Market Size & Trends

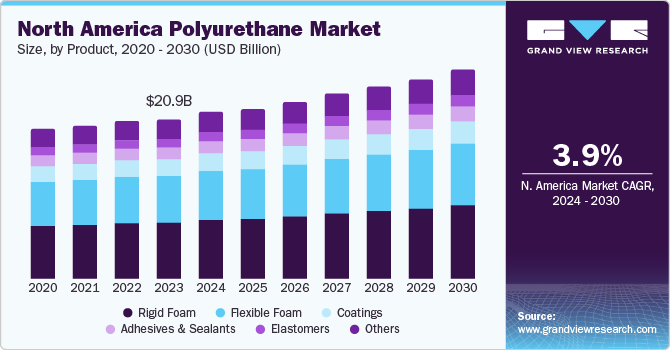

The North America polyurethane market size was valued at USD 20.88 billion in 2023 and is projected to grow at a CAGR of 3.9% from 2024 to 2030. Market growth is driven by the construction sector’s surge in demand due to foreign direct investment and rising construction activities. The automotive and aviation industries’ adoption of eco-friendly solutions and the increasing demand for durable plastics also contribute to market growth.

One of the primary drivers is the construction sector, which is experiencing a surge in demand due to increased foreign direct investment and rising construction activities. Polyurethane foam’s insulation and soundproofing properties make it an essential component in this sector, ensuring its demand continues to rise. Another key driver is the automotive and aviation industries, where polyurethane foam’s lightweight and durable characteristics make it an ideal material for cushioning and aerospace applications.

The increasing adoption of eco-friendly solutions in these industries, aimed at reducing environmental impact and improving fuel efficiency, is also driving demand for polyurethane foam. This trend is expected to continue, providing opportunities for market players who offer bio-based polyurethane products. Furthermore, the growing demand for durable plastics in construction and other sectors is also contributing to the growth of the polyurethane market. Polyurethane’s superior performance compared to alternatives like polystyrene and polypropylene makes it a popular choice among end-users.

Supportive government policies promoting investment in domestic markets and sustainability initiatives are also creating opportunities for growth. In North America, the market is expected to experience significant growth due to increasing investments in infrastructure development and renewable energy sources. For instance, Mexico aimed to reach 35% clean power by 2024, with renewable energy sources being a key component of this strategy, as stated in the Clean Energy Ministerial. The demand for polyurethane foam insulation is likely to increase in the region as investments in aerospace and renewable energy sources rise. Market players who offer rigid foam products, which are efficient insulation options for roofs, walls, and doors, are well-positioned to capitalize on this growth opportunity.

Product Insights

Rigid foam dominated the market and accounted for a share of 34.1% in 2023. The increasing focus on energy efficiency in building structures has driven the demand for rigid foam insulation, which offers superior performance and sustainability. As governments implement strict energy codes and building standards, market players are capitalizing on this trend by promoting rigid foam products for retrofit and new construction projects.

Flexible foam is expected to grow significantly with a CAGR of 4.1% during the forecast period. Flexible polyurethane foam is the most sought-after material due to its versatility, applicability in various industries, and outstanding characteristics such as cushioning and comfort. Its widespread use in the automotive, furniture, bedding, packaging, and construction sectors has contributed to its market dominance. As a result, it has become a highly popular and sought-after material, with a strong presence in the market.

End Use Insights

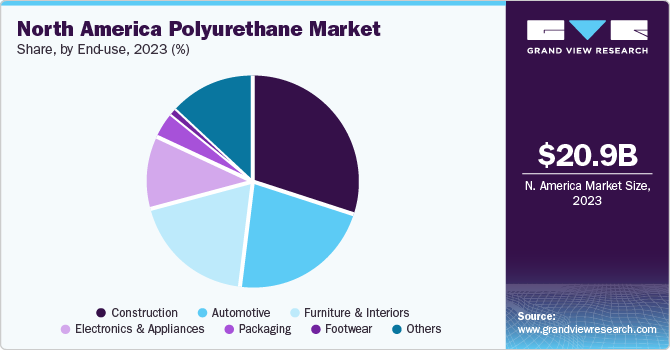

Construction accounted for the largest market revenue share of 29.8% in 2023. The construction sector is experiencing sustainable growth, driven by the demand for insulating buildings and green buildings. The industry is forecasted to expand globally, necessitating integration of sustainable practices into basic construction processes. This underscores the increasing importance of green building initiatives, transforming the construction landscape.

The electronics & appliances segment is projected to grow at the fastest CAGR of 4.9% over the forecast period. Polyurethane’s thermal insulation properties make it an ideal material for refrigerators, freezers, and air conditioners. The implementation of energy conservation codes will drive demand for improved insulation materials, benefiting polyurethane. Its shock-absorbing properties also protect sensitive electronics from damage, while its sealing and bonding capabilities ensure longer-lasting, high-performance parts.

Country Insights

U.S. Polyurethane Market Trends

The U.S. polyurethane market dominated the North America polyurethane market in 2023, generating a revenue share of 50.5%. The building and construction sector dominates the U.S., driven by the demand for rigid polyurethane foam’s environmental benefits, including increased energy efficiency and reduced project weight. The transportation sector also contributes significantly, driven by the need for sustainable polymeric formulations for vehicle weight reduction and fuel efficiency.

Canada Polyurethane Market Trends

The Canada polyurethane market held a substantial share of the North American market, driven by increased demand for energy-efficient building materials, particularly rigid polyurethane foams. Government initiatives promoting sustainability and reducing carbon footprints further accelerate growth. The construction sector’s expansion, infrastructure investments, and automotive and aerospace industries’ adoption of lightweight polyurethane materials also contribute to this growth.

Key North America Polyurethane Company Insights

Some key companies in the North America Polyurethane market include The Dow Chemical Company; Covestro AG; BASF; Huntsman International LLC; Eastman Chemical Company; and others. Leading companies are implementing organic and inorganic growth strategies, including capacity expansions, mergers and acquisitions, and joint ventures, to preserve and enhance their market share in the polyurethane industry.

-

Covestro AG is a supplier of advanced polymers, specializing in the development and production of polyurethane raw materials, derivatives, coatings, adhesives, and specialty chemicals, as well as polycarbonates and other chemicals. Its portfolio includes a range of products, including polycarbonates, specialty chemicals, and byproducts.

-

Huntsman International LLC is a chemical production company, manufacturing and selling a diverse portfolio of chemicals, including MDI-based rigid and flexible foams. With over 3,000 customers across various sectors, including construction, automotive, and aerospace, Huntsman leverages its commitment to innovation to develop energy-efficient solutions.

Key North America Polyurethane Companies:

- The Dow Chemical Company

- Covestro AG

- BASF

- Huntsman International LLC

- Eastman Chemical Company

- Mitsubishi Chemical Group Corporation

- RAMPF Holding GmbH & Co. KG

- The Lubrizol Corporation

- Mitsui & Co. (U.S.A.), Inc.

- DIC CORPORATION

- Recitel NV/SA

- Woodbridge

- RTP Company

- Tosoh Bioscience LLC

Recent Developments

-

In August 2024, Huntsman International LLC appointed Jan Buberl President of Performance Products Division, effective August 1, 2024. He brought success and global experience to the role, having served as Huntsman Polyurethanes, Americas VP and at Venator and BASF.

-

In July 2024, BASF launched Haptex 4.0, a polyurethane solution to produce synthetic leather while introducing a fully recyclable material. This formulation and recycling was enabled with PET fabric as a single unit, eliminating the need for layer removal.

-

In May 2024, The Lubrizol Corporation introduced the Pearlbond ECO 590 HMS TPU to its bio-based thermoplastic polyurethane portfolio for adhesives. The TPU is a renewable source resin for hot melt adhesives.

North America Polyurethane Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 21.50 billion

|

|

Revenue forecast in 2030

|

USD 27.08 billion

|

|

Growth rate

|

CAGR of 3.9% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, end use, country

|

|

Regional scope

|

North America

|

|

Country scope

|

U.S., Canada, Mexico

|

|

Key companies profiled

|

The Dow Chemical Company; Covestro AG; BASF; Huntsman International LLC; Eastman Chemical Company; Mitsubishi Chemical Group Corporation; RAMPF Holding GmbH & Co. KG; The Lubrizol Corporation; Mitsui & Co. (U.S.A.), Inc.; DIC CORPORATION; Recitel NV/SA; Woodbridge; RTP Company; Tosoh Bioscience LLC

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

North America Polyurethane Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America polyurethane market report based on product, end use, and country.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Rigid Foam

-

Flexible Foam

-

Coatings

-

Adhesives & Sealants

-

Elastomers

-

Others

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Furniture and Interiors

-

Construction

-

Electronics & Appliances

-

Automotive

-

Footwear

-

Packaging

-

Others

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)