considering the technological advancements as well as modernization in the field. Rising consumer spending on various healthcare as well as wellness products is expected to fuel industry growth over the forecast period. In addition, cost-effectiveness as well as easy accessibility to these products is further expected to boost product needs among consumers.

The demand for natural and plant-based nootropics has increased with growing interest in holistic health. These compounds are recommended because they are sourced from plants and are consistent with natural, sustainable, and ethical wellness practices. In accordance with the holistic health concept, they are viewed as a means of improving cognitive performance while encouraging balance between the mind and body. This market surge is an effect of the rising consumer focus on health and wellness. With the increasing number of students attending college as well as a workforce that demands better qualifications due to the low unemployment rate, prospective candidates have been seeking natural ways to gain a competitive advantage and improve their performance.

The rising trend of cognitive enhancement among healthy consumers for academic and professional advantage is expected to fuel the need for nootropics over the next six years. In addition, the growing use of the product among athletes and sports professionals as well as among consumers for personal improvement will have a positive impact on the market over the forecast period.

The growing geriatric population coupled with the rising occurrence of various brain-related diseases including dementia and other issues such as arthritis has increased the need for nootropics. Moreover, these products are employed for the treatment of other cognitive and age-related disorders including hyperactivity, as well as Parkinson's disease. Numerous consumers across the globe have been undergoing depression as well as other mood and emotional disorders. Thus, rising demand for mood enhancers is also expected to stimulate industry growth over the next six years.

Manufacturers are responding to the rising demand for nootropics by focusing on research and development, as well as new product launches, quality control, vegan and plant-based options, and specialized products for various niches. For instance, in July 2022, BioAdaptives Inc. launched MindnMemory, an advanced nootropic designed to boost memory, clarity, mental focus, and concentration. This stimulant-free formulation is known for its gradual onset and sustained effects, avoiding the abrupt "high" and "crash" associated with caffeine and similar substances.

The unique formulation draws inspiration from traditional Chinese medicine and Ayurvedic culture, catering to the increasing demand for a high-quality product that promotes optimal cognitive performance. It is intended for individuals dealing with age-related cognitive decline and anyone, including e-gamers, looking to improve perception, judgment, accuracy, reaction speed, and mood.

Distribution Channel Insights

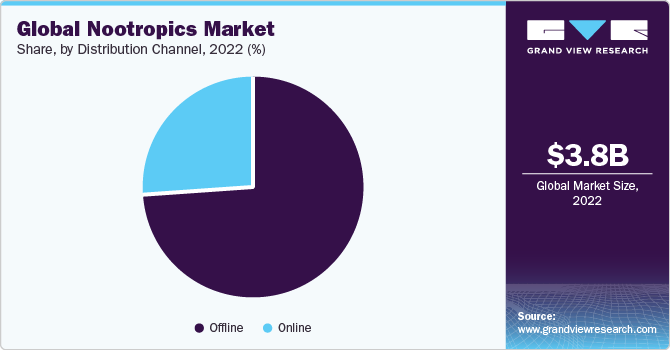

The sales of nootropics through offline channels held a 73.7% share in 2022. Traditional retail outlets such as hypermarkets, supermarkets, pharmacies & drugstores, and convenience stores maintain a strong presence in many regions, providing consumers with easy access to these products. Moreover, companies are focusing on increasing product awareness among retailers and customers regarding the ingredients and suitability of the product. As a result, offline channels will continue to be the dominant sales platform for the market during the forecast period.

The online segment is expected to grow at a CAGR of 16.2% from 2023 to 2030. Online channels are timesaving when compared to visiting physical stores, providing a convenient way to order. This growth is largely attributed to the convenient shopping experience provided by online platforms such as Amazon, iHerb, and Vitacost, among others. These online platforms, often operated by third-party sellers, offer a wide range of products from major manufacturers as well as local producers. They have established robust supply chains that transcend geographical boundaries.

Regional Insights

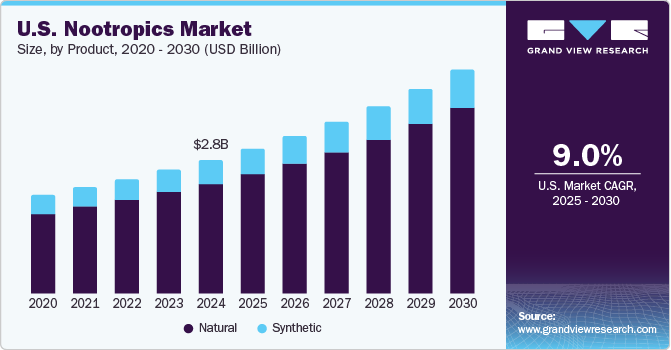

North America held a major revenue share of over 41.2% of the global nootropics industry in 2022. The demand for nootropics in this region has increased, which can be attributed to the growing health and wellness trend. This trend has led consumers to explore natural and holistic approaches to self-care, and nootropics, derived from natural compounds, align with these trends. Furthermore, the increasing presence of key players in this market and their continuous product launches have contributed to the popularity of nootropics in the region, further driving their demand during the forecast period.

The market in Europe is anticipated to grow with a CAGR of 14.9% over the forecast period. Nootropics were first synthesized in Europe. Increasing consumer preference for naturally derived nootropics over synthetic supplements is expected to create growth opportunities for key market players. Furthermore, a growing choice of smart drugs among students to cope with the stress of examinations is anticipated to boost the market growth. Increasing investments in the nootropics industry are also aiding companies in widening their offerings. In August 2021, Mindscopic, a Belgium-based start-up company specializing in nootropics, experienced a significant boost in its production capabilities following a successful funding round. As a result, the company was able to increase the production of its nootropic products, catering to the growing demand from consumers seeking cognitive enhancement and improved mental clarity.

The market in Asia Pacific is anticipated to grow at a CAGR of 15.7% over the forecast period. Growing awareness of daily nutritional requirements has driven consumer demand for certain medical supplements, including functional and nootropics, especially in response to the COVID-19 pandemic in Asia Pacific. With people unable to fulfill their nutritional requirements through standard diets, they are recognizing the importance of additional dietary supplements such as vitamins, minerals, nootropics, and others.

Form Insights

Capsule/ tablets nootropics segment held a revenue share of 49.2% in the global market in 2022. Capsules offer consumers a convenient and precise way to deliver a consistent dose of nootropic ingredients. Furthermore, unlike the powdered or liquid forms, capsules eliminate the need for measuring and mixing, which saves time and simplifies the consumption process. As a result, capsules will continue to remain the dominant form during the forecast period.

Nootropic drinks are anticipated to witness a CAGR of 15.6% from 2023 to 2030. Nootropics in liquid form are gaining popularity due to their ability to be digested more quickly than food, allowing them to boost the brain instantly compared to other forms. Secondly, the inclusion of natural elements such as ginseng and ashwagandha in nootropic drinks resonates with the escalating consumer enthusiasm for natural remedies, which further propels the preference for drinkable nootropics. These natural elements are acknowledged for their ability to combat fatigue, bolster immunity, and improve mood.

In an article by FMCG gurus in 2021, a study revealed the surging worldwide interest in cognitive health products. The report indicated that 66% of consumers displayed interest, marking a significant increase from the 53% recorded three years prior. This trend indicates a potentially expanding market for nootropic beverages as well.

Key Companies & Market Share Insights

Manufacturers are adopting various strategies to maintain a competitive edge, with a primary focus on introducing a wide variety of nootropics in terms of ingredients, formulations, and delivery methods to cater to different cognitive needs and consumer preferences. Manufacturers are also investing in educating consumers about the benefits and proper usage of nootropics. Some of the initiatives include:

-

In September 2022, Neuriva, a cognitive health supplement brand under Reckitt, partnered with chef and food enthusiast Alton Brown to promote a holistic approach to brain health. Through this partnership, Alton Brown aimed to empower consumers to prioritize their brain health as an integral part of their overall well-being. This collaboration highlighted the Neuriva product line, which included Neuriva Plus, along with their new offerings, Neuriva Sleep and Neuriva Brain + Energy.

-

In August 2022, Nu: tropic, a UK-based provider of nootropic products, announced the launch of nootropic-based snack bars. The bars are made of Norwegian black oats and include essential brain nutrients such as choline, phosphatidylserine, and omega-3. The bars are available in maple and pecan, salted caramel, raisin and almond, and apple and cinnamon flavors.

-

In October 2021, Australia-based start-up Savvy Beverage announced an instant coffee and soda drink containing nootropic ingredients to improve brain function. The product line is an extension of its current product line of functional coffee pods, which are compatible with Nespresso coffee machines.

Key Nootropics Companies:

- Onnit Labs, Inc.

- Reckitt Benckiser Group PLC

- Mental Mojo, LLC

- NooCube

- Mind Lab Pro (Performance Lab Group Ltd)

- TruBrain

- Neu Mind, LLC

- Nooflux LLC

- Zhou Nutrition

- Kimera Koffee

Nootropics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.23 billion

Revenue forecast in 2030

USD 11.17 billion

Growth rate

CAGR of 14.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; China; India; Brazil; UAE

Key companies profiled

Onnit Labs, Inc.; Reckitt Benckiser Group PLC; Mental Mojo, LLC; NooCube; Mind Lab Pro (Performance Lab Group Ltd); TruBrain; Neu Mind, LLC; Nooflux LLC; Zhou Nutrition; Kimera Koffee

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nootropics Market Report Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global nootropics market report based on form, distribution channel, and region:

-

Form Outlook (Revenue, USD Million, 2017 - 2030)

-

Capsules/Tablets

-

Powder

-

Drinks

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global nootropics market size was estimated at USD 3.75 billion in 2022 and is expected to reach USD 4.23 billion in 2023.

b. The global nootropics market is expected to grow at a compounded growth rate of 14.6% from 2023 to 2030 to reach USD 11.17 billion by 2030.

b. Capsule/tablet nootropics accounted for the largest share of 49.2% in the global market in 2022. Capsules offer consumers a convenient and precise way to deliver a consistent dose of nootropic ingredients.

b. Some key players operating in the nootropics market are Onnit Labs, Inc., Reckitt Benckiser Group PLC, Mental Mojo, LLC, NooCube, Mind Lab Pro (Performance Lab Group Ltd), TruBrain, Neu Mind, LLC, Nooflux LLC, Zhou Nutrition, and Kimera Koffee

b. The rising consumer spending on various healthcare as well as wellness products is expected to fuel industry growth over the forecast period. In addition, cost-effectiveness, as well as easy accessibility to these products, is further expected to boost product needs among consumers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."