- Home

- »

- Electronic & Electrical

- »

-

North America Fountain Dispenser Equipment Market Report, 2030GVR Report cover

![North America Fountain Dispenser Equipment Market Size, Share & Trends Report]()

North America Fountain Dispenser Equipment Market Size, Share & Trends Analysis Report By Machine Type (Automated, Semi-automated, Manual), By Channel, By Placement, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-093-8

- Number of Report Pages: 128

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

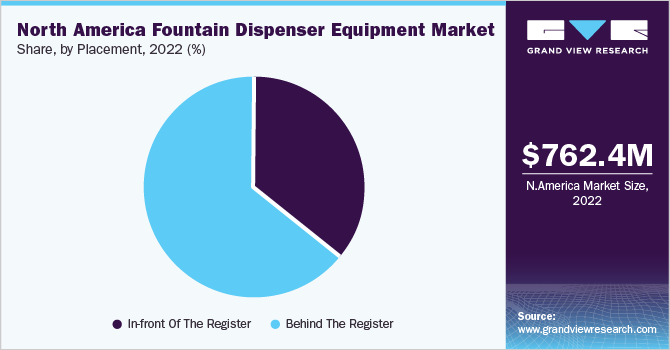

The North America fountain dispenser equipment market size was valued at USD 762.4 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030. One significant driver supporting the growth of the fountain dispenser equipment market in North America is the continuous advancement of technology. Technological innovations have revolutionized the capabilities and functionalities of fountain dispensers, attracting businesses in the foodservice industry. These advancements have significantly improved the customer experience and streamlined beverage operations.

Modern fountain dispensers incorporate advanced features such as touch-screen interfaces, automated cleaning systems, and improved beverage mixing mechanisms. The introduction of user-friendly touch-screen interfaces enables intuitive and convenient beverage selection, allowing customers to easily customize their drink choices. Automated cleaning systems streamline the maintenance process, reducing manual labor and ensuring proper hygiene standards.

Additionally, enhanced beverage mixing mechanisms facilitate the precise blending of flavors and carbonation, ensuring consistent and high-quality drink offerings. Technological advancements have enabled advanced monitoring and data analytics capabilities in fountain dispensers. Real-time monitoring of equipment performance, beverage consumption, and inventory levels helps businesses optimize operations, identify maintenance needs, and make data-driven decisions.

This data-driven approach allows businesses to enhance efficiency, minimize downtime, and improve overall productivity. The integration of technology in fountain dispenser equipment also facilitates connectivity and compatibility with other systems. This enables seamless integration with point-of-sale (POS) systems, inventory management software, and mobile applications, creating a more integrated and efficient beverage service ecosystem.

As businesses strive to deliver superior customer experiences and optimize their operations, the continuous technological advancements in fountain dispenser equipment play a pivotal role. The adoption of these advanced technologies enhances the efficiency, convenience, and customization capabilities of fountain dispensers, driving their demand and contributing to the growth of the market in North America.

In June 2021, Miso Robotics introduced an automated beverage dispenser in collaboration with Lancer Worldwide. This cutting-edge machine is designed to efficiently pour and seal beverages, enabling seamless handoff to staff members. With the increasing labor shortage and the growing emphasis on off-premises dining, the Miso Robotics machine aims to streamline quick-service operations. The machine's primary objective is to enhance efficiency and speed, addressing the evolving needs of the industry. Miso Robotics recognized the potential for automation to play a significant role in the beverage sector, leading to the creation of this innovative solution.

The North America market for soda fountain dispenser machine has experienced a notable increase in household applications in recent years. This trend can be attributed to several factors that have driven the adoption of these appliances within residential settings. One key factor is the growing desire for convenience and customization in beverage consumption among households.

Fountain dispenser machine offers a wide range of beverage options, allowing individuals to create their preferred drinks with ease. Whether it's mixing flavors, adjusting carbonation levels, or experimenting with different combinations, fountain dispensers provide a level of customization that traditional bottled beverages cannot match. This appeals to households seeking to elevate their at-home beverage experience and cater to the unique preferences of family members and guests.

Moreover, the cost-effectiveness of fountain dispenser equipment has contributed to its increased household application. With the ability to utilize concentrates or syrups and carbonated water, fountain dispensers offer a more economical alternative to purchasing pre-packaged beverages. This not only saves money in the long run but also reduces the accumulation of single-use packaging waste, aligning with sustainability concerns that many households prioritize.

The advancements in technology and design have also played a role in the rising household application of fountain dispenser equipment. Modern fountain dispensers are designed to be compact, user-friendly, and aesthetically pleasing, making them suitable for residential kitchens or entertainment areas. Enhanced features such as touch-screen interfaces, automated cleaning systems, and precise beverage mixing capabilities have made these appliances more appealing and user-centric.

Furthermore, the COVID-19 pandemic has influenced consumer behavior, leading to a shift toward at-home dining and entertainment. As households seek to replicate the experiences typically found in restaurants or cafes, the incorporation of fountain dispenser equipment allows for a touch of novelty and convenience, enhancing the overall dining or entertaining experience within the comfort of one's own home.

Thus, the increasing household application of soda fountain dispenser machine in North America can be attributed to the desire for convenience, customization, cost-effectiveness, technological advancements, and the changing landscape of at-home dining and entertainment. As households embrace the benefits and versatility offered by fountain dispensers, their presence in residential settings is likely to continue growing.

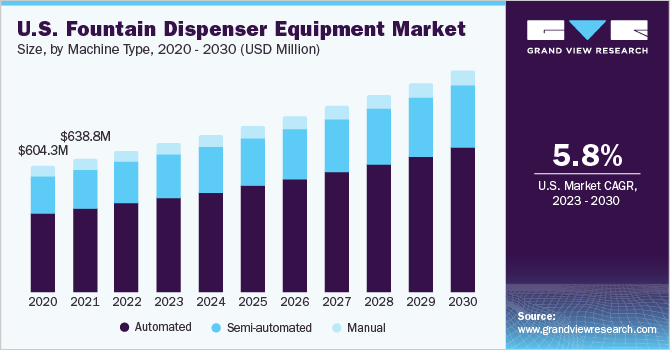

Machine Type Insights

Automated fountain dispenser equipment accounted for a share of 63.3% in 2022. Beverage companies have responded to the demand by introducing a wide range of flavored sparkling water products, often infused with natural flavors or fruit essence. Brands like SodaStream Inc., i-Drink Products Inc., and Mr. Butler are leading the share in the market, providing various models and flavor options for consumers to choose from.

Products such as automatic sparkling water makers like E-Terra electric sparkling water makers from SodaStream Inc. have gained widespread acceptance among the population. In addition, several players in the industry are indeed focused on meeting consumers' evolving preferences for convenience and customization by offering automated fountain dispensers. These automated dispensers enhance the self-service experience and provide additional features that cater to consumer demands.

Semi-automated fountain dispensers are expected to grow at a CAGR of 3.2% over the forecast period. The demand for semi-automated fountain dispensers is particularly notable in fast-food chains, quick-service restaurants, movie theaters, convenience stores, and other food service establishments across the region where self-service beverage stations are prevalent.

These dispensers offer convenience to customers, as they can easily refill their drinks and experiment with different flavors. These machines typically offer a combination of manual and automated features, providing a balance between convenience and customization. Major fast-food chains in the region often incorporate semi-automated fountain dispensing machines as part of their beverage service. Customers can select their preferred drinks and customize them with different flavors or mix-ins.

Channel Insights

Restaurants accounted for a share of 33.5% in 2022. Fountain dispensers are gaining widespread acceptance among the restaurants such as quick-service, limited-service, and full-service eateries across the region. Fountain dispensers offer a self-service approach, allowing customers to fill their cups or glasses with their preferred beverages.

This convenience saves time for both customers and restaurant staff, particularly in busy or high-traffic periods. In July 2020, the Coca-Cola Company announced the addition of its touchless fountain dispensers, called Freestyle dispensers, to restaurants, retailers, and other food service operators across the U.S. Users can select and pour their fountain beverages from their phones without the need to download an app.

The residential segment is expected to grow with a CAGR of 7.9% over the forecast period. In residential settings across the U.S., consumers prefer compact soda makers and single-serve soda dispensers that allow them to enjoy canned or bottled sodas at home. These units, resembling vending machines or refrigerated dispensers, can be placed in residential settings, offering convenience for those who prefer pre-packaged beverages.

Compact soda makers are designed for home use and allow users to carbonate water and add soda syrups to create their own carbonated beverages. These machines typically require a CO2 canister for carbonation and offer various flavors to choose from. They are convenient for individuals or families who enjoy making their own sodas and want control over the carbonation levels and flavor intensity.

Placement Insights

Equipment placed in-front of the register accounted for a share of 36.2% in 2022. An in-front-of-the-register fountain dispenser is a type of fountain dispenser unit that is positioned in-front of the cash register or checkout area in a retail establishment. It is strategically placed to provide customers with easy access to beverages and encourage impulse purchases. Positioning the fountain dispenser close to the register allows customers to quickly and conveniently add a beverage to their order. They can easily grab a cup and dispense their preferred drink without having to navigate through the store or wait in another line.

Equipment placed behind the register is expected to grow at a CAGR of 6.2% over the forecast period from 2023 to 2030. Behind the register fountain dispensers are a specific type of fountain dispenser units designed for use in drive-thru lanes at fast-food restaurants or other similar establishments. These units are specifically built to provide convenience and efficiency for customers who prefer to order and receive their beverages while remaining in their vehicles. These units are typically designed with a user-friendly layout that allows drivers to easily access the beverage options and operate the dispenser while remaining seated in their vehicles.

Country Insights

The U.S. fountain dispenser equipment market was valued at USD 674.4 million in 2022. Fountain dispensers have been a staple in American culture for many years, and their popularity is driven by factors such as affordability, convenience, and the ability to offer a wide variety of beverage choices. The demand for fountain dispensers has often been driven by consumer preferences for customizable drinks and convenience.

The ability to mix different flavors, add ice or carbonation, and control serving size has made fountain dispensers appealing to consumers in commercial spaces such as quick-service restaurants, limited-service, and full-service restaurants. Additionally, manufacturers are playing a significant role in catering to the increasing demand from commercial places like healthcare sectors, entertainment venues, educational institutions, and food sector businesses across airports and hotels.

The Canada fountain dispenser equipment market is anticipated to grow with a CAGR of 6.8% over the forecast period. Fountain dispensers are popular across various commercial applications in Canada, particularly in the food service industry. Major fast-food chains in Canada feature fountain dispensers as a central part of their beverage service. Canadians are increasingly preferring healthier beverages to reduce the consumption of sugary drinks like soda. Also, these dispensers are often present in gas stations and travel centers across Canada. They allow travelers to refill their drinks during long journeys.

Key Companies & Market Share Insights

Key players operating in the market are adopting various steps to increase their presence in the market. These steps include strategies such as partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

-

In May 2023, Coca-Cola introduced Coca-Cola Flex powered by Freestyle, an innovative beverage dispenser designed to enhance the customer experience and streamline operations. This new dispenser offers more than 40 beverage options, all within the compact footprint of a standard 6-valve fountain dispenser. By merging the advantages of traditional fountain dispensers with the innovation and variety of Coca-Cola Freestyle, Coca-Cola Flex provides a compelling solution for both businesses and consumers.

-

In January 2023, Celli Group, a leading player in the development and manufacturing of beverage dispensing systems and accessories, purchased 100% shares of CAB Spa, an Italian beverage dispenser machine manufacturer. The company aims to expand its product portfolio and venture into new markets, specifically targeting the frozen drinks sector, through the acquisition.

-

In July 2022, Pentair plc, a company specializing in water treatment and sustainable solutions, successfully concluded the previously disclosed acquisition of Manitowoc Ice from Welbilt, Inc. for USD 1.6 billion, with adjustments following customary practices. Manitowoc Ice is a prominent provider of commercial ice makers.

Some prominent players in the North America fountain dispenser equipment market include:

-

The Coca-Cola Company

-

PepsiCo

-

FBD Partnership, LP

-

Lancer Worldwide

-

Manitowoc Ice

-

Keurig Dr Pepper Inc.

-

Cornelius

-

Multiplex

-

CELLI SPA

-

Follett Products, LLC

North America Fountain Dispenser Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 806.2 million

Revenue forecast in 2030

USD 1.21 billion

Growth rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Machine type, channel, placement, country

Country scope

U.S.; Canada

Key companies profiled

The Coca-Cola Company; PepsiCo; FBD Partnership, LP; Lancer Worldwide; Manitowoc Ice; Keurig Dr Pepper Inc.; Cornelius; Multiplex; CELLI SPA; Follett Products, LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

North America Fountain Dispenser Equipment Market Report Segmentation

This report forecasts growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global North America fountain dispenser equipment market report based on machine type, channel, placement, and country:

-

Machine Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Automated

-

Semi-automated

-

Manual

-

-

Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Restaurants

-

Quick-service

-

Limited-service

-

Full-Service

-

-

Business & Industry

-

Travel & Leisure

-

Hotels/ Lodging

-

Airports

-

-

Healthcare

-

Hospitals

-

Others

-

-

Education

-

Colleges & Universities

-

K-12 Schools

-

-

Entertainment Venues

-

Sports Stadiums

-

Cinemas

-

Others

-

-

Residential

-

Others

-

Convenience Stores

-

Supermarket Foodservice

-

-

-

Placement Outlook (Revenue, USD Million, 2017 - 2030)

-

In-front Of The Register

-

Behind The Register

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America fountain dispenser equipment market size was estimated at USD 762.4 million in 2022 and is expected to reach USD 806.2 million in 2023.

b. The North America fountain dispenser equipment market is expected to grow at a compounded growth rate of 5.9% from 2023 to 2030 to reach USD 1.21 billion by 2030.

b. Automated fountain dispenser equipment accounted for a share of 63.3% in 2022. Beverage companies have responded to the demand by introducing a wide range of flavored sparkling water products, often infused with natural flavors or fruit essence. Brands like SodaStream Inc., i-Drink Products Inc., and Mr. Butler are leading the share in the market, providing various models and flavor options for consumers to choose from.

b. Some key players operating in North America fountain dispenser equipment market include The Coca-Cola Company, PepsiCo, FBD Partnership, LP, Lancer Worldwide, Manitowoc Ice, Keurig Dr Pepper Inc., Cornelius, Multiplex, CELLI SPA, Follett Products, LLC

b. Key factors that are driving the market growth include, continuous advancement of technology, advanced features such as touch-screen interfaces, automated cleaning systems, and improved beverage mixing mechanisms.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."