- Home

- »

- Clothing, Footwear & Accessories

- »

-

North America Sporting Goods Market Share Report, 2030GVR Report cover

![North America Sporting Goods Market Size, Share & Trends Report]()

North America Sporting Goods Market Size, Share & Trends Analysis Report By Sports Type (Ball Sports, Racquet sports), By Distribution Channel (Offline, Online), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-035-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

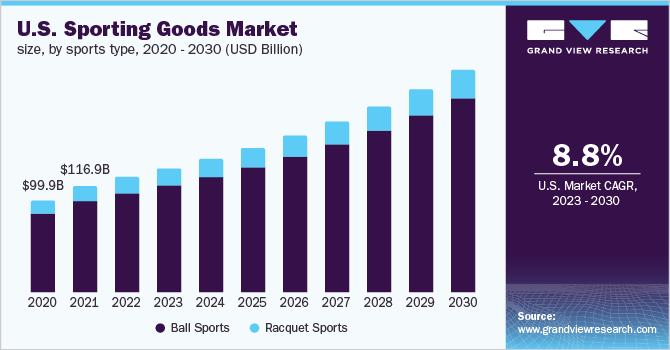

The North America sporting goods market size was valued at USD 137,170.9 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.7% from 2023 to 2030. In addition, the growing popularity of national and international sports events, such as the Soccer World Cup, Olympic Games, and Cricket World Cup, is further contributing to the growth of the sporting goods market in North America. Participation of women in sports has witnessed a tremendous increase in North American countries over the past few years.

According to the new State of the Industry Report from the Sports & Fitness Industry Association and Sports Marketing Surveys USA, 232.6 million Americans took part in sports and fitness activities in 2021, the most since 2016. The increasing awareness about the benefits of a healthy lifestyle and the importance of sports and fitness activities is stimulating the demand for sporting goods in North America.

In 2020, COVID-19 had a significant effect on the North American sporting goods market, with decreased sales reported by most companies. In the early stages of the pandemic, the revenues of sporting goods manufacturing companies decreased. However, by the end of 2020, these players performed well in terms of revenue by a significant margin compared to manufacturers of other apparel, footwear, and equipment. Additionally, sporting goods manufacturers showed greater resilience than players in other industries as there was a significant rise in sports and fitness activities among individuals during the pandemic.

According to 2022 data released by the Olympic committee, the U.S. Olympic team of 222 athletes for the Beijing Games includes 107 women, the most for any nation in the history of the Winter Olympics. Further, data released by the Government of Canada, stated that in the 2020 Olympics games, over half of Canada's athletes were women (60%) and 55% of Canada's Paralympic team were women athletes. The increase in the participation of women in sports is expected to have a positive impact on the regional sporting goods market.

The COVID-19 pandemic adversely affected several industries including the sports and fitness industry. In 2020 and 2021, many tournaments and game events, including the Cricket World Cup, and the Olympics, were postponed or altered their formats. As a result, stakeholders in the market are trying to assess the downstream impact arising from disrupted cash flows, insecurities, and potential declines in long-term attendance and engagement.

However, the sports industry has managed to return to its pre-COVID-19 growth levels amid a difficult economic environment. In 2020, sporting goods companies focused on three trends: consumer shift, digital leap, and industry disruption. In 2021, these trends continued, in some cases accelerated, or took interesting new turns. The increase in focus on new trends by companies is expected to drive the sporting goods market in North America during the forecast period.

Sports Type Insights

By sports type, the ball sports segment accounted for the largest share of more than 84.9% in 2022. One of the key reasons driving market expansion during the projection period is the notable increase in the popularity of sports events like the Olympics, Football World Cup, NBA, and others around the world. The global sports event sector is expanding because of the increasing public interest in athletes and premier league tournaments. The increasing interest of individuals in sports, coupled with rising expenditure on fitness apparel and gear, is supporting the sporting goods market for ball sports.

The racket sports segment, which includes tennis, badminton, table tennis, squash, and other sporting goods, is expected to witness significant growth in the coming years. Racquet sports engagement is crucial to one's overall health and well-being. Sports participation has advantages that go beyond just the physical, such as psychological and social advantages. These factors are aiding in boosting the participation rate in racquet sports and contributing to the demand for these sporting goods in the region.

Distribution Channel Insights

Based on the distribution channel, the North America sporting goods market has been bifurcated into offline and online channels. The offline segment accounted for a revenue share of 58.8% in 2022. Consumers have started spending more time outside during the pandemic. As a result, the sales of sporting goods apparel and equipment have grown. Sports goods retailers in the U.S. reported monthly sales increases in 2021 over 2020. Specialty stores such as DICK’S Sporting Goods, Golf Galaxy, Nike, Adidas, Puma, and Public Lands are designed to create an interactive shopping environment that highlights their extensive product assortments and value-added services for sporting enthusiasts.

The online distribution channel segment is expected to witness the fastest CAGR of 9.0% over the forecast period. With a significant share of people still working from home and changing attitudes regarding business attire, athleisure continues to witness a rise in popularity. Sporting goods companies can leverage the increased appeal of digital exercise, improved health awareness, and fresh perspectives on sports and fitness. Moreover, sporting goods merchants and brands advertise their items and apparel on social media through athletes and influencers to gain more visibility. Based on an analysis by data analytics company Hookit, global media business SportsPro named Nike the most marketable company in the world.

Regional Insights

The U.S. accounted for the largest revenue share of over 92.5% in 2022. The increasing participation of women and children in sports and fitness activities is likely to create a significant demand for sports and fitness goods over the forecast period. Major manufacturers are launching new products in the country to attract more customers. In addition, during the COVID-19 pandemic, growing concerns about health and fitness activities encouraged the U.S. population to spend on fitness and health accessories to maintain a good physique and posture. This played a key role in driving sporting goods sales in the country, ultimately leading to market growth.

On the other hand, Canada is expected to register a significant growth rate of 7.4% during the forecast period. Due to the rising popularity of various sports and increasing investments in promoting sports in the country. Popular sports like hockey, golf, baseball, softball, racquet sports, soccer, basketball, volleyball, skiing, and snowboarding are the most popular sports in Canada. In addition, the growing participation of youngsters in different outdoor sports events will drive the demand for sporting equipment for convenience and comfort. This will likely boost the consumption of sporting goods in the country.

Key Companies & Market Share Insights

The major players in the sporting goods market focus on diversifying and expanding the range of their product offerings. Mergers & acquisitions are prominent strategies adopted by key players. Manufacturers are providing robust services to gain a competitive advantage over others.

-

Adidas launched its new SS23 Melbourne Tennis Collection, a range of performance apparel that features striking colorful prints, inspired by plant life and nature. In addition, the collection also utilizes HEAT.RDY and Aeroready technologies.

-

Tyrese Maxey, an upcoming NBA player, officially joined New Balance. Tyrese is the perfect choice to represent the company because of his approach to the game, as well as his passion and leadership both on and off the court.

-

Yonex Co., Ltd. launched a new racquet model in its ASTROX line. The brand-new ASTROX NEXTAGE racquet is meant for intermediate players who want more power and a satisfying hitting experience.

-

Yonex Co., Ltd. launched New POWER CUSHION AERUS Z badminton shoes, which are incredibly lightweight and offer quick footwork.

-

as a commitment to help end plastic waste, Adidas launched TERREX HS1, its first product created with wood-based SPINNOVA fibers. At least 30% of the fabric of the product is made from SPINNOVA fibers and 70% is made from organic cotton.

Some prominent players in the North America sporting goods market include:

-

Nike, Inc.

-

Adidas AG

-

PUMA SE

-

Columbia Sportswear Company

-

Under Armour, Inc.

-

lululemon athletica Inc.

-

Yonex Co., Ltd.

-

New Balance Athletics, Inc

-

Callaway Golf Company

-

ANTA Sports Products Limited

North America Sporting Goods Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 147,953.2 million

Revenue forecast in 2030

USD 267,645.1 million

Growth Rate (Revenue)

CAGR of 8.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sports type, distribution channel, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Nike, Inc.; Adidas AG; PUMA SE; Columbia Sportswear Company; Under Armour, Inc.; lululemon athletica Inc.; Yonex Co., Ltd.; New Balance Athletics, Inc.; Callaway Golf Company; ANTA Sports Products Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options North America Sporting Goods Market Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the North America sporting goods market report based on sports type, distribution channel, and country:

-

Sports Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Ball Sports

-

Basket Ball

-

American Football/Gridiron Football

-

Golf

-

Baseball

-

Hockey

-

Soccer

-

Volleyball

-

Others

-

-

Racquet sports

-

Tennis

-

Badminton

-

Table Tennis

-

Squash

-

Others

-

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America sporting goods market size was estimated at USD 137,170.9 million in 2022 and is expected to reach USD 147,953.2 million in 2023.

b. The North America sporting goods market is expected to grow at a compound annual growth rate of 8.7% from 2023 to 2030 to reach USD 267,645.1 million by 2030.

b. U.S. dominated the North America sporting goods market with a share of 97.6% in 2022. The increasing participation of women and children in sports and fitness activities is likely to create a significant demand for sports and fitness goods over the forecast period.

b. Some key players operating in the North America sporting goods market include Nike, Inc., Adidas AG, PUMA SE, Columbia Sportswear Company, Under Armour, Inc., lululemon athletica Inc., Yonex Co., Ltd., New Balance Athletics, Inc, Callaway Golf Company, ANTA Sports Products Limited

b. Key factors that are driving the market growth include growing popularity of national and international sports events, such as the Soccer World Cup, Olympic Games, and Cricket World Cup. Participation of women in sports has witnessed a tremendous increase in North American countries over the past few years

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."