- Home

- »

- Consumer F&B

- »

-

North America Baby Food Market Size, Industry Report, 2030GVR Report cover

![North America Baby Food Market Size, Share & Trends Report]()

North America Baby Food Market Size, Share & Trends Analysis Report By Application (Milk Formula, Dried, Prepared), By Distribution Channel (Supermarket, Online), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-413-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

North America Baby Food Market Trends

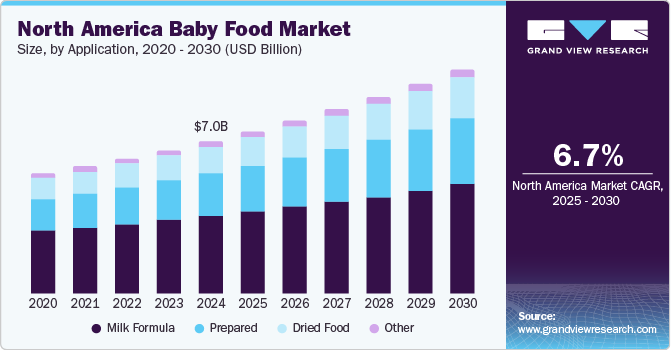

The North America baby food market size was valued at USD 7.04 billion in 2024 and is expected to expand at a CAGR of 6.7% from 2025 to 2030. Rising parental awareness regarding infant nutrition and the benefits of high-quality baby food products is a significant driver. Parents are increasingly seeking nutritious, organic, and natural baby foods to ensure their infants' optimal growth and development. The busy lifestyles of modern parents have also led to a growing demand for convenient and ready-to-eat baby food options that save time while providing balanced nutrition.

Technological advancements in food processing and packaging have improved baby foods safety, shelf-life, and nutritional content, further boosting market growth. Additionally, the increasing number of working mothers and the rise in dual-income households have fueled the demand for packaged baby food products. Furthermore, the influence of social media and parenting blogs has heightened awareness about the importance of proper infant nutrition, driving parents to invest in premium baby food products.

Infants and children are vulnerable to foodborne illnesses as their immune systems are not fully developed to fight off infections. Thus, factors like premium quality products and their safety are among the most essential criteria influencing the buyer’s decision. In addition, growing demand for gluten-free versions is also supplementing industry growth in North America.

Application Insights

Milk formula dominated the market with the largest revenue share of 50.1% in 2024. Milk formula is a vital nutritional source for infants who are not breastfed or require supplemental nutrition. The rising number of working mothers has increased the demand for convenient and reliable infant nutrition options, making milk formula a preferred choice. Additionally, advancements in milk formula formulations have improved their nutritional content, closely mimicking the benefits of breast milk, which reassures parents about their infants' health and development. The availability of various specialized milk formulas tailored to address specific dietary needs, such as lactose intolerance or premature infants, also contributes to its dominance. Furthermore, leading milk formula brands' strong marketing efforts and wide distribution networks ensure easy accessibility and consumer trust.

The prepared baby food segment is expected to grow at the fastest CAGR of 7.8% over the forecast period. The convenience of ready-to-eat baby food products appeals to busy parents who seek quick and easy feeding solutions without compromising on nutrition. The increasing awareness about infant nutrition and the benefits of providing balanced, healthy meals to babies further fuels the demand for prepared baby food. Additionally, innovations in product formulations, including organic and natural ingredients, cater to the growing preference for wholesome and safe baby food options. The availability of various flavors and textures in prepared baby food products also attracts parents looking to introduce their infants to diverse tastes. Moreover, strong marketing campaigns and the expanding distribution network of prepared baby food brands ensure these products are easily accessible to consumers.

Distribution Channel Insights

Supermarkets dominated the market with the largest revenue share in 2024. Supermarkets are a primary shopping destination for many parents, offering a wide array of baby food products under one roof. The convenience of purchasing baby food during regular grocery shopping trips contributes to their popularity. Supermarkets also benefit from extensive distribution networks and strategic locations, making it easy for consumers to access a variety of baby food brands. Additionally, supermarkets' frequent promotional offers, discounts, and loyalty programs attract budget-conscious parents. The ability to inspect products and compare options enhances consumer confidence in their purchases.

The online channel is expected to grow at the fastest CAGR over the forecast period. The convenience of online shopping is a significant driver, as busy parents increasingly turn to e-commerce platforms to purchase baby food from the comfort of their homes. The availability of a wide range of baby food products online, including organic and specialty options, appeals to health-conscious parents. Additionally, online retailers often provide detailed product information, customer reviews, and easy comparison tools, which help parents make informed decisions. The frequent discounts, subscription services, and delivery options offered by online platforms also enhance the attractiveness of this channel.

Country Insights

U.S. Baby Food Market Trends

The U.S. baby food market dominated the North American industry, with the largest revenue share of 61.2% in 2024. The high purchasing power of U.S. consumers allows for increased spending on premium and organic baby food options. Additionally, the strong presence of major baby food manufacturers and brands in the U.S. ensures various product offerings, catering to diverse consumer preferences. The robust distribution networks, including both traditional retail channels and rapidly growing e-commerce platforms, further enhance the accessibility and availability of baby food products. Moreover, the increasing awareness about infant nutrition and the rising number of working parents who seek convenient and nutritious feeding options contribute to the market's growth.

Canada Baby Food Market Trends

Canada's baby food industry was identified as a lucrative region in 2024. Canadian parents are increasingly prioritizing high-quality, nutritious baby food options, driving demand for organic, natural, and premium products. The growing awareness of the importance of infant nutrition and the benefits of healthy eating habits from an early age has further boosted the market. Additionally, the rise in dual-income households and the increasing number of working mothers have led to a greater need for convenient, ready-to-eat baby food solutions. The robust distribution networks and the presence of well-established retail channels, including supermarkets and online platforms, ensure wide accessibility and availability of baby food products across the country. Furthermore, innovations in baby food formulations and packaging, catering to diverse dietary needs and preferences, have attracted a broad consumer base.

Mexico Baby Food Market Trends

Mexico's baby food industry is expected to grow at the fastest CAGR of 7.5% over the forecast period. The increasing urbanization and rising disposable incomes in Mexico are driving the demand for high-quality, convenient baby food products. Parents are becoming more conscious of the nutritional needs of their infants and are seeking ready-to-eat options that provide balanced nutrition. The expanding middle class and the growing number of working mothers fuel the demand for packaged baby food, as they seek convenient feeding solutions that do not compromise quality. Additionally, the influence of Western dietary trends and the rising awareness about the benefits of organic and natural baby foods are contributing to the market's growth. The robust distribution networks and the expansion of modern retail channels, including supermarkets and online platforms, ensure easy accessibility to a wide range of baby food products.

Key North America Baby Food Company Insights

Some key companies in the North American baby food market include Nestle, Danone, Abbott, Hain Celestial Group, and others.

-

Nestlé is a global leader in the baby food industry, with a long history dating back to its founding in 1866 by pharmacist Henri Nestlé. The company initially gained recognition for creating a milk-based baby formula to help infants who couldn't be breastfed. Over the years, Nestlé has expanded its product range to include a variety of baby foods, such as cereals, snacks, and ready-to-eat meals.

-

Danone has a strong heritage in dairy products and has leveraged this expertise to develop a range of baby formulas and foods. Danone's extensive research and development efforts and global presence ensure that it remains a trusted name in the baby food market.

Key North America Baby Food Companies:

- Nestle

- Danone

- Abbott

- Comp4

- Mead Johnson & Company, LLC.

Recent Developments

-

In October 2024, Bobbie, a pioneering mom-founded pediatric nutrition company, launched its grass-fed Whole Milk Infant Formula, enhancing choices for U.S. parents while upholding its commitment to quality. The new formula features whole milk from grass-fed cows and includes naturally occurring MFGM, closely resembling breast milk's nutritional profile.

-

In September 2024, Perrigo Company plc announced a strategic brand partnership between Good Start and Dr. Brown to introduce a new line of infant formula solutions. This collaboration, which combines Good Start's 50 years of trusted experience with Dr. Brown's reputation for high-quality feeding products, aims to provide families with reliable nutrition options that address formula tolerance concerns.

North America Baby Food Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.49 billion

Revenue forecast in 2030

USD 10.36 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel, country

Country scope

U.S., Canada, Mexico

Key companies profiled

Nestle; Danone; Abbott; Hain Celestial Group; Mead Johnson & Company, LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Baby Food Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America baby food market report based on application, distribution channel, and country:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Milk Formula

-

Dried Food

-

Prepared

-

Other

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket

-

Others

-

Online Channels

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."