- Home

- »

- Next Generation Technologies

- »

-

North America MRO Distribution Market Size Report, 2030GVR Report cover

![North America MRO Distribution Market Size, Share & Trends Report]()

North America MRO Distribution Market Size, Share & Trends Analysis Report By Product (Power Transmission, Automation), By End-use (Food, Beverage & Tobacco), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-072-9

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

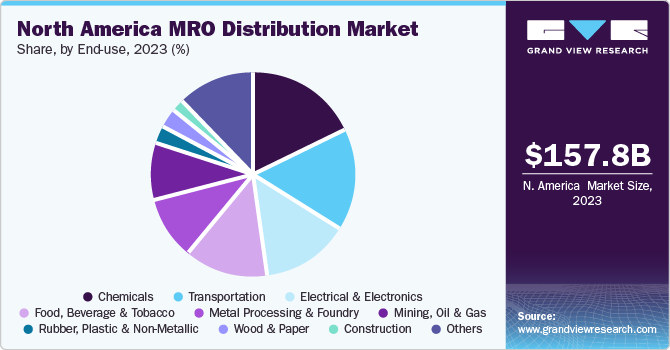

The North America MRO distribution market size was valued at USD 157.80 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 2.6% from 2024 to 2030. The MRO market forecasts are dependent on optimum efficiency products developed by manufacturers in order to achieve low costs. The periodic maintenance, repair, and overhaul activities help to reduce operational costs and enhance the productivity of industrial operations. As a result, industries initiate multiple scheduled and preventive maintenance processes.

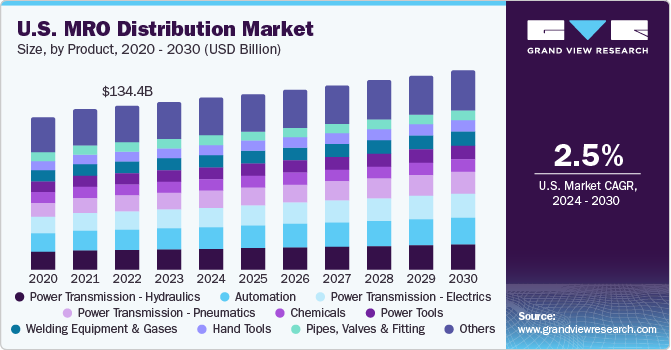

The U.S. MRO market is primarily driven by the expanding presence of OEMs and the growth of service industries in the country. Additionally, the industrial sector, which accounts for a significant share of the GDP of the U.S., is likely to witness growth on account of favorable economic conditions, the presence of significant market players, vital financial status, increasing investments, dollar evaluation, and rapid industrialization. This is further anticipated to drive the market growth in the country.

The MRO distribution or supply chain was traditionally considered an indirect component of industrial operations. However, MRO adoption has registered a considerable change within the industries, especially with the OEMs, considering MRO distribution channels as potential partners to enhance operational efficiencies, resulting in higher profitability. Simultaneously, technology & service outsourcing providers have developed specific solutions to address the needs of several regional end-use industries.

The manufacturers need to maintain their assets, including facilities, equipment, workforce, machineries, etc., as it is essential to prevent any machinery or equipment failure, which otherwise will lead to a loss in production and, eventually, loss of profitability. Hence, maintaining these physical assets is indispensable for running an organization efficiently. Manufacturers focus on optimum energy use, with minimum downtime, so that the physical capital lasts longer and remains an asset rather than becoming a liability. To achieve such production efficiency, the manufacturers depend on preventive maintenance and repair services, fueling the market growth.

Market Concentration & Characteristics

The market growth stage is medium, and pace of the market growth is accelerating. The market is fragmented on account of the large number of industrial MRO companies involved in providing maintenance, repair, and overhaul services. Additionally, the players have a wide range of distribution networks across the world, which further increases the competition in the market.

Several technologies have been adopted by the MRO distributors in the market to enhance the process and make it more efficient. MRO distribution has been a labor-intensive industry that requires skilled professional service providers. However, with increasing labor costs, distributors are investing and focusing on embedding robotics in the MRO market.

The North America MRO distribution market is governed by a number of regulations and standards with regard to its service and products. Several agencies have levied regulations for MRO distribution market in North America. Additionally, specific regulations in the market applies to manufacturers and distributors of machinery and devices but not to operating companies. However, these regulations could have a significant impact on the North America MRO distribution market, affecting the development and adoption of MRO services.

MRO products do not have any defined substitutes. However, similar product models with different brand images act as strong substitutes for each other. Hence, the threat of substitutes is minimal, with only threat of internal substitution.

End-user concentration is a significant factor in the North America MRO distribution market. Since there are several end-user industries that are driving demand for MRO distribution services. The concentration of demand in a small number of end-user industries creates opportunities for companies that focus on providing MRO distribution services for these industries. However, it also creates challenges for companies that are trying to compete in a crowded market.

Product Insights

Automation dominated the market and accounted for a share of 12.5% in 2023. Automation in overall maintenance, repair, and overhaul operations is gaining traction in the region owing to its facilities of easy maintenance and efficient tracking of every task. Use of fully mechanized and automated machinery clubbed with integrated software contributes to the efficient services of the structures. Moreover, rising concerns about reducing overall operational time are anticipated to increase the penetration of automated services in MRO operations.

With the widespread use of electrical components in production mechanisms to facilitate transmission operations, power transmission product is expected to grow by a significant CAGR of 3.5% over the forecast period. The components clubbed in the mechanical assemblies are current devices, fuses, switches, circuits, and other electrical components.

End-use Insights

Chemical segment dominated the market in 2023 with a revenue share of 18.2%. According to the American Chemistry Council (ACC), the chemical industry is anticipated to gain substantial growth over the forecast period. The U.S. has been one of the attractive locations for chemical manufacturers to operate, with capital spending in the sector surging 21% in 2018 and reaching over USD 44 billion, which has benefited the market, and the trend is expected to continue over the forecast period.

Food, beverage & tobacco sector is projected to grow at the fastest CAGR over the forecast period. The food-producing companies in North America are focusing on improving machine capabilities to increase food production. Moreover, the companies are also focusing on the norms for food safety and standards. Thus, MRO operations in food, beverage, and tobacco facilities are carried out frequently to maintain the operational flow.

Further, it is expected that several facilities will be built in the region as a result of increasing shale gas operations to support component distribution. The increase in domestic onshore oil & gas production and shale gas transportation are expected to propel the demand for MRO activities in the facilities, fueling market growth.

Regional Insights

The U.S. MRO distribution market dominated the market and accounted for 87.1% share in 2023. U.S. exhibits one of the largest MRO sectors in world and is characterized by presence of several leading companies. Furthermore, demand for MRO distribution in the country is primarily driven by expanding presence of OEMs. Additionally, The industrial sector, which accounts for a significant share of the GDP of the U.S., is likely to witness growth on account of favorable economic conditions, the presence of significant market players, vital financial status, increasing investments, dollar evaluation, and rapid industrialization. This is further expected to drive the market growth in the country.

Canada is anticipated to witness significant growth in the MRO distribution market. The manufacturing sector in Canada is expected to witness considerable growth. Thus, growing manufacturing of industrial machinery, owing to the rising demand from end-use industries, is expected to promote market growth in the country.

The major manufacturing industries in Mexico include automotive, apparel & textile, medical devices, and consumer products. The automotive manufacturing industry in Mexico has witnessed high growth over the past few, owing to several major automotive companies, including Chrysler, Fiat, Ford, GM, and Toyota, setting up their manufacturing plants owing to close proximity to the U.S. and South American market. This is expected to increase the demand for maintenance, repair, and overhaul, thus driving the growth of MRO services market over the forecast period.

Key Companies & Market Share Insights

Major companies compete on the basis of distribution networks, delivery efficiency, and competitive pricing. The market is highly fragmented and is characterized by the presence of a large number of players. The product demand is highly dependent on the growth of the end-use industries and is expected to grow moderately due to limited growth realized by the application industries. Quality, price, and efficiency in delivery are the major competitive factors that are expected to decide the choice of supplier for MRO.

-

In December 2023, Harrington Process Solutions, a distributing company based in California, acquired PumpMan, which offers maintenance, repair, and replacement services for components of wastewater and water pumping systems. The acquisition will help Harrington Process Solutions to strengthen its position in water sector by adding pump services of PumpMan.

-

In October 2022, Premier Farnell Limited strengthened its investments in industrial products in order to support predictive maintenance services for manufacturers. This includes the accumulation of industrial internet-of-things (IIoT) to help the manufacturers in reducing the time, cost and effort required to implement scheduled maintenance.

Key North America MRO Distribution Companies:

- Hillman Group, Inc.

- Wajax Limited

- FCX Performance

- SBP Holdings

- R.S. Hughes Co., Inc.

- DGI Supply

- Lawson Products, Inc.

- AWC

- Hisco, Inc.

- W.W. Grainger, Inc.

- Bisco Industries

- Kaydon Bearings

- Bearing Distributors, Inc.

North America MRO Distribution Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 161.69 billion

Revenue forecast in 2030

USD 188.47 billion

Growth Rate

CAGR of 2.6% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, End-use, region

Regional scope

North America

Country scope

U.S., Canada, Mexico

Key companies profiled

Hillman Group, Inc., Wajax Limited, FCX Performance, SBP Holdings, R.S. Hughes Co., Inc., DGI Supply, Lawson Products, Inc., AWC, Hisco, Inc., W.W. Grainger, Inc., Bisco Industries, Kaydon Bearings

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America MRO Distribution Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-se0067ments from 2018 to 2030. For this study, Grand View Research has segmented the North America MRO distribution market report based on product, end-use, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Abrasives

-

Chemicals

-

Cutting Tools

-

Fasteners

-

Hand Tools

-

Pipes, Valves & Fitting

-

Power Tools

-

Power Transmission - Hydraulics

-

Power Transmission - Pneumatics

-

Power Transmission - Electronics

-

Rubber Products

-

Seal

-

Welding Equipment & Gases

-

Automation

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food, Beverage & Tobacco

-

Textile

-

Wood & Paper

-

Mining, Oil & Gas

-

Metal Processing & Foundry

-

Rubber, Plastic & Non-metallic

-

Chemicals

-

Pharmaceuticals

-

Electrical & Electronics

-

Transportation

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

New England

-

Mid-Atlantic

-

East North Central

-

West North Central

-

South Atlantic

-

East South Central

-

West South Central

-

West

-

-

Canada

-

Eastern Canada

-

Western Canada

-

Northern Canada

-

-

Mexico

-

-

Frequently Asked Questions About This Report

b. North America MRO distribution market size was estimated at USD 157.8 billion in 2023 and is expected to reach USD 161.69 billion in 2024.

b. The North America MRO distribution market is expected to grow at a compound annual growth rate of 2.6% from 2024 to 2030 to reach USD 188.47 billion by 2030.

b. Hydraulic power transmission led the market and accounted for more than 12.0% share of the market revenue in 2023, owing to the hydraulic systems being installed in heavy machinery in order to ease the lifting and contracting operations

b. Some of the key players operating in the North America maintenance, repair and overhaul distribution market include Hillman Group, Inc., Wajax Industrial Components, FCX Performance, SBP Holdings, R.S. Hughes Co., Inc., DGI Supply, Lawson Products, Inc., AWC, Hisco, Inc., Kimball Midwest, Bisco Industries, Kaydon Corporation, and BDI.

b. The key factors that are driving the North America MRO distribution market include expanding the manufacturing sector in North America, Increasing product penetration in the manufacturing industry, and various initiatives by manufacturers to attain optimum efficiency.

Table of Contents

Chapter 1. North America MRO Distribution Market: Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumption

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. List of Data Sources

Chapter 2. North America MRO Distribution Market: Executive Summary

2.1. Market Outlook, 2023 (USD Million)

2.2. Segmental Outlook

2.3. Competitive Insights

Chapter 3. North America MRO Distribution Market: Variables, Trends & Scope

3.1. Market Segmentation

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Restraint Analysis

3.4. Business Environmental Tools Analysis: North America MRO distribution market

3.4.1. Porter’s Five Forces Analysis

3.4.1.1. Bargaining Power of Suppliers

3.4.1.2. Bargaining Power of Buyers

3.4.1.3. Threat of Substitution

3.4.1.4. Threat of New Entrants

3.4.1.5. Competitive Rivalry

3.4.2. PESTLE Analysis, by SWOT

3.4.2.1. Political Landscape

3.4.2.2. Economic Landscape

3.4.2.3. Social Landscape

3.4.2.4. Technology Landscape

3.4.2.5. Environmental Landscape

3.4.2.6. Legal Landscape

3.5. Market Disruption Analysis

Chapter 4. North America MRO Distribution Market: Product Estimates & Trend Analysis

4.1. Key Takeaways

4.2. Product Market Share Analysis, 2023 & 2030

4.3. Abrasives

4.3.1. North America MRO Distribution Market estimates and forecasts, by Abrasives, 2018 - 2030 (USD Billion)

4.4. Chemicals

4.4.1. North America MRO Distribution Market estimates and forecasts, by Chemicals, 2018 - 2030 (USD Billion)

4.5. Cutting Tools

4.5.1. North America MRO Distribution Market estimates and forecasts, by Cutting Tools, 2018 - 2030 (USD Billion)

4.6. Fasteners

4.6.1. North America MRO Distribution Market estimates and forecasts, by Fasteners, 2018 - 2030 (USD Billion)

4.7. Hand Tools

4.7.1. North America MRO Distribution Market estimates and forecasts, by Hand Tools, 2018 - 2030 (USD Billion)

4.8. Pipes, Valves & Fitting

4.8.1. North America MRO Distribution Market estimates and forecasts, by Pipes, Valves & Fitting, 2018 - 2030 (USD Billion)

4.9. Power Tools

4.9.1. North America MRO Distribution Market estimates and forecasts, by Power Tools, 2018 - 2030 (USD Billion)

4.10. Power Transmission - Hydraulics

4.10.1. North America MRO Distribution Market estimates and forecasts, by Power Transmission - Hydraulics, 2018 - 2030 (USD Billion)

4.11. Power Transmission - Pneumatics

4.11.1. North America MRO Distribution Market estimates and forecasts, by Power Transmission- Pneumatics, 2018 - 2030 (USD Billion)

4.12. Power Transmission - Electrics

4.12.1. North America MRO Distribution Market estimates and forecasts, by Power Transmission- Electrics, 2018 - 2030 (USD Billion)

4.13. Rubber Products

4.13.1. North America MRO Distribution Market estimates and forecasts, by Rubber Products, 2018 - 2030 (USD Billion)

4.14. Seal

4.14.1. North America MRO Distribution Market estimates and forecasts, by Seal, 2018 - 2030 (USD Billion)

4.15. Welding Equipment & Gases

4.15.1. North America MRO Distribution Market estimates and forecasts, by Welding Equipment & Gases, 2018 - 2030 (USD Billion)

4.16. Automation

4.16.1. North America MRO Distribution Market estimates and forecasts, by Automation, 2018 - 2030 (USD Billion)

4.17. Others

4.17.1. North America MRO Distribution Market estimates and forecasts, by Others, 2018 - 2030 (USD Billion)

Chapter 5. North America MRO Distribution Market: End-use Estimates & Trend Analysis

5.1. Key Takeaways

5.2. End-use Market Share Analysis, 2023 & 2030

5.3. Food, Beverage, & Tobacco

5.3.1. North America MRO Distribution Market estimates and forecasts, by Food, Beverage, & Tobacco, 2018 - 2030 (USD Billion)

5.4. Textile

5.4.1. North America MRO Distribution Market estimates and forecasts, by Textile, 2018 - 2030 (USD Billion)

5.5. Wood & Paper

5.5.1. North America MRO Distribution Market estimates and forecasts, by Wood & Paper, 2018 - 2030 (USD Billion)

5.6. Mining, Oil, & Gas

5.6.1. North America MRO Distribution Market estimates and forecasts, by Mining, Oil, & Gas, 2018 - 2030 (USD Billion)

5.7. Metal Processing & Foundry

5.7.1. North America MRO Distribution Market estimates and forecasts, by Metal Processing & Foundry, 2018 - 2030 (USD Billion)

5.8. Rubber, Plastic & Non-Metallic

5.8.1. North America MRO Distribution Market estimates and forecasts, by Rubber, Plastic & Non-Metallic, 2018 - 2030 (USD Billion)

5.9. Chemicals

5.9.1. North America MRO Distribution Market estimates and forecasts, by Chemicals, 2018 - 2030 (USD Billion)

5.10. Pharmaceuticals

5.10.1. North America MRO Distribution Market estimates and forecasts, by Pharmaceuticals, 2018 - 2030 (USD Billion)

5.11. Electrical & Electronics

5.11.1. North America MRO Distribution Market estimates and forecasts, by Electrical & Electronics, 2018 - 2030 (USD Billion)

5.12. Transportation

5.12.1. North America MRO Distribution Market estimates and forecasts, by Transportation, 2018 - 2030 (USD Billion)

5.13. Construction

5.13.1. North America MRO Distribution Market estimates and forecasts, by Construction, 2018 - 2030 (USD Billion)

5.14. Others

5.14.1. North America MRO Distribution Market estimates and forecasts, by Others, 2018 - 2030 (USD Billion)

Chapter 6. North America MRO Distribution Market: Regional Estimates & Trend Analysis

6.1. Key Takeaways

6.2. Regional Market Share Analysis, 2023 & 2030

6.3. North America

6.3.1. North America MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.3.2. U.S.

6.3.2.1. U.S. MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.3.2.2. New England

6.3.2.2.1. New England MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.3.2.3. Mid-Atlantic

6.3.2.3.1. Mid-Atlantic MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.3.2.4. East North Central

6.3.2.4.1. East North Central MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.3.2.5. West North Central

6.3.2.5.1. West North Central MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.3.2.6. South Atlantic

6.3.2.6.1. South Atlantic MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.3.2.7. East South Central

6.3.2.7.1. East South Central MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.3.2.8. West South Central

6.3.2.8.1. West South Central MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.3.2.9. West

6.3.2.9.1. West MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.3.3. Canada

6.3.3.1. Canada MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.3.3.2. Eastern Canada

6.3.3.2.1. Eastern Canada MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.3.3.3. Western Canada

6.3.3.3.1. Western Canada MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.3.3.4. Northern Canada

6.3.3.4.1. Northern Canada MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.3.4. Mexico

6.3.4.1. Mexico MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. North America MRO Distribution Market Supplier Intelligence

7.1. Kraljic Matrix/Portfolio Analysis

7.2. Engagement Model

7.3. Negotiation Strategies

7.4. Sourcing Best Practices

7.5. Vendor Selection Criteria

7.6. List of Raw Material Suppliers

Chapter 8. Competitive Landscape

8.1. Key Players, their Recent Developments, and their Impact on Industry

8.2. Key Company/Competition Categorization

8.3. Company Market Position Analysis

8.4. Company Heat Map Analysis

8.5. Strategy Mapping

8.6. Company Listing

8.6.1. Hillman Group, Inc.

8.6.1.1. Company Overview

8.6.1.2. Financial Performance

8.6.1.3. Product Benchmarking

8.6.1.4. Strategic Initiatives

8.6.2. Wajax Industrial Components

8.6.2.1. Company Overview

8.6.2.2. Financial Performance

8.6.2.3. Product Benchmarking

8.6.2.4. Strategic Initiatives

8.6.3. FCX Performance

8.6.3.1. Company Overview

8.6.3.2. Financial Performance

8.6.3.3. Product Benchmarking

8.6.3.4. Strategic Initiatives

8.6.4. SBP Holdings

8.6.4.1. Company Overview

8.6.4.2. Financial Performance

8.6.4.3. Product Benchmarking

8.6.4.4. Strategic Initiatives

8.6.5. R.S. Hughes Co., Inc.

8.6.5.1. Company Overview

8.6.5.2. Financial Performance

8.6.5.3. Product Benchmarking

8.6.5.4. Strategic Initiatives

8.6.6. DGI Supply

8.6.6.1. Company Overview

8.6.6.2. Financial Performance

8.6.6.3. Product Benchmarking

8.6.6.4. Strategic Initiatives

8.6.7. Lawson Products, Inc.

8.6.7.1. Company Overview

8.6.7.2. Financial Performance

8.6.7.3. Product Benchmarking

8.6.7.4. Strategic Initiatives

8.6.8. AWC

8.6.8.1. Company Overview

8.6.8.2. Financial Performance

8.6.8.3. Product Benchmarking

8.6.8.4. Strategic Initiatives

8.6.9. Hisco, Inc.

8.6.9.1. Company Overview

8.6.9.2. Financial Performance

8.6.9.3. Product Benchmarking

8.6.9.4. Strategic Initiatives

8.6.10. W.W. Grainger, Inc.

8.6.10.1. Company Overview

8.6.10.2. Financial Performance

8.6.10.3. Product Benchmarking

8.6.10.4. Strategic Initiatives

8.6.11. Bisco Industries

8.6.11.1. Company Overview

8.6.11.2. Financial Performance

8.6.11.3. Product Benchmarking

8.6.11.4. Strategic Initiatives

8.6.12. Kaydon Bearings

8.6.12.1. Company Overview

8.6.12.2. Financial Performance

8.6.12.3. Product Benchmarking

8.6.12.4. Strategic Initiatives

8.6.13. Bearing Distributors, Inc.

8.6.13.1. Company Overview

8.6.13.2. Financial Performance

8.6.13.3. Product Benchmarking

8.6.13.4. Strategic Initiatives

List of Tables

Table 1 North America MRO Distribution Market Estimated & Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 2 North America MRO Distribution Market Estimated & Forecasts, By End - use, 2018 - 2030 (USD Billion)

Table 3 U.S. MRO Distribution Market Estimated & Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 4 U.S. MRO Distribution Market Estimated & Forecasts, By End - use, 2018 - 2030 (USD Billion)

Table 5 New England MRO Distribution Market Estimated & Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 6 New England MRO Distribution Market Estimated & Forecasts, By End - use, 2018 - 2030 (USD Billion)

Table 7 Mid - Atlantic MRO Distribution Market Estimated & Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 8 Mid - Atlantic MRO Distribution Market Estimated & Forecasts, By End - use, 2018 - 2030 (USD Billion)

Table 9 East North Central MRO Distribution Market Estimated & Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 10 East North Central MRO Distribution Market Estimated & Forecasts, By End - use, 2018 - 2030 (USD Billion)

Table 11 West North Central MRO Distribution Market Estimated & Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 12 West North Central MRO Distribution Market Estimated & Forecasts, By End - use, 2018 - 2030 (USD Billion)

Table 13 South Atlantic MRO Distribution Market Estimated & Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 14 South Atlantic MRO Distribution Market Estimated & Forecasts, By End - use, 2018 - 2030 (USD Billion)

Table 15 East South Central MRO Distribution Market Estimated & Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 16 East South Central MRO Distribution Market Estimated & Forecasts, By End - use, 2018 - 2030 (USD Billion)

Table 17 West South Central MRO Distribution Market Estimated & Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 18 West South Central MRO Distribution Market Estimated & Forecasts, By End - use, 2018 - 2030 (USD Billion)

Table 19 West MRO Distribution Market Estimated & Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 20 West MRO Distribution Market Estimated & Forecasts, By End - use, 2018 - 2030 (USD Billion)

Table 21 Canada MRO Distribution Market Estimated & Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 22 Canada MRO Distribution Market Estimated & Forecasts, By End - use, 2018 - 2030 (USD Billion)

Table 23 Eastern Canada MRO Distribution Market Estimated & Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 24 Eastern Canada MRO Distribution Market Estimated & Forecasts, By End - use, 2018 - 2030 (USD Billion)

Table 25 Western Canada MRO Distribution Market Estimated & Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 26 Western Canada MRO Distribution Market Estimated & Forecasts, By End - use, 2018 - 2030 (USD Billion)

Table 27 Northern Canada MRO Distribution Market Estimated & Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 28 Northern Canada MRO Distribution Market Estimated & Forecasts, By End - use, 2018 - 2030 (USD Billion)

Table 29 Mexico MRO Distribution Market Estimated & Forecasts, By Product, 2018 - 2030 (USD Billion)

Table 30 Mexico MRO Distribution Market Estimated & Forecasts, By End - use, 2018 - 2030 (USD Billion)

Table 31 Recent Developments & Impact Analysis, By Key Market Participants

Table 32 Company Heat Map Analysis, 2023

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Patter

Fig. 3 Primary Research Process

Fig. 4 Market Research Approaches - Bottom Up Approach

Fig. 5 Market Research Approaches - Top Down Approach

Fig. 6 Market Research Approaches - Combined Approach

Fig. 7 Market Outlook

Fig. 8 Segmental Outlook

Fig. 9 Competitive Outlook

Fig. 10 North America MRO Distribution - Market segmentation & scope

Fig. 11 North America MRO Distribution - Market Dynamics

Fig. 12 North America MRO Distribution Market estimates and forecasts, by Abrasives, 2018 - 2030 (USD Billion)

Fig. 13 North America MRO Distribution Market estimates and forecasts, by Chemicals, 2018 - 2030 (USD Billion)

Fig. 14 North America MRO Distribution Market estimates and forecasts, by Cutting Tools, 2018 - 2030 (USD Billion)

Fig. 15 North America MRO Distribution Market estimates and forecasts, by Fasteners, 2018 - 2030 (USD Billion)

Fig. 16 North America MRO Distribution Market estimates and forecasts, by Hand Tools, 2018 - 2030 (USD Billion)

Fig. 17 North America MRO Distribution Market estimates and forecasts, by Pipes, Valves & Fitting, 2018 - 2030 (USD Billion)

Fig. 18 North America MRO Distribution Market estimates and forecasts, by Power Tools, 2018 - 2030 (USD Billion)

Fig. 19 North America MRO Distribution Market estimates and forecasts, by Power Transmission - Hydraulics, 2018 - 2030 (USD Billion)

Fig. 20 North America MRO Distribution Market estimates and forecasts, by Power Transmission- Pneumatics, 2018 - 2030 (USD Billion)

Fig. 21 North America MRO Distribution Market estimates and forecasts, by Power Transmission- Electrics, 2018 - 2030 (USD Billion)

Fig. 22 North America MRO Distribution Market estimates and forecasts, by Rubber Products, 2018 - 2030 (USD Billion)

Fig. 23 North America MRO Distribution Market estimates and forecasts, by Seal, 2018 - 2030 (USD Billion)

Fig. 24 North America MRO Distribution Market estimates and forecasts, by Welding Equipment & Gases, 2018 - 2030 (USD Billion)

Fig. 25 North America MRO Distribution Market estimates and forecasts, by Automation, 2018 - 2030 (USD Billion)

Fig. 26 North America MRO Distribution Market estimates and forecasts, by Others, 2018 - 2030 (USD Billion)

Fig. 27 North America MRO Distribution Market estimates and forecasts, by Food, Beverage, & Tobacco, 2018 - 2030 (USD Billion)

Fig. 28 North America MRO Distribution Market estimates and forecasts, by Textile, 2018 - 2030 (USD Billion)

Fig. 29 North America MRO Distribution Market estimates and forecasts, by Wood & Paper, 2018 - 2030 (USD Billion)

Fig. 30 North America MRO Distribution Market estimates and forecasts, by Mining, Oil, & Gas, 2018 - 2030 (USD Billion)

Fig. 31 North America MRO Distribution Market estimates and forecasts, by Metal Processing & Foundry, 2018 - 2030 (USD Billion)

Fig. 32 North America MRO Distribution Market estimates and forecasts, by Rubber, Plastic & Non-Metallic, 2018 - 2030 (USD Billion)

Fig. 33 North America MRO Distribution Market estimates and forecasts, by Chemicals, 2018 - 2030 (USD Billion)

Fig. 34 North America MRO Distribution Market estimates and forecasts, by Pharmaceuticals, 2018 - 2030 (USD Billion)

Fig. 35 North America MRO Distribution Market estimates and forecasts, by Electrical & Electronics, 2018 - 2030 (USD Billion)

Fig. 36 North America MRO Distribution Market estimates and forecasts, by Transportation, 2018 - 2030 (USD Billion)

Fig. 37 North America MRO Distribution Market estimates and forecasts, by Construction, 2018 - 2030 (USD Billion)

Fig. 38 North America MRO Distribution Market estimates and forecasts, by Others, 2018 - 2030 (USD Billion)

Fig. 39 U.S. MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 40 New England MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 41 Mid-Atlantic MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 42 East North Central MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 43 West North Central MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 44 South Atlantic MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 45 East South Central MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 46 West South Central MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 47 West MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 48 Canada MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 49 Eastern Canada MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 50 Western Canada MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 51 Northern Canada MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 52 Mexico MRO Distribution Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 53 Key Company Categorization

Fig. 54 Company Market Positioning

Fig. 55 Strategy MappingWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- North America MRO Distribution Market Product Outlook (Revenue, USD Billion; 2018 - 2030)

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- North America MRO Distribution Market End-use Outlook (Revenue, USD Billion; 2018 - 2030)

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- North America MRO Distribution Market Regional Outlook (Revenue, USD Billion; 2018 - 2030)

- North America

- North America MRO Distribution Market, By Product

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- North America MRO Distribution Market, By End-use

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- U.S.

- U.S. MRO Distribution Market, By Product

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- U.S. MRO Distribution Market, By End-use

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- New England

- New England MRO Distribution Market, By Product

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- New England MRO Distribution Market, By End-use

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- New England MRO Distribution Market, By Product

- Mid-Atlantic

- Mid-Atlantic MRO Distribution Market, By Product

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- Mid-Atlantic MRO Distribution Market, By End-use

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- Mid-Atlantic MRO Distribution Market, By Product

- East North Central

- East North Central MRO Distribution Market, By Product

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- East North Central MRO Distribution Market, By End-use

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- East North Central MRO Distribution Market, By Product

- West North Central

- West North Central MRO Distribution Market, By Product

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- West North Central MRO Distribution Market, By End-use

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- West North Central MRO Distribution Market, By Product

- South Atlantic

- South Atlantic MRO Distribution Market, By Product

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- South Atlantic MRO Distribution Market, By End-use

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- South Atlantic MRO Distribution Market, By Product

- East South Central

- East South Central MRO Distribution Market, By Product

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- East South Central MRO Distribution Market, By End-use

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- East South Central MRO Distribution Market, By Product

- West South Central

- West South Central MRO Distribution Market, By Product

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- West South Central MRO Distribution Market, By End-use

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- West South Central MRO Distribution Market, By Product

- West

- West MRO Distribution Market, By Product

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- West MRO Distribution Market, By End-use

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- West MRO Distribution Market, By Product

- U.S. MRO Distribution Market, By Product

- Canada

- Canada MRO Distribution Market, By Product

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- Canada MRO Distribution Market, By End-use

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- Eastern Canada

- Eastern Canada MRO Distribution Market, By Product

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- Eastern Canada MRO Distribution Market, By End-use

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- Eastern Canada MRO Distribution Market, By Product

- Western Canada

- Western Canada MRO Distribution Market, By Product

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- Western Canada MRO Distribution Market, By End-use

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- Western Canada MRO Distribution Market, By Product

- Northern Canada

- Northern Canada MRO Distribution Market, By Product

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- Northern Canada MRO Distribution Market, By End-use

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- Northern Canada MRO Distribution Market, By Product

- Canada MRO Distribution Market, By Product

- Mexico

- Mexico MRO Distribution Market, By Product

- Abrasives

- Chemicals

- Cutting Tools

- Fasteners

- Hand Tools

- Pipes, Valves & Fitting

- Power Tools

- Power Transmission - Hydraulics

- Power Transmission - Pneumatics

- Power Transmission - Electrics

- Rubber products

- Seal

- Welding Equipment & Gases

- Automation

- Others

- Mexico MRO Distribution Market, By End-use

- Food, Beverage, & Tobacco

- Textile

- Wood & Paper

- Mining, Oil, & Gas

- Metal Processing & Foundry

- Rubber, Plastic & Non-Metallic

- Chemicals

- Pharmaceuticals

- Electrical & Electronics

- Transportation

- Construction

- Others

- Mexico MRO Distribution Market, By Product

- North America MRO Distribution Market, By Product

- North America

North America MRO Distribution Market Dynamics

Driver: Expanding manufacturing sector in North America

The manufacturing industries play a vital role in the North American economy. Governments in the region have focused on developing the manufacturing sector to drive economic growth. This sector has been a dynamic force for economic growth, innovation, and productivity, serving as the foundation for various other industries such as rental, healthcare, financial, professional services, and technology. The United States has been at the forefront of innovation in advanced manufacturing technologies, including the Internet of Things (IoT), predictive analytics, smart factories, advanced materials, and more, which are crucial for future competitiveness. The shift towards more significant value and the use of advanced technology is expected to drive the manufacturing industry further. The United States is among the top five countries that have invested in advanced manufacturing technologies and processes. Industry experts predict that advanced technologies will remain among the top ten technologies in the coming years. New and favorable regulatory policies in the United States, focused on profitability, monetary control, technology transfer, foreign direct investments (FDIs), science and technology, intellectual property protection, safety, and health regulations, serve as indicators to attract new businesses and create a competitive advantage. The North American region receives significant investment in manufacturing thanks to its strong energy profile, high-quality infrastructure, talented workforce, and robust industrial clusters that support innovation. The United States has always been a key player in this cluster.

Driver: Various initiatives taken by manufacturers to attain a higher level of operational optimization

The maintenance of assets, such as facilities, equipment, workforce, and machinery, is crucial for manufacturers to prevent any machinery or equipment failures. Failure to do so can result in a loss of production and, ultimately, a loss of profitability. Therefore, it is essential for organizations to maintain these physical assets efficiently. Manufacturers strive for optimal energy usage and minimal downtime to ensure that their physical capital remains an asset rather than a liability. To achieve production efficiency, manufacturers rely on preventive maintenance and repairs. Manufacturers are actively pursuing various initiatives to enhance key performance indicators in the region. These initiatives involve analyzing the facility's equipment or machinery to prioritize repairs and determine which resources need to be replaced or transformed. Additionally, routine preventive procedures are implemented to maintain the machinery in optimal working condition. Over the past few years, North American manufacturers have increasingly embraced these key performance indicators (KPIs) to ensure smooth equipment operations and organizational success.

Restraint: Process inefficiencies and waste of MRO materials

MRO products and their materials vary based on the specific requirements of different industries. These materials and services are used in the process of production and maintenance to operate, repair, and maintain machinery, equipment, and facilities. They are referred to as MRO services and materials. Procuring materials or services for maintenance and repair may seem insignificant and often falls below the endorsement thresholds. However, these seemingly unimportant purchases made by organizations are frequently underutilized and difficult to control, resulting in increased costs and unnecessary inventory wastage. The expenses associated with maintenance and repair constitute a significant portion of operating expenses, thereby impacting a company's operational profitability. Inefficiencies in MRO materials and waste management services typically manifest in three ways:

-

Extensive inventories that move slowly or sluggishly.

-

Wastage of time and resources.

-

Deficiencies in ERP or other systems.

What Does This Report Include?

This section will provide insights into the contents included in this North America mro distribution market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

North America mro distribution market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

North America mro distribution market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the North America mro distribution market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for North America mro distribution market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of North America mro distribution market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

North America MRO Distribution Market Categorization:

The North America mro distribution market was categorized into three segments, namely product (Abrasives, Chemicals, Cutting Tools, Fasteners, Hand Tools, Pipes, Valves & Fitting, Power Tools, Power Transmission - Hydraulics, Power Transmission - Pneumatics, Power Transmission - Electronics, Rubber Products, Seal, Welding Equipment & Gases, Automation), End-use (Food, Beverage & Tobacco, Textile, Wood & Paper, Mining, Oil & Gas, Metal Processing & Foundry, Rubber, Plastic & Non-metallic, Chemicals, Pharmaceuticals, Electrical & Electronics, Transportation, Construction), and regions (North America).

Segment Market Methodology:

The North America mro distribution market was segmented into product, End-use, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The North America mro distribution market was analyzed at a regional level. The global was divided into North America, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into three countries, namely, the U.S., Canada, Mexico.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

North America mro distribution market companies & financials:

The North America mro distribution market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

The Hillman Group - The Hillman Group, founded in 1964 and headquartered in Ohio, United States, is a prominent supplier of comprehensive hardware products and associated merchandising services to retail markets throughout North America. The company operates under three main segments: fastening, hardware, and personal protective solutions. The hardware solutions encompass many products, including keys, threaded rods, metal shapes, accessories, key duplication systems, and identification items such as numbers, tags, letters, and signs. The personal protective equipment product range includes gloves, eyewear, and face masks. The fastening solutions segment of the company consists of three subcategories: core fasteners, construction fasteners, and specialty fasteners and anchors. Core fasteners include bolts, washers, and screws, while construction fasteners encompass drywall, metal screws, and collated nails. Anchors include plastic anchors, toggle bolts, and wedge anchors. The company supports its product sales with various services, including the design and installation of merchandising systems and inventory maintenance. The company's primary customer base comprises retail outlets, hardware stores, home centers, mass merchants, and OEM & industrial customers. In 2018, the company expanded its B2B e-commerce capabilities, allowing customers to order products online through its website conveniently.

-

Wajax Limited - Wajax Limited, founded in 1858 and headquartered in Ontario, Canada, is a prominent distributor of industrial products and services in the country. With over 100 branches nationwide, it is a leading manufacturer of industrial parts and equipment. The company specializes in the sale, after-sales service, and parts support for a wide range of industrial equipment, components, and power systems. Additionally, Wajax offers comprehensive end-to-end solutions for various industries, including construction, transportation, mining, oil & gas, food & beverages, power generation, forestry, and marine. Its industrial product segment focuses on distributing diverse equipment and products, such as bearings, filter systems, hydraulic equipment and components, fluid handling pumps, pneumatic valves, and cylinders. Furthermore, Wajax distributes seals, bearings, and power transmission products from renowned brands like SKF, Garlock, Robco, Timken, Schaeffler, Sumitomo Drive Technologies, Gates, and Continental. As of December 2020, the company employs approximately 2,615 individuals, comprising technicians, sales professionals, and support staff, dedicated to serving its 32,000 clients across various industrial sectors in Canada.

-

FCX Performance - FCX Performance, formerly known as Simco Controls, was established in 1984. In 1999, the company underwent a name change and became FCX Performance. In 2018, it was acquired by Applied Industrial Technologies. Headquartered in Ohio, United States, FCX Performance specializes in providing flow control solutions to various process industries such as chemical, food & beverages, pharmaceutical, and biotech. It also offers specialized solutions for the pulp & paper, oil & gas, and steel industries within the United States. The company's extensive product range includes valves, pumps, seals, compressors, instrument measurement & control equipment, and corrosion-resistant piping. With 18 stocking, assembly, and service centers spread across the country, FCX Performance maintains a stock of approximately 45,000 products. Moreover, it operates at over 65 locations, serving 38 states within the United States. In addition to its product offerings, the company provides consultation services, system audits, and comprehensive maintenance and repair services. These services encompass instrumentation services, valve automation and repair, pump and rotating equipment repair, and engineered and integrated systems services.

-

SBP Holdings - SBP Holdings, founded in 1968 and headquartered in Texas, United States, operates as a holding company. The company's operations are primarily carried out through its three subsidiaries: Singer Equities, Bishop Lifting Products Inc., and Dakota Fluid Power Inc. These subsidiaries cater to various industries, including chemical, pulp & paper, food & beverages, and marine. Singer Equities specializes in distributing industrial rubber products like hydraulic hoses, conveyor belts, and gaskets. They also offer industrial-grade composites, metal hoses, and metal gaskets. With 59 service locations across North America, the company employs over 600 individuals. Bishop Lifting Products, Inc., on the other hand, provides wire rope, sling and rigging, and rental facilities, offering a wide range of lifting solutions such as winches, wire ropes, and hoist ropes. Lastly, Dakota Fluid Power, Inc. offers comprehensive hydraulic services, including sales, assembly, component repair & maintenance, and inspection services.

-

Lawson Products, Inc. - Lawson Products, Inc., founded in 1952 and headquartered in Illinois, United States, specializes in the distribution of industrial maintenance and repair supplies. Its customer base comprises industrial, commercial, institutional, and government maintenance, repair, and overhaul (MRO) operators. The company operates from a 300,000 square feet facility in McCook, Illinois, and strategically located distribution centers across North America. It operates through two segments: the Lawson operating segment and the bolt operating segment. The bolt operating segment distributes products and provides Vendor Managed Inventory ("VMI") services. Moreover, this segment primarily serves customers through 14 branches located in various provinces of Canada. Lawson Products offers many products, including fasteners, cutting tools, welding products, and material handling components. The company also supplies collision and mechanical repair products through aftermarket and OEM channels. As of December 2020, Lawson Products employed 1,910 individuals, with approximately 1,330 dedicated to marketing and sales, around 470 in operations and distribution, and 140 in management and distribution.

-

R.S. Hughes Co., Inc. - Established in 1954, R.S. Hughes Co., Inc. is headquartered in California, United States. The company specializes in the distribution of industrial supplies and maintains a vast inventory of industrial products manufactured by ISO 9001:2008 registered companies. It offers customers multiple purchasing options, including an online platform, sales representatives, and warehouse locations. The company ensures efficient and timely delivery with over 50 warehouses spread across the United States and Mexico. Its product portfolio encompasses a wide range of industrial products such as abrasives, power tools, cutting tools, adhesives & sealants, and chemicals & lubricants. Moreover, the company offers services like die cutting, laminating, rewinding, printing, and slitting through its Saunders division. These products and services cater to various industries, including aerospace, general manufacturing, and transportation.

-

Hisco, Inc. - Hisco, Inc. was established in 1971 and has its headquarters in Houston, Texas, United States. The company specializes in distributing supplies to the aerospace, defense, electronics, and medical equipment industries. It is registered with the United States Department of Defense as an International Traffic in Arms Regulations (ITAR) supplier. This registration allows the company to provide and manufacture products and OEM assemblies that require ITAR registration. The company offers various products, including abrasives, fasteners and hardware, hand and power tools, motion control and fluid power, and test and measurement equipment. In addition, it provides specialized cold storage warehousing solutions and vendor managed inventory services. Hisco, Inc. works with renowned suppliers such as 3M, Henkel, Loctite, and Brady. It also offers value-added fabrication and custom repackaging services through its Precision Handling Group and Adhesive Materials Group divisions. Amidst the COVID-19 pandemic, the company has expanded its product range to include various safety and personal protection items, such as respiratory protection, protective clothing, face protection, and gloves. Furthermore, Hisco, Inc. efficiently manages its distribution operations through a network of over 30 stocking locations across North America.

-

bisco industries - bisco industries, founded in 1973 and headquartered in California, United States, operates as a subsidiary of EACO Corporation. The company specializes in the distribution of electronic components and fasteners, catering to a diverse range of industries such as aerospace, communication, industrial equipment, computers, fabrication, and marine. bisco industries offers its products under three main segments: electronic hardware, electronic components and fasteners, and hardware. The electronic hardware segment comprises printed circuit board hardware and enclosures & cabinets. In contrast, the electronic components segment includes connectors, optoelectronics, wire and cable components, terminals and terminal blocks, test equipment, and circuit protection. The fasteners and hardware segment encompasses panel fasteners, latches, access hardware handles, general assembly hardware, and military fasteners & hardware. In addition to its product offerings, the company provides value-added services to its customers, including auto-replenishment and part modification services. With 49 branches across the United States and Canada, bisco industries employs over 488 individuals as of December 2020. Furthermore, the company has ambitious plans for global expansion, with upcoming branches in Mexico and Europe.

-

Kaydon Bearings - Kaydon Bearings, founded in 1941 and headquartered in Michigan, USA, is a leading company in the design and production of bearings for various industries. These industries include aerospace & defense, oil & gas, medical systems, industrial machinery, mining, renewable energy, robotics, and semiconductors. The company offers a wide range of bearing products, categorized into thin section bearings, slewing ring bearings, and custom bearings. The thin section bearing range includes Reali-Slim, Ultra-Slim, and Real-Slim TT bearings in various configurations. The slewing ring bearings consist of eight-point contact, four-point contact, cross roller, three-row roller, and wire-race bearings. Additionally, the company specializes in the design and manufacturing of high-performance bearings tailored to specific applications. With eight production facilities in the United States, Mexico, China, and Brazil, Kaydon Bearings efficiently manages its manufacturing operations. In October 2013, the company was acquired by SKF Group, but it continues to operate independently.

-

BDI - Founded in 1935 and headquartered in Ohio, United States, BDI specializes in the distribution of industrial products and supply chain solutions. The company's primary offerings encompass mechanical power transmission, electrical power transmission, bearings, and pneumatic & hydraulic fluid power. These products cater to various sectors, including automotive, food processing, metal fabrication, pulp & paper, material handling, and mining. In addition to its product line, BDI also provides various services such as repair, automation, Customer Economic Value Added (CEVA) Analysis, and additive manufacturing. The company collaborates with renowned suppliers like Gates, Siemens, SKF Group, and Henkel Loctite. With a global presence, BDI employs over 1,500 individuals across 200 branch locations in 12 countries as of December 2020.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

North America MRO Distribution Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2018 to 2023, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

North America MRO Distribution Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."