- Home

- »

- Animal Health

- »

-

North America & Europe Companion Animal Diagnostics Imaging Market Report, 2030GVR Report cover

![North America & Europe Companion Animal Diagnostics Imaging Market Size, Share & Trends Report]()

North America & Europe Companion Animal Diagnostics Imaging Market Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats), By Solutions (Services, PACS), By Application, By End Use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-014-6

- Number of Pages: 240

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The North America & Europe companion animal diagnostics imaging market size was estimated at USD 1.82 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.6% over the forecast period. The industry is primarily driven by factors, such as increasing adoption of pet insurance, pet humanization, initiatives by leading companies, and technological advancements. In February 2021, for instance, Fujifilm launched VXR Veterinary X-Ray Room for veterinarians comprising high sensitivity, low-dose DR detectors, and advanced image processing technologies. This expanded the company’s portfolio and supported its growth objectives.

The COVID-19 pandemic significantly impacted the industry with lower demand and sales, especially in the equipment segment. However, the industry was able to recover gradually as veterinary care services were recognized as essential during the pandemic and were thus operational. Patient volume remained dynamic due to movement restrictions as well as lockdowns and elective procedures were postponed by several veterinary healthcare facilities to minimize cross infections. Telemedicine and PACS segments, on the other hand, witnessed a surge in demand owing to increased awareness about the associated benefits and increased penetration of these solutions.

Growing pet humanization combined with an increase in the pet population is expected to fuel the growth of the industry in the coming years. In November 2021, the American Veterinary Medical Association reported that the pet cat and dog population increased significantly in the U.S., from 135.2 million to 143.7 million between 2016 to 2020. Veterinary care expectations are getting closer to human medical care expectations, as more pet owners are forming a deep attachment with their companion animals. Owners are willing to spend more money and time on their pets to provide them with better healthcare.

Various initiatives by leading companies are another important factor contributing to the industry's growth. Esaote Group reported 19% growth in the order book in 2021. Heska Corporation reported a cumulative total installed base of more than 6,000 imaging devices comprising digital radiography, computer radiography, and ultrasound solutions during 2021.IDEXX Laboratories, Inc., on the other hand, reported teleradiology to be one of its fastest-growing businesses during 2022. The company also reported an increase in active installed bases, higher realized prices, and higher service revenue during 2022.

Animal Type Insights

In 2022, the dogs segment dominated the industry and accounted for the maximum share of more than 49.00% of the overall revenue. The high share can be attributed to a comparatively higher population of pet dogs due to the wide popularity of dogs as pets. Moreover, dog owners are more willing to spend on their pet’s health and well-being. The conditions brought on by the COVID-19 pandemic further increased pet parents’ awareness about their animal wellbeing. This is expected to result in more people opting to get their pets diagnosed in time at the slightest sign of discomfort or illness.

This contributes to segment growth. The other animal type segment is projected to grow at the fastest CAGR during the forecast years. The segment comprises small mammals, exotic pets, and birds. The growing availability of solutions for diagnostic imaging of other animal types and the expansion of service offerings by specialty animal practices is expected to fuel the segment growth during the forecast period. In December 2021, VetCAT IQ—a 3D Cone Beam Computed Tomography (CBCT) system—was installed by Xoran Technologies at Chicago Exotics Animal Hospital—an exotics-only animal hospital in the U.S.

Solutions Insights

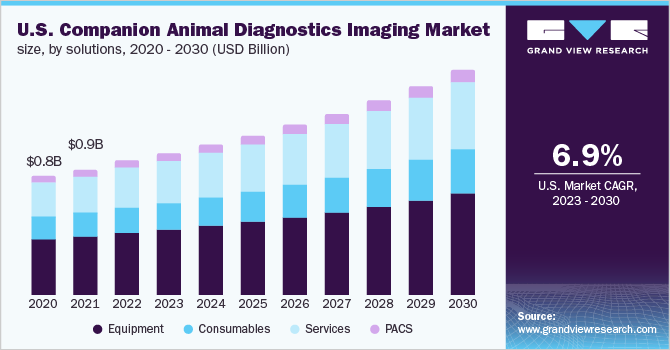

The equipment solutions segment dominated the industry in 2022 and accounted for the highest share of more than 46.50% of the overall revenue. Imaging equipment, such as CT, MRI, ultrasonography, and X-rays, have become widely available in veterinary medicine owing to their greater demand and feature advancements. Radiography is anticipated to remain a mainstay in the veterinary field due to its ease of use, low cost, and availability. The services solutions segment, on the other hand, is estimated to register the fastest growth rate during the forecast period.

The uptake of services, such as education & training, imaging, telemedicine, and support services, is on the rise due to increasing availability and demand. Telemedicine services, including teleradiology, for example, were widely preferred during the COVID-19 lockdown. It enabled veterinary professionals to consult with patients or veterinary radiologists regarding patient cases virtually. Key players are also offering education & training services to expand their portfolio. Heska Corp., for instance, provides veterinary continuing education online and in labs with CE credit courses on dental radiology and ultrasound. Such initiatives are expected to fuel segment growth.

Application Insights

The orthopedics and traumatology segment dominated the industry in 2022 and accounted for the maximum share of more than 27.25% of the overall revenue. To examine changes in joints or bones, radiography and CT are the preferred procedures. Veterinary practitioners prefer solutions that support a timely diagnosis that is both reliable and accurate. In March 2021, Hallmarq Veterinary Imaging launched Standing Leg CT (slCT) to help improve lameness diagnosis in horses. The CT is based on a unique ring design with the detector plate placed very close to the region of interest, which improves image quality.

The dental segment is projected to grow at the fastest growth rate during the forecast period. This growth can be attributed to the increasing dental disease prevalence in animals. Periodontal disease, for example, is one of the most prevalent issues in small animal veterinary practice. Around 70% of cats and 80% of dogs have periodontal disease by the age of two. A dental x-ray is necessary for a thorough assessment of dental issues. This is expected to contribute to the high CAGR of the segment.

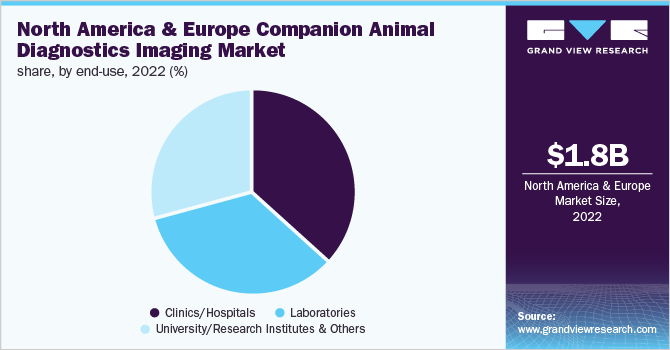

End-use Insights

The clinics/hospitals segment dominated the industry in 2022 and accounted for the largest share of over 30% of the overall revenue. The segment is anticipated to grow at the fastest CAGR during the forecast years. This can be attributed to the segment holding the majority of facilities, the increasing adoption of advanced diagnostic imaging to expand service offerings, and the high patient volume received in these facilities. In May 2022, Butterfly Network, Inc. specializing in handheld, whole-body ultrasound partnered with Petco Health and Wellness Company, Inc. to deploy Butterfly iQ+ Vet to the latter’s 200+ network of veterinary hospitals.

Veterinary Emergency Referral Center (VERC) in Hawaii opted for the installation of a 1.5T Small Animal MRI from Hallmarq in May 2022 to increase access to advanced imaging. The VERC also chose Hallmarq’s subscription-based service that enables easy remote access to licensed technologists for operating the small animal MRI machine. Similarly, the company’s Standing Equine MRI was installed in ARCHIPP’s new equine facility in Poland to bring lameness diagnosis within reach of horse owners and referring vets in the area.

Regional Insights

The North American region dominated the industry in 2022 and accounted for the largest share of more than 62.25% of the overall revenue. Increasing adoption of pet insurance is anticipated to propel the industry growth with the growing concern about pets among pet owners. For instance, the North American Pet Health Insurance Association (NAPHIA) estimated that at the end of 2021 about 4.41 million pets were insured across the region. Furthermore, the overall pet health insurance marketplace was estimated to have grown by about 27% during 2021.

Developed European economies, such as the U.K. and Germany, account for a major share of the industry. Over the forecast period, the market is anticipated to exhibit the fastest growth rate. This can be attributed to the high healthcare costs, the presence of key players, and a rise in the prevalence of pet diseases. Key industry players, such as ESAOTE SPA, Agfa-Gevaert Group, Hallmarq Veterinary Imaging, are headquartered in the region in Italy, Belgium, and the U.K. respectively. These companies are involved in the deployment of various strategic initiatives to improve their industry presence.

Key Companies & Market Share Insights

The industry is notably fragmented. It is characterized by the presence of several companies competing for a considerable share of the market. These companies implement extensive growth strategies, such as strategic alliances, increasing product differentiation, and mergers & acquisitions, to gain a larger market share. For instance, in June 2021, IDEXX Laboratories, Inc. acquired ezyVet, a provider of Practice Information Management Systems (PIMS). This added to the company’s cloud software offerings. Similarly, in February 2021, MyVet Imaging partnered with SOUND to deliver veterinary dental imaging solutions. These solutions are designed to produce diagnostic periodontal images. Such factors are likely to maintain the intensity of rivalry in the market at a high level. Some of the key players in the North America & Europe companion animal diagnostics imaging market include:

-

IDEXX Laboratories, Inc.

-

SOUND

-

Heska Corp.

-

ESAOTE SPA

-

Canon Medical Systems Corp.

-

Siemens Healthcare Ltd.

-

FUJIFILM Holdings America Corp.

-

Hallmarq Veterinary Imaging

-

Carestream Health

-

Agfa-Gevaert Group

North America & Europe Companion Animal Diagnostics Imaging Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.94 billion

Revenue forecast in 2030

USD 3.24 billion

Growth rate

CAGR of 7.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, solutions, application, end-use, and region

Regions covered

North America And Europe

Country scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; The Netherlands; Belgium; Denmark; Norway; Sweden; Rest of Europe

Key companies profiled

IDEXX Laboratories, Inc.; SOUND; Heska Corp.; ESAOTE SPA; Canon Medical Systems Corp.; Siemens Healthcare Ltd.; FUJIFILM Holdings America Corp.; Hallmarq Veterinary Imaging; Carestream Health; Agfa-Gevaert Group

Customization scope

Free report customization (equivalent upto to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America & Europe Companion Animal Diagnostics Imaging Market Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America & Europe companion animal diagnostics imaging market report on the basis of animal type, solutions, application, end-use, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Solutions Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

X-ray

-

Digital Radiography

-

Fixed

-

Mobile

-

Dental

-

-

Computer Radiography

-

-

Ultrasound

-

Console/On-platform

-

Portable

-

Handheld

-

-

MRI

-

CT

-

Multi-slice CT

-

Cone-beam

-

-

C-Arm/Fluoroscopy

-

ECG/EKG

-

-

Consumables

-

Services

-

Support Services

-

Education/Training Services

-

Diagnostic Imaging Services

-

Telemedicine

-

-

PACS

-

Cloud

-

On-premise

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedics & Traumatology

-

Oncology

-

Cardiology

-

Neurology

-

Dental

-

Internal Medicine

-

Emergency Critical Care

-

Theriogenology

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinics/Hospitals

-

Laboratories

-

University/Research Institutes & Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

North-East

-

New England

-

Middle Atlantic

-

-

Mid-West

-

East North Central

-

West North Central

-

-

West

-

Mountain

-

Pacific

-

-

South

-

South Atlantic

-

East South Central

-

West South Central

-

-

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

The Netherlands

-

Belgium

-

Denmark

-

Norway

-

Sweden

-

Rest of Europe

-

-

Frequently Asked Questions About This Report

b. The total North America & Europe companion animal diagnostics imaging market size was estimated at USD 1.82 billion in 2022 and is expected to reach USD 1.94 billion in 2023.

b. The total North America & Europe companion animal diagnostics imaging market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 3.24 billion by 2030.

b. The clinics/hospitals segment dominated the market by end-use in 2022 with a share of over 30% and is also anticipated to grow the fastest over the coming years. This can be attributed to the segment holding the majority of facilities, the increasing adoption of advanced diagnostic imaging to expand service offerings, and the high patient volume received in these facilities.

b. Some key players operating in the North America & Europe companion animal diagnostics imaging market include IDEXX Laboratories, Inc.; SOUND; Heska Corporation; ESAOTE SPA; Canon Medical Systems Corporation; Siemens Healthcare Limited; FUJIFILM Holdings America Corporation; Hallmarq Veterinary Imaging; Carestream Health; and the Agfa-Gevaert Group.

What are the factors driving the North America & Europe companion animal diagnostics imaging market?b. Key factors that are driving the market growth include increasing adoption of pet insurance, pet humanization, initiatives by leading companies, and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."