- Home

- »

- Advanced Interior Materials

- »

-

North America Automotive Flooring Market, Report, 2030GVR Report cover

![North America Automotive Flooring Market Size, Share & Trends Report]()

North America Automotive Flooring Market Size, Share & Trends Analysis Report By Material (Polypropylene, Nylon), By Product (Carpets, Mats), By Application (LCV, HCV), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-033-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

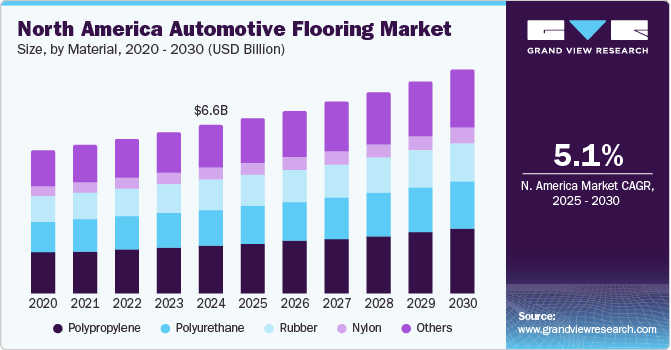

The North America automotive flooring market size was valued at USD 6.64 billion in 2024 and is projected to grow at a CAGR of 5.1% from 2025 to 2030. This growth is attributed to a significant shift in consumer preferences towards quality vehicles emphasizing comfort, noise reduction, and ride quality, leading to increased demand for insulating flooring products. In addition, technological advancements in lightweight materials and eco-friendly solutions also contribute to this trend. Furthermore, the focus on vehicle aesthetics, safety standards, and rising disposable incomes further fuel the market's expansion.

Automotive flooring is specialized flooring designed for the automotive sector, typically made from rubber or plastic to endure the heavy loads and wear associated with vehicles. This type of flooring is widely used in environments such as car dealerships, garages, parking facilities, and repair shops, where it protects surfaces from spills and debris while providing essential traction for vehicles. Available in various colors, textures, and styles, automotive flooring allows for customization and personalization. Its resistance to oil, grease, and other automotive fluids makes it an ideal choice for the industry.

Moreover, maintenance is straightforward, requiring only sweeping, mopping, or vacuuming to keep it looking pristine. The slip-resistant properties of automotive flooring also help mitigate the risk of accidents in these settings. The overall growth of the automotive industry significantly drives the market for automotive flooring. As manufacturers embrace more complex vehicle designs, there is an increasing demand for lightweight, durable, and easy-to-install flooring solutions. Complying with modern safety regulations further propels this demand, particularly for materials that offer superior slip resistance and shock absorption.

Furthermore, automotive flooring's ability to withstand extreme temperatures and resist wear from constant use also contributes to its appeal. In response to environmentally conscious consumers, manufacturers are developing eco-friendly options that utilize energy-efficient, recycled, and renewable materials.

Material Insights

Polypropylene materials dominated the market and accounted for the largest revenue share of 28.6% in 2024 attributed to the increasing demand for lightweight and durable components. In addition, as automakers focus on enhancing fuel efficiency and reducing emissions, polypropylene's lightweight nature makes it an ideal choice for various applications, including interior components and bumpers. Furthermore, the material's cost-effectiveness and recyclability align with the industry's shift towards sustainability, further boosting its adoption.

Polyurethane materials are expected to grow at a CAGR of 5.1% over the forecast period, owing to their excellent durability and flexibility. The rising emphasis on passenger comfort and safety has increased demand for polyurethane flooring solutions that provide cushioning and shock absorption. Furthermore, polyurethane's wear and tear resistance and ability to withstand extreme temperatures make it suitable for various automotive applications. Moreover, the growing trend of using eco-friendly materials also influences the market, as manufacturers develop bio-based polyurethane options to cater to environmentally conscious consumers.

Product Insights

Carpets led the market and accounted for the largest revenue share of 53.6% in 2024, driven by the rising demand for vehicle customization and personalization. Consumers increasingly seek to tailor their vehicles' interiors to reflect their individual styles, making carpets attractive due to their various colors, textures, and designs. In addition, carpets enhance the aesthetic appeal of vehicles while providing excellent sound absorption and insulation, contributing to a quieter and more comfortable driving experience. Furthermore, the trend towards eco-friendly materials further supports the adoption of carpets as manufacturers develop sustainable and recyclable options.

Mats are expected to grow at the fastest CAGR of 5.4% from 2025 to 2030, owing to their practicality and functionality. As vehicle owners prioritize cleanliness and protection, mats are essential accessories that guard against dirt, moisture, and wear. In addition, the increasing popularity of SUVs and trucks has heightened demand for durable, easy-to-clean mats that can withstand rigorous use. Furthermore, material technology advancements have led to customized mats that fit specific vehicle models perfectly, enhancing their appeal.

Application Insights

Light commercial vehicles (LCVs) held the dominant position in the market and accounted for the largest revenue share of 55.3% in 2024. This growth is attributed to the rapid expansion of the e-commerce and logistics sectors. As businesses increasingly rely on LCVs for deliveries, there is a heightened demand for strong flooring solutions that can withstand heavy usage and cargo handling. Furthermore, manufacturers focus on creating customized flooring options that cater to specific customer needs, enhancing vehicle functionality and aesthetics. Moreover, the need for lightweight materials that improve fuel efficiency further contributes to the overall market growth.

Heavy commercial vehicles (HCVs) are expected to grow at a CAGR of 6.8% over the forecast period, driven by increasing emphasis on safety and comfort in HCVs has led manufacturers to adopt advanced flooring solutions that provide insulation against noise and vibrations. In addition, as regulations around emissions and safety standards become stricter, there is a growing demand for high-quality flooring materials that enhance vehicle performance and durability. Moreover, the rising production of HCVs to meet the demands of various industries, including construction and transportation, is boosting the need for robust flooring solutions designed to endure harsh conditions, further propelling market growth.

End-use Insights

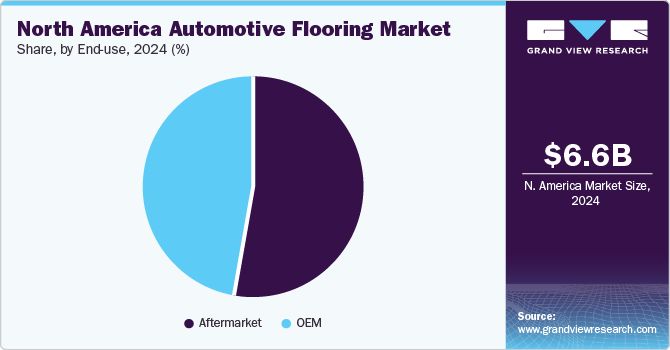

The aftermarket segment dominated the market and accounted for the largest revenue share of 52.5% in 2024. This growth is primarily driven by increasing consumer demand for vehicle customization and replacement parts. As vehicle owners seek to enhance their cars' aesthetics and comfort, aftermarket flooring products like mats and carpets have gained popularity. Furthermore, the high replacement rate of flooring components due to wear and tear further fuels this market segment. Moreover, the rise of e-commerce has also facilitated easier access to various aftermarket flooring options, promoting sales and product diversity.

The OEM segment is expected to grow at a CAGR of 3.3% over the forecast period. This growth is attributed to the shift towards high-quality materials that enhance vehicle performance and aesthetics. In addition, automakers increasingly focus on integrating advanced flooring solutions that provide better insulation, noise reduction, and overall ride quality. The demand for lightweight materials to improve fuel efficiency and comply with environmental regulations drives OEM adoption. Furthermore, as vehicle production ramps up in response to rising consumer preferences for comfort and safety, OEMs invest in innovative flooring technologies that cater to these evolving needs.

Region Insights

The automotive flooring market in the U.S. dominated the North American market and accounted for the largest revenue share of 61.5% in 2024. This growth is attributed to a strong focus on vehicle comfort and aesthetics. As consumer preferences shift towards high-quality interiors, there is an increasing demand for advanced flooring solutions for noise reduction and insulation. The rise of e-commerce has also facilitated greater access to aftermarket products, allowing consumers to customize their vehicles with various flooring options. Furthermore, regulatory standards promoting lightweight and environmentally friendly materials further stimulate market growth as manufacturers seek to enhance fuel efficiency and comply with sustainability initiatives.

Mexico Automotive Flooring Market Trends

Mexico automotive flooring market is expected to grow at a CAGR of 5.3% over the forecast period, owing to the country's robust automotive manufacturing sector. With several major international automakers establishing production facilities, there is a growing need for high-quality flooring materials that meet OEM specifications. The presence of a skilled workforce and favorable trade agreements also attract investment in the automotive industry, driving demand for both original equipment and aftermarket flooring solutions. Furthermore, as the local economy improves and disposable incomes rise, consumers increasingly seek vehicles with enhanced interior features, further propelling the growth of automotive flooring products in the region.

Key North America Automotive Flooring Company Insights

Some of the key players in the market include AGM Automotive, LLC, Apache Mills, Inc., Auria Solutions, Ltd., and others. These companies employ various strategies to enhance their market presence and gain a competitive edge. They focus on new product launches, introducing innovative flooring solutions that meet evolving consumer demands for comfort, durability, and aesthetics. In addition, strategic partnerships are also common, allowing companies to leverage each other's strengths and expand their market reach. Furthermore, mergers and acquisitions are utilized to consolidate resources and capabilities, facilitating entry into new markets and enhancing product offerings.

-

Apache Mills, Inc. specializes in manufacturing high-quality floor mats and matting products tailored for various applications, including automotive flooring. The company operates within the automotive sector, focusing on creating durable and innovative flooring solutions that enhance vehicle aesthetics and functionality. The company is recognized for its commitment to sustainability, utilizing recycled materials in its products, which aligns with the growing demand for environmentally responsible manufacturing practices in the automotive industry.

-

RPM International Inc. focuses on advanced materials that offer durability, comfort, and aesthetic appeal, catering to the evolving needs of the automotive sector. By leveraging innovative technologies and materials, RPM International aims to enhance vehicle interiors while addressing safety and performance requirements, positioning itself as a key player in the automotive flooring landscape.

Key North America Automotive Flooring Companies:

- AGM Automotive, LLC.

- Apache Mills, Inc.

- Auria Solutions, Ltd.

- Sika AG

- Sherwin-Williams Company

- RPM International Inc.

- Magna International Inc.

North America Automotive Flooring Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.93 billion

Revenue forecast in 2030

USD 8.88 billion

Growth Rate

CAGR of 5.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, end-use, region

Regional scope

North America

Country scope

U.S., Canada, Mexico

Key companies profiled

AGM Automotive, LLC.; Apache Mills, Inc.; Auria Solutions, Ltd.; Sika AG; Sherwin-Williams Company; RPM International Inc.; Magna International Inc.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Automotive Flooring Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the North America automotive flooring market report based on material, product, application, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyurethane

-

Polypropylene

-

Nylon

-

Rubber

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Carpets

-

Mats

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

PC

-

LCVs

-

HCVs

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."