- Home

- »

- Medical Devices

- »

-

North America Unit Dose Manufacturing Market Report, 2030GVR Report cover

![North America Unit Dose Manufacturing Market Size, Share & Trends Report]()

North America Unit Dose Manufacturing Market Size, Share & Trends Analysis Report By Sourcing (In-house, Outsourcing), By Product (Liquid Unit Dose, Solid Unit Dose), By End Use, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-396-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

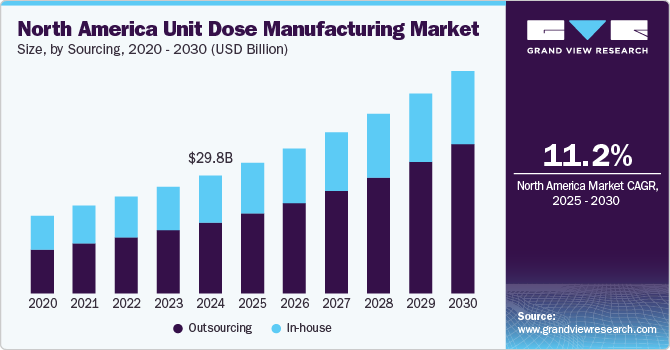

The North America unit dose manufacturing market size was estimated at USD 29.82 billion in 2024 and is projected to grow at a CAGR of 11.23% from 2025 to 2030. The rise in chronic diseases and an aging population has increased demand for precise, convenient, and safe medication delivery methods, stimulating the shift toward unit dose packaging. This format enhances medication adherence, minimizes dosing errors, and reduces waste, supporting hospitals' and healthcare providers' focus on improving patient outcomes and safety.

Technological advancements in automation and digitalization are streamlining production processes, enhancing accuracy, and supporting scalability. Furthermore, regulatory agencies, such as the U.S. FDA, emphasize stringent guidelines for accurate dosage and safety, creating a favorable environment for unit dose packaging. In addition, the increasing adoption of unit dose packaging by long-term care facilities, outpatient services, and home healthcare providers will boost the market growth potential in North America.

The rising prevalence of chronic diseases and an aging population significantly propel market growth in North America. As individuals age, the growing incidence rate of chronic conditions such as diabetes, hypertension, and cardiovascular diseases requires consistent and accurate medication regimens. Unit dose packaging offers a reliable solution by ensuring precise dosage administration, thereby enhancing patient adherence and minimizing the risk of medication errors.

The elderly population often requires multiple medications, making unit dose systems invaluable for managing complex treatment plans. As per the Population Reference Bureau, the U.S. population aged 65 and older is expected to grow from 58 million in 2022 to 82 million by 2050. This demographic shift increases the demand for unit dose packaging and drives healthcare providers to adopt these systems to improve overall patient outcomes. Furthermore, the increasing projection on personalized medicine and customized therapeutic approaches aligns with the benefits of unit dose manufacturing, strengthening its critical role in addressing the healthcare challenges among the geriatric population.

Technological advancements in automation and digitalization are critical driving factors in the North America unit dose manufacturing industry. Innovative manufacturing technologies, including automated packaging lines, robotics, and advanced software systems, have transformed unit dose production by enhancing efficiency, accuracy, and scalability. Automation minimizes human error, ensures consistent quality, and accelerates production processes, thereby meeting the increasing demand for unit dose packaging.

Digitalization aids real-time monitoring, data analytics, and traceability, enabling manufacturers to maintain stringent quality control standards and comply with regulatory requirements. Innovations such as smart packaging and Internet of Things (IoT) integration offer enhanced advantages, including inventory management and patient compliance tracking. These technological strides reduce operational costs and improve overall reliability and responsiveness, positioning the unit dose manufacturing market for sustained growth and competitiveness in the North America healthcare sector.

Continuous advancements in supply chain management and inventory control are also driving the market growth in North America. Efficient supply chain operations are essential for the appropriate availability of medications, reducing stockouts, and minimizing excess inventory. Unit dose packaging assists in streamlined inventory management by allowing for precise tracking of medication usage and expiration dates. This level of control enhances the ability of healthcare facilities to maintain optimal stock levels, reduce waste, and manage costs effectively. In addition, unit dose systems support just-in-time inventory practices, enabling healthcare providers to respond instantly to varying patient demands and seasonal variations in medication needs. The integration of advanced supply chain technologies, such as automated inventory systems and predictive analytics, further enhances the efficiency and reliability of unit dose manufacturing and distribution. These developments bolster the operational capabilities of healthcare providers and boost the strategic importance of unit dose packaging in the overall healthcare supply chain ecosystem.

Regulatory authorities in North America, such as the U.S. Food and Drug Administration (FDA) and Health Canada, play a crucial role in influencing the unit dose manufacturing market through stringent guidelines and compliance requirements. These regulations mandate precise dosage accuracy, safety standards, and quality assurance protocols, requiring manufacturers to adopt unit dose packaging solutions that meet stringent guidelines. Compliance with regulatory standards ensures that medications are dispensed accurately, reducing the probability of dosing errors and enhancing patient safety.

Regulatory emphasis on traceability and accountability in pharmaceutical distribution chains fosters the adoption of unit dose systems, accelerating detailed tracking and documentation of medication dispensing. The need to adhere to Good Manufacturing Practices (GMP) and other regulatory frameworks drives investments in advanced manufacturing technologies and quality control measures. Consequently, the regulatory landscape ensures high standards of patient care and stimulates the growth and innovation within the North America unit dose manufacturing industry.

Sourcing Insights

Based on sourcing, the outsourcing segment led the market with the largest revenue share of 60.13% in 2024. The segment is estimated to maintain its leading position over the forecast period. The segment growth is attributed to the growing trend of outsourcing unit dose manufacturing by pharmaceutical and healthcare companies to specialized contract manufacturing organizations (CMOs) to streamline costs, optimize efficiency, and access advanced packaging technologies. Outsourcing allows these companies to focus on core competencies such as research and development, leaving production complexities to CMOs that offer state-of-the-art equipment, regulatory expertise, and scalable solutions. In addition, the stringent regulatory environment in North America demands robust quality assurance, a specialization that many CMOs are well-equipped to handle. This trend is particularly prominent among small and mid-sized pharmaceutical firms, which may lack in-house manufacturing capacity but benefit from high-quality, cost-effective solutions from outsourcing providers. Thus, the aforementioned factors are expected to drive segmental demand in the near future.

The in-house segment is predicted to witness at a considerable CAGR over the forecast period. As, large pharmaceutical companies prioritize control over production processes and quality standards. By managing unit dose packaging internally, these companies can ensure alignment with proprietary technologies, maintain tighter control over quality assurance, and safeguard intellectual property. In-house capabilities also allow for greater agility in responding to sudden shifts in demand or specific product needs. Several large pharmaceutical companies have sufficient infrastructure and resources to handle high-volume production, enabling streamlined processes, efficient logistics, and a quicker route to market for specialized unit dose products, thereby strengthening segment market growth.

Product Insights

The solid unit dose segment led the market with the largest revenue share of 49.71% in 2024. The segment is expected to maintain its position over the forecast period. The segment growth can be attributed to its convenience, stability, and ease of administration. Solid dosage forms offer extended shelf life, reduced contamination risk, and precise dosing, making them a preferred choice for healthcare providers and patients. This segment is particularly suitable for chronic disease medications that require consistent, long-term dosing and align well with unit dose packaging benefits such as accuracy and patient adherence. In addition, advancements in tablet and capsule coating technologies further enhance the demand for solid doses by improving palatability and allowing for controlled or sustained release, meeting varied therapeutic needs effectively.

The liquid unit dose segment is expected to witness at a considerable CAGR over the forecast period. The segment growth is owing to its suitability for pediatric, geriatric, and patients with difficulty swallowing solid forms. Liquid unit doses offer precise, ready-to-use formats that reduce dosing errors and enhance compliance, which is essential for high-precision therapies and acute care settings. This segment also supports flexible dosing and adjustments for varied patient needs without requiring solid form modification. In addition, aseptic packaging advancements have enhanced liquid dose stability and shelf life, increasing their practicality and demand. With rising demand in outpatient and home care settings, the liquid unit dose segment is anticipated to grow significantly in the North America unit dose manufacturing industry.

End Use Insights

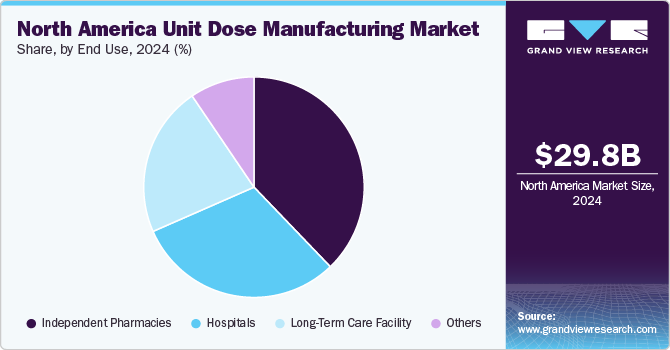

Based on end use, the independent pharmacies segment led the market with the largest revenue share of 37.83% in 2024 and is anticipated to witness at the fastest CAGR over the forecast period. This growth is primarily driven by the huge patient footfall, patient preference, and versatile product portfolio offered by such establishments. Unit dose packaging allows these pharmacies to offer precise medication dispensing, reducing the risk of errors and enhancing patient safety. In addition, it simplifies inventory management by minimizing drug wastage and improving stock rotation. As patient-centric care becomes more prominent, independent pharmacies utilize unit dose packaging to offer personalized medication regimens, particularly for long-term care or chronic condition management. These factors drive the growing adoption of unit dose solutions, support operational efficiency, and improve patient outcomes.

The hospitals segment accounted for the second-largest revenue share in 2024. Unit dose packaging ensures precise dosing, reduces the possibility of medication errors, and supports medication safety protocols within hospital settings. In addition, it enhances workflow efficiency by streamlining medication dispensing and inventory management, which is critical in fast-paced hospital environments. The increasing focus on patient safety and the adoption of electronic health records (EHR) systems further persuade hospitals to adopt unit dose solutions.

Country Insights

U.S. Unit Dose Manufacturing Market Trends

The unit dose manufacturing market in U.S. dominated the North America unit dose manufacturing market with the largest revenue share of 89.92% in 2024. The market growth is owing to a robust healthcare infrastructure, rising prevalence of chronic diseases, and stringent regulatory standards emphasizing medication safety. The Centers for Disease Control and Prevention’s National Center for Health Statistics reported an estimated 107,543 drug overdose deaths in the U.S. in 2023. The geriatric population is especially at risk; patients aged 65 and above are gradually taking 10 or more prescriptions each day. Thus, increased demand for accurate, patient-friendly medication formats in hospitals, outpatient centers, and home care has led to the widespread adoption of unit dose packaging. Unit dose aids in the elimination of the possibility of erroneous dosing, which is likely to boost its demand during the forecast period.

The Canada unit dose manufacturing market is expected to witness at the fastest CAGR over the forecast period. The market growth is owing to a rising focus on patient safety, especially in long-term and home care settings, where accurate dosing is essential. In addition, regulatory prominence on medication accuracy and growing demand for streamlined healthcare solutions foster the adoption of unit dose packaging across Canada.

Key North America Unit Dose Manufacturing Company Insights

The North America unit dose manufacturing industry is highly competitive, with leading companies utilizing advanced technologies and strategic partnerships to strengthen their market presence. Key players such as Catalent Inc., Thermo Fisher Scientific, Unither Pharmaceuticals, and PCI Pharma Services dominate through extensive manufacturing capabilities and investments in automation and digital solutions, which enhance production efficiency and compliance. Moreover, smaller players and niche firms focus on innovation in specific dosage forms or end-user customization. The key companies are implementing several market growth strategies, such as collaboration, merger & acquisition, expansion, service portfolio expansion, and competitive pricing, to gain a competitive edge in the market.

Key North America Unit Dose Manufacturing Companies:

- Catalent Inc.

- Unither Pharmaceuticals

- Thermo Fisher Scientific

- Corden Pharma

- Mikart LLC

- LTS LOHMANN Therapie-Systeme AG (TapeMark)

- Renaissance Lakewood LLC

- Medical Packaging Inc.

- American Health Packaging

- PCI Pharma Services

- Amcor PLC

- Bristol-Myers Squibb

- AbbVie Inc.

- Merck & Co. Inc.

- Pfizer Inc.

View a comprehensive list of companies in the U.S. Unit Dose Manufacturing Market

Recent Developments

-

In February 2024, Mikart LLC announced the addition of advanced Fette double-sided tablet presses to broaden its oral solid dosage production capacity. This integration enables Mikart to enhance its operation capabilities in a significant market.

-

In September 2023, Mikart LLC acquired the advanced Flexpack NF-150 Horizontal Sachet-Packaging Machine, strengthening its production capabilities and commitment to high-quality pharmaceutical manufacturing.

-

In February 2024, Novo Holdings and Catalent, Inc. announced a merger agreement. In the agreement, Novo Holdings will acquire Catalent for USD 16.5 billion. Such acquisitions offered numerous growth opportunities to the company in a significant market.

North America Unit Dose Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 33.02 billion

Revenue forecast in 2030

USD 56.22 billion

Growth rate

CAGR of 11.23% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sourcing, product, end use, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Catalent Inc.; Unither Pharmaceuticals; Thermo Fisher Scientific; Corden Pharma; Mikart; LTS LOHMANN Therapie-Systeme AG (TapeMark); Renaissance Lakewood LLC; Medical Packaging Inc.; American Health Packaging; PCI Pharma Services; Amcor PLC; Bristol-Myers Squibb; AbbVie Inc.; Merck & Co. Inc.; Pfizer Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Unit Dose Manufacturing Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America unit dose manufacturing market report based on the sourcing, product, end use, and country:

-

Sourcing Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourcing

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid Unit Dose

-

Solid Unit Dose

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Independent Pharmacies

-

Long Term Care Facility

-

Hospitals

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America unit dose manufacturing market size was estimated at USD 29.82 billion in 2024 and is expected to reach USD 33.02 billion in 2025.

b. The North America unit dose manufacturing market is expected to grow at a compound annual growth rate of 11.23% from 2025 to 2030 to reach USD 56.22 billion by 2030.

b. Independent pharmacies dominated the North America unit dose manufacturing market with a share of 37.83% in 2024. This is attributable to high patient footfall and a diverse portfolio of independent pharmacies.

b. Some key players operating in the North America unit dose manufacturing market include Catalent Inc.; Unither Pharmaceuticals; Thermo Fisher Scientific; Corden Pharma; Mikart; LTS LOHMANN Therapie-Systeme AG (TapeMark); Renaissance Lakewood LLC; Medical Packaging Inc.; American Health Packaging; PCI Pharma Services; Amcor PLC; Bristol-Myers Squibb; AbbVie Inc.; Merck & Co. Inc.; and Pfizer Inc..

b. Key factors that are driving the North America unit dose manufacturing market growth include increasing adoption of unit doses, benefits of manufacturing unit doses over packaging, growing outsourcing activities, technological advancements in unit dose manufacturing and increasing prevalence of chronic diseases and demand for personalized medicine

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."