- Home

- »

- Homecare & Decor

- »

-

North America & Europe Luxury Interior Fabric Market Report 2030GVR Report cover

![North America & Europe Luxury Interior Fabric Market Size, Share & Trends Report]()

North America & Europe Luxury Interior Fabric Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Curtains, Upholstery), By Distribution Channel (Offline, Online), By Raw Material, By End-user, And Segment Forecasts

- Report ID: GVR-4-68039-405-9

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The North America & Europe luxury interior fabric market size was estimated at USD 1.27 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.6% from 2023 to 2030. The demand for luxury interior fabrics is fueled by the demand for high-quality and lavish aesthetics. The opulent textures, intricate patterns, and distinctive designs of these fabrics attract consumers and help them elevate their living spaces. As more individuals attain higher levels of disposable income, they are willing to invest in high-quality, aesthetically pleasing interior fabrics to enhance the look and feel of their homes. In addition, growing awareness about sustainable and eco-friendly materials has led to a demand for luxury fabrics made from natural and ethically sourced materials, appealing to environmentally conscious consumers.

The growth of the luxury real estate market and the hospitality industry has also contributed to the demand for premium interior fabrics, as property developers and hoteliers seek to create unique and opulent spaces to appeal to customers. The selection of interior fabrics rests in the hands of designers who often work with a variety of textiles to build the preferred look. Fabrics are usually used to add texture or color to a room and can be incorporated to accentuate the décor as needed. Fabrics add colors to the interior, whether in the office or home. The colors can vary according to the space-warm, bright colors for homes and dark, subtle tones for offices.

Luxury fabric makers are incorporating traditional techniques and patterns into contemporary designs to create unique offerings. According to home services company Angi’s 2022 State of Home Spending report, the year witnessed a return to more normal home spending patterns in the U.S., with an increase in spending and projects compared to 2019 and a decrease from the unusually high demand seen in 2021. The motivation behind home improvement spending has shifted from being primarily driven by financial factors to an increasing emphasis on lifestyle considerations.

With rising home prices and mortgage rates, consumers are increasingly investing in home improvement or home remodeling projects to revamp their spaces. Growing home values have doubled homeowner equity in the past five years. Innovation in materials presents a significant growth opportunity in the market, particularly in the context of sustainability. Unique, eco-friendly, and high-performance offerings can set luxury fabric brands apart. Companies must invest in research and development to attract environmentally conscious consumers and differentiate their products.

Product Insights

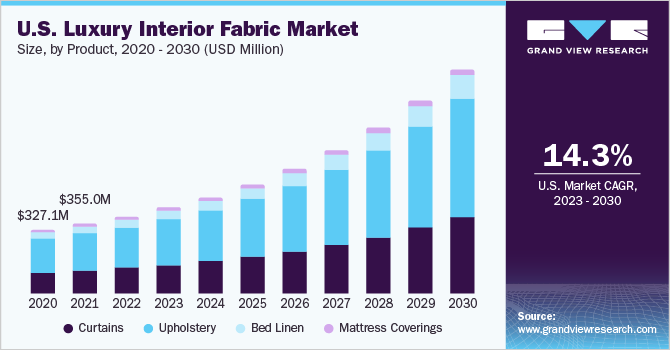

The upholstery segment dominated the market with a share of 52.6% in 2022. Upholstered furniture is viewed as one of the fastest-growing segments in the overall furniture market. The increasing purchasing power of consumers, improvements in the standards of living, and changing lifestyles have led to the demand for luxury upholstery fabrics for various types of seating furniture, including beds, chairs, and sofas.

The curtains segment is anticipated to grow at a CAGR of 13.9% over the forecast period. Curtains are widely used in most households as they serve multiple functions, such as providing privacy and blocking light. Given the fact that they are in plain sight and contribute to the ambiance, consumers pay considerable attention to the color, pattern, and material while purchasing curtains. Furthermore, increased consumer spending on home interiors in the North America and Europe regions is expected to boost the demandfor premium curtains among the high-income population.

Distribution Channel Insights

The offline segment held the largestrevenue share of 57.6% in 2022. Consumers prefer offline distribution channels as they give a first-hand look and feel of the fabrics, which helps in the easy inspection of the quality and specifications. Brands have been able to create a unique shopping experience for customers with the help of traditional brick-and-mortar stores.

Some of the prominent offline distribution channels in this market are company retail stores, supermarkets & hypermarkets, specialty stores, and multi-brand stores. However, the online distribution channel segment is anticipated to have the fastest CAGR of 14.3% over the forecast period.Online retailers provide numerous value-added services, such as cash on delivery, convenient return policies, and integrated and centralized customer services.

End-user Insights

The commercial application segment is anticipated to have a CAGR of 13.7% over the forecast period. Luxury fabrics used in commercial interior settings must be much more durable than those used in homes and other domestic spaces. In North America & Europe, luxury interior fabrics are gaining traction in the commercial sector, especially in healthcare, hospitality, and cruises. According to the 2023 U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics, upscale and upper-midscale new-construction hotels dominate this pipeline, accounting for 62% of the projects and 57% of the rooms in the entire U.S. construction pipeline.

The domestic application segment accounted for the largest revenue share of 60.4% in 2022. The market is poised for growth due to the increasing number of home remodeling projects undertaken by consumers in North America and Europe. According to the Joint Center for Housing Studies of Harvard University, Americans are investing over USD 400 billion in residential renovations and repairs. Furthermore, there is a rising preference for personalized fabrics in various interior elements, such as chairs, beds, and other furniture items, which is expected to drive market growth.

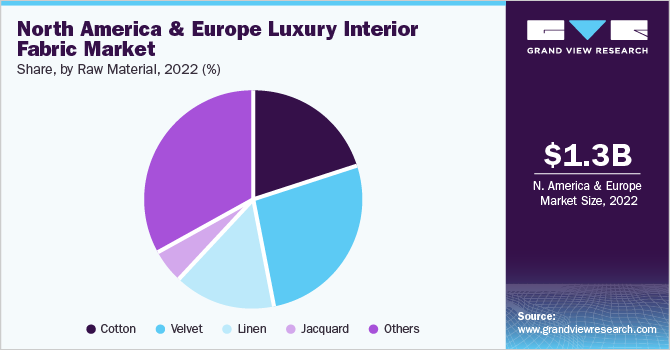

Raw Material Insights

The velvet segment dominated the market in 2022 and accounted for the second-largest share of 27.4% of the overall revenue. Velvet is preferred for upholstered furniture, decorative cushions, and curtains, as it enhances the elegance of interior spaces. Various types of velvet fabrics are available in the market, such as crushed velvet, panne velvet, embossed velvet, stretch velvet, chiffon velvet, ciselé velvet, and pile-on-pile velvet.

The jacquard fabric segment is anticipated to have the fastest CAGR of 14.0% over the forecast period. Jacquards make an excellent choice for chair and furniture upholstery due to their inherent structure. They remain wrinkle-free and maintain a tidy appearance, making them perfect for achieving sleek, well-defined interiors and formal settings. Zimmer + Rohde, a German manufacturer, introduced INTUITION, a jacquard fabric that artfully balances texture, surface, and line, creating a visual and tactile richness that elevates interior design.

Regional Insights

Europe held the largestrevenue share of 57.3% in 2022. Led by countries, such as the UK, Germany, Italy, and France, the demand for luxury interior fabric in Europe continues to be driven by the increasing popularity of high-quality and sustainably sourced products. Growing consumer awareness regarding high-end fabrics for home interiors is also boosting the regional market growth. The market in North America is anticipated to have the fastest CAGRof 14.1% over the forecast period.

Key players in the region provide a wide range of textiles and exceptional customer service to attract high-income groups. Top Fabric, based in Los Angeles, has been offering high-quality, exquisite fabrics for the last two decades. The company is engaged in the designing, production, and delivery of fabrics, such as jacquard, cut & burnout velvets, chenille, suedes, mohair, and curtain/drapery fabrics. It caters to individual customers as well as businesses.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies, such as innovation and new product launches in retail, to enhance their portfolio offering in the market:

-

In September 2023, Kravet Inc. expedited its production process by including all its smart fabrics and frames in the Quickship program. This move ensures a 10-day production timeline for customers, aiming to support projects, budgets, and tight timelines. The Kravet Smart collection, featuring over 2,000 fabrics and 150 furniture frames, offers personalization options, and the frames come with a lifetime warranty, aligning with the company's sustainability commitment

-

In May 2023, Rubelli unveiled its new websites available in three languages-French, English, and Italian. This step aligns with the company's digitalization strategy, which has significantly progressed over the past two years. Notably, this includes the implementation of Product Lifecycle Management (PLM) and Customer Relationship Management (CRM) platforms for the structured management of products and customers

-

In February 2023, Pierre Frey introduced the Braquenié Anniversaire 1823–2023 collection to celebrate its 200th anniversary. This collection comprises a carefully curated range of wallcoverings, upholstery, and rug designs chosen from its extensive historical archives

Some of the key players operating in the North America & Europe luxury interior fabric market include:

-

Jim Thompson Fabrics

-

Pierre Frey

-

Sanderson Design Group

-

The Romo Group

-

Kravet Inc.

-

Dedar S.p.A

-

Nina Campbell

-

De Le Cuona

-

Rubelli S.p.A.

-

Nobilis

-

Colefax Group plc

North America & Europe Luxury Interior Fabric Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.41 billion

Revenue forecast in 2030

USD 3.53 billion

Growth rate

CAGR of 13.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2020

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, raw material, distribution channel, end-user, region

Regional scope

North America; Europe

Country scope

U.S.; U.K.

Key companies profiled

Jim Thompson Fabrics; Pierre Frey; Sanderson Design Group; The Romo Group; Kravet Inc.; Dedar S.p.A; Nina Campbell; De Le Cuona; Rubelli S.p.A; Nobilis; Colefax Group plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America & Europe Luxury Interior Fabric Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the North America & Europe luxury interior fabric market report on the basis of product, raw material, distribution channel, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Curtains

-

Doors

-

Windows

-

-

Upholstery

-

Chairs

-

Sofas

-

Beds

-

Luxury Cushion

-

-

Bed Linen

-

Mattress Coverings

-

-

Raw Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Cotton

-

Velvet

-

Linen

-

Jacquard

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Domestic

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

-

Frequently Asked Questions About This Report

b. The North America & Europe luxury interior fabric market size was estimated at USD 1.27 billion in 2022 and is expected to reach USD 1.41 billion in 2023.

b. The North America & Europe luxury interior fabric market is expected to grow at a compound annual growth rate of 13.6% from 2023 to 2030 to reach USD 3.53 billion by 2030.

b. The upholstery products segment dominated the North America & Europe luxury interior fabric market and accounted for a revenue share of 52.7% in 2022.

b. Some key players operating in the North America & Europe luxury interior fabric market include Jim Thompson Fabrics, Pierre Frey, Style Library, The Romo Group, Kravet Inc., Dedar S.p.A, Nina Campbell, De Le Cuona, Rubelli SPA, Nobilis, Colefax Group plc.

b. Key factors that are driving the North America & Europe luxury interior fabric market growth include rising per capita disposable income and purchasing power, many consumers are shifting towards premium furniture and related products, since furniture, once upholstered, is more comfortable since it is padded and covered with fabric and Increasing purchasing power of consumers, along with improvements in the standard of living and changing lifestyles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.