- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Polyols Market Size, Industry Report, 2030GVR Report cover

![North America Polyols Market Size, Share & Trends Report]()

North America Polyols Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Polyether, Polyester), By Application (Rigid Foam, Flexible Foam, Coatings, Adhesives & Sealants), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-104-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Polyols Market Size & Trends

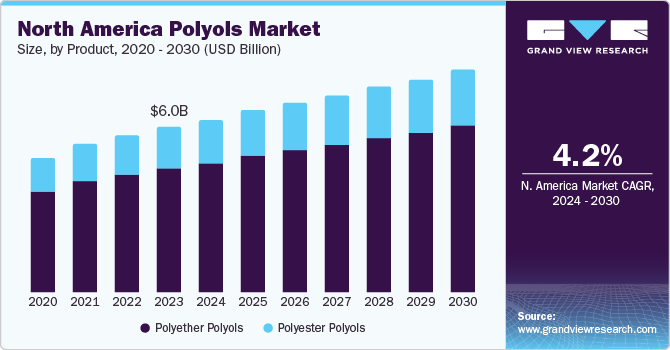

The North America polyols market size was valued at USD 6.03 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. The market growth is attributed to the favorable properties of polyols, including strength, resilience, and energy absorption, making them ideal for commercial and consumer products such as furniture, bedding, textiles, transportation, packaging, carpet cushioning, and fibers. Moreover, the construction sector’s positive outlook, particularly in regions of North America, is expected to boost the production of flexible foams, further boosting the demand for polyols. The rising demand for polyurethane in the building and construction sector, driven by its enhanced insulation capability and efficiency, has led to a progressive influence on the market growth of polyols in the forecast years.

The polyols market is experiencing growth due to the automotive industry's preference for polyol-based polyurethane, which is versatile, cost-effective, and functional. The increasing need for sustainable packaging solutions, driven by environmental concerns and regulations, is also fueling this growth. Polyols are commonly used in the production of polyurethane foams and coatings, providing flexibility, longevity, and resistance to moisture. However, packaging solutions derived from polyols can also help prolong the shelf life of different perishable products and offer increased protection while they are stored and transported.

The increasing awareness of consumers about the importance of using eco-friendly and sustainable materials in producing polyurethane foams for various industries is projected to drive growth in the polyols market. Furthermore, major companies are adopting bio-based polyols to minimize their dependence on petrochemical-derived polyols due to increasing environmental concerns and fluctuating raw material prices. Numerous companies are exploring the development and marketing of bio-based polyols, considering the potential future of bio-based polyols, in response to a growing push from regulation authorities for the use of environmentally friendly products.

Product Insights

Polyether polyols dominated the market and accounted for the largest revenue share of 75.7% in 2023 as they are characterized by their excellent rebound properties, resistance, and hydrolytic stability, making them ideal for formulating rigid polyurethane foams. Their growing application in flexible foam production, widely used in furniture, bedding, and automotive interiors, is a significant driver of market expansion. The increasing consumer preference for comfort and luxury in these sectors further enhances the demand for polyether polyols. Additionally, the growth of the construction industry, fueled by urbanization and infrastructure projects, is increasing the need for polyurethane-based building materials, including insulation foams, coatings, and adhesives.

Polyester polyols are projected to witness a fastest CAGR of 4.5% over the forecast period. These polyols are commonly used in creating both flexible and rigid foams for furniture, where they are valued for their comfort, durability, and structural integrity in products such as sofas, mattresses, and chairs. Polyester materials are also cost-effective, making them popular in the clothing industry, which drives demand in the global market. The rise of budget-friendly online clothing retailers has further increased the appeal of polyester garments, known for their durability and low maintenance needs.

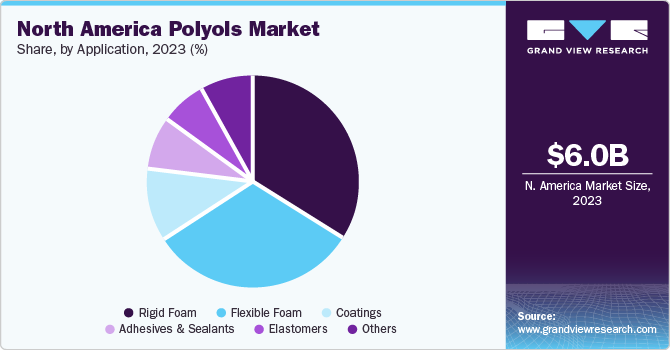

Application Insights

The flexible foam application dominated the market with a market share of 33.7% in 2023. It can be molded into different forms and is frequently utilized in bedding, furniture, packaging, carpet padding, and various upholstery items in car interiors. The flexible polyurethane foams offer environmental advantages such as emission-free burning, filtering pollutants, and minimizing waste. These materials can be recycled easily and are eco-friendly. Progress in this field has introduced the soft and special sensation of memory foam in bedding and pillows, the convenience of mattress-in-a-box, support and enhanced ergonomics in furniture, and success in various other uses such as transportation, sporting goods, or carpet padding. A rising inclination is seen in producing flexible foam using bio-based materials instead of traditional petroleum sources.

Coating applications are expected to grow significantly over the forecast period. The demand for polyols in coating applications is driven by the industrial sector, particularly in the automotive, construction, and electronics sectors, which need high-performance coatings. The emphasis on sustainability has increased the demand for eco-friendly coatings, with bio-based polyols being favored for their reduced reliance on fossil fuels and lower carbon footprints. Moreover, performance requirements, such as resistance to wear, UV stability, and chemical resistance, further drive the need for advanced polyols. Regulatory compliance with stringent environmental standards necessitates the adoption of low-VOC and non-toxic coatings.

Country Insights

The North America polyols market has experienced lucrative growth over the forecast years. Construction and building activities in the region witness robust growth, with the increasing demand for polyols due to heightened construction in various segments such as residential, commercial, and industrial. Manufacturers are concentrating on creating bio-based polyols and enhancing the recyclability of polyurethane products to meet environmental standards and consumer demand for eco-friendly alternatives. The changing market offers chances for creativity and expansion, leading to an increased usage of polyurethane polyols in various regional applications.

U.S. Polyols Market Trends

The polyols market in the U.S. dominated the North American market with a revenue share of 75.7% in 2023 attributed to the expanding construction and automotive industries. The increasing demand for polyurethane foams in insulation applications is particularly significant, as these materials enhance building energy efficiency. In addition, the rising trend towards sustainable and bio-based polyols aligns with environmental concerns, further propelling market growth. Furthermore, the U.S. also benefits from a strong industrial base and technological advancements, which facilitate the development and adoption of innovative polyol products in various sectors, including packaging and furniture manufacturing.

Mexico Polyols Market Trends

Mexico polyols market is expected to grow at the fastest CAGR over the forecast period owing to the increasing demand for flexible and rigid polyurethane foams in furniture and automotive interiors. Furthermore, the growing focus on sustainability leads to a higher adoption of bio-based polyols derived from renewable resources. As urbanization continues and infrastructure projects expand, the need for efficient insulation materials and lightweight vehicle components is expected to boost the market further.

Key North America Polyols Company Insights

Some of the key companies in the North American polyols market include Dow, Shell, Huntsman International LLC., Arkema, Sanyo Chemical America Incorporated., Repsol, BASF, Everchem Specialty Chemicals., and Honeywell International Inc.

-

Huntsman International LLC specializes in the production of polyether and aromatic polyester polyols. The company manufactures diverse products under the JEFFOL and TERO brands, which are essential for creating high-performance polyurethane systems used across various industries, including construction, automotive, and furniture. With a global footprint that includes extensive manufacturing facilities and a commitment to innovation, Huntsman serves over 3,000 customers in more than 90 countries, addressing the growing demand for sustainable and efficient materials.

-

Sanyo Chemical Industries focuses on producing polyester polyols and other specialty chemicals. The company is known for its high-quality products that cater to diverse applications, such as flexible and rigid foams used in furniture, automotive interiors, and insulation materials. Sanyo Chemical Industries emphasizes research and development to enhance the performance and sustainability of its polyol offerings, positioning itself as a competitive player in the global market while addressing the increasing demand for eco-friendly solutions.

Key North America Polyols Companies:

The following are the leading companies in the north america polyols market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- Shell

- Huntsman International LLC.

- Arkema

- Sanyo Chemical America Incorporated.

- Repsol

- BASF

- Everchem Specialty Chemicals.

- Honeywell International Inc.

- Mitsui Chemicals, Inc.

- ADM

- Covestro AG

Recent Developments

-

In April 2024, Sanyo Chemical Industries signed a memorandum of understanding (MOU) with Econic Technologies to develop CO2-based polyols to achieve carbon neutrality. This collaboration focuses on utilizing captured carbon dioxide as a raw material for producing sustainable polyols, essential in manufacturing polyurethane foams and other materials. The partnership underscores both companies' commitment to innovation and sustainability as they work together to advance eco-friendly solutions in the chemical industry and contribute to global efforts to reduce carbon emissions.

-

In May 2023, Mitsui Chemicals and Sanyo Chemical Industries announced the formation of a 50-50 Limited Liability Partnership (LLP) aimed at enhancing the production of polypropylene glycols (PPGs). Established on May 15, 2023, the partnership seeks to address shared productivity and supply stability challenges within Japan's competitive polyurethane market. PPGs are critical raw materials used in various applications, including automotive parts and construction materials. The LLP will focus on operational cooperation and joint procurement of raw materials to strengthen both companies' competitiveness in the PPG sector.

North America Polyols Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.32 billion

Revenue forecast in 2030

USD 8.11 billion

Growth rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America

Country scope

U.S., Canada, Mexico

Key companies profiled

Dow; Shell; Huntsman International LLC.; Arkema; Sanyo Chemical America Incorporated.; Repsol; BASF; Everchem Specialty Chemicals.; Honeywell International Inc.; Mitsui Chemicals, Inc.; ADM; Covestro AG

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Polyols Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global North America polyols market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyether polyols

-

Polyester polyols

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Rigid foam

-

Flexible foam

-

Coatings

-

Adhesives & sealants

-

Elastomers

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.