- Home

- »

- Pharmaceuticals

- »

-

North America Legal Cannabis Market, Industry Report, 2030GVR Report cover

![North America Legal Cannabis Market Size, Share & Trends Report]()

North America Legal Cannabis Market Size, Share & Trends Analysis Report By Source (Marijuana, Hemp), By Derivatives (CBD, THC), By Cultivation, By End Use (Medical, Recreational, Industrial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-828-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

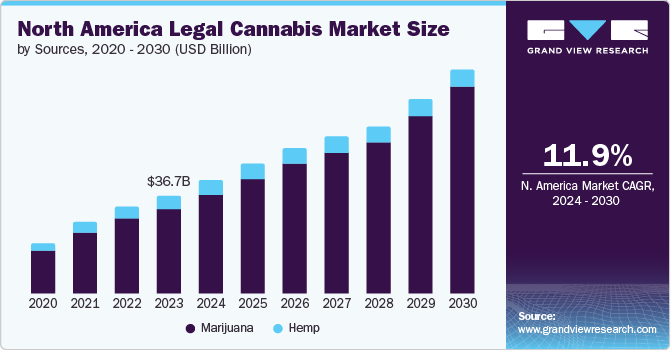

The North America legal cannabis market size was estimated at USD 36.70 billion in 2023 and is projected to grow at a CAGR of 11.9% from 2024 to 2030. Growing legalization and rising awareness with respect to health benefits provided by consumption of cannabis are some of the major factors driving the growth of the market. For instance, in May 2023, the Government of Minnesota legalized cannabis for recreational use and became the 23rd state in the U.S. to legalize adult-use cannabis. Moreover, Kentucky’s General Assembly passed a law legalizing medical cannabis for residents, which is effective from January 2025.

The growing need for remedies regarding pain management amongst the patient population is propelling the market growth. Moreover, the increasing number of patients suffering from chronic pain are the other factors anticipated to fuel the demand for cannabis for medical purposes over the forecast period. For instance, according to data published by the U.S. Pain Foundation in August 2023, 17.1 million individuals are suffering from high-impact chronic pain, and over 51.6 million individuals are living with chronic pain in the U.S. In addition, according to a study published in the JAMA Network Open in January 2023, almost one-third (1/3) of patients reported using cannabis to manage chronic pain.

Favorable government initiatives and rising investments by public and private companies propelling market growth. For instance, in April 2023, Alberta's government introduced the Sustainable Canadian Agricultural Partnership (Sustainable CAP) Program. Under this program, cannabis growers and processors in Canada are eligible to apply for USD 2.6 billion (3.5 billion Canadian dollars) in funding. The Ministry of Agriculture and Irrigation governs the program.

Furthermore, the positive consumer attitude towards cannabis, the expansion of cannabis market players, and the growing number of companies entering the North American region to cater to the growing demand for cannabis support the market growth. For instance, The Cannabist Company, a New York-based cannabis company, expanded its retail footprint by launching adult-use sales of cannabis in New Jersey, Maryland, and Virginia in July 2024. The company already has its operations in 16 states in the U.S.

Moreover, the rising utilization of cannabis for medical and non-medical purposes and ongoing research activities boost the market growth. For instance, in the last five years, federal funding has varied from USD 5,368.9, allocated to Ricci Cannabis for the development of a “wine style” non-alcoholic cannabis drinks through the National Research Council of Canada’s Industrial Research Assistance Program, to a significant USD 3.92 million granted to Pbg Biopharm a through the government’s Regional Economic Growth through Innovation program.

Furthermore, various cannabis companies invest in R&D to incorporate AI in their cannabis cultivation process and launch an AI-based platform. For instance, in April 2023, Barky AI and Highten introduced Canna-GPT, a cannabis AI platform that makes cannabis education more accessible. Users can ask cannabis-related queries in the app to get the answers efficiently and quickly.

Market Concentration & Characteristics

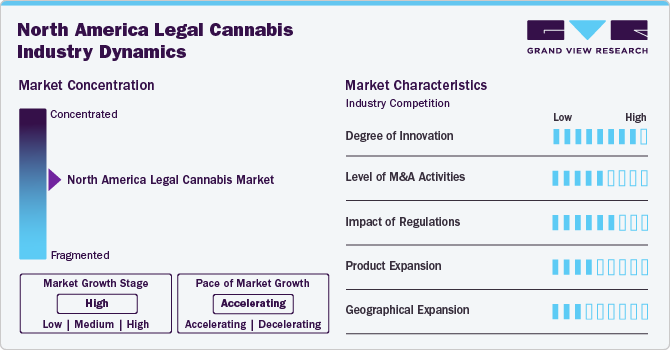

The North America legal cannabis market is characterized by a high degree of innovation owing to ongoing clinical trials on the use of cannabis and its medicinal properties, increasing product demand due to its health benefits, and growing preference for cannabis extracts such as oils and tinctures. For instance, Philadelphia College of Osteopathic Medicine (PCOM) conducts medical marijuana research to evaluate the effect of medical cannabis on quality of life, behavior, and chronic pain.

North America legal cannabis market is characterized by a medium level of merger and acquisition (M&A) activity by the leading players. Through M&A activity, these companies can expand their product portfolio, enter new territories, and strengthen their market position. For instance, in May 2022, Canopy Growth Corporation and Lemurian, Inc., a California-based cannabis company, entered into definitive agreements to acquire Jetty Extracts.

North America legal cannabis market is expected to witness significant growth owing to the increasing number of countries legalizing and providing a systematic regulatory framework for the cultivation and sale of cannabis. The regulatory authorities vary from state to state in the U.S. which are as follows:

Many companies are adopting various strategies, which include collaboration, product expansion, and partnerships, to strengthen their market position. For instance, in October 2023, The Cronos Group introduced new THCV -infused products, including Spinach FEELZ Full Tilt THC|THCV gummies and vapes with different flavors.

The popularity of cannabis-containing foods and the legalization of cannabis is rapidly rising due to the various health benefits associated with cannabis. Due to legalization, many market players are expanding their market presence in such areas. For instance, in June 2023, Canopy Growth Corporation partnered with VASCO Cannabis, Inc., a cannabis cultivator company, to increase the availability of its cannabis offerings across La Belle province.

Sources Insights

By source, the marijuana segment dominated the market in 2023 and is anticipated to witness the fastest growth with a CAGR of 12.92% over the forecast period. This growth is attributed to the growing adoption of marijuana products along with increasing legalization of medical marijuana.

In addition, marijuana oil is used for the treatment of cancer & nausea and can also be used for the improvement of the sleep cycle and for alleviating stress, pain, & anxiety. It is mostly used by people who refrain from smoking buds due to their ill effects. The demand for marijuana oil is anticipated to increase over the forecast period, as there has been a substantial increase in the number of patients preferring oil as compared to buds.

The hemp segment held a significant share in 2023, owing to its applications in several sectors, including pharmaceuticals, cosmetics, nutraceuticals, and food & beverage. Moreover, many key players focus on numerous initiatives, such as distribution partnerships and product innovation, to maintain their position in the market. For instance, in October 2022, Charlotte's Web Holdings, Inc. partnered with Gopuff Retail Company for the distribution of its products through Gopuff Retail Company in the U.S. states such as Arizona, Illinois, California, and New York and is expected to continue to expand throughout 2022 and 2023.

Derivatives Insights

By derivatives, the CBD segment dominated the market with a revenue share of 64.6% in 2023. Factors such as growing public awareness about CBD's health advantages, positive legislative policies, rising adoption of CBD-based cosmetics, and the increased use of CBD oil in multiple industries and its use in several medicines propel the market growth. Delush, Calyx Wellness, KaliKare, High On Love, Fitish, Birch + Beauty, Emprise Canada, and Love Necta are some of the CBD-based cosmetics brands available in North America.

However, other segment is expected to witness the fastest growth over the forecast period. This segment includes terpenes, flavonoids, and other minor cannabinoids. The growing popularity of terpenes and minor cannabinoids and new product launches are anticipated to boost the segment's growth. For instance, in January 2024, Texas Original, a medical cannabis company, introduced the Elevate beverage product, a medical cannabis product infused with cannabigerol (CBG). It offers uplifting, energizing relief for common symptoms associated with pain, anxiety, and inflammation.

Cultivation Insights

By cultivation, the indoor cultivation segment held the largest market share of 54.5% in 2023 and is expected to witness fastest growth over the forecast period. The liberalization of laws and regulations associated with cannabis cultivation, particularly for hemp cultivation due to its low THC content, is further increasing its adoption. Moreover, the legalization of cannabis in various states in the U.S. and countries in North America and its rising adoption for medical purposes are factors driving the market for cannabis cultivation. For instance, 18 states and Washington, D.C. in the U.S. permit some form of at-home cannabis growing.

The outdoor cultivation segment is expected to grow lucratively over the forecast period. Outdoor cultivation eliminates the need for expensive growing equipment, lowering the overall cost of the operation due to the ready availability of a natural environment that provides the necessary factors for cannabis plants to grow, driving the number of outdoor cultivation farms and aiding segment growth. Moreover, the introduction of new cannabis facilities boosts the market growth. For instance, in August 2019, MJ Holdings, Inc., a cannabis company in Nevada, launched an outdoor cannabis cultivation facility in the Amargosa Valley of Nevada.

End Use Insights

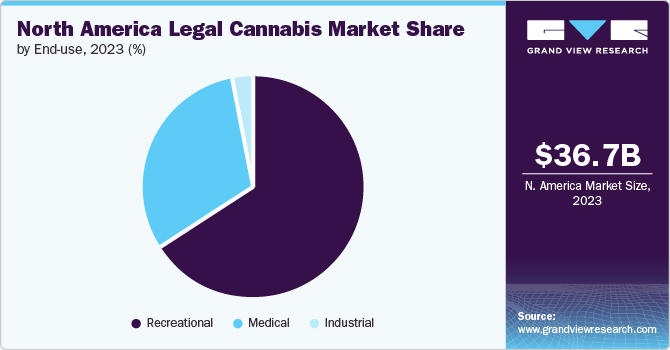

By end use, the recreational use segment dominated the market with revenue share of 66.3% in 2023 and is anticipated to grow at a fastest CAGR over the forecast period. Factors such as the growing legalization of cannabis for adult use and the increasing adoption of cannabis vape pens are fueling the market's growth. According to Headset.io, Vape Pens are the second most popular category in the U.S. and third most popular in Canada, capturing 23.6% and 17.1% market share, respectively; furthermore, according to data published by Flowhub, Millennials, and Gen Z makeup 62.8% of all U.S. cannabis sales.

The medical use held a significant market share in 2023, owing to the rising trend in plant-based medicines, especially for pain management. Furthermore, the growing acceptance of cannabis for the treatment of various chronic conditions, such as cancer, diabetes, depression and anxiety, arthritis, and epilepsy, drives the segment's growth. For instance, Epidiolex (CBD oral solution) was approved by the U.S. FDA for the treatment of seizures associated with two forms of epilepsy such as Dravet syndrome and Lennox-Gastaut syndrome.

Key North America Legal Cannabis Company Insights

Key participants in the North America legal cannabis market are focusing on developing innovative business growth strategies such as product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key North America Legal Cannabis Companies:

- Canopy Growth Corporation

- Charlotte's Web, Inc.

- Aurora Cannabis Inc.

- Tilray Brands

- The Cronos Group

- Jazz Pharmaceuticals, Inc.

- Sundial Growers

- Medipharm Labs

- NuLeaf Naturals, LLC

- Irwin Naturals

Recent Developments

- In July 2023, the RIFF cannabis brand from Tilray Brands launched new THC beverages with two fruit flavors: wild raspberry lemonade and blue raspberry ice.

- In March 2023, Irwin Naturals, launched Irwin Naturals Cannabis’ new CBD 25mg Softgels in Canada. The product is available nationwide under the Starseed Medicinal Medical Group platform.

North America Legal Cannabis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 41.75 billion

Revenue forecast in 2030

USD 82.18 billion

Growth rate

CAGR of 11.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, derivatives, cultivation, end use, and region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Canopy Growth Corporation, Charlotte's Web, Inc., Aurora Cannabis Inc., Tilray Brands, The Cronos Group, Jazz Pharmaceuticals, Inc., Sundial Growers, Medipharm Labs, NuLeaf Naturals, LLC, Irwin Naturals

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Legal Cannabis Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030.For the purpose of this study, Grand View Research has segmented the North America legal cannabis market report on the basis of source, derivatives, cultivation, end use, and region:

-

Sources Outlook (Revenue, USD Million, 2018 - 2030)

-

Marijuana

-

Flowers

-

Oil and Tinctures

-

-

Hemp

-

Hemp CBD

-

Industrial Hemp

-

-

-

Cultivation Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor Cultivation

-

Greenhouse Cultivation

-

Outdoor Cultivation

-

-

Derivatives Outlook (Revenue, USD Million, 2018 - 2030)

-

CBD

-

THC

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Use

-

Cancer

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer’s

-

Post-Traumatic Stress Disorder (PTSD)

-

Parkinson's

-

Tourette’s

-

Others

-

-

Recreational Use

-

Industrial Use

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America legal cannabis market size was estimated at USD 36.70 billion in 2023 and is expected to reach USD 41.75 billion in 2024.

b. The North America legal cannabis market is expected to grow at a compound annual growth rate of 11.95% from 2024 to 2030 to reach USD 82.18 billion by 2030.

b. The U.S. dominated the North America legal cannabis market with a share of 91.55% in 2023. This is attributable to the increasing legalization of medical marijuana and the liberalism of government regarding the same.

b. Some of the players operating in the North America legal cannabis market are Canopy Growth Corporation; Aphria, Inc.; Aurora Cannabis; Tilray; The Cronos Group; GW Pharmaceuticals; Sundial Growers; Insys Therapeutics, Inc.; Vivo Cannabis; and Cara Therapeutics, Inc.

b. Growing legalization and rising awareness with respect to health benefits provided by the consumption of cannabis are some of the major factors driving the growth of the North America legal cannabis market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."