- Home

- »

- Pharmaceuticals

- »

-

North America Alopecia Market Size And Share Report, 2030GVR Report cover

![North America Alopecia Market Size, Share & Trends Report]()

North America Alopecia Market Size, Share & Trends Analysis Report By Treatment (Pharmaceuticals, Devices), By Disease Type (Alopecia Areata), By End-use, By Sales Channel, By Gender, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-083-4

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

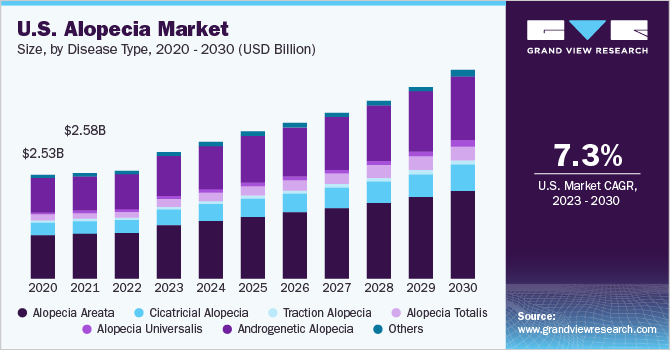

The North America alopecia market size was valued at USD 2.88 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030. The increasing prevalence of alopecia coupled with the rising prevalence of autoimmune and other chronic disorders that lead to hair loss are the major factors driving the market. According to the American Academy of Dermatology Association, hair loss affects around 80 million American people with 30 million women and 50 million men. Moreover, it is an estimation that around 10% to 20% of people with alopecia areata have a close blood relative who already has AA.

Moreover, the presence of several leading players in the region and the introduction of novel therapeutic options are also expected to drive the North America alopecia market. The market is driven by product line expansion undertaken by leading players. For instance, in June 2021, Hims & Hers Health, Inc, a leading telehealth company announced the availability of Hers Minoxidil 5% Foam and Hims Minoxidil 5% Foam for topical hair regrowth and to fulfill customer needs, which is expected to increase the market growth. Moreover, the presence of organizations that help to promote awareness regarding hair loss is likely to facilitate market expansion. Organizations such as American Hair Loss Association, National Alopecia Areata Foundation, and Canadian Alopecia Areata Foundation are involved in promoting awareness regarding hair loss and supporting research activities through funding.

The presence of a robust pipeline of investigational candidates for the treatment of hair loss is anticipated to accelerate the North America alopecia market. For instance, Equillium Bio, a leading clinical-stage biopharmaceutical company engaged in the development of novel therapeutics for autoimmune disorders is investigating EQ101, an IL-2/9/15 antagonist for the treatment of alopecia areata (AA). Moreover, Concert Pharmaceuticals is engaged in the development of CTP-543 which is a JAK1 and JAK2 inhibitor for the management of AA. In July 2020, the company obtained breakthrough therapy designation for CTP-543 from the U.S. FDA for the treatment of severe to moderate cases of alopecia. Furthermore, additional investigational candidates such as LY3009104 of Lily, PF 06651600 of Pfizer Inc., HCW9302 of HCW Biologics, and LH-8 of Legacy Healthcare are also being investigated for the treatment of hair loss.

The prevalence of cancer is expected to increase in the U.S. According to the American Cancer Society, in 2020, the estimated number of new cancer cases was 1.8 million in the country, whereas, in 2022, the number is expected to reach 1.9 million. The national expenditure for cancer care was estimated to be around USD 150.8 billion in 2018, which is expected to reach around USD 245 billion in 2030. Certain medications prescribed to patients for the treatment of cancer are also responsible for hair loss. For instance, chemotherapeutic agents, radiation therapy, hormone therapy, and immunotherapy are more likely to induce hair loss or hair thinning. Cancer incidences are expected to rise by about 70% over the next two decades, thus driving the North America alopecia industry.

Treatment Insights

Based on treatment, the pharmaceuticals segment dominated the North America alopecia market with a revenue share of 98.1% in 2022 and is expected to dominate the treatment segment during the forecast period. The growth of the pharmaceutical segment is attributed to the rising demand for drugs for the treatment of hair loss, lower costs of pharmaceutical products, easy availability, and various efforts taken by pharmaceuticals company to develop novel therapeutics for alopecia. For instance, companies such as Lilly, Concert Pharmaceuticals, Pfizer Inc, etc. are involved in the development of novel therapeutics with high efficacy for the treatment of hair loss.

The devices segment is estimated to register a steady growth rate during the projected period. Laser cap is growing at the fastest CAGR attributed to increasing demand for painless treatment, user-friendly, high adoption of non-invasive therapies, and occurrence of minimal side effects with high adoption of such devices. Moreover, the demand for the segment is also fueled by rising disposable incomes and a surge in healthcare spending in the region.

Disease Type Insights

The alopecia areata segment dominated the disease type segment with a share of 41.83% in 2022 and is likely to hold the largest share over the forecast period. The growth of the segment is owing to increasing disease prevalence, high treatment rates, the surge in awareness about alopecia areata, and various ongoing regulatory approvals. For instance, according to the NAAF, more than 6.8 million people in the U.S. have alopecia areata with a lifetime risk of 2.1%. In addition, ongoing regulatory approvals are expected to propel segment growth forward. For instance, in March 2020, Incyte Corporation and Eli Lilly and Company announced that the U.S. FDA had granted a breakthrough therapy designation to baricitinib for the management of alopecia areata.

Alopecia universalis is anticipated to grow at the fastest CAGR over the forecast period. The market growth is strongly driven by the impending launches of key late-stage pipeline products: baricitinib, ruxolitinib, ritlecitinib, Xeljanz (tofacitinib), Breezula (clascoterone), & SM04554, and initiatives undertaken by various organizations to aware people about the condition and available treatment.

End-use Insights

In 2022, the dermatological clinics led the North America alopecia market with a share of 57.06% and are expected to maintain their dominance over the forecast period. The demand for the dermatological clinics segment is driven by the growing focus on aesthetic appearance, rising consciousness about looks, and increased consumer awareness about the management & treatment of hair loss. The worldwide increase in the usage of prescription drugs and increase in doctor visits also contributes to the large share of the dermatology clinics segment.

The homecare settings segment is anticipated to register the fastest CAGR during the forecast period. The high demand for the homecare settings segment is primarily due to the high degree of convenience, and higher penetration of topical hair growth products. Moreover, the growing number of regulatory approvals for home-use devices and the rising adoption of laser therapy for hair loss treatment is anticipated to boost the segment growth.

Gender Insights

The male segment held the largest share of 54.38% of the North America alopecia market in 2022. Cases of androgenetic alopecia among men are a key contributor to the segment growth. Furthermore, awareness related to hair fall and trends in medical & surgical treatments for hair restoration procedures are also on the rise among men. However, the adoption of hair restoration procedures and traditional medicines may negatively impact market growth.

The female segment is estimated to grow at the fastest rate over the forecast period. The growth of this segment is supported by changing lifestyles, increasing incidences of PCOS, and high penetration of cosmetic products. Moreover, the increasing incidence of female pattern hair loss and the introduction of treatment options for females also highlights the growth in the alopecia treatment industry.

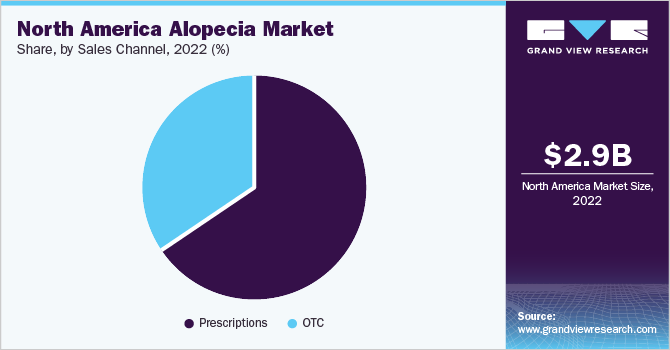

Sales Channel Insights

The prescription segment dominated the North America alopecia industry in 2022, with a share of 65.78%. The growth of the prescription segment is due to the rising incidences of severe forms of alopecia areata, increasing outpatient visits for AA treatment, and the presence of a robust pipeline of investigational candidates for the management of hair loss.

Rising penetration of OTC products and e-commerce remain major positives for the growth of the market. Furthermore, the surge in demand for OTC products owing to their easy availability has driven the usage of several products. Growing demand for low-cost hair loss treatment, rising consumer awareness regarding the adverse effects of prescribed drugs, and increasing availability of OTC drugs are major drivers in the market. OTC products are widely used in developing regions where players may find multiple opportunities to address unmet medical needs by reformulating products.

Country Insights

The U.S. held the largest share of 91.37% of the alopecia market in North America. Some of the factors responsible for its dominance are increasing awareness about the disease, rising R&D for novel therapeutics, and a growing disease burden. The positive phase 3 clinical trial results in new potential drug candidates coupled with the expected launch of pipeline products, which may fuel market growth over the forecast period.

For instance, in March 2022, Eli Lilly and Company announced the phase 3 clinical trial results at the American Academy of Dermatology (AAD) Annual Meeting, wherein around 75% of participants achieved 90% scalp hair regrowth in 52 weeks. Moreover, the company expects regulatory decisions by the U.S. FDA, EMA, and PMDA in 2022.

The alopecia market in Canada is anticipated to witness significant growth over the forecast period owing to research collaborations and strong product pipelines of local players. Triple Hair, a clinical-stage Canadian biotechnology company, is planning to initiate a phase-3 clinical study by 2023 for an innovative triple combination therapy Therapy-07, which has the potential to promote hair growth in men with androgenetic alopecia. As per the company, this product, when approved, may generate an annual revenue of USD 1 to 2.5 billion.

Key Companies & Market Share Insights

Companies are leveraging on untapped opportunities in the market to strengthen their position and gain a competitive edge. New product development, R&D initiatives, and mergers & acquisitions are among the key strategic undertakings of market players. For instance, in March 2023, Concert Pharmaceuticals was acquired by Sun Pharmaceuticals Industries Ltd. to expand its dermatology portfolio.

Concert Pharmaceuticals is a late-stage biopharmaceutical company developing a potential treatment for mild to severe alopecia areata, deuruxolitinib. Additionally, in March 2023, Concert Pharmaceuticals announced the data from THRIVE-AA2, a Phase 3 clinical trial. The oral investigational medicine deuruxolitinib showed significantly improved scalp hair regrowth for adult patients with moderate to severe alopecia areata. Some prominent players in the North America alopecia industry include:

-

Cipla Inc.

-

Sun Pharmaceuticals Industries Ltd

-

Johnson & Johnson Services, Inc

-

Merck & Co., Inc.

-

Lexington Intl., LLC

-

Cirrus Hair Centers

-

Vita-Cos-Med Klett-Loch GmbH

-

Transitions Hair

-

PureTech Health

-

Curallux, LLC

-

Dr. Reddy's Laboratories Ltd

-

GSK plc

-

Aurobindo Pharma

-

Mylan N.V. (Viatris, Inc.)

-

Freedom Laser Therapy, Inc.

-

Apira Science, Inc. (iGrow Laser.)

-

Revian, Inc

-

Theradome

-

LUTRONIC

-

WON TECH Co., Ltd

-

LifeMD

-

LG Electronics

North America Alopecia Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.41 billion

Revenue forecast in 2030

USD 5.65 billion

Growth Rate

CAGR of 7.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2020

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2018 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Treatment, disease type, sales channel, end-use, gender, country

Regional scope

North America

Country scope

U.S., Canada

Key companies profiled

Cipla Inc; Sun Pharmaceuticals Industries Ltd; Johnson & Johnson Services, Inc; Merck & Co., Inc.; Lexington Intl., LLC; Cirrus Hair Centers; Vita-Cos-Med Klett-Loch GmbH; Transitions Hair; Puretech Health; Curallux, LLC; Dr. Reddy's Laboratories Ltd; GSK plc; Aurobindo Pharma; Mylan N.V. (Viatris, Inc.); Freedom Laser Therapy, Inc.; Apira Science, Inc. (iGrow Laser.); Revian, Inc; Theradome Inc.; LUTRONIC Inc.; WON TECH Co., Ltd; LifeMD; LG Electronics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Alopecia Market Report Segmentation

This report forecasts revenue growth at regional, & country levels and provides an analysis of the latest market trends in each of the sub-markets from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America alopecia industry report based on treatment, disease type, sales channel, end-use, gender, and country.

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Topical

-

OTC

-

Minoxidil

-

Others

-

-

Prescription

-

Betamethasone Dipropionate

-

Fluocinolone Acetonide

-

Finasteride

-

Minoxidil

-

-

-

Oral

-

OTC

-

Prescription

-

Minoxidil

-

Finasteride

-

Corticosteroids

-

-

-

PRP

-

-

Devices

-

Laser Cap

-

Laser Comb

-

Laser Helmet

-

-

-

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Alopecia Areata

-

Male

-

Female

-

-

Cicatricial Alopecia

-

Male

-

Female

-

-

Traction Alopecia

-

Male

-

Female

-

-

Alopecia Totalis

-

Male

-

Female

-

-

Alopecia Universalis

-

Male

-

Female

-

-

Androgenetic Alopecia

-

Male

-

Female

-

-

Others

-

Male

-

Female

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Homecare Settings

-

Dermatology Clinics

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescriptions

-

OTC

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

-

Country Outlook (Volume, Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America alopecia market size was estimated at USD 2.88 billion in 2022 and is expected to reach USD 3.41 billion in 2023.

b. The North America alopecia market is expected to grow at a compound annual growth rate of 7.5% from 2023 to 2030 and is expected to reach USD 5.65 billion by 2030.

b. The alopecia areata segment is expected to dominate the North America alopecia market with a share of 41.83% in 2022 due to the increasing disease prevalence, high treatment rate, a surge in awareness about alopecia areata, and various ongoing regulatory approvals.

b. Some key players operating in the North America alopecia market include Cipla Inc, Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd, GSK plc, Aurobindo Pharma, and Viatris Inc. among others.

b. Increasing prevalence of alopecia and hair loss coupled with increasing prevalence of autoimmune and other chronic disorders that lead to hair loss are the major factors driving the North America alopecia market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."