- Home

- »

- Consumer F&B

- »

-

North America Processed Meat Market Size Report, 2030GVR Report cover

![North America Processed Meat Market Size, Share & Trends Report]()

North America Processed Meat Market (2025 - 2030) Size, Share & Trends Analysis Report By Meat (Poultry, Beef, Pork, Mutton), By Type, By Product (Chilled, Frozen, Canned, Dry & Fermented), By Country (U.S., Canada, Mexico), And Segment Forecasts

- Report ID: GVR-4-68039-419-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Meat Market Size & Trends

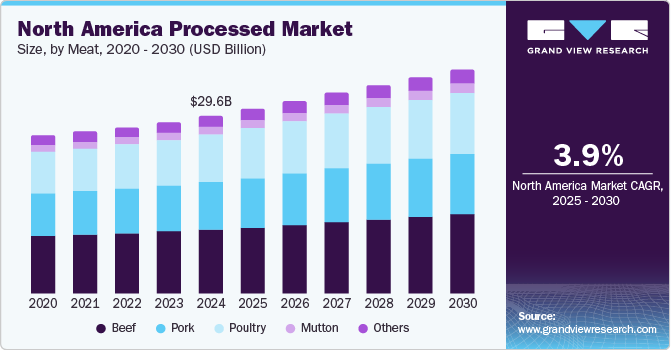

The North America processed meat market size was valued at USD 29.61 billion in 2024 and is expected to grow at a CAGR of 3.9% from 2025 to 2030. Key factors driving North America processed meat industry growth include rising disposable incomes, busy lifestyles, and an increasing demand for convenient food options. Innovations in product offerings, such as Benny's Original Meat Straws, alongside a high production rate due to feed availability, further contribute to this growth. Additionally, government support and advancements in production technology play significant roles in facilitating this expansion.

Rising disposable incomes and busy lifestyles lead consumers to seek convenient food options. Innovations such as Benny’s Original Meat Straws and Tillamook Country Smoker’s All Natural Cranberry Turkey Jerky cater to these needs. Additionally, increased consumer awareness about the benefits of protein-rich foods drives demand. Companies like Tyson Foods are expanding their product lines with items such as sausages, salami, hot dogs, ham, bacon, and corned beef, which are preserved to maintain quality. Government support and advancements in production technology also contribute to North America processed meat industry growth. For instance, The U.S. Department of Agriculture has invested in expanding poultry and meat processing capacity. This investment will bring new entrants and small processing facilities.

Meat Insights

The beef segment dominated the North America processed meat industry with the largest revenue share of 36.3% in 2024. Beef, being a high-quality protein source rich in essential minerals such as iron, zinc, and B vitamins, has become a popular choice among health-conscious consumers. Additionally, the popularity of high-protein diets and fitness trends has further boosted the demand for beef. People with higher financial resources are more likely to purchase high-quality beef cuts and value-added products, contributing to increased sales and revenue for beef producers. The rising beef production is expected to drive market growth. For instance, in 2023, the U.S. produced a predictable 26.96 billion pounds of beef. Moreover, U.S. beef exports set a new record in 2022, reaching 3.5 billion pounds, an increase of over 3 percent compared to the previous record in 2021. This rise can be primarily attributed to a 16 percent increase in exports to China, which grew from more than 540 million pounds in 2021 to approximately 627 million pounds in 2022.

The poultry segment is expected to grow at the highest CAGR over the forecast period. The segment growth is attributed to the increasing consumer demand for protein-rich diets, advancements in poultry farming techniques, and the rising popularity of convenient and ready-to-cook poultry products. Additionally, expanding distribution channels and the growing awareness of the health benefits associated with poultry consumption have further contributed to the segment's robust growth.

Type Insights

The cured segment dominated the North America processed meat industry with the largest revenue share in 2024. There is a rising demand for a variety of cured meat products, such as bacon, ham, and sausages, which consumers highly favor due to their taste, convenience, and long shelf life. The appeal of cured meats has been further enhanced by advancements in processing technologies and flavor innovations, which have introduced diverse products to meet varying consumer preferences.

The uncured segment is expected to grow at the fastest CAGR over the forecast period. Uncured meats, processed using natural curing agents like celery powder and sea salt, appeal to consumers seeking cleaner labels and more transparent ingredient lists. Additionally, the expanding availability of uncured meat products in both traditional retail and online channels has made them more accessible to a broader audience. Food processing and packaging innovations have also contributed to the extended shelf life and enhanced flavor of uncured meats, further driving their popularity.

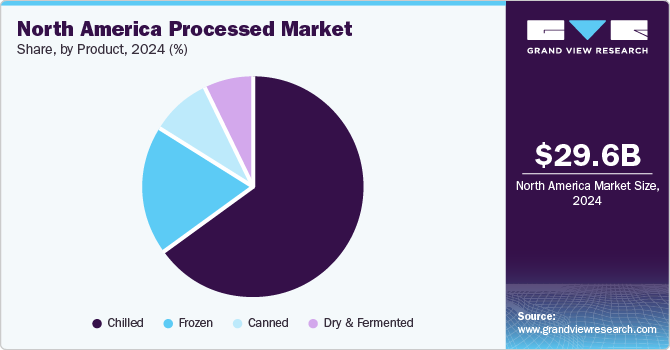

Product Insights

The chilled processed meat segment dominated the market with the largest revenue share in 2024. Chilled processed meats, such as sausages, hams, and sliced meats, are favored for their convenience and extended shelf life while maintaining freshness. The growing demand for ready-to-eat and easy-to-prepare meal options has also played a significant role in boosting the popularity of chilled processed meats. Additionally, advancements in refrigeration technology and efficient supply chain logistics have enhanced the availability and accessibility of these products, contributing to their market growth.

The frozen segment is expected to grow at the highest CAGR over the forecast period. Frozen meat products offer the advantage of being stored for extended periods without compromising on quality and nutritional value, making them a preferred choice for busy households. Additionally, advancements in freezing technologies have improved the taste and texture of frozen meats, making them more appealing to consumers. The rise in the number of working professionals and dual-income households has also fueled the demand for ready-to-cook and easy-to-prepare meal options, further boosting the frozen meat segment.

Country Insights

U.S. Processed Meat Market Trends

The U.S. processed meat industry dominated the regional market, with the largest revenue share of 61.4% in 2024. The strong presence of leading meat processing companies in the U.S., advanced production technologies, and efficient supply chain logistics have enabled the industry to meet this demand effectively. Additionally, the cultural preference for meat-centric diets and the widespread consumption of processed meats in fast food and convenience meals have significantly contributed to the industry’s robust performance. The well-established supply chain and distribution network, encompassing supermarkets, hypermarkets, and foodservice channels, has further bolstered the market share of the U.S. processed meat industry. For instance, in July 2024, Secretary Tom Vilsack announced that the Biden-Harris Administration is investing in strengthening American food supply chains. Through the Meat and Poultry Processing Expansion Program (MPPEP), the USDA is collaborating with the New Hampshire Community Loan Fund to provide over USD 83 million in grants to 24 independent processors across 15 states. Funded by President Biden’s American Rescue Plan, this initiative aims to build new processing plants, create jobs, offer better business opportunities for local producers, and provide consumers with more grocery options.

Canada Processed Meat Market Trends

Canada processed meat industry held a considerable share in 2024. This growth is attributed to the growing demand for convenient and ready-to-eat meat products among Canadian consumers. The variety of processed meat offerings, including sausages, deli meats, bacon, and frozen meats, caters to the diverse taste preferences and busy lifestyles of the population. Furthermore, the presence of well-established meat processing companies and advancements in food technology have enhanced the quality and shelf life of these products. For instance, in April 2023, The Centre for Meat Innovation and Technology (CMIT) in Canada aimed to enhance technology and improve employee skills within the meat-processing sector. CMIT director Luis Garcia stated that the center benefit both processors and meat and poultry producers, driving advancements in the industry and supporting sector growth. In addition, the robust distribution network, spanning supermarkets, hypermarkets, and online retail channels, has made processed meats readily accessible to consumers across Canada.

Mexico Processed Meat Market Trends

Mexico processed meat industry is expected to grow at the highest CAGR over the forecast period. This rapid growth is attributed to several factors, including rising disposable incomes among the middle-class population, which boosts consumer spending on meat products. Additionally, the increasing demand for convenience foods and ready-to-eat meal options has driven the popularity of processed meats. The expansion of distribution channels, such as supermarkets, hypermarkets, and online retail, has also made these products more accessible to consumers. Furthermore, growing meat consumption is further expected to drive market growth. For instance, in 2024, meat consumption in Mexico increased by 4.5%, driven by enhanced purchasing power from social programs, remittances, and higher wages, according to the Mexican Meat Council (COMECARNE). Beef and pork consumption rose by 6.9% and 6.7%, respectively, as Mexicans shifted towards higher-value cuts. Chicken consumption increased by 1.9%, reaching 4.07Mt.

Key North America Processed Meat Company Insights

Some key companies in the North America processed meat industry include Tyson Foods, Inc., Conagra Brands, Sysco Corporation, Smithfield Foods, Inc., Perdue Farms, and others.

-

Tyson Foods, Inc. is one of the largest food companies in the world, known for its extensive range of processed meat products. The company has become a major value-added chicken, beef, and pork supplier to retail grocers, foodservice distributors, and restaurant chains. Tyson Foods operates through four main segments: Chicken, Beef, Pork, and Prepared Foods. The company manufactures a wide variety of processed meat products, including Buffalo wings, chicken nuggets, and tenders.

-

Conagra Brands focuses on providing convenient and easy-to-prepare food solutions, catering to the evolving lifestyle patterns of modern consumers. The company's processed meat offerings include sausages, deli meats, and pre-cooked bacon. Conagra Brands has also been at the forefront of innovation in flavor, packaging, and preservation techniques, ensuring that its products meet the demands of health-conscious consumers.

Key North America Processed Meat Companies:

- Tyson Foods, Inc.

- Conagra Brands

- Sysco Corporation

- Smithfield Foods, Inc.

- Perdue Farms

- Cargill, Incorporated

- JBS Foods

- Hormel Foods Corporation

- National Beef Packing Company, LLC.

- OSI Group

Recent Developments

- In August 2024, Cargill announced the acquisition of two case-ready meat plants from a subsidiary of Ahold Delhaize U.S., Infinity Meat Solutions. The plants are located in North Kingstown, Rhode Island, and Camp Hill, Pennsylvania. These facilities produce up to 2 million lbs of pork and beef products weekly and employ 800 workers. The acquisition enhances Cargill's ability to supply muscle cuts, packaged ground beef and pork, and value-added products to US grocery store brands. Cargill aims to provide retailers with high-quality products, reduce back-room prep work, and improve customer service.

North America Processed Meat Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 30.73 billion

Revenue forecast in 2030

USD 37.24 billion

Growth rate

CAGR of 3.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Meat, product, type, country

Country scope

U.S., Canada, Mexico

Key companies profiled

Tyson Foods, Inc.; Conagra Brands; Sysco Corporation; Smithfield Foods, Inc.; Perdue Farms; Cargill, Incorporated; JBS Foods; Hormel Foods Corporation; National Beef Packing Company, LLC.; OSI Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Processed Meat Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America processed meat market report based on meat, product, type, and country:

-

Meat Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Poultry

-

Beef

-

Pork

-

Mutton

-

Others

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cured

-

Uncured

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Chilled

-

Frozen

-

Canned

-

Dry & Fermented

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.