- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Awnings Market Size, Industry Report, 2030GVR Report cover

![North America Awnings Market Size, Share & Trend Report]()

North America Awnings Market Size, Share & Trend Analysis Report By Product (Stationary, Retractable), By Application (Residential, Commercial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-387-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

North America Awnings Market Size & Trends

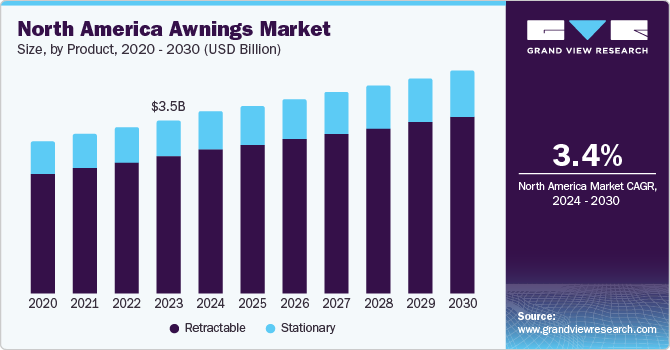

The North America awnings market size was valued at USD 3.48 billion in 2023 and is projected to grow at a CAGR of 3.4% from 2024 to 2030. The residential sector is experiencing significant growth, fueled by consumer interest in home remodeling and outdoor aesthetics. Moreover, the demand for smart awnings and a range of awning products is driving market growth.

Urbanization and outdoor living are significant drivers, as consumers seek to enhance their patios and balconies with shading solutions. Market growth in the region is being fueled by the increasing demand for energy-efficient solutions, as consumers seek to reduce their reliance on air conditioning and minimize their environmental impact. Furthermore, product innovation is playing a crucial role in driving market growth, with advancements in technology leading to the development of features such as motorized awnings with remote controls and weather sensors.

The U.S. residential sector is experiencing significant growth, driven by consumer interest in home remodeling and outdoor aesthetics. This trend is expected to continue, as homeowners seek to enhance their outdoor living spaces and create additional living areas. Moreover, the commercial sector is also experiencing growth, as businesses seek to enhance their outdoor spaces and create welcoming environments for customers.

North America awnings market is being driven by the increasing demand for smart awnings that can be controlled remotely through devices such as smartphones, Alexa, and Google Home. This trend is expected to continue, as consumers seek to integrate their awnings into their smart home systems. Furthermore, the market is being driven by the increasing demand for a range of awning products that can be used for additional living spaces and sunshade. Overall, the North America awnings market is expected to continue growing, driven by a combination of these factors.

Product Insights

Retractable awnings dominated the market and accounted for a share of 78.9% in 2023. As consumers increasingly seek to optimize their outdoor living spaces, retractable awnings have emerged as a popular solution. These outdoor blinds offer adjustable shade and protection from the elements, allowing homeowners to control the amount of direct sunlight entering their rooms. Suitable for regions with varying weather conditions, this flexibility enhances the usability and functionality of patios, decks, and balconies.

Stationary awnings are projected to grow at a CAGR of 2.9% over the forecast period. Anticipated increase in demand for the product is expected due to its growing popularity in outdoor parking construction and commercial building backyards. The demand for stationary awnings is projected to increase substantially due to a rising popularity in hotels, retail stores, cafes, and restaurants. In addition, these products are printable they can be printed with the name and logo of the business entity.

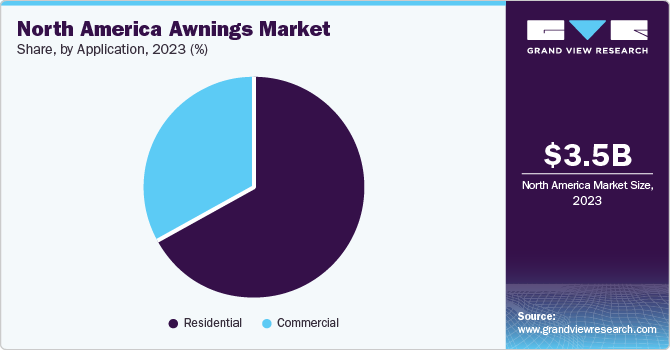

Application Insights

Residential segment accounted for the largest market revenue share of 67.0% in 2023. The residential sector has witnessed a significant increase in awning installations, driven by the need for aesthetic enhancement and energy efficiency. Window awnings effectively reduce direct sunlight, heat, and UV rays, conserving electricity significantly. The growing adoption of motorized retractable products in new residential construction is expected to further boost demand over the forecast period.

Commercial segment is expected to grow significantly with a CAGR of 3.0% during the forecast period. Shops, and hotels, for instance incorporate awnings to make the exterior of the commercial space be as welcoming as the interior. That way, the awnings can be painted to the business house’s preferred colors and can also have signs or advertisements on them. In addition, they offer shelter for outdoor dining spaces, enhancing the comfort and pleasure of patrons.

Regional Insights

The U.S. awnings market dominated the North America market with a share of 81.4% in 2023. The hospitality industry’s increasing interest in the product’s attractive is projected to benefit industry growth. Patio awnings are anticipated to be the top choice in the U.S. market because of the increasing demand from both residential and commercial sectors, particularly resorts. The increasing construction of high-end residences is pushing up demand and driving market expansion. Furthermore, the rising investment in lawns and gardens is leading to an increased use of the product for garden tents and for protecting nurseries from heat and rain, thereby driving up demand.

The awnings market in Mexico is anticipated to grow at the fastest CAGR of 4.5% over the forecast period as consumers seek to enhance outdoor living spaces. The hospitality sector’s expansion, with restaurants and hotels investing in outdoor areas, is also contributing to growth. Energy efficiency, convenience, and sustainability are key drivers, with advancements in awning technology, such as motorization and eco-friendly materials, catering to evolving consumer preferences.

Key North America Awnings Company Insights

Some key companies in North America awnings market include SunSetter Products; Advanced Design Awnings & Signs; Sunair Awnings; Awning Company of America, Inc.; and others. The industry is characterized by a mix of local and international players, with a focus on innovation and strategic partnerships. Firms are investing in product development, particularly in retractable and motorized awnings, and employing mergers and acquisitions to enhance market presence.

-

SunSetter Products provides stand-alone and window awnings, vertical solar shades, flagpoles, screen rooms, and extras, assisting clients with affordable awning options.

-

Advanced Design Awnings & Signs designs, creates, and installs various types of awnings and signs. Company manufactures fabric, vinyl, illuminated, and metal awnings and canopies.

Key North America Awnings Companies:

- SunSetter Products

- Advanced Design Awnings & Signs

- Sunair Awnings

- Awning Company of America, Inc.

- Carroll Architectural Shade

- Eide Industries, Inc.

- NuImage Awnings / Futureguard

- KE USA Inc. (Durasol Awnings, Inc.)

- Aristocrat Awnings

- Marygrove Awnings

Recent Developments

-

In July 2024, NuImage Awnings and Futureguard previously offered Sunbrella fabrics as a standard choice for retractable and stationary awnings. These fabrics, recognized by The Skin Cancer Foundation, provided UV protection against UVA and UVB rays.

North America Awnings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.64 billion

Revenue forecast in 2030

USD 4.44 billion

Growth rate

CAGR of 3.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Regional scope

North America

Country scope

U.S., Canada, Mexico

Key companies profiled

SunSetter Products; Advanced Design Awnings & Signs; Sunair Awnings; Awning Company of America, Inc.; Carroll Architectural Shade; Eide Industries, Inc.; NuImage Awnings / Futureguard; KE USA Inc. (Durasol Awnings, Inc.); Aristocrat Awnings; Marygrove Awnings

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Awnings Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America awnings market report based on product, application, and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Retractable

-

Stationary

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."