- Home

- »

- Homecare & Decor

- »

-

Northern Lights Tourism Market Size & Share Report, 2030GVR Report cover

![Northern Lights Tourism Market Size, Share & Trends Report]()

Northern Lights Tourism Market Size, Share & Trends Analysis Report By Traveler Type (Couple, Friends, Family, Solo), By Age Group (18-34 Years, 35-49 Years, 50-64 Years, 65+ Years), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-403-1

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Northern Lights Tourism Market Trends

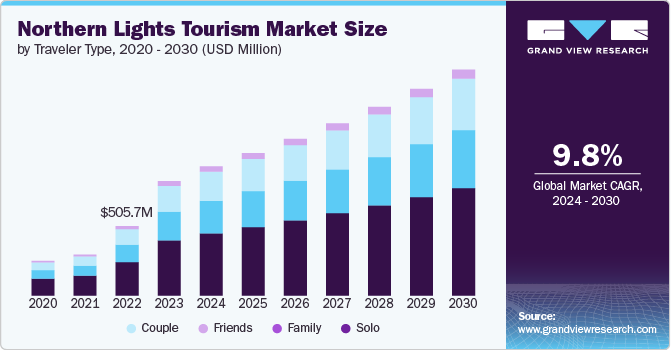

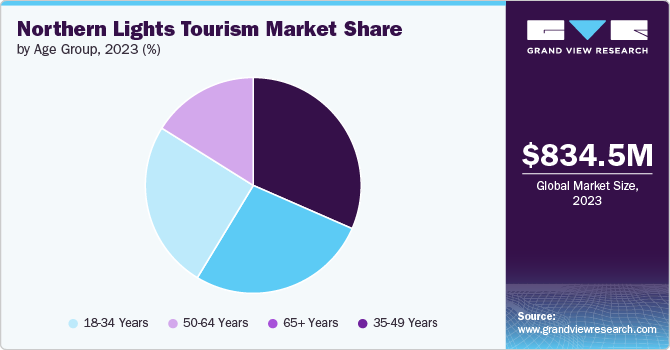

The global northern lights tourism market size was estimated at USD 834.5 million in 2023 and is projected to grow at a CAGR of 9.8% from 2024 to 2030. The Northern Lights, or Aurora Borealis, have long enchanted and captivated people worldwide. This natural phenomenon, caused by charged solar particles colliding with the Earth's atmosphere, results in stunning light displays that dance across the night sky.

Tromsø, often dubbed the "Capital of the Northern Lights," has become a premier destination for aurora hunters. This growing interest in northern lights tourism is driven by the ethereal beauty and unique experience it offers, making it a bucket-list item for many travelers. The surge in popularity is reflected in the booming winter tourism market in Northern Norway, particularly in Tromsø, where the influx of visitors has significantly increased in recent years.

Several factors contribute to the growing appeal of Northern Lights tourism. Improved accessibility is a major driver for Aurora tourism, with the number of direct flights to Tromsø doubling since 2018. Currently, around 20 direct flights from various European cities arrive weekly, facilitating easier travel for international visitors. This increase in connectivity, coupled with Tromsø's relatively mild winter temperatures compared to other Arctic destinations like Finnish Lapland, makes it a more attractive option for tourists. The city's strategic coastal location also offers additional activities such as whale watching and King Crab fishing, further enhancing its appeal.

The tourism market’s investment in developing high-quality, market-oriented services has also played a crucial role in attracting more visitors for aurora tourism. Companies like Best Arctic have expanded their offerings, including knowledgeable guides and tailored tour packages that combine aurora viewing with cultural and historical insights. This approach has made the experience more accessible and enjoyable for tourists, contributing to the market’s overall growth. Moreover, initiatives like the Arctic-365 cluster and the Northern Norway Tourist Board have been instrumental in fostering collaboration among travel companies, enhancing service quality, and promoting the region as a top winter destination.

Despite the rising popularity, tourism growth also presents challenges, particularly concerning infrastructure. Tromsø is undergoing significant developments, such as the construction of a new terminal at the airport, to accommodate the increasing number of visitors. However, other destinations like Kirkenes struggle with limited infrastructure and accommodation options, hindering their potential to match Tromsø's success. The trend towards northern travel, possibly influenced by climate change and a desire for unique, cold-weather experiences, suggests that demand for Northern Lights tourism will continue to rise. A 2024 Expedia survey reported a dramatic increase in searches for winter travel, with interest in Canada’s Churchill rising by 110%, Northern Lights destinations such as Lapland in Finland soaring by 370%, and Alta in Norway growing by 100%.

In June 2024, Abercrombie & Kent launched more than 65 itineraries spanning six continents and 22 new journeys to different parts of the world for 2025. The itineraries also include a package for a Finland and Sweden trip. Highlights include exploring the Sami culture, snowmobiling, sled-dog safaris, and staying in unique accommodations like glass-domed Aurora Cabins. Activities also include ice fishing, snowshoeing, and the chance to see the northern lights. This journey features luxury accommodations, guided tours, and gourmet meals, with internal flights between destinations.

Traveler Type Insights

Based on traveler type, the couples segment led the market with the largest revenue share of 48.23% in 2023. Couples visit the Northern Lights for the enchanting and romantic experience of witnessing this natural phenomenon together. The breathtaking display of vibrant colors against the night sky creates unforgettable memories and a sense of awe. Exclusive accommodations and intimate settings in the Arctic regions enhance the overall experience. In addition, the opportunity to explore unique winter activities, such as sled-dog safaris and snowshoeing, adds to the allure for couples seeking adventure and connection.

The friends segment is expected to grow at the fastest CAGR of 10.2% from 2024 to 2030. The journey offers opportunities for collaborative planning and overcoming challenges together, enhancing teamwork and mutual support. Experiencing new cultures and environments collectively broadens perspectives and fosters deeper connections. In addition, the unique and memorable nature of such a trip creates lasting memories that can be cherished. According to the Adventure Travel Trade Association (ATTA), approximately 23% of adventure travelers chose to travel with their friends in the year 2021.

Age Group Insights

Based on age group, the 18-34 years segment led the market with the largest revenue share of 31.56% in 2023. Trips to witness the northern lights align perfectly with Gen Z's preferences for enchanting natural scenery and unique experiences. This generation prioritizes destinations with stunning natural beauty and authentic local experiences over nightlife and entertainment. The Northern Lights offer a breathtaking spectacle that satisfies their desire for memorable and Instagram-worthy adventures. As per the 2024 Booking.com research, Gen Z's preferred vacation locations are mostly determined by three factors: good local cuisine, high value for money, and captivating natural beauty.

The 35-49 years segment is projected to grow at the fastest CAGR of 10.6% from 2024 to 2030. According to Tripadvisor’s Winter Travel Index for 2023, 58% of U.S. respondents planned winter travel, a figure consistent with the previous year’s data. Notably, 63% of Millennials were also planning winter trips, driven by seasonal events such as winter festivals, winter sports, school breaks, and cultural or religious holidays.

Regional Insights

The northern lights tourism market in North America accounted for a market share of 19.08% in 2023 in the global market. The breathtaking natural phenomenon attracts travelers seeking extraordinary experiences, and the region's winter activities, such as skiing and festivals, complement the allure of the aurora. In addition, strong social media promotion and a growing interest in adventure travel drive demand, making Northern Lights destinations highly sought after. Manitoba, Yukon, Nunavut, Newfoundland, and Ontario are some of the most popular Canadian destinations for witnessing northern lights.

U.S. Northern Lights Tourism Market Trends

The northern lights tourism market in U.S. held a dominant 70% share of the North America market in 2023. In 2022, the U.S. led global spending on international tourism, with expenditures reaching USD 112 billion, according to UNTWO. A 2024 Expedia survey reveals that 42% of Americans intend to prioritize chasing the Northern Lights in the coming year, surpassing other bucket list experiences. This interest outstrips plans to visit Egypt’s pyramids (36%) or walk along the Great Wall of China (33%).

Europe Northern Lights Tourism Market Trends

Europe dominated the northern lights tourism market with the revenue share of 45.48% in 2023. The market here is set to rise due to recent spectacular displays caused by the strongest solar storm in over 20 years, which made the auroras visible as far south as southern England. The increased frequency and visibility of these breathtaking light shows are drawing more tourists seeking unique and stunning natural phenomena. In addition, heightened media coverage and social media posts showcasing these rare occurrences boost interest and drive travel to experience the northern lights.

Key Northern Lights Tourism Company Insights

The market is fragmented. Many brands have identified untapped opportunities within their service portfolio and are taking steps to address these market gaps. This often involves developing new itineraries, expanding the lodge network, and marketing campaigns. For instance, in November 2023, the "Panorama Luxury in Tromso" program, which offers stays in two brand-new, lavish glass lodges in Norway, was launched by Off the Map Travel. These lodges are specifically designed for Aurora viewing, allowing guests to comfortably watch the northern lights from the comfort of their beds.

Key Northern Lights Tourism Companies:

The following are the leading companies in the northern lights tourism market. These companies collectively hold the largest market share and dictate industry trends.

- Abercrombie & Kent

- Quark Expeditions

- Scott Dunn

- Exodus Travels

- Intrepid Travels

- Hurtigruten Expeditions

- Butterfield & Robinson Inc.

- Lindblad Expeditions

- Travel Edge

- The Aurora Zone

Recent Developments

-

In June 2024, Jet2.com expanded its popular Iceland packages, known for Northern Lights viewing, to Liverpool John Lennon Airport (LJLA) for the first time this upcoming winter. The program includes three dedicated trips from LJLA and twice-weekly flights from Manchester Airport to Iceland, covering key winter periods. Customers can choose between flight-only or package holiday options, which feature guided Northern Lights tours, flights, luggage, transfers, and central Reykjavik hotel stays

-

In November 2023, Off the Map Travel announced the launch of the "Panorama Luxury in Tromso" itinerary, which offers stays in two brand-new, lavish glass lodges in Norway. These lodges are specifically designed for Aurora viewing, allowing guests to comfortably watch the northern lights from the comfort of their beds

-

In April 2023, Aurora Expeditionsintroduced the "In Shackleton’s Footsteps" itinerary, a 20-day journey retracing Shackleton's historic voyage from Ushuaia to South Georgia, departing March 16-April 4, 2025. New this season, the company plans to explore the Chilean Fjords in two voyages: a 14-day Antarctic Explorer and a 13-day Spirit of Antarctica, both featuring stunning landscapes and wildlife. In addition, the 13-day Spirit of Antarctica, starting November 12, 2024, offers a dedicated photography experience with professional guidance

Northern Lights Tourism Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 941.9 million

Revenue forecast in 2030

USD 1,647.9 million

Growth rate

CAGR of 9.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Traveler type, age group, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; UK; Germany; France; Denmark; Sweden; Norway; Iceland; Finland; Japan; China; India; Australia; Brazil; South Africa

Key companies profiled

Abercrombie & Kent; Quark Expeditions; Scott Dunn; Exodus Travels; Intrepid Travels; Hurtigruten Expeditions; Butterfield & Robinson Inc.; Lindblad Expeditions; Travel Edge; The Aurora Zone

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Northern Lights Tourism Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global northern lights tourism market report based on traveler type, age group, and region:

-

Traveler Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Couple

-

Friends

-

Family

-

Solo

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

18-34 Years

-

35-49 Years

-

50-64 Years

-

65+ Years

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Denmark

-

Sweden

-

Norway

-

Iceland

-

Finland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global northern lights tourism market was estimated at USD 834.5 million in 2023 and is expected to reach USD 941.9 million in 2024.

b. The global northern lights tourism market is expected to grow at a compound annual growth rate of 9.8% from 2024 to 2030 to reach USD 1,647.9 million by 2030.

b. Europe dominated the northern lights tourism market with a share of around 45% in 2023. The market here is set to rise due to recent spectacular displays caused by the strongest solar storm in over 20 years, which made the auroras visible as far south as southern England.

b. Key players in the northern lights tourism market are Abercrombie & Kent; Quark Expeditions; Scott Dunn; Exodus Travels; Intrepid Travels; Hurtigruten Expeditions; Butterfield & Robinson Inc.; Lindblad Expeditions; Travel Edge; The Aurora Zone.

b. Key factors that are driving the northern lights tourism market growth include its improved accessibility, increased flight connectivity, mild winter temperatures, enhanced local activities, and investments in high-quality tourism services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."