- Home

- »

- Medical Devices

- »

-

North America Wheelchair Market Size & Share Report, 2030GVR Report cover

![North America Wheelchair Market Size, Share & Trends Report]()

North America Wheelchair Market Size, Share & Trends Analysis Report By Product (Manual, Electric), By Category Type (Adult, Pediatric), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-296-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The North America wheelchair market was valued at USD 1.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030, according to a new report released by Grand View Research, Inc. The growing geriatric population in the U.S., which requires long-term care, the availability of technologically improved products, and the rising demand for home healthcare services and staff are factors driving the industry. The COVID-19 pandemic has interrupted and impacted the wheelchair manufacturing companies’ operations and businesses and may continue further, due to government-imposed mandated closures, work-from-home orders, and social distancing guidelines, as well as voluntary facility closures. The government’s policy regarding the COVID-19 pandemic is still adapting and evolving.

As a result, the countries where the products are manufactured and distributed are still subject to changing regulations. These issues may be faced by suppliers and consumers, resulting in continuing supply chain disruption and reduced customer demand. The growing geriatric population, the high prevalence of impairment among people of various age groups, and the need for assistance and care are expected to drive the market. According to the U.S. census bureau, the overall population of the country would increase by 400 million by 2050.

By 2030, the government estimates that more than 20% of the U.S. population would consist of individuals aged over 65 years, a 50% increase compared to the population in 2010. Mobility-related impairment is the third most common ailment in Canada, implying that the market for wheelchairs and assisted mobility equipment is projected to expand. The Assistive Devices Program, which operates in cities, such as Ontario, assists with the cost of manual wheelchairs, power wheelchairs, and power scooters. 75% of the cost of mobility aids is covered under this program, and the rest 25% is paid by the consumer.

The Canadian market is expected to grow due to technological advancements, the rising cases of disability, and government initiatives for assistive devices. The market is also driven by the rising obesity among people in the U.S. According to the statistic of Statista, around 29% of those aged 65 and older in the U.S. were obese in 2020. Obesity, which impairs the musculoskeletal system, is one of the primary reasons for handicapped mobility. To meet this need, major manufacturers, such as Invacare, Sunrise Medical, and Carex, offer a variety of heavy-duty bariatric wheelchairs.

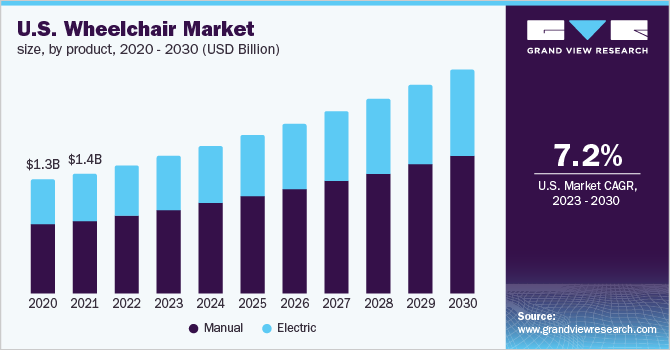

Product Insights

The manual product segment dominated the market with a revenue share of more than 61.1% in 2022. The manual wheelchair is the most common type of mobility assistive device that assists the disabled and geriatric population. According to the WHO, over 610 million (10%) people worldwide have disabilities, with approximately 10% (61 million) of them using wheelchairs. Around 20% of women and 17% of men in the U.S. have some form of disability, indicating that one out of every four American women is disabled.

The electric product segment is anticipated to witness a lucrative growth rate of over 6.8% from 2023 to 2030. Electric wheelchair manufacturing is witnessing numerous technological innovations. This growth can be ascribed to the fact that electric or power chairs offer significant levels of independence and comfort, as well as the opportunity to travel without the assistance of a second person around the clock.

Category Type Insights

The adult category type segment dominated the market with the largest revenue share of over 69.1% in 2022. This is because the majority of disabled people in the U.S. are between the ages of 18 and 65 years. According to the CDC, 61 million (26%) adults in the U.S. have a disability, with 13.7% of those disabilities being mobility-related. Mobility impairment is the most frequent type of functional disability among adults in the U.S.

Furthermore, the proportion of the population aged 65 years and above is projected to increase from roughly 12% (35 million) in 2000 to nearly 20% (71 million) by 2030, implying that demand for adult wheelchairs or mobility-assistive equipment will certainly rise in the future. According to the CDC, by 2023, people over the age of 65 years will outnumber children, resulting in a rise in total disability in the country. Moreover, most of the leading manufacturers provide a greater number of mobility equipment for adults. These factors are expected to propel the North America wheelchair market during the forecast period.

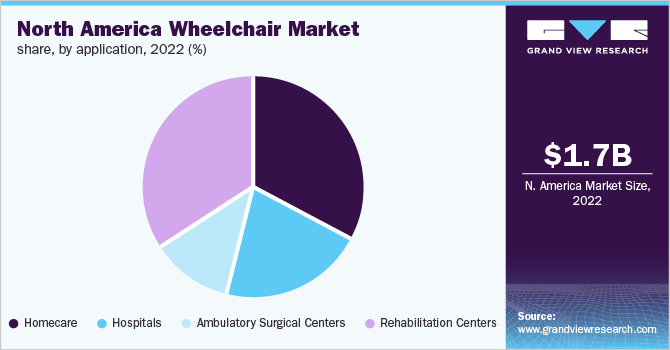

Application Insights

The rehabilitation centers application segment led the market in 2022 with the largest revenue share of more than 34.1%. This is mainly because mobility equipment, such as wheelchairs, is mostly utilized as a part of rehabilitation programs for those recovering from surgery or injury. Based on application, the market has been divided into rehabilitation centers, hospitals, Ambulatory Surgical Centers (ASCs), and home care.

The hospitals application segment is anticipated to witness the fastest growth rate of more than 7.7% over the forecast period due to growing patient visits in these healthcare settings. The main objective of hospitals is to stabilize a patient, not to offer long-term care. As a result, a person with a temporary or permanent impairment must get a doctor’s prescription to purchase a wheelchair and receive Medicare benefits.

Regional Insights

The U.S. dominated the market and accounted for the largest revenue share of 90.9% in 2022. According to the CDC, about 61 million people in the U.S. were suffering from various disabilities, with the highest percentage in the South region. Since more than 13.7% of the disabled population has mobility issues, the market for wheelchairs is expected to rise over the projected period. In addition, favorable government programs to assist the target population are also fueling the market growth. The Americans with Disabilities Act (ADA) of 1990, the Patient Protection and Affordable Care Act, and the Rehabilitation Act provide people with disabilities with job protection, additional health treatment options for long-term support and services, and access to high-quality and affordable care.

The presence of a large number of market players is likely to benefit the regional market. For instance, Luci, a U.S.-based smart wheelchair startup, was formed in 2017 to improve a product that would offer power wheelchair users unparalleled safety and mobility. It evolves into a navigator for the users who map their surroundings and the sensor-fusion system integrates information from cameras, ultrasonic sensors, and radar to provide a 360-degree image of the world. In December 2020, Numotion, a mobility product provider, and Luci struck a national distribution deal. Numotion was the first distributor of Luci’s hardware and software in the U.S.

Key Companies & Market Share Insights

Market players are undertaking various strategic initiatives, such as the signing of the new partnership agreement, collaborations, mergers & acquisitions, and geographic expansions, to enhance their product portfolio, improve manufacturing capacities, and gain a competitive advantage. For example, in June 2020, GF Health Products, Inc. acquired Gendron, Inc, which is a leading designer and manufacturer of mobile patient management devices, in the U.S. This acquisition will assist the company in expanding its operations in the country. Some prominent players in the North America wheelchair market include:

-

Carex Health Brands, Inc.

-

DeVilbiss Healthcare LLC

-

GF Health Products, Inc.

-

Invacare Corporation

-

Medline Industries, Inc.

-

Sunrise Medical

-

Karman Healthcare, Inc.

-

Quantum Rehab

-

Numotion

-

Pride Mobility Products Corp.

-

Sermax Mobility Ltd.

North America Wheelchair Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.8 billion

Revenue forecast in 2030

USD 2.9 billion

Growth rate

CAGR of 7.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Product, category type, application, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Carex Health Brands, Inc.; DeVilbiss Healthcare LLC; GF Health Products, Inc.; Invacare Corporation; Medline Industries, Inc.; Sunrise Medical; Karman Healthcare, Inc.; Quantum Rehab; Numotion; Pride Mobility Products Corp.; Sermax Mobility Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Wheelchair Market Segmentation

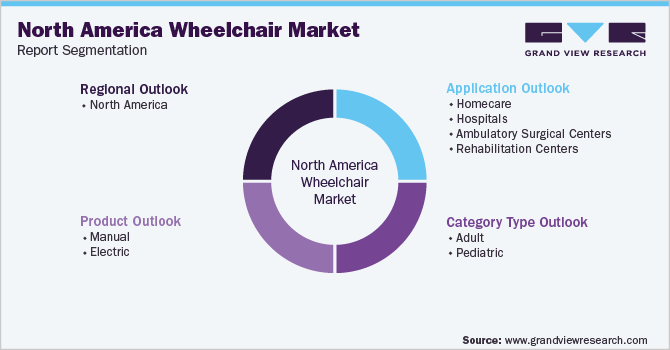

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America wheelchair market report based on product, category type, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manual

-

Electric

-

-

Category Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Adult

-

Pediatric

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Homecare

-

Hospitals

-

Ambulatory Surgical Centers

-

Rehabilitation Centers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America wheelchair market size was estimated at USD 1.7 billion in 2022 and is expected to reach USD 1.8 billion in 2023.

b. The North America wheelchair market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 2.9 billion by 2030.

b. The U.S. dominated the North America wheelchair market with a share of 90.9% in 2022. This is attributable to the rising disabled population in the U.S.

b. Some key players operating in the North America wheelchair market include Invacare Corporation, DeVilbiss Healthcare LLC, Sunrise Medical LLC, Pride Mobility Products Corp.

b. Key factors that are driving the North America wheelchair market growth include the growing geriatric population in the U.S., which requires long-term care, the availability of technologically improved products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."