- Home

- »

- Advanced Interior Materials

- »

-

North America Wiring Duct Market Size & Share Report, 2030GVR Report cover

![North America Wiring Duct Market Size, Share & Trends Report]()

North America Wiring Duct Market Size, Share & Trends Analysis Report By Product (Slotted Wiring Duct, Solid-wall Wiring Duct), By End-use (Telecommunication, Construction), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-014-2

- Number of Report Pages: 127

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

Report Overview

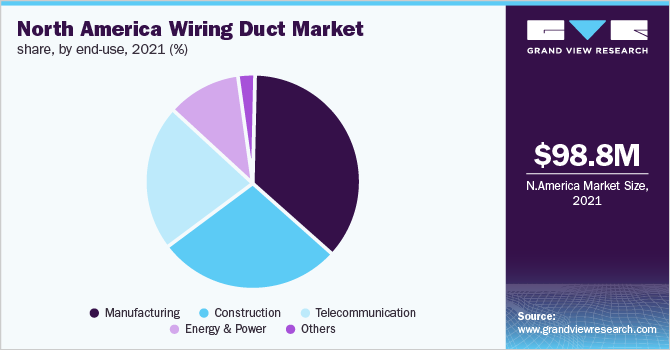

The North America wiring duct market size was estimated at 98.8 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.9% from 2022 to 2030. The market is expected to be driven by rising manufacturing activities due to rapid urbanization and industrialization in North America. Surging product demand for efficient management and protection of cables used in control systems, machinery, factories, aircraft, and residential & commercial construction primarily fuels the growth of wiring duct products in North America.

The slotted wiring duct segment accounted for the largest product segment owing to its lightweight, heat resistance, vibration control, and scorelines allowing easy finger & sidewall section removal properties. In addition, these are used for managing cable management in the data centers of telecommunications and the energy & power industry which is expected to boost product demand.Enhancement in construction and growing investments in construction developments in the economy have propelled market growth in the past few years.

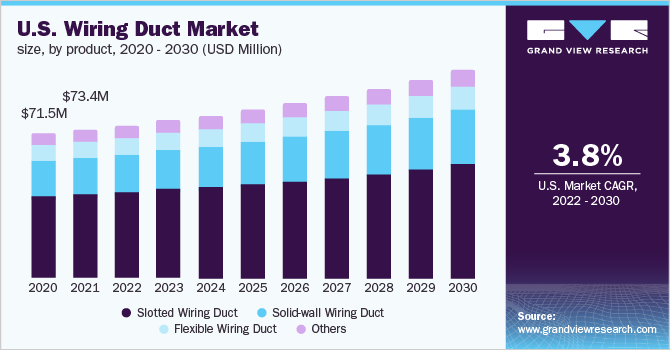

The U.S. had the largest share in terms of revenue and accounted for 74.3% of the total market in 2021. The wiring ducts are used in various applications for neat and efficient routing of patch and equipment cords from the switch/server to the patch panel. Also, it has extensive usage in data centers. The U.S. broadband industry along with both fixed and mobile network operators are investing heavily in fiber networks. As the U.S. telecommunications industry is seeing increased activity from the major telecommunication and cable companies, which is expected to propel the market for U.S. wiring ducts.

The wiring duct market in North America is characterized by strong competition owing to the presence of prominent manufacturers of these ducts, including ABB, Panduit, IBOCO, and HellermannTyton which serve major geographies across the region. These manufacturers compete with each other based on the quality and costs of their products to increase their profitability and gain a competitive edge.

Some of the key vendors in the market, such as ABB, Panduit, and Omega Engineering, Inc, are forward integrated, hence have their own distributor and representative network. This reduces price volatility for manufacturers and ensures a consistent supply of goods, irrespective of changing geo-political tensions. The rise in acceptance of wiring duct products has encouraged companies to develop innovative products like halogen-free, fire-retardant, and thermoplastic material for production which is compatible with multiple applications.

End-users consider several factors for choosing manufacturers or distributors of wiring ducts, including the variety and the quality of raw materials used for their development and their designs based on the requirements of applications wherein these ducts are to be used, along with their colors and estimated prices.

Product Insights

Slotted wiring ducts led the market and accounted for a revenue of USD 56.2 million in 2021 owing to their ability to act as an alternative to cable ties where ducts can guide and organize short runs of electrical cables in control panels, enclosures, and machines. The narrow and wide fingers of these slotted wiring ducts hold the cables inside yet allow the cables to be directed in and out of the duct. Also, the cost-effectiveness and resistance to dust and moisture accumulation offered by slotted wiring ducts are expected to fuel their demand across North America.

The cover on these ducts can also be removed to create an open duct offering easy maintenance and installation by the workers. Many manufacturers also provide a finished product that is already present in standard enclosure size, so end-users do not need to measure and cut the duct on their own. These characteristics are expected to drive demand for slotted wiring ducts over the forecast period.

Solid-wall wiring duct product segment is expected to grow at a significant CAGR of 4.7% over the forecast period. The demand for these products is expected to grow on account of their growing use for short-length electrical wiring in machines, control panels, and enclosures and their widespread availability with removable covers.

The flexible wiring duct product segment accounted for a market share of 10.1% in 2021, owing to rising demand for routing cables around curves of the control panel. This is expected to drive major demand over the forecast periodFlexible wiring ducts are also slotted on the sidewall with finger designs. However, these are used for routing and protecting the cables in applications that require flexibility. The alternate ribs present on the product exhibit an angle pointing slightly inwards which makes it ideal to insert and extract cables.

End-Use Insights

The manufacturing application segment accounted for the largest share in 2021 and is expected to grow at a CAGR of 4.2% over the forecast period from 2022 to 2030. The increasing population of North America and the surge in correlated demand for manufactured goods have resulted in efforts by manufacturing companies to enhance their productivity. This fuels the demand for cables that connect different types of machinery using wiring ducts in manufacturing facilities. These aforementioned factors are expected to boost market demand for wiring ducts.

Wire and Cable management is not just about ensuring the optical aspect of the facility, but also enabling orderly wire routing that saves maintenance costs and time for the manufacturing facility. Additionally, it enables easy repair work and maintenance of cables, as well as enhances the general operational safety of manufacturing facilities. The wide range of wiring ducts offered by different companies is expected to lead the market demand in North American manufacturing facilities.

The telecommunications segment is the fastest-growing segment at a CAGR of 4.6% over the forecast period. The rapid growth of revenue owing to surging investments by governments of different countries in North America to expand and enhance their digital infrastructures is likely to boost the market demand over the projected period.

The construction segment of the wiring duct market in North America is projected to grow at a CAGR of 3.2% in terms of revenue over the forecast period. These products are used to separate cables in electric wiring systems and prevent similar cables from interfering with each other. In multiunit housing apartments, wiring ducts can efficiently separate the storage spaces to remove the clutter and mismanagement of electrical cables. These ducts are mainly used for efficiently power wiring in buildings, apartments, offices, and other public buildings hence will increase market demand in construction application in North America.

Regional Insights

Total revenue in the U.S. dominated the North America wiring duct market in 2021 and is projected to grow at a CAGR of 3.8% during the forecast period. This growth can be attributed to the growing use of neat and efficient routing of patch and equipment cords from the switch/server to the patch panel. Hence, extensive use of these products in data centers is expected to drive the market demand in the country.

The energy and power industry utilizes wiring ducts for the installation of solar panels, wind turbines, and also in power transmission centers owing to their characteristics of efficiently connecting cables to the control panel. Additionally, wiring ducts manage the weight of cables on the junction boxes of solar panels. The U.S. energy & power industry is driven by continuous investments from the government which are key factors driving the demand for wiring ducts in the region.

The well-established telecommunication industry in Canada is expected to contribute to the demand for wiring duct products and solutions in the region over the forecast period. According to the Canadian Wireless Telecommunications Association (CWTA), the telecommunications industry remained a critical player in supporting the economic growth of the country in 2021 and contributed approximately USD 75.00 billion to the GDP in the same year. Thus, expanding wireline telecommunication services in Canada requires efficient management and routing of cables to different types of machinery. This is expected to drive the growth of wiring ducts in Canada over the forecast period from 2022 to 2030.

Mexico was valued at USD 9.8 million in 2021 and is expected to grow at the fastest CAGR of 4.6% over the forecast period. The emergence of Mexico as an upcoming manufacturing hub in North America has resulted in the establishment of numerous industries in the country owing to the easy availability of low-cost labor. PVC wiring ducts with slotted sides allow a large number of cables to be supported in one panel, hence its use in manufacturing plants reduces the cluttering of cables and ensures efficient connection among different types of machinery. The aforementioned factors are expected to boost the demand for wiring ducts in the region.

Key Companies & Market Share Insights

The wiring duct market in North America is moderately fragmented with leading players promoting their cost-effective products with advanced features. End-users select the product after consideration of various features such as if they are halogen-free, as well as based on their color, size, installation ease, and cost efficiency.

Additionally, industry leaders remain focused on collaborations with third-party wholesale distributors and suppliers to deliver end-to-end wiring duct solutions to end-users. Manufacturers are engaged in partnerships for increasing their production capacities to cater to the demand from various applications. Some prominent players in the North America wiring duct market include:

-

ABB

-

Panduit

-

Omega Engineering, Inc

-

Phoenix Contact

-

IBOCO

-

SESCO

-

HellermannTyton

-

TE Connectivity.

-

Electriduct.

-

Arrow Electronics, Inc.

-

Greaves Corporation

-

Techspan Industries Inc.

North America Wiring Duct Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 101.8 million

Revenue forecast in 2030

USD 140.0 million

Growth Rate

CAGR of 3.9% from 2022 to 2030

Base year for estimation

2021

Actual estimates/Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, end-use, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

ABB; Panduit; Omega Engineering, Inc; Phoenix Contact; IBOCO; SESCO; HellermannTyton; TE Connectivity. Electriduct.; Arrow Electronics, Inc.; Greaves Corporation; Techspan Industries Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Wiring Duct Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the North America wiring duct market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Slotted Wiring Duct

-

Solid-wall Wiring Duct

-

Flexible Wiring Duct

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Telecommunication

-

Construction

-

Manufacturing

-

Energy & Power

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America wire duct market size was estimated at USD 98.8 million in 2021 and is expected to reach USD 101.8 million in 2022.

b. The North America wire duct market is expected to grow at a compound annual growth rate of 3.9% from 2022 to 2030 to reach USD 140.0 million by 2030.

b. Slotted wire duct dominated the North America wire duct market with a share of 56.9% in 2021 owing to its growing use in data centers in telecommunication across North America.

b. Some of the key players operating in the North America wire duct market include ABB, Panduit, Omega Engineering, Inc., Phoenix Contact, IBOCO, and SISCO.

b. The key factor which is driving North America wire duct market is rising manufacturing and telecommunications activities due to rapid urbanization and industrialization in North America.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."