- Home

- »

- Advanced Interior Materials

- »

-

North America Steel Rebar Market Size, Share, Report, 2030GVR Report cover

![North America Steel Rebar Market Size, Share & Trends Report]()

North America Steel Rebar Market Size, Share & Trends Analysis Report By Application (Construction, Infrastructure, Industrial), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-954-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

“2030 North America steel rebar market value to reach USD 16.23 billion.”

North America Steel Rebar Market Trends

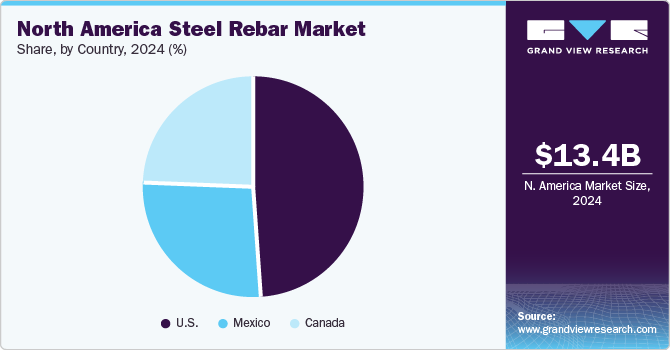

The North America steel rebar market size was estimated at USD 13.39 billion in 2024 and is projected to grow at a CAGR of 4.1% from 2025 to 2030. The market is anticipated to be driven by rising investments in infrastructure development projects and construction activities. In 2021, the United States enacted the Bipartisan Infrastructure Law, officially titled the Infrastructure Investment and Jobs Act, representing a historic USD 1.2 trillion investment in the nation's infrastructure. This legislation is designed to address critical infrastructure needs across various sectors, including transportation, broadband, and energy. It aims to modernize roads, bridges, public transit, and airports, driving the growth of steel rebar market.

Growing awareness of the need for sustainable and earthquake-resistant infrastructure has led to increased demand for high-strength, corrosion-resistant steel rebar. In regions prone to seismic activity, such as California, the adoption of seismic-resistant construction standards has driven the use of epoxy-coated and stainless steel rebar, which offers enhanced durability and resilience in earthquake-prone areas.

Rapid urbanization and industrial growth, especially in metropolitan areas, have led to the expansion of infrastructure projects, further increasing steel rebar demand. The growth of industrial parks and logistics hubs, particularly near ports and trade routes in North America, has created the need for large-scale industrial construction, relying heavily on steel rebar for foundation and structural support in facilities like warehouses and manufacturing plants.

Drivers, Opportunities & Restraints

The growing emphasis on green building standards and sustainable construction practices is driving the demand for environmentally friendly and recycled steel rebar. The LEED (Leadership in Energy and Environmental Design) certification encourages the use of recycled materials, including steel rebar, in construction. Rebar made from recycled steel scrap is increasingly being used in LEED-certified projects across North America, such as the Bank of America Tower in New York, which used a large amount of recycled steel in its construction.

The shift towards renewable energy, particularly the construction of solar farms, wind energy facilities, and hydroelectric plants, offers an emerging market for steel rebar. These projects demand high-strength, corrosion-resistant steel rebar to ensure the durability and longevity of energy infrastructure. With urban populations growing and housing demands rising, the residential construction sector across North America is increasing. The use of steel rebar in the construction of apartment complexes, high-rise buildings, and other residential structures is essential for maintaining structural integrity, making this an important growth area for the steel rebar market.

The fluctuating prices of raw materials, particularly steel and iron ore, can lead to increased production costs for rebar manufacturers, making it difficult to maintain stable pricing and profit margins. Stringent environmental regulations related to carbon emissions and waste management in the steel industry can pose challenges for rebar manufacturers. Compliance with these regulations may require significant investment in cleaner technologies, increasing operational costs. The growing adoption of alternative construction materials, such as composite rebar or fiber-reinforced polymers, which offer better corrosion resistance and longevity, can limit the demand for traditional steel rebar.

Pricing Trend

In 2023, the North America steel rebar market experienced notable price fluctuations, driven largely by tariffs and government subsidies. U.S. tariffs on imported steel, particularly under Section 232, continued to affect the cost of steel rebar by limiting supply from major exporters such as China and Turkey, thereby driving up domestic prices. In response, U.S. steel manufacturers benefited from government subsidies aimed at promoting local production, helping to stabilize supply but at elevated price levels.

Instances of price hikes were observed in the first half of 2023, as global inflation and high energy costs impacted raw material procurement. In addition, the ongoing infrastructure projects funded by the Bipartisan Infrastructure Law increased demand for steel rebar, further contributing to higher prices. By mid-2023, the market showed signs of stabilization as supply chains adjusted to the tariffs and domestic production capacities expanded, yet prices remained relatively higher compared to pre-2022 levels due to persistent input cost pressures.

Application Insights

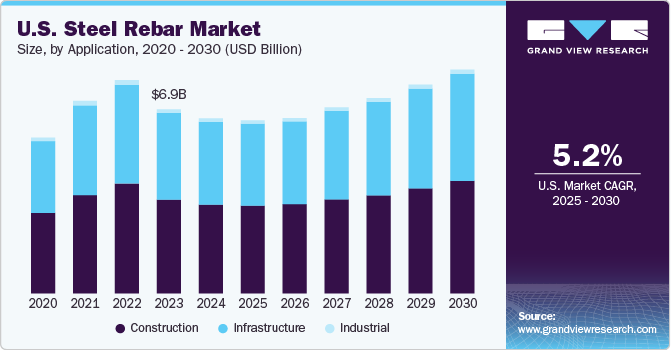

“Construction segment held the revenue share of over 49.5% in 2024.”

As urbanization accelerates across North America, the need for residential, commercial, and industrial buildings has risen sharply. This trend drives demand for steel rebar, which is essential in reinforcing concrete for high-rise buildings, housing complexes, and industrial facilities. Cities such as Toronto and New York have seen increased construction activity in 2023, where steel rebar has played a critical role in meeting construction requirements. As of June 2024, Toronto boasts 258,397 active projects, which collectively represent approximately 90% of the units required to meet the Municipal Housing Target by 2031. The increase in development will lead to an increased demand for steel rebar.

Infrastructure segment is expected to grow at fastest CAGR of 4.3% over the forecast period. Private sector participation in infrastructure development, including public-private partnerships (PPPs), leads to increased construction activities and subsequently, a higher demand for steel rebar. PPP projects in areas such as transportation and energy have emerged across North America, with significant investments directed toward highways, bridges, and renewable energy facilities, all of which require substantial quantities of steel rebar.

Country Insights

“U.S. held the revenue share of over 49.0% in 2024.”

U.S. Steel Rebar Market

Rising construction spending in the country is expected to boost the product demand during the forecast period. For instance, according to the U.S. Census Bureau, the growth of construction spending in the country is registering growth every year. For instance, on a y-o-y basis, U.S. construction spending rose by 6.4% in 2023.

Canada Steel Rebar Market Trends

In Canada, various construction projects focused on ensuring long-term economic growth, transitioning to a clean economy, and improving social inclusion are being initiated. Rising investments in such projects including the building of affordable housing units, expansion of public transit networks, and communication networks are anticipated to positively influence the market growth over the forecast period.

Mexico Steel Rebar Market Trends

Production facilities are relocating their manufacturing base from Asia to Mexico, which is expected to vastly aid economic development in Mexico. This in turn, has augmented spending on public works and led to surging demand for industrial parks and other construction activities. Thus, growing investments towards construction development is expected to augment steel rebar growth in the country over the forecast period.

Key North America Steel Rebar Company Insights

Some of the key players operating in the steel rebar market include Nucor Corporation, Steel Dynamics, Inc., Charter Steel.

-

Nucor Corporation is one of the largest steel producers in the United States and a prominent player in the North American steel rebar market. Nucor’s product offerings in the steel rebar segment include standard rebar, epoxy-coated rebar, and high-strength rebar, catering to various construction and infrastructure projects.

-

Steel Dynamics operates several steel mills and recycling facilities across the country, with a strong focus on sustainability and environmental responsibility. Among its product offerings, SDI provides a comprehensive range of steel rebar products, including deformed and smooth rebar in various grades and sizes, which are utilized in construction projects ranging from infrastructure to commercial and residential buildings.

Key North America Steel Rebar Companies:

- Acerinox

- ArcelorMittal

- CMC Steel

- EVRAZ North America

- Gerdau

- Nucor

- Pacific Steel Corp

- Radius Recycling

- Steel Dynamics

- Ternium

View a comprehensive list of companies in the North America Steel Rebar Market

Recent Developments

-

In June 2024, White Cap, distributor of specialty construction products, announced its strategic expansion into the rebar sector through the acquisition of Rebar Solutions, LLC. This acquisition aligns with White Cap's commitment to enhancing its service offerings and strengthening its position in the construction industry by providing comprehensive solutions to contractors and builders. By integrating Rebar Solutions' expertise and capabilities, White Cap aims to improve supply chain efficiency and meet the growing demand for high-quality rebar products.

-

On June 5, Deacero announced a USD 600 million investment in a new steel plant in Ramos Arizpe, Mexico, set to begin production in February 2026, adding 1 million tons of steel output. The facility will focus on green steel using electric-arc furnace technology, reducing CO2 emissions while meeting domestic demand and eliminating imports.

North America Steel Rebar Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.39 billion

Revenue forecast in 2030

USD 16.23 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD billion/million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Acerinox; ArcelorMittal; CMC Steel; EVRAZ North America; Gerdau; Nucor; Pacific Steel Corp.; Radius Recycling; Steel Dynamics; Ternium

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Steel Rebar Market Segmentation

This report forecasts revenue and volume growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America steel rebar market report on the basis of application and region.

-

Application Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Infrastructure

-

Industrial

-

-

Country Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America steel rebar market size was estimated at USD 13.39 billion in 2024 and is expected to reach USD 13.29 billion in 2025.

b. The North America steel rebar market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2030 to reach USD 16.23 billion by 2030.

b. Based on application segment, construction held the largest revenue share of more than 49.5% in 2024 owing to rapid infrastructure developments.

b. Some of the key vendors of the North America steel rebar market are Cargill, Incorporated, Schmidt Rebar, Inc., United States Steel Corporation, Forterra, Inc., SteelFab, Inc., McCarthy Building Companies, Inc., Cleveland-Cliffs Inc., Bayou Steel Group, Ritchie Bros. Auctioneers, SWS Steel, Inc., Miller Formless Company, Inc.

b. Rapid urbanization and industrial growth are major driving factors for North America steel rebar market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."