- Home

- »

- Electronic & Electrical

- »

-

North America Dishwasher Market, Industry Report, 2030GVR Report cover

![North America Dishwasher Market Size, Share & Trends Report]()

North America Dishwasher Market Size, Share & Trends Analysis Report By Product (Freestanding, Built-In), By Size (Width) (Compact Size, Standard Size), By Tub Type, By Price Range, By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-327-8

- Number of Report Pages: 102

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

North America Dishwasher Market Trends

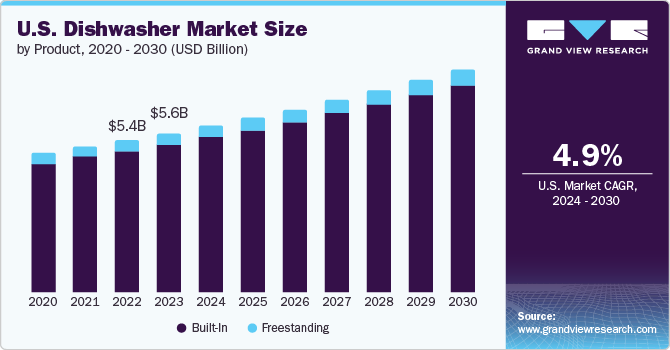

The North America dishwasher market size was estimated at USD 6.22 billion in 2023 and is expected to grow at a CAGR of 5.0% from 2024 to 2030. According to the U.S. Energy Information Administration, over 89 million homes in America have a dishwasher, representing only 61% of households. This suggests that there is still a significant portion of the population that does not own a dishwasher. Furthermore, the population with dishwashers in the region is also witnessing a change in their appliances, opting for new dishwashers with improved water and energy efficiency. This presents a notable opportunity for dishwashers in the region, which is expected to contribute to product demand and market growth during the forecast period.

Consumers are constantly seeking ways to streamline their daily routines and maximize efficiency. With increasingly hectic schedules and numerous responsibilities, many individuals find themselves strapped for time and energy to tackle household chores. As a result, there is a growing demand for appliances that can alleviate the burden of mundane tasks and free up valuable time for other activities. Dishwashers, with their ability to automate the process of cleaning dishes, have emerged as indispensable appliances for modern households seeking convenience and efficiency.

One of the key drivers behind the popularity of dishwashers is their ability to save time and effort. In the past, washing dishes by hand was a labor-intensive and time-consuming chore that could eat into precious leisure time or leave individuals feeling exhausted after a long day.

However, with the advent of dishwashers, this once-dreaded task has been significantly simplified. Rather than spending valuable time scrubbing pots, pans, and utensils, consumers can simply load them into the dishwasher, press a button, and let the appliance do the work for them. This convenience factor resonates strongly with busy individuals and families juggling multiple commitments.

Moreover, the surge in innovation within the dishwasher industry has been a pivotal driving force behind the market's growth and evolution. With advancements in technology, manufacturers have been able to introduce features and functionalities that enhance both the efficiency and convenience of dishwashing appliances.

One significant aspect of this innovation is the development of smart dishwashers. These appliances are equipped with internet connectivity and can be controlled remotely via smartphones or other smart devices. This connectivity allows users to monitor the progress of their dishwashing cycles, receive alerts when detergent or rinse aid levels are low, and even troubleshoot issues without the need for professional assistance. The convenience and peace of mind offered by smart features have resonated with consumers, driving demand for these modern appliances.

In September 2023, at IFA 2023, Midea, a leading advocate of Matter certification, unveiled its innovative Matter-connected dishwasher, reaffirming its dedication to industry standards. Midea's newest dishwasher showcases a range of intelligent features designed to streamline daily tasks. Through the accompanying app, users gain remote control capabilities, empowering them to oversee the dishwasher's operation from any location. In addition, the app sends timely reminders for dishwasher maintenance, enhancing user convenience.

Furthermore, innovations in water and energy efficiency have played a crucial role in shaping the market for dishwashers. Manufacturers have continually refined their designs to minimize water and energy consumption while maintaining excellent cleaning performance. This not only appeals to environmentally conscious consumers but also translates into cost savings over the long term. As sustainability becomes an increasingly important consideration for consumers, the availability of energy-efficient dishwasher options has become a significant selling point, further contributing to the demand and growth for dishwashers in the region during the forecast period.

Industry Dynamics

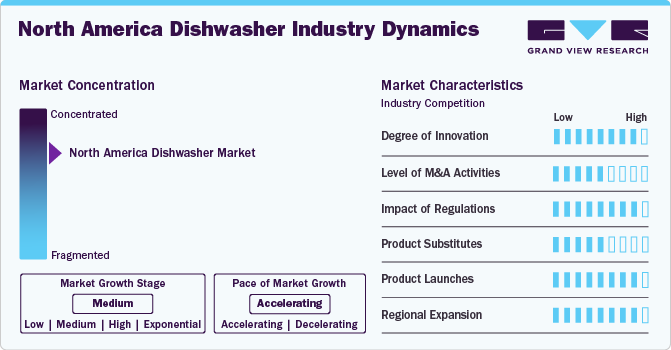

Manufacturers in the North America dishwasher market are actively engaged in various initiatives to meet evolving consumer demands and market trends.

The market shows a medium to high degree of innovation. Consumer demand for convenience and efficiency drives manufacturers to develop advanced features. People seek appliances that save time and resources, prompting companies to integrate smart technology, such as Wi-Fi connectivity and voice control, enabling remote operation and integration with home automation systems.

Furthermore, the competitive market environment has led manufacturers to spend on research and development in order to differentiate their products through unique features like advanced cleaning technologies, quiet operation, customizable cycles, and ergonomic designs.

The mergers and acquisitions are in the range of low to medium in the market. Companies undergoing the mergers and acquisitions are seeking strategic partnerships to enhance their product portfolios, expand their market presence, and leverage on each other’s strengths. Moreover, the competitive nature of the market has led to further encouraging the players to explore synergies, leading to occasional mergers and acquisitions aiming to gain a competitive edge and achieving economies of scale in the market.

The U.S. Department of Energy (DOE) sets strict energy efficiency standards that dishwashers must meet to reduce energy consumption. Compliance with these regulations requires manufacturers to innovate and improve the energy performance of their products, impacting design and technology choices.

Moreover, Environmental Protection Agency (EPA) regulations, particularly those under the ENERGY STAR program, push for water and energy conservation. Dishwashers must meet specific criteria to be ENERGY STAR certified, driving manufacturers to develop more efficient and eco-friendly models, as a result of stringent regulations particularly in this region.

North American consumers prioritize convenience, efficiency, and smart home integration. This demand encourages manufacturers to frequently introduce new models with advanced features such as smart connectivity, improved cleaning technologies, and energy efficiency.

In addition, the market is highly competitive, with numerous brands vying for market share. To stay ahead, companies regularly launch new products to differentiate themselves, attract new customers, and retain existing ones. Moreover, regular product launches help brands maintain visibility and relevance in the market. As a result, the product launches are in the range of medium to high in the region.

Product Insights

Built-In dishwashers market accounted for a revenue share of 92.6% in 2023. The region is witnessing an increasing trend of renovation and remodeling among homeowners. As more homeowners seek to update and enhance their kitchens, there is a growing preference for built-in appliances that seamlessly integrate with kitchen cabinetry. Built-in dishwashers offer a sleek and streamlined appearance, fitting seamlessly under countertops or within custom cabinetry configurations. These factors are fueling the demand for and growth of built-in dishwashers in the region during the forecast period.

The freestanding market is expected to grow at a significant CAGR from 2024 to 2030. The growing trend of smaller living spaces, such as apartments and condos, where built-in dishwashers may not be feasible or practical. Freestanding dishwashers offer a flexible solution, allowing renters and homeowners alike to easily install and relocate them as needed without extensive remodeling. Furthermore, freestanding dishwashers are generally more affordable than built-in ones, making them a preferred choice for budget-conscious consumers. Unlike built-in dishwashers, freestanding models offer ease of installation, further driving their growth and adoption in the region during the forecast period.

Size (Width) Insights

Standard (24 inches) dishwashers market accounted for revenue share of 90.6% in 2023. Consumers prefer standard (24 inches) dishwashers for their capacity, durability, and extensive features. The larger space inside these dishwashers allows them to accommodate more place settings, typically ranging between 10 to 12, making them particularly suitable for larger households or those who frequently entertain guests. Moreover, standard dishwashers come equipped with an array of features that enhance their functionality and versatility. These include adjustable upper racks, fold-down tines for customizable loading configurations, removable silverware baskets for easy unloading, and stainless-steel tubs that resist stains better than their plastic counterparts.

On the other hand, compact (18 inches) dishwashers’ market is expected to grow at the fastest CAGR from 2024 to 2030. Compact dishwashers offer a space-saving solution without compromising on functionality, making them ideal for individuals or families living in urban environments where space is at a premium. Moreover, the U.S. has 2.6 persons per household, whereas Canada has 2.4 persons per household. Both countries have a lower number of people per household, and compact size dishwashers are well-suited for households with smaller family sizes, driving their adoption and growth in the region during the forecast period.

Tub Type Insights

Standard tub dishwasher segment accounted for revenue share of 81.2% in 2023. Standard tub dishwashers are widely available from a variety of manufacturers, offering consumers a broad selection to choose from. This availability, coupled with the diverse range of features and price points, makes standard tub models a convenient choice for many consumers who seek convenience, simplicity, and affordability. Therefore, standard tub dishwashers are expected to remain the dominant tub type in the region during the forecast period.

Tall and deep tub dishwasher segment is expected to grow at a significant CAGR 2024 to 2030. These tubs feature adjustable second and third racks for flexible loading of bowls, mugs, and other hard-to-fit items, along with increased interior capacity allowing for the convenience of loading more utensils. These features are driving the growth of the tall and deep tub dishwashers in the region during the forecast period.

Price Range Insights

USD 501 to USD 1,500 priced dishwashers accounted for revenue share of 49.3% in 2023. A diverse selection of dishwashers is available within this price range, catering to various consumer preferences and needs. Moreover, manufacturers are continually launching new dishwashers in this category. Dishwashers in this price range are equipped with both basic and advanced features, enhancing the overall consumer experience and cleaning performance. As a result, this price range dominates the market in the region and will continue to remain the dominant price range for dishwashers during the forecast period.

The sales of USD 1,501 to USD 3,000 priced dishwashers are expected to grow significantly from 2024 to 2030. Dishwashers in this price range feature sleek, modern designs and premium finishes that enhance the overall aesthetic of the kitchen. In addition, they come equipped with more advanced features such as built-in Wi-Fi and smart water leak detectors, driving their adoption among homeowners in the region.

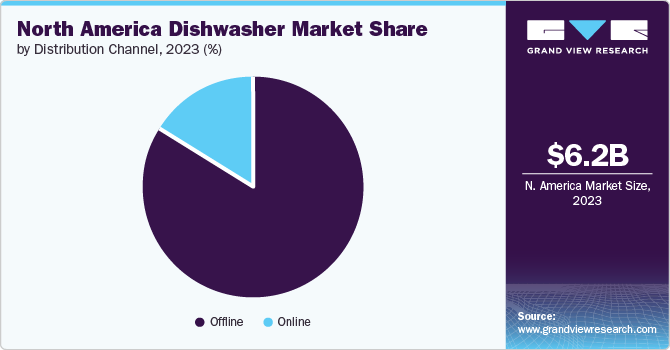

Distribution Channel Insights

Sales of dishwashers through offline channel accounted for a revenue share of 84.0% in 2023. Many consumers prefer to physically see and interact with appliances before making a purchase. Offline channels, such as appliance stores, specialty kitchen appliances stores, hypermarkets & supermarkets, and home improvement retailers, offer consumers the opportunity to view, touch, and sometimes even test dishwashers before buying. In addition, these offline retailers often provide free installation services, especially for built-in dishwashers. As a result, the offline channel of distribution will continue to dominate the sales platform for the market in the region during the forecast period.

Sales of dishwashers through online channels are expected to grow at the fastest CAGR from 2024 to 2030. The widespread availability of e-commerce platforms and online retail outlets has significantly expanded consumer access to a diverse array of dishwasher models, brands, and price points. This accessibility allows consumers to browse, compare, and purchase dishwashers from the comfort of their homes, offering convenience and flexibility in the decision-making process. The prevalence of digital marketing and advertising efforts by dishwasher manufacturers and online retailers have contributed to the growth of the online distribution channel. Through targeted digital campaigns, social media engagement, and search engine optimization, companies can effectively reach and engage with a large audience of potential dishwasher buyers, driving traffic to their online platforms, and augmenting the sales of dishwashers.

Country Insights

U.S. Dishwasher Market Trends

The U.S. accounted for a revenue share of 89.9% in 2023. The market in the U.S. is driven by rapid technological advancements in dishwashers, including smart features like Wi-Fi connectivity, voice control, and advanced sensor technology. American consumers, particularly tech-savvy individuals, are attracted to these innovative features. In addition, the National Kitchen & Bath Association's 2022 report noted a 20.5% increase in kitchen spending in the U.S., reaching USD 95.4 billion, with 25% of the overall spending on kitchen appliances, including dishwashers. This is expected to drive the market for dishwashers in the country during the forecast period.

Furthermore, manufacturers in the U.S. are constantly introducing new features and innovations to enhance the functionality and user experience of dishwashers. From smart connectivity options that allow users to control their dishwashers remotely via smartphone apps to advanced sensors and wash cycles that optimize cleaning performance, these technological advancements are attracting consumers who seek convenience, efficiency, and superior cleaning results, driving the sales of dishwashers in the country during the forecast period.

Canada Dishwasher Market Trends

Canada dishwasher market is expected to grow at a CAGR of 5.7% from 2024 to 2030. The low penetration of dishwashers in Canada compared to that of the U.S. and the advantages of having a dishwasher at home, such as their water & energy efficiency, time-saving capabilities, and convenience & ease of use, among others, are contributing to the increased demand for dishwashers in Canada.

Key North America Dishwasher Company Insights

The North America market is characterized by the presence of numerous well-established players such Whirlpool Corporation; Samsung Electronics Co., Ltd.; Robert Bosch GmbH, General Electric Company (Haier Company); Miele; LG Electronics Inc., among others. The market players face intense competition from each other as some of them are among the top North America dishwasher manufacturers with diverse product portfolios for North America dishwashers. These companies have a large customer base due to the presence of established and vast distribution networks to reach out to both regional and international consumers.

Key North America Dishwasher Companies:

- Whirlpool Corporation

- Samsung Electronics Co. Ltd.

- Robert Bosch GmbH

- LG Electronics Inc.

- Frigidaire (Electrolux Inc.)

- Kenmore (Transform Holdco LLC)

- General Electric Company (Haier Company)

- AGA Rangemaster Limited

- Miele

- ASKO

Recent Developments

-

In March 2024, Miele Professional, a global provider of cutting-edge, commercial-grade appliances launched MasterLine, an innovative series of dishwashers tailored to cater to the varied requirements of both residential and commercial clientele. MasterLine redefines benchmarks for hygiene assurance, efficiency, and convenience, offering robust cleaning capabilities across dual levels, swift cycle times, and a wide range of optional accessories.

-

In February 2024, LG Electronics Inc. unveiled the 14-person LG Dios Objet Collection Dishwasher, aimed at optimizing space efficiency and convenience. This new product is offered in three variations: built-in models with product heights of 10 cm and 15 cm from the kitchen floor, as well as a freestanding option. Its design eliminates the need for separate installation work, providing customers with customizable choices to suit their kitchen interior requirements.

-

In September 2023, At IFA 2023, Midea, a leading advocate of Matter certification, unveiled its innovative Matter-connected dishwasher, reaffirming its dedication to industry standards. Midea's newest dishwasher showcases a range of intelligent features designed to streamline daily tasks. Through the accompanying app, users gain remote control capabilities, empowering them to oversee the dishwasher's operation from any location. The app sends timely reminders for dishwasher maintenance, enhancing user convenience.

-

In March 2023, Swedish brand ASKO introduced the new DW60 dishwasher series, emphasizing state-of-the-art solutions and performance while maintaining an elegant design suitable for various kitchens. The dishwasher is designed to last for 20 years and features high-quality stainless-steel components instead of plastic for durability and environmental friendliness. ASKO's new dishwasher includes a Flexi Racks system for easier loading and a Turbo Combi Drying feature for improved performance.

North America Dishwasher Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.52 billion

Revenue forecast in 2030

USD 8.72 billion

Growth Rate (Revenue)

CAGR of 5.0% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Thousand Units and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Size (Width), Tub Type, Price Range, Distribution Channel, Country

Regional scope

North America

Country scope

U.S, Canada

Key companies profiled

Whirlpool Corporation; Samsung Electronics Co. Ltd.; Robert Bosch GmbH; LG Electronics Inc.; Frigidaire (Electrolux Inc.); Kenmore (Transform Holdco LLC); General Electric Company (Haier Company); AGA Rangemaster Limited; Miele; ASKO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Dishwasher Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America dishwasher market report based on product, size (width), tub type, price range, distribution channel, and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Freestanding

-

Built-In

-

-

Size (Width) Outlook (Revenue, USD Million, 2018 - 2030)

-

Compact Size (18 inches)

-

Standard Size (24 inches)

-

-

Tub Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard Tub

-

Tall Tub

-

Tall & Deep Tub

-

-

Price Range Outlook (Revenue, USD Million; Volume, Thousand Units; 2018 - 2030)

-

Up to USD 500

-

USD 501 to USD 1,500

-

USD 1,501 to USD 3,000

-

Above USD 3,000

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Country Outlook (Revenue, USD Million; Volume, Thousand Units; 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America dishwasher market size was estimated at USD 6.22 billion in 2023 and is expected to reach USD 6.52 billion in 2024.

b. The North America dishwasher market market is expected to grow at a compounded growth rate of 5.0% from 2024 to 2030 to reach USD 8.72 billion by 2030.

b. Built-In dishwasher dominated the North America dishwasher market with a share of 92.6% in 2023. An increasing number of homeowners seek to update and enhance their kitchens, there is a growing preference for built-in appliances that seamlessly integrate with kitchen cabinetry.

b. Some key players operating in North America dishwasher market include Whirlpool Corporation, General Electric Company (Haier Company), Samsung Electronics Co., Ltd., and Robert Bosch GmbH.

b. Key factors driving market growth include the increasing launch of dishwashers equipped with smart features like Wi-Fi connectivity, voice control, and advanced sensor technology, as well as the growing spending by homeowners on kitchen remodeling and renovations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."