- Home

- »

- Advanced Interior Materials

- »

-

North America Geotextiles Market Size & Share Report, 2030GVR Report cover

![North America Geotextiles Market Size, Share & Trends Report]()

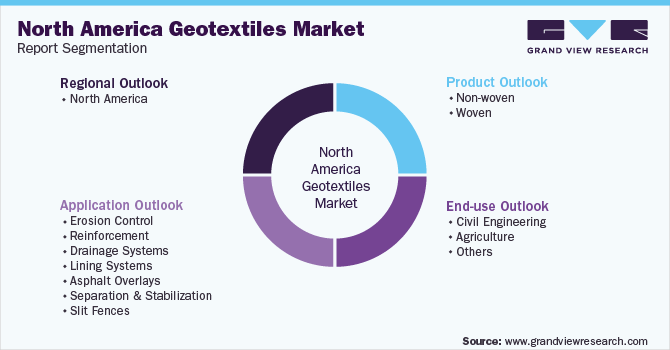

North America Geotextiles Market Size, Share & Trends Analysis Report By Product (Non-woven, Woven), By Application (Erosion Control, Reinforcement, Drainage System), By End-use, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-032-4

- Number of Report Pages: 118

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Report Overview

The North America geotextiles market size was estimated at 1.05 billion in 2022 and is expected to expand at a 5.4% compound annual growth rate (CAGR) from 2023 to 2030. The market is expected to be driven by rising civil engineering activities due to rapid urbanization and industrialization in North America. The cost-effectiveness and longer lifespan of geotextiles as compared to other materials and the growing environmental concerns regarding soil erosion are projected to drive the product demand in North America.

The non-woven segment accounted for the largest product share in 2o22, owing to their unique properties such as absorbency, liquid repellency, and mechanical strength. Enhancement in construction and growing investments in construction developments in the economy have propelled market growth in the past few years. In addition, the rising need for non-woven geotextiles in the transport infrastructure industry on account of their high tensile strength and low- cost is expected to drive the product demand.

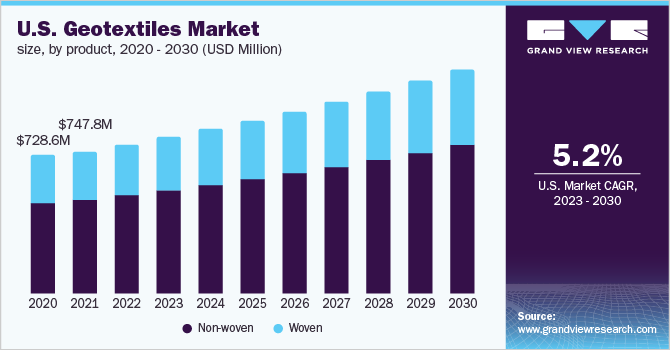

The U.S. held the largest share in terms of revenue and accounted for 74.7% of the total market revenue in 2022. The demand for geotextiles is anticipated to increase owing to the rising areas of civil, geotechnical, environmental, coastal, and hydraulic engineering. The pavements in the U.S. have now incorporated geotextiles beneath parking lots, railroad track ballast, and roads. Along with that, USDoT in several states of the U.S. has introduced multiple mandatory standard specifications for using geotextiles on the roads.

The market players position themselves by offering a wide range of geotextile products. The majority of the players are also offering geotextiles along with other types of geosynthetics such as geogrids, geomembranes, geonets, geocells, and geocomposites. Furthermore, the companies are continuously engaged in offering products through innovative and advanced methods to deal with the increasing need for their use in various construction applications.

Companies such as TenCate Geosynthetics, Fibertex Nonwovens A/S, Officine Maccaferri S.p.A., and Propex Operating Company LLC are some of the dominant market players. These companies offer a diversified product portfolio. New entrants or emerging players such as Nilex, Inc. and Belton Industries are likely to gain opportunities by manufacturing novel products to establish themselves in the industry. In addition, new entrants focus on their specific strengths and are engaged in expanding their customer base.

BASF, DuPont, ExxonMobil, LyondellBasell, and Formosa Plastics Corporation, U.S.A., supply their product using their established channel of distribution and third-party distributors to reach a wider customer base. The suppliers also maintain long-term contracts with the manufacturers of geotextiles, to assure the consistent sales of products, irrespective of the changing market conditions.

Product Insights

Non-woven led the market and accounted for a revenue of USD 696.6 million in 2022 owing to a rise in the transport infrastructure industry on account of their high tensile strength and low cost. There is a growing demand for nonwoven geotextiles in developing countries such as the U.S. and Canada due to the heavy infrastructural development. In addition, innovation in using non-woven geotextiles within drainage sub-systems and increasing the life span of dumps is further expected to aid in the market growth.

Polypropylene non-woven fabric dominated the geotextile market with a 56.2% revenue share in 2022 owing to its low cost, high strength, and low specific gravity. In addition, the demand for polypropylene fabric in geotextile is increasing due to the rise in bio-based geotextile consumption and the growing demand from the transport and construction industry.

Spunbond non-woven technology accounted for the largest revenue share of 51.1% in 2022. The spun-bond process is the most common among the various non-woven fabrication processes as it eliminates the intermediate steps and reduces production costs. Additionally, the spun bond technology involves a one-step fabrication facility that transforms polymer pallets into geotextile sheets. Therefore, spun-bond technology use is expected to further increase in North America.

Woven registered a revenue of USD 354.5 million in 2022 owing to high modulus and stability through the interlocking of fabric strips for projects involving geotextiles. The material is economical, offers high strength, and is available at a low cost, which is expected to boost the market. In addition, woven geotextile materials can withstand a large amount of tension and their impermeable property makes them ideal for reinforcement and separation purposes. The majority of woven geotextile is produced from polyethylene in the form of slit film, extruded tape, monofilament, and multifilament.

End-Use Insights

The demand for geotextiles in civil engineering end-use dominated the market in 2022 and is expected to reach USD 1059.9 million valuations by 2030. The majority of the geotextiles are used for road, highways, and pavement construction which is driving the product expansion as it has a larger absorption capacity, adding extra strength to the infrastructure, and extending its life.

Geotextiles are extensively used in the reinforcement of streets, embankments, pipelines, dams, canals, and ponds. In civil engineering, geotextiles have six distinct functions including separation, reinforcement, filtration, sealing, drainage, and protection. Geotextiles are broadly used for road construction as they strengthen the soil by adding tensile strength. They are also used on road surfaces as a quick dewatering layer, which is expected to propel the product demand in North America during the forecast period.

The demand for geotextiles in the agriculture industry is expected to grow during the forecast period at a CAGR of 5.3%. Geotextiles are used in ground surface & greenhouse covers, fence protection & support, ground surface reinforcement, containment, waste management, stockings, packaging, and storage, which helps farm owners save cultivated crops from being damaged by harmful natural elements. This is likely to boost the market demand over the projected period.

Other than civil engineering and agriculture, geotextiles are also used in defense, wastewater treatment facilities, sports, and electronics. The demand for geotextiles is expected to increase with their growing application in the above-mentioned industries. The other end-use segment accounted for USD 137.5 million in 2022 and is expected to reach USD 203.4 million by 2030.

Application Insights

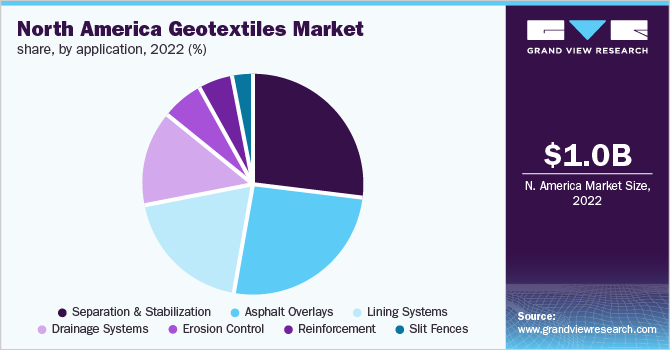

The separation & stabilization application segment accounted for the largest share in 2022 and is expected to grow at a CAGR of 4.9% from 2023 to 2030. The increase in severe weather events in North America is causing damage to crucial highways that serve as community lifelines while also raising maintenance demands, disrupting regular road operations, and severely harming the economy. Thus, resulting in increased demand for geotextiles in separation applications.

The demand for geotextiles in erosion control applications is expected to grow substantially over the projection period as it controls soil erosion caused by running water, waves, wind, moving ice, and other bank erosion agents. The U.S. has been experiencing a drastic shift in weather patterns over the past ten years, which is causing major flooding in the Midwest and California, where a majority of the various food crop varieties are cultivated. So, the mentioned factor is resulting in yield loss. Hence, to minimize crop damage, farmers prefer to use geotextiles, which is expected to enhance the geotextile industry in North America during the forecast period.

The drainage system segment is the fastest-growing segment at a CAGR of 6.0% during the forecast period. The rapid growth of revenue owing to surging provides a constant and ongoing filter, requires less excavation, and results in a more negligible impact on the environment. Furthermore, these are easier to build, are of superior quality, and need significantly less material, which is likely to boost the market demand over the projected period.

The reinforcement segment of the geotextile market in North America is projected to grow at a CAGR of 4.4% in terms of revenue during the forecast period. Geotextiles are employed in various reinforcement application domains such as dams, retaining walls, roadways, and embankments over soft soils. Geotextile can significantly strengthen the surface of the earth when used as reinforcement or to enhance soil support. For instance, it uniformly spreads the load to prevent deformations when positioned on the sand. Hence it is expected to increase market demand for reinforcement applications in North America.

Regional Insights

The U.S. dominated the North America geotextiles market and is projected to grow at a CAGR of 5.2% in terms of revenue during the forecast period. This growth can be attributed to the high utilization of drainage systems and the constant requirement of maintaining these drainage systems. Hence, extensive use of these products in the drainage system is expected to drive the demand in the country.

The U.S. government is taking several initiatives to upgrade public infrastructure. For instance, in 2021, the U.S. Department of Transportation (USDoT) announced the investment of USD 906 million in infrastructure through the Infrastructure for Rebuilding America (INFRA) discretionary grant program. In total, 24 projects in 18 states were awarded funding to improve major bridges, ports, highways, and railroads across the country which are key factors driving the demand for geotextiles in the country.

The well-established civil engineering industry in Canada is expected to contribute to the demand for geotextile products and solutions in the country over the forecast period. The government of Canada is investing USD 131.23 billion in infrastructure over 12 years through the ‘Investing in Canada’ program, which was introduced in 2016. This program delivers investments across five broad segments including investments to build new urban transit networks, to allow affordable housing, for access to clean air and safe water, to grow local economies, and for efficient transportation systems. This is expected to lead to the growth of the industry for geotextile in Canada over the forecast period.

Total revenue in Mexico was valued at USD 109.2 million in 2022 and is expected to grow at a CAGR of 6.5% during the forecast period. The growth of the construction and building industry in Mexico is attributed to the infrastructure and development programs by the federal government. Furthermore, the construction industry in the country is expected to witness variable growth on account of internal and external factors such as declining international oil prices and global economic conditions. The aforementioned factors are expected to boost product demand in the country.

Key Companies & Market Share Insights

Key players are entering into agreements with emerging and small-scale players to expand their distribution capacities and increase the geographical presence of their products. Furthermore, manufacturers are focusing on other efficient and effective distribution channels. As a result, companies are likely to establish partnerships with e-commerce portals to ensure that buyers have timely access to geotextile products.

The substitutes of geotextiles include several other geosynthetic products such as geonets and geogrids. These products possess the same functional utilities as geotextiles. However, geotextiles are less expensive as they are synthesized using inexpensive raw materials and comparatively simpler production methods. Additionally, the product is expected to witness the internal threat of substitution from eco-friendly and natural raw materials such as coir and jute. Some prominent players in the North America geotextiles market include:

-

TenCate Geosynthetics

-

NAUE GmbH & Co. KG

-

Officine Maccaferri S.p.A.

-

Propex Operating Company, LLC

-

Fibertex Nonwovens A/S

-

AGRU America, Inc.

-

HUESKER Group

-

TYPAR

-

Nilex, Inc.

-

Belton Industries

North America Geotextiles Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.1 billion

Revenue forecast in 2030

USD 1.6 billion

Growth rate

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million square meters, revenue in USD Million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Segments covered

Product; application; end-use; country

Key companies profiled

TenCate Geosynthetics; NAUE GmbH & Co. KG; Officine Maccaferri S.p.A.; Propex Operating Company, LLC; Fibertex Nonwovens A/S; AGRU America, Inc.; HUESKER Group; TYPAR; Nilex, Inc.; Belton Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Geotextiles Market Segmentation

This report forecasts volume and revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America geotextiles market report based on product, application, end-use, and country:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Non-woven

-

Non-woven By Polymer

-

Polypropylene

-

Polyester

-

Polyethylene

-

Others

-

Non-woven By Technology

-

Spunbond

-

Needlepunch

-

-

Woven

-

Woven By Polymer

-

Polypropylene

-

Polyester

-

Polyethylene

-

Others

-

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Erosion Control

-

Reinforcement

-

Drainage Systems

-

Lining Systems

-

Asphalt Overlays

-

Separation & Stabilization

-

Slit Fences

-

-

End-use Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Civil Engineering

-

Agriculture

-

Others

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America geotextile market size was estimated at USD 1,051.1 million in 2022 and is expected to reach USD 1,106.2 million in 2023.

b. The North America geotextile market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 1,599.2 million by 2030.

b. Non-woven geotextile dominated North America geotextile market with a share of 66.3% in 2022 owing to its unique properties such as absorbency, liquid repellency, and mechanical strength.

b. Some of the key players operating in the North America geotextile market include TenCate Geosynthetics, NAUE GmbH & Co. KG, Fibertex Nonwovens A/S.

b. The key factor which is driving North America geotextile market is rising civil engineering and agricultural activities due to rapid urbanization and industrialization in North America.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."