- Home

- »

- Advanced Interior Materials

- »

-

North America Screw Piles Market Size & Share Report 2030GVR Report cover

![North America Screw Piles Market Size, Share & Trends Report]()

North America Screw Piles Market Size, Share & Trends Analysis Report By Installation Type (DIY, Professional Installer), By Region (U.S. Canada, Mexico), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-068-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

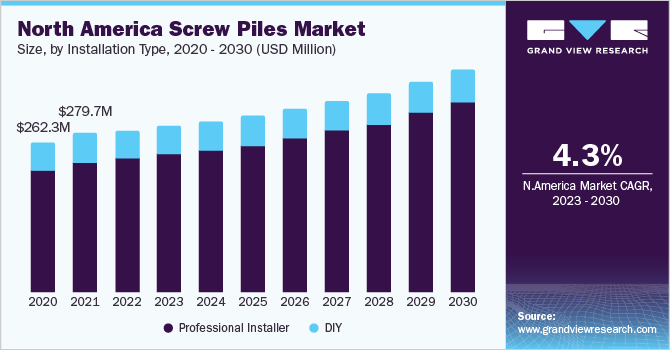

The North America screw piles market size was estimated at USD 285.4 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. The growing construction industry across North America coupled with rising government investment regarding infrastructural development is expected to drive North America screw piles industry growth over the forecast period.

The growing need for instant installations and high-quality load-bearing structures in North America is expected to further boost product demand. Moreover, screw piles are used as foundation construction for the transfer of structural loads deeper into soft soils to stronger and less compressible materials. The above-mentioned factors are expected to be a major factor driving the demand in North America for screw piles in building & construction applications over the forecast period.

Screw-piles are typically installed using standard construction equipment such as a track excavator or a mini-excavator installed with an industrial size low-speed high torque hydraulic motor. There is no need for specialized equipment like a crane with a pile hammer or a large drilled shaft rig. This allows for quick and low-cost mobilization; contractors can respond and arrive on site quickly, thus, driving the market in North America over the forecast period.

Screw piles are unique among foundations and anchoring systems as they can be loaded immediately after installation. There is no need to wait for concrete or grout to harden or, in the case of driven piles, for excess pore water pressures to dissipate. This can be an important factor for projects in North America, such as emergency response centers, where the construction schedule is tight and the rest of the project is dependent on the foundations or anchors being installed.

In comparison to most other types of construction activity taking place in North America that involve the installation of driven piles the installation of screw piles causes little to no site disturbance or soil cuttings. Additionally, this keeps the site clean, necessitates minimal cleanup after each installation, and results in lower project costs.

Screw piles are ideal for projects in remote areas of North America where mobilization costs are high and other construction support services are limited or unavailable. Retrofitting projects may require low headroom spaces to complete the work, such as inside existing structures. Thus, screw piles are ideal for low headroom or limited access situations because they can be manufactured as modular systems comprised of lead sections and extension sections, which, in turn, is likely to propel the market growth in North America.

Installation Type Insights

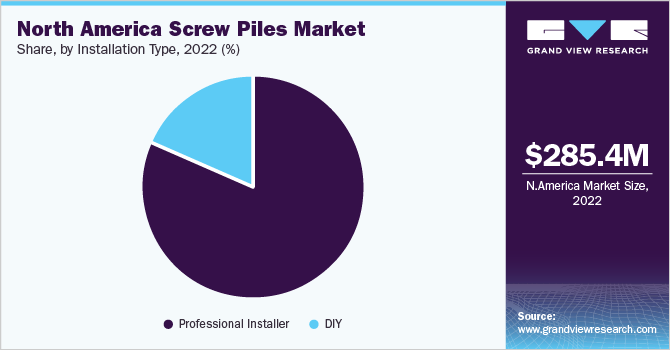

Professional installers in North America accounted for the largest and fastest segment with 81.1% revenue share in 2022 owing to expanding construction in North America, code compliance, and insurance and liability provided by screw piles which are installed professionally. In North America screw piles are professionally installed by trained and experienced professionals who use specialized tools.

In North America screw piles installed by professionals require a variety of hydraulic equipment. Portable hydraulic torsion bars or towers, mini skid steers, mini excavators, and utility sector-style auger trucks are typically used for smaller, light-duty helical screw piles. However, for larger, high-capacity helical screw piles, 15 tons or larger excavators are used as the primary installation equipment. Although modified drill rigs or custom equipment may also be utilized on occasion.

The DIY segment accounted was USD 54.1 million in 2022 as more homeowners in North America are taking on DIY projects, such as establishing outdoor play structures for kids, signboards, and pole lights. According to the survey of USA Today, high home prices, mortgage rates, inflation, and rise in labor costs in North America are forcing many homeowners to do home improvement by themselves.

In North America the manually installed screw piles are commonly used in light foundations for all around-the-house applications, from a fence or small gate to a children’s swing set, shed, and decking. The piles are easy to install with a digging bar without extensive foundation work or preparation and are suitable for all kinds of soil. The commonly used dimension for DIY screw piles are 68.0 x 2.0 x 550 mm, 68.0 x 2.0 x 800 mm, and 68.0 x 2.0 x 1200 mm and the weight of screw piles ranges from 2.5-7 kg.

Regional Insights

The U.S. is projected to be the largest market in North America which was valued at more than 60.0% revenue share in 2022 driven by the growing residential & commercial real estate in the country owing to rising consumer confidence and industry-low interest rates. In February 2022, the overall construction spending in the U.S. was USD 1,704 billion, which is 11.2% higher than in February 2021. The expansion of the construction industry is expected to be a key contributor to the rapid growth of the screw piles market in the country.

Canada accounted for a substantial revenue share of North America screw piles industry in 2022 owing to increasing government investment in infrastructure projects coupled with expanding population, rising urbanization, and increased immigration rate across the country is driving the demand for the construction of residential and non-residential building structures. Rising commercial construction activities in the country owing to the growth of the service industry are expected to fuel the demand for office spaces, thereby, driving the North America screw piles market over the forecast period.

As of 2022, the service sector accounts for over 70% of the GDP in Canada. An increasing number of services-providing firms in the country is expected to propel the demand for office spaces, thereby, fueling commercial construction sector growth. Rising commercial construction activities in key provinces of the country are expected to boost the consumption of screw pile products over the forecast period.

Mexico was valued at a revenue share of over 15.0% in 2022 and is further anticipated to grow at the fastest rate over the forecast period. The Mexican government identified infrastructure and construction as essential industries. Furthermore, in October 2020, the Mexican government announced a USD 14.2 billion infrastructure plan for the upgradation and new construction of infrastructure projects, which included airports, ports, and housing projects. These planned projects are expected to be completed by 2023, thus, creating a high demand for screw piles in this time frame.

Key Companies & Market Share Insights

The competitive rivalry among manufacturers of screw piles in North America is high as the market is characterized by the presence of a large number of regional players. The major players typically offer a diverse range of construction productsrather than producing only one type of product, As a result, these manufacturers primarily compete based on pricing and product portfolio. In addition, companies compete for market share by offering specialized installation services.

Various initiatives such as technology innovations, research & development, partnerships, and merger & acquisitions to manufacture cost-effective screw piles products have been undertaken by the key market players in North America. For instance, in June 2021, Cyntech's helical pile and pipeline anchoring division completed a management buyout from Keller in June 2021 and was renamed Cyntech Group. The buyout helped the company to regain its market share and competitive edge in North America. Some prominent players in the North America screw piles include:

-

Helical Anchors, Inc.

-

Cyntech Group

-

Hubbel Power Systems Inc

-

Earth Contact Products

-

GoliathTech Piles

-

Maclean Power Systems.

-

Patriot Foundation Systems

-

Pier Tech Systems LLC

-

Ram Jack Distribution, LLC

-

Roterra Piling Ltd.

-

American Ground Screw MFG & Supply

-

American Earth Anchors, Inc.

North America Screw Piles Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 292.4 million

Revenue forecast in 2030

USD 392.6 million

Growth Rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Installation type, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Helical Anchors, Inc.; Cyntech Group; Hubbel Power Systems Inc; Earth Contact Products; GoliathTech Piles; Maclean Power Systems.; Patriot Foundation Systems; Pier Tech Systems LLC; Ram Jack Distribution, LLC; Roterra Piling Ltd.; American Ground Screw MFG & Supply; American Earth Anchors, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Screw Piles Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America screw pilesmarket based on installation type, and region:

-

Installation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

DIY

-

Professional Installer

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America screw piles market size was estimated at USD 285.4 million in 2022 and is expected to reach USD 292.4 million in 2023.

b. The North America screw piles market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 392.6 million by 2030.

b. Professional installer type dominated North America screw piles market with a share of 81.1% in 2022 owing to the code compliance and insurance & liability provided by screw piles which are installed professionally.

b. Some of the key players operating in the North America screw piles market include Helical Anchors, Inc., Cyntech Group, Hubbell Power Systems Inc, Earth Contact Products, GoliathTech Piles, and Maclean Power Systems.

b. The key factor which is driving North America screw piles market is rising civil engineering and construction activities due to rapid urbanization and industrialization across the region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."