- Home

- »

- Medical Devices

- »

-

North America Scar Treatment Market Size, Report, 2030GVR Report cover

![North America Scar Treatment Market Size, Share & Trends Report]()

North America Scar Treatment Market Size, Share & Trends Analysis Report By Product (Topical, Laser, Injectables), By Scar Type (Atrophic Scars, Hypertrophic & Keloid Scars), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-196-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

North America Scar Treatment Market Trends

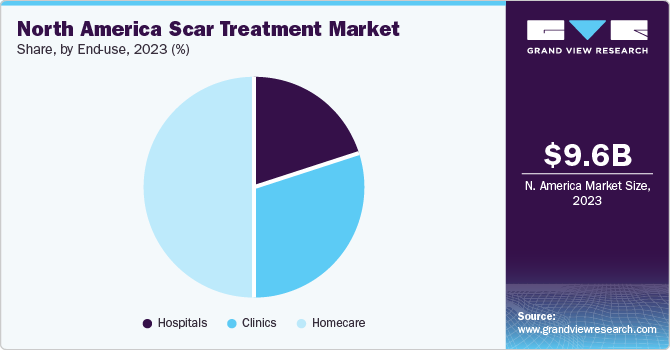

The North America scar treatment market size was estimated at USD 9.6 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.6% from 2024 to 2030. The market is expected to grow due to several factors, such as growing concern among people regarding their aesthetic appearance, an increasing number of road accidents & burn injuries, and technological advancements supplementing new device launches.

In addition, the adoption of ambulatory surgery centers and the development of portable or mobile scar treatment devices are expected to boost the market growth.

Furthermore, the market is experiencing remarkable technological developments with the introduction of laser therapy. For instance, MedLite C6, a Q-switched laser-based instrument developed for treating acne. Laser instruments help destroy scar tissue, thereby assisting in scar treatment procedures. Treatment with laser products involves both surgical and nonsurgical procedures. Plastic and reconstructive surgery is also a part of the surgical laser treatment process. For instance, in June 2022, Cynosure launched PicoSure Pro Device to treat wrinkles, acne scars, and pores.

According to a report by the American Society of Plastic Surgeons in 2022, nearly 50,930 scar revision procedures were performed in the U.S. Hence, the demand for aesthetic appeal plays an important role in increasing the number of reconstructive surgical cases for scar revision. In addition to skin corrective surgeries, scar treatment products are widely adopted.

Market Concentration & Characteristics

The scar treatment market is witnessing considerable technological developments with the introduction of laser therapies. Laser therapies are of two forms—ablative and nonablative. Nonablative laser therapy, with the help of a functional pulse-dyed laser, destroys scar tissue through vascularization. Lumenis is one of the leading companies specializing in laser instruments for scar treatment. For instance, UltraPulse uses CO2 laser for the treatment of acne scars. Cynosure, Inc. offers nonablative laser technology in its product portfolio. For instance, MedLite C6, a Q-Switched laser-based instrument, was developed for the treatment of acne scars. The degree of innovation is high in the market.

Mergers and acquisition activities in the market can lead to larger companies with source investing in research and development (R&D), marketing, and distribution. Merging companies can enhance the product portfolio, creating a more comprehensive range of scar treatment options for patients.Market players are entering into strategic acquisitions and mergers to gain a higher share via market expansion. For instance, Suneva and Viveon Health Acquisition Corp. entered into a merger agreement in 2022. The goal of this agreement was to create a leading regenerative aesthetics company.

Regulations can significantly impact the market in several ways affecting both the demand and supply sides. Safety and efficiency requirements for new scar treatments can slow the market growth by delaying new product launches. This can limit patients access to innovative options and potentially stifle demand. Insurance coverage for scar treatment can significantly influence the patient’s demand. Regulations can have a complex impact on the market. While they can hinder growth and innovation, they also play a crucial role in ensuring patient safety and product quality. For instance, Suneva Medical introduced Bellafill, an injectable derma filler used in correction of facial acne scars (patients aged 21 and above). The product is approved by the U.S. FDA for treatment of facial acne scars.

Product expansion can have a significant impact on the market. Introducing new products caters to diverse consumer needs and preferences, which would attract new customer segments, thus expanding the overall market size. Introducing new technologies and formulation can improve treatment efficiency and address unmet needs, attracting patients who seek more advanced solutions. For instance, in 2022, CYNOSURE announced the launch of PicoSure Pro system. The system was the only FDA-cleared 755 nm picosecond laser capable of treating unwanted pigmentation and treatment for skin revitalization.

Expanding into new regions increases the potential customer base, leading to an overall larger market size and potentially higher demand for scar treatment, products and services. Regional expansion can necessitate efficient logistics and distribution networks to ensure timely and cost-effective delivery of products and services across diverse location. In 2020, Lumenis entered into an agreement with DELEO, a France-based medical device company. The partnership provided DELEO with exclusive rights to distribute Lumenis products in France and Switzerland. CYNOSURE entered into a distribution partnership with Jeisys Medical KK. Under this agreement, Jeisys Medical KK would have exclusive distribution rights of Cynosure’s laser product portfolio in Japan. This partnership was anticipated to expand Cynosure’s geographic footprint.

Product Insights

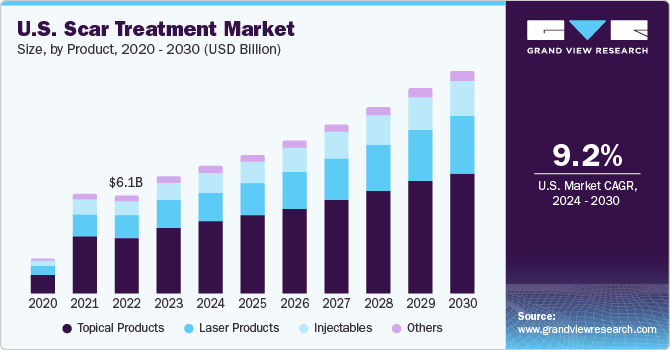

The topical products segment dominated the market with a revenue share of 56.3% in 2023. Topical products are applied directly to the skin's surface. They include silicone sheets, creams, gels, and others. These products are frequently purchased as they are easily accessible to consumers as OTC products. Furthermore, treatment with these products does not require individuals to visit physicians for medication, thus, as a more convenient option, it is expected to increase demand for these products.

Laser products is anticipated to witness the fastest growth over the forecast period, owing to the different laser technologies and their efficiency. Laser scar treatment is painless for removing scars, taking around 30 minutes to treat scars, causing minimal discomfort. Cosmetic laser surgeries are also adopted on a large scale by patients with scars such as acne, keloid, and stretch marks. Post-burn marks cause a hindrance in the routine lifestyle of victims. Laser therapies are commonly performed to remove these marks.

Scar Type Insights

The atrophic scars segment dominated the market with a share of 36.2% in 2023 due to the rising prevalence of acne scars. Topical creams and gels are commonly used to treat these scars. The keloid and hypertrophic scars are expected to grow significantly over the forecast period due to the prevalence among people with wound injuries. Atrophic scars are commonly caused by muscle and fat loss in the body over an injured area. Atrophic scars form when the skin does not produce enough collagen to heal the infection site. This type of scar looks like a pit and is typically caused by staphylococcus infections, acne, chickenpox, and surgery.

This segment is also expected to grow the fastest during the forecast period, owing to the treatment used for scars that helps stimulate skin’s natural healing process. Treating scars entails the application of topical gels, creams, and ointments that are widely available. The scar treatment stimulates the skin's natural healing process by replacing collagen, elastin, and other fibrous tissues. This allows the healed lesion's surface to grow around the surrounding area, as most such scars result from acne using these creams reduces the visibility of the scars. As the demand for aesthetic appeal grows, the need for topical products to treat atrophic scars also increases.

End-use Insights

Homecare dominated the market with a share of 50.0% in 2023, owing to the rising prevalence of acne scars and increased accessibility to at-home scar treatments. This segment is predicted to continue its lead over the forecast period. Several treatments are available for painful, itchy, or unsightly scars. Most minor scars can be easily treated at home; patients with mild-to-moderate severity scars usually visit clinics for consultation and continue with homecare treatment. There is a wide range of OTC products in the market that patients can buy from online or offline pharmacies.

The clinics segment is expected to witness a considerable growth rate from 2024 to 2030. Clinics provide core assistance in removing and reducing scars. In most emergencies, patients visit hospitals for primary care & treatment and later follow up at specialty clinics. When the scar treatment begins, an individual usually visits a dermatologist for an initial consultation. The expertise offered by dermatologists is more specific and allows patients to evaluate available treatment options. The prevalence of acne scars has boosted the demand for treatment procedures offered at dermatology clinics. In recent times, there have been several clinics that provide precise and the latest technological procedures in dermatology. With increasing esthetic consciousness, there has been a significant rise in the demand for specialty clinics offering services for enhancing esthetic appeal.

Country Insights

Key factors contributing to the market growth include the high aesthetic consciousness among people and the rapid adoption of advanced products. Moreover, technologically advanced laser scar treatment is in high demand in the region. The increasing prevalence of burn injuries, skin-related disorders, and trauma is a significant factor likely to contribute to market growth in this region. Moreover, the availability and adoption of advanced treatment options for scars, such as laser treatment, have been widely accepted in North America.

U.S. Scar Treatment Market Trends

Scar treatment market in the U.S. is expected to grow significantly. According to the American Burn Association (ABA), around 486,000 burn cases are reported annually. Scar treatment due to burn injuries is covered under reimbursement policies in the U.S. However, scar treatment for acne is only reimbursed once a healthcare professional provides a Letter of Medical Necessity. Moreover, increased healthcare spending is another primary driver for the country’s market. The growing incidence of road accidents that require intensive care and wound management is accelerating market growth.

Canada Scar Treatment Market Trends

Canada scar treatment market is expected to grow steadily over the forecast period, owing primarily to technological advancements. Government organizations such as the Canadian Dermatology Association are further promoting the treatment of acne scars with microdermabrasion, resulting in increased awareness among patients. The Canadian Association of Medical Spas and Aesthetic Surgeons (CAMACS) has recognized the need to implement proper guidelines due to the increasing number of cosmetic procedures.

Key North America Scar Treatment Company Insights

The major players are focusing on strategies such as the launch of new products, mergers and acquisitions, and geographical expansions to cater to the unmet demand of the target population. For instance, in August 2023, Sofwave Medical Ltd received approval from the FDA for its Precise SUPERB Applicator to treat acne scars. Similarly, in July 2022, Secret Duo of ilooda Co., Ltd. received approval from the FDA for its product, Secret Duo, a 1540 nm laser to treat scars post monkeypox infection.

Key North America Scar Treatment Companies:

The following are the leading companies in the North America scar treatment market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these North America scar treatment companies are analyzed to map the supply network.

- Smith & Nephew PLC

- Lumenis Be Ltd.

- Merz Pharmaceuticals, LLC

- Sonoma Pharmaceuticals, Inc.

- Cynosure

- CCA Industries, Inc.

- Newmedical Technology Inc.

- Mölnlycke Health Care AB

- Suneva Medical

- Scar Heal Inc.

- Pacific World Corporation

- Perrigo Company plc

Recent Developments

-

In January 2023, Sanoma Pharmaceuticals, Inc., a U.S.-based global healthcare leader launched two new products, Reliefacyn Plus, and Rejuvacyn Plus, and expanded their line of office dispense products for skin care professionals.

-

In April 2022, Perrigo, a leader in consumer self-care products, declared that the previously announced acquisition of Héra SAS (HRA Pharma) was completed. Such strategic initiatives are aiding the company's growth. ScarAway imitates the silicone sheets used by doctors to treat scars.

-

In June 2022, CYNOSURE announced the launch of PicoSure Pro system. The system was the only FDA-cleared 755 nm picosecond laser capable of treating unwanted pigmentation and treatment for skin revitalization.

-

In September 2020, Suneva Medical entered into a strategic partnership with Neauvia North America to market & distribute Neauvia’s plasma energy products across North America. The partnership was expected to strengthen Suneva’s products portfolio in regenerative esthetic products.

North America Scar Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.4 billion

Revenue forecast in 2030

USD 18.1 billion

Growth rate

CAGR of 9.6% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Market representation

Revenue in USD million/billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Segments covered

Product, scar type, end-use, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Smith & Nephew PLC; Lumenis Be Ltd.; Merz Pharmaceuticals, LLC; Sonoma Pharmaceuticals, Inc.; Cynosure; CCA Industries, Inc.; Newmedical Technology Inc.; Mölnlycke Health Care AB; Suneva Medical; Scar Heal Inc.; Pacific World Corporation; Perrigo Company plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Scar Treatment Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America scar treatment market report based on product, scar type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical Products

-

Creams

-

Gels

-

Silicon Sheets

-

Others

-

-

Laser Products

-

CO2 Laser

-

Pulse-dyed Laser

-

Others

-

-

Injectables

-

Others

-

-

Scar Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Atrophic Scars

-

Hypertrophic & Keloid Scars

-

Contracture Scars

-

Stretch Marks

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Homecare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America scar treatment market is estimated at USD 9.6 billion in 2023 and is expected to reach USD 10.4 billion in 2024.

b. The North America scar treatment market is expected to grow at a CAGR of 9.6% from 2024 to 2030 to reach USD 18.1 billion in 2030.

b. The topical products segment dominated the market with a revenue share of 56.3% in 2023.. Topical products are applied directly to the skin's surface. They include silicone sheets, creams, gels, and others.

b. Some of the prominent players in the North America scar treatment market include Smith & Nephew PLC, Lumenis, Merz Pharmaceuticals, LLC, Sonoma Pharmaceuticals, Inc., Cynosure, CCA Industries, Inc., Newmedical Technology Inc., Mölnlycke Health Care AB, Suneva Medical, Scar Heal Inc., Pacific World Corporation, Perrigo Company plc.

b. The market is expected to grow due to several factors, such as growing concern among people regarding their aesthetic appearance, an increasing number of road accidents & burn injuries, and technological advancements supplementing new device launches.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."