- Home

- »

- Animal Health

- »

-

North America Veterinary Oncology Market, Report, 2030GVR Report cover

![North America Veterinary Oncology Market Size, Share & Trends Report]()

North America Veterinary Oncology Market Size, Share & Trends Analysis Report By Animal (Canine, Feline), By Therapy (Radiotherapy, Surgery, Chemotherapy), By Cancer (Skin Cancer, Lymphoma), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-138-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

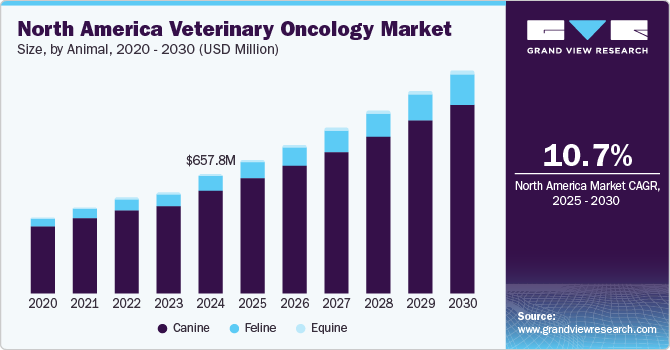

The North America veterinary oncology market size was estimated at USD 657.78 million in 2024 and is projected to grow at a CAGR of 10.70% from 2025 to 2030. Growing adoption of veterinary cancer medicines as treatment options and a rising incidence of cancer in the pet population are expected to drive the market growth over the coming years. The growing willingness of owners to pay for pet healthcare and government initiatives for veterinary cancer therapy are the primary market drivers.

The rising number of veterinary clinical trials investigating the safety and effectiveness of various oncologic therapies in pets further contributes to market growth. Moreover, increasing strategic initiatives for R&D of targeted therapies for cancer in companion animals is boosting market growth. For instance, in January 2024, the Morris Animal Foundation awarded grants to eight new research projects focused on advancing canine cancer treatment. These studies will explore various aspects of cancer in dogs, such as molecular tools for lymphoma detection, immune cell therapies, and predictive tests for bladder cancer treatments. The research aims to enhance understanding, diagnosis, and treatment in both dogs and humans.

Furthermore, an increase in pet insurance adoption is driving the growth of the North American veterinary oncology industry by reducing financial barriers for pet owners. This growth in insurance coverage facilitates access to advanced cancer treatments and diagnostics, boosting demand for veterinary oncology services. According to the AVMA, pet owners are increasingly turning to pet insurance to manage the costs associated with their pets' healthcare. For instance, the North American Pet Health Insurance Association (NAPHIA) stated that the pet insurance market in the U.S. reached approximately $3.2 billion in 2023. By the end of 2023, the number of insured pets in the U.S. had grown to around 5.7 million, marking a 17% increase compared to 2022. California, New York, and Florida were identified as the states with the highest number of insured pets.

The market is anticipated to grow due to increased corporate investments in canine cancer therapies. The companies are implementing strategies, such as licensing, R&D partnerships, and business growth, to improve their product portfolio in canine oncology. For instance, July 2023, Ardent Animal Health partnered with FidoCure to expand access to oncology innovation in veterinary medicine by leveraging the latter's genomic testing and precision medicine platform. Such expansion efforts and the need to provide comprehensive pet care are likely to drive the market growth over the forecast period.

Market Characteristics & Concentration

The market is fragmented and competitive due to the presence of several small to large market players. Players are actively involved in providing new treatment modalities for pets to fight cancer through mergers & acquisitions, partnerships, and collaborations. For instance, in August 2024, Akston Biosciences and Purdue University are partnering to develop an anti-cPD-L1 monoclonal antibody to treat canine cancer. Akston will license and manufacture the antibody, with clinical trials starting soon, expanding Akston's therapeutic offerings for animal health.

The North American market for veterinary oncology is highly innovative, characterized by advancements in immunotherapy, targeted therapies, and precision medicine. Companies are investing heavily in R&D to develop novel treatment solutions, diagnostic tools, and personalized therapies, significantly enhancing the effectiveness and scope of cancer care for pets. Similarly, academic universities are also engaging into R&D of pet cancer therapies. For instance, in March 2024, Yale University developed a cancer vaccine that has demonstrated effectiveness in treating dogs, leading to increased survival rates and tumor shrinkage. Hunter, an 11-year-old golden retriever with osteosarcoma, has been cancer-free for two years following this novel treatment, which may also have future applications for humans.

The North American market experiences high levels of M&A activity, driven by the need for innovation and market expansion. Companies frequently engage in mergers and acquisitions to enhance their research capabilities, broaden their product offerings, and consolidate their market positions.

Regulations in the market impact product development and market entry by enforcing rigorous approval processes and safety standards. These regulations ensure the efficacy and safety of new treatments and therapies, shaping the innovation landscape and influencing the pace of market growth.

Product substitutes in the North American market, such as alternative therapies and holistic treatments, can impact market growth by providing additional options for pet owners. These substitutes may drive competition and innovation but also challenge traditional treatment modalities by offering diverse approaches to care for pets.

Regional expansion in the North American market is driven by increased investment in infrastructure and partnerships, leading to broader availability of advanced cancer treatments. Growing demand for specialized oncology services and expanding veterinary practices across various regions contribute to the market's regional growth.

Animal Insights

Based on the type of animal, the market is categorized into canine, feline, and equine segments. The canine segment dominated the market in 2024 with a share of 86.25%. The rising incidence of canine cancer, rising investment in veterinary oncology research & development, and growing veterinary healthcare costs are expected to drive market growth. The demand for efficient and cutting-edge therapies for cancer is expected to grow along with the prevalence of canine cancer cases, fueling segment growth. For instance, in 2024, The National Cancer Institute reported that over 6 million canines are diagnosed with cancer every year, and it is the main cause of mortality for dogs post their middle age. Therefore, the need for treatments will continue to increase due to the growing incidence of cancer in dogs, driving sector growth.

The feline segment is expected to be the fastest-growing segment with a lucrative CAGR of 12.38% over the forecast period due to the increase in the feline population, the prevalence of cancer, and need for effective treatment. For instance, according to the American Pet Products Association, in 2024, roughly 40 million households in the U.S. had cats, and younger generations, especially millennials, were more likely to own them. In addition, cat-related visits to the vet increased dramatically in the months following the COVID-19 outbreak. According to the World Small Animal Veterinary Association (WSAVA), one in five cats is susceptible to acquiring cancer throughout their lifespan. According to estimates, the market growth is driven by increasing numbers of pet cats, higher incidence rates, and more frequent veterinary visits.

Therapy Insights

Based on therapy, surgery held the largest market share of 36.09% in 2024. Surgery is often most effective for tumors that can be completely removed without threatening the crucial structures where the tumor has not yet spread to other parts of the body. In the case of malignant cancer, it is frequently the first step. If the tumor is low-grade and there are no signs of local or distant metastasis, malignant cancer surgery could help in achieving remission. If the surgery succeeds, there may be no need for additional therapy, and the cancer may never come back. The growing instances of surgeries performed on pets for their treatment and technological advancements in these procedures contribute to the market growth. However, surgical treatments can partially or completely remove tumors, but pets may have some pain & discomfort, which may limit the adoption of surgery by pet owners. This is expected to hinder the growth of this market segment over the forecast period. In addition, a growing number of research projects, including surgeries on pet populations, are being conducted, which is further boosting the market's expansion.

Immunotherapy segment is estimated to grow at the fastest CAGR over the forecast period. Immunotherapy is considered one of the most promising recent developments in tumor treatment, which strengthens the body's immune response against cancer. Several nonprofit organizations dedicated to animal health research are sponsoring studies to bring new treatment options to the market. For instance, the University of Minnesota received funding from the Morris Animal Foundation in January 2023 to study & develop novel immunotherapeutics for big-breed dogs suffering from osteosarcoma. Osteosarcoma is a fatal bone cancer. Thus, the companies working on immunotherapeutic R&D for veterinary oncology also contribute to the market's expansion. Moreover, the market is growing as a result of an increase in the number of veterinarians dedicated to conducting immunotherapy clinical trials and growing investment in canine oncology clinical trials. For instance, in May 2024, Petco Love invested an additional $1 million in the May pet cancer campaign. Similarly, since 2010, national nonprofit Petco Love and Blue Buffalo have committed to an annual campaign called Supporting Pets in Their Fight Against Cancer, with a total investment of $20 million.

Cancer Insights

Based on cancer, the skin cancer segment holds the largest share of 39.01% in 2024 due to the high prevalence of mast cell tumors, which are among the most common skin cancers in dogs. Mast cell tumors and other skin cancers are prevalent in pets, leading to increased demand for effective treatments and diagnostics. In addition, increased awareness and advancements in targeted therapies and immunotherapy drive greater demand for effective treatments.

The others segment is expected to grow at the fastest CAGR over the forecast period. The growing incidence of adenocarcinoma is expected to drive the segment growth during the forecast period. According to data published by Springer Nature in September 2024, Apocrine gland anal sac adenocarcinoma (AGASACA) is a very common tumor affecting the anal sacs of dogs. Metastases are common, with 47-96% of dogs observed suffering from locoregional lymph node metastases. In addition, initiatives undertaken by public and private stakeholders are expected to contribute to segment growth. For instance, in May 2021, the World Small Animal Veterinary Association established the WSAVA Oncology Working Group (WOW) to develop global veterinary oncology practice guidelines. This would help educate owners about cancer in pets and enable veterinarians to improve treatment standards.

Country Insights

The North America veterinary oncology market is driven by an increasing number of veterinary cancer care centers and the availability of advanced treatment for pet cancer management. For instance, In May 2024, ChemoTech’s Animal Care launched its TSE cancer treatment technology in Canada, having secured a $37,000 initial order from an Ottawa clinic. The order depends on successful electrical safety testing, which is expected to be completed in 3-6 weeks. This marks ChemoTech's first step toward commercialization in North America, with plans to expand its sales force as demand grows.

Moreover, growing strategic initiatives by key players to increase access to precision medicine treatments for pet cancer in North America are boosting demand for oncology care in the region. For instance, in July 2023, Ardent and FidoCure entered into a transformative partnership to increase access to oncology innovation in the animal health market. This collaboration uses each company's strengths to advance science, give more animals access to cutting-edge precision medicine, and promote innovation in North America veterinary oncology industry.

U.S. Veterinary Oncology Market Trends

The veterinary oncology market in the U.S. held the largest share of 89.02% in the North American region in 2024, attributed to the increasing focus on pet health, the presence of multiple key pet drug manufacturing companies, and the rapid adoption of innovative pet care options. Furthermore, the increasing government funding for pet oncology and the presence of well-established market players in veterinary oncology are expected to further drive the market growth.

The increase in partnerships between key players, is driving the U.S. market growth. These partnerships enhance research, development, and distribution of innovative cancer treatments, improving access and outcomes for companion animals. For instance, In April 2023, Torigen Pharmaceuticals partnered with Veterinary Management Groups (VMG) to provide over 2,000 clinics access to its experimental autologous cancer immunotherapy for pets. This agreement aims to expand the availability of innovative cancer treatments for companion animals across the U.S., empowering veterinarians with advanced therapeutic options.

Canada Veterinary Oncology Market Trends

The veterinary oncology market in Canada is driven by the increasing incidence of cancer in pets, the growing adoption of pet insurance, presence of regulatory authorities focused on improving animal care, and the presence of centers focused on animals. For instance, in July 2023, Thrive Pet Healthcare and Fidocure entered into a strategic partnership to enhance pet oncology treatment. Thrive Pet Healthcare has used Fidocure's precision medicine platform in more than 200 instances of canine cancer since the start of the partnership in 2022. These types of joint ventures in the country are fueling market growth with their work focus on providing comprehensive cancer care for both animals and humans.

Furthermore, growing coordination among veterinarian universities, educational hospitals, and private veterinary specialty practices around the country is leading to considerable cancer research being conducted in several prominent medical institutions. For instance, the Comparative Oncology Trials Consortium (COTC), governed by the Comparative Oncology Program of the NIH-NCI Center for Cancer Research, strives to develop and conduct clinical trials in cancer-stricken dogs to assess potential medicines. Such new initiatives that involve carrying out clinical trials for pet cancer investigation are contributing to market growth.

Key North America Veterinary Oncology Company Insights

The North American veterinary oncology industry is highly fragmented and competitive, with numerous small and large players actively providing new cancer treatment modalities for pets. Companies use mergers, acquisitions, and partnerships to advance R&D, focusing on innovative therapies, diagnostic tools, and collaborations with veterinarians and researchers. The market is driven by advancements in immunotherapy, targeted therapies, and precision medicine, with rising cancer diagnoses expected to increase demand for effective treatments.

Key North America Veterinary Oncology Companies:

- Elanco

- Boehringer Ingelheim International GmbH

- Zoetis

- Elekta AB

- PetCure Oncology

- Accuray Incorporated

- Varian Medical Systems, Inc. (parent company: Siemens Healthineers)

- Virbac

- Merck & Co., Inc.

- Dechra Pharmaceuticals PLC

- NovaVive Inc.

- Ardent Animal Health, LLC (A BreakthrU Company)

Recent Developments

-

In April 2024, ELIAS Animal Health expanded its Lenexa, Kansas facility to prepare for the commercial launch of ELIAS Cancer Immunotherapy (ECI), the USDA-approved adoptive cell therapy for canine osteosarcoma. The company is also seeking $10 million in Series A funding to support manufacturing and product development.

-

In October 2023, Merck Animal Health announced the availability of gilvetmab, a novel caninized monoclonal antibody for treating dogs with mast cell tumors and melanoma. This checkpoint inhibitor, recently conditionally licensed by the USDA, aims to enhance treatment options for veterinary oncologists across the U.S.

North America Veterinary Oncology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 734.45 million

Revenue Forecast in 2030

USD 1.22 billion

Growth Rate

CAGR of 10.70% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Animal, therapy, cancer, country

Country scope

U.S., Canada, Mexico

Key companies profiled

Elanco, Boehringer Ingelheim International GmbH, Zoetis, Elekta AB, PetCure Oncology, Accuray Incorporated, Varian Medical Systems, Inc. (parent company: Siemens Healthineers), Virbac, Merck & Co., Inc., Dechra Pharmaceuticals PLC, NovaVive Inc., Ardent Animal Health, LLC (A BreakthrU Company)

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Veterinary Oncology Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America veterinary oncology market report based on animal, therapy, cancer, and country.

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Canine

-

Feline

-

Equine

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Radiotherapy

-

Stereotactic Radiation Therapy

-

LINAC

-

Other Types

-

-

Conventional Radiation Therapy

-

-

Surgery

-

Chemotherapy

-

Immunotherapy

-

Other Therapies

-

-

Cancer Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Cancers

-

Lymphomas

-

Sarcomas

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America veterinary oncology market size was estimated at USD 657.78 million in 2024 and is expected to reach USD 734.45 million in 2025.

b. The North America veterinary oncology market is expected to grow at a compound annual growth rate of 10.86% from 2025 to 2030 to reach USD 1.22 billion by 2030.

b. U.S. dominated the North America veterinary oncology market in 2024 with a share of 89.02%. This is attributable to the increased cancer incidence in domestic animals, rise in pet companionship, and high spending on veterinary treatment.

b. Some key players operating in the North American veterinary oncology market include Boehringer Ingelheim International GmbH, Elanco Animal Health, Zoetis Services LLC, Elekta AB, PetCure Oncology, Accuray Incorporated, Varian Medical Systems, Inc., Virbac, Torigen Pharmaceuticals Inc., Dechra Pharmaceuticals PLC, NovaVive Inc., and Ardent Animal Health, LLC (A BreakthrU Company).

b. The North America veterinary oncology market is driven by the rising incidence of cancer in pets, the number of veterinary clinical trials investigating the safety and effectiveness of various oncologic therapies, and the increasing penetration of pet insurance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."