- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Blow Molded Plastics Market Report, 2030GVR Report cover

![North America Blow Molded Plastics Market Size, Share & Trends Report]()

North America Blow Molded Plastics Market Size, Share & Trends Analysis Report By Technology (Extrusion, Injection), By Product (PE, PVC), By Application (Automotive & Transport, Packaging), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-534-2

- Number of Report Pages: 156

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

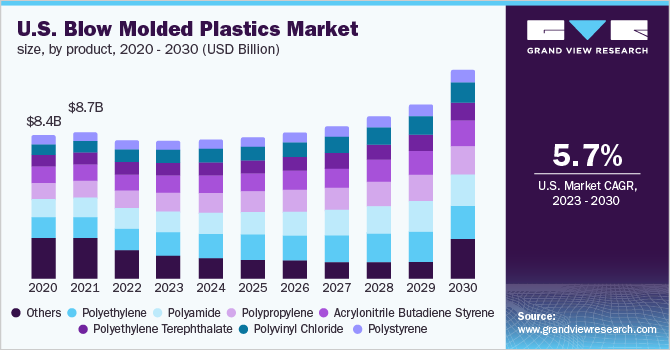

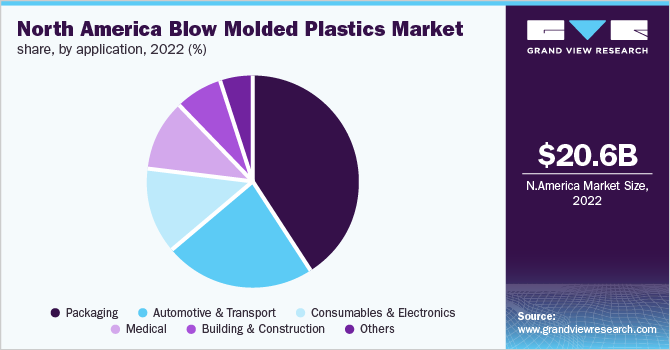

The North America blow molded plastics market size was estimated to be USD 20.62 billion in 2022 and is anticipated to witness a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. The industry is driven by a shift in trends toward replacing glass & metal and increasing investments in the construction industry. Blow-molded plastics are widely used for different applications, such as concrete forms of all shapes and sizes, panels, barricades, and traffic markers, in the building & construction industry. Industries, such as construction, packaging, and automotive, are the primary industries propelling the demand for blow-molded plastic products and services.

The product demand in the U.S. is majorly generated by the growing automotive industry on account of the popularity of Electric Vehicles (EVs) and a rise in the number of construction activities. The U.S. has witnessed rapid growth in construction projects in the recent past. The U.S. federal government is planning to invest USD 2 trillion over 10 years for infrastructure development. The country is characterized by a low-risk environment, a stable economy, and a robust financial sector. These factors have provided a multitude of opportunities for investors in recent years.

These factors are likely to trigger infrastructure spending in the country. Many new manufacturers in the market are emerging in remote locations of the country owing to the highly segregated population. The per capita consumption of plastics in the country is higher than the world average. However, tier II and III cities have a small population, leading to a requirement of one or two manufacturing facilities in each city. Most of the tier I cities have established manufacturing plants, leaving limited scope for the expansion of existing facilities and almost no room for the establishment of new plants.

Technology Insights

On the basis of technologies, the industry has been further categorized into extrusion, injection, stretch, and compound blow molding. The injection blow molding technology segment dominated the industry in 2022 and accounted for the maximum share of more than 37.85% of the overall revenue. The segment is projected to expand further at the fastest growth rate, maintaining its dominant position throughout the forecast period. The extrusion blow molding technology segment is estimated to register the second-fastest growth rate from 2023 to 2030.

The cost of extrusion blow mold is lower than the injection blow mold due to the lower pressure requirement in the former. The machinery costs are also lower for extrusion blow mold, which is an added advantage for the process. Stretch blow molding technology is used for producing high-clarity and high-quality bottles; however, it has limited use in the industry. This technology is used for the manufacturing of soda bottles, personal care containers, and household cleaner containers, among others. Stretch blow molded plastics are produced mainly on customized orders from customers.

Product Insights

On the basis of products, the industry has been further categorized into Polypropylene (PP), Acrylonitrile Butadiene Styrene (ABS), Polyethylene (PE), Polystyrene (PS), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Polyamide (PA), and others. The PE product segment dominated the market in 2022 and accounted for the maximum share of more than 17.80% of the overall revenue. PE compounds are commonly used in the packaging and electrical & electronics industries. Major applications of PE compounds include different grades of bottles used for packaging a wide range of products, such as food and chemicals.

On the other hand, the PVC product segment is estimated to register the fastest growth rate during the forecast period. The PET product segment also accounted for a significant revenue share and will expand further at a steady CAGR from 2023 to 2030. PET has several applications in the packaging industry, including for manufacturing food & beverage product packaging bottles. During the COVID-19 pandemic, the demand for PP and PET was high on account of the demand for face masks, protective gowns, and packaging bottles for hand sanitizers.

Application Insights

The packaging application segment dominated the industry in 2022 and accounted for the largest share of more than 41.35% of the overall revenue. The segment is estimated to expand further at the fastest growth rate, retaining its dominant industry position throughout the forecast period. The packaging industry is majorly driven by high consumerism in emerging economies and demand for plastic compounds, such as PE and PET. The demand for blow-molded plastics is increasing primarily in packaging applications owing to the rising demand for plastic bottles for hand sanitizers, disinfectants, household cleaning liquids, and others to tackle the COVID-19 infection.

The automotive & transportation segment accounted for the second-largest revenue share in 2022 and is projected to expand further at a steady growth rate during the forecast period. The increasing incorporation of plastics in automotive components and the simultaneous rise in the production of electric passenger cars and heavy-duty vehicles, particularly in the Asia and Central & South American regions, are expected to support the growth of the automotive & transportation application segment over the forecast period.

Country Insights

The U.S. dominated the industry in 2022 and accounted for the maximum share of more than 41.60% of the total revenue. The country is expected to continue its dominance during the forecast period. The demand for blow-molded plastics in the country is majorly generated by the rapidly growing automotive industry on account of the popularity of EVs and a rise in the number of construction activities. The U.S. has witnessed rapid growth in construction projects in the recent past. Plastics are produced from various petrochemicals derived from crude oil. Thus, declining prices of crude oil coupled with the increasing demand for plastics in the region are paving the way for the growth of the plastics market.

Canada is one of the biggest producers of crude oil globally. Blow-molded plastics provide strength and durability to metal products with the added advantage of low weight. Mexico is expected to benefit from the rising construction spending and growing consumer preference for sustainable and lightweight building materials over conventional materials. The growing automotive sector and shift in consumer purchase behavior from considering a car as a luxury item to now considering it as a necessity are also anticipated to have a positive impact on the market growth in the country.

Key Companies & Market Share Insights

Major market players, in particular, compete based on application development capability and new technologies used in product formulation. For instance, recently, Cyprus-based company, Cypet Technologies Ltd. developed a new technology for one-step injection blow-molding to produce large 120 liters of PET drums. This technology is distinct from traditional injection molding methods since the technology molds the preforms horizontally for the opening direction of the mold to be horizontal. Some of the prominent companies operating in the North America blow molded plastics market are:

-

Magna International, Inc.

-

Berry Global, Inc.

-

Pet All Manufacturing, Inc.

-

Dow, Inc.

-

Comar, LLC

-

The Plastic Forming Company, Inc.

-

Agri-Industrial Plastics

-

Garrtech Inc.

-

Creative Blow Mold Tooling

-

North American Plastics, Ltd.

-

Machinery Center, Inc.

-

Custom-Pak, Inc.

-

APEX Plastics

-

INEOS Group

-

LyondellBasell Industries Holdings B.V.

-

Exxon Mobil Corp.

-

Gemini Group, Inc.

North America Blow Molded Plastics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 31.58 billion

Growth rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, product, application, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Magna International Inc.; Berry Global Inc.; Pet All Manufacturing, Inc.; Dow Inc.; Comar, LLC; The Plastic Forming Company, Inc.; Agri-Industrial Plastics; Garrtech, Inc.; Creative Blow Mold Tooling; North American Plastics, Ltd.; Machinery Center, Inc.; Custom-Pak Inc.; APEX Plastics; INEOS Group; LyondellBasell Industries Holdings B.V.; Exxon Mobil Corp.; and Gemini Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Blow Molded Plastics Market Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America blow molded plastics market report based on technology, product, application, and region:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Extrusion

-

Injection

-

Stretch

-

Compound

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polyethylene (PE)

-

Polystyrene (PS)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Polyamide (PA)

-

Polyamide 6 (PA6)

-

Polyamide 66 (PA66)

-

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Consumables & Electronics

-

Automotive & Transport

-

Building & Construction

-

Medical

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the North America blow molded plastics market include Magna International, Inc., Berry Global, Inc., Pet All Manufacturing, Inc., Dow Inc., Comar, LLC, The Plastic Forming Company, Inc., Agri-Industrial Plastics, Garrtech, Inc., Creative Blow Mold Tooling, North American Plastics, Ltd., Machinery Center, Inc., Custom-Pak Inc., Custom-Pak Inc., INEOS Group, LyondellBasell Industries Holdings B.V., Exxon Mobil Corporation, and Gemini Group, Inc.

b. Key factors that are driving the North America blow molded plastics market growth include shift in trends towards a replacement of glass & metal and growing construction spending in an emerging market.

b. The North America blow molded plastics market size was estimated at USD 20.62 billion in 2022 and is expected to reach USD 20.87 billion in 2023.

b. The North America blow molded plastics market is expected to grow at a compound annual growth rate of 5.5% from 2022 to 2030 to reach USD 31.58 billion by 2030.

b. Injection blow molding dominated the North America blow molded plastics market with a share of 37.88% owing to its rising demand from automotive and other industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."