- Home

- »

- Healthcare IT

- »

-

Occupational Therapy Software Market, Industry Report 2030GVR Report cover

![Occupational Therapy Software Market Size, Share & Trends Report]()

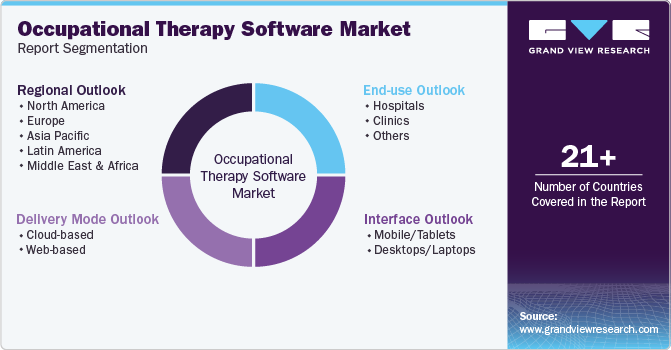

Occupational Therapy Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Delivery Mode (Clinical, Web-based Management), By Interface (Mobile/Tablets, Desktops/Laptops), By End Use (Hospitals, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-983-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

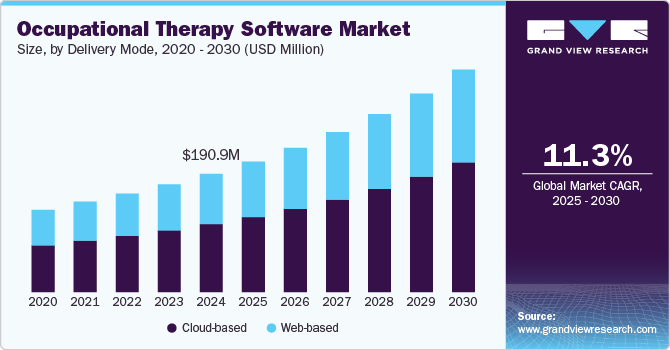

The global occupational therapy software market size was estimated at USD 190.86 million in 2024 and is projected to grow at a CAGR of 11.27% from 2025 to 2030. The rising prevalence of chronic and neurodegenerative diseases and the growing geriatric population are factors contributing to market growth. In addition, the increasing adoption of digital solutions in the healthcare industry, such as the telehealth services, further contributes to market growth.

The occupational therapy software industry is expected to witness substantial growth, driven by the increasing need for therapies that support patients with cognitive, physical, and sensory challenges. These therapies are vital for individuals dealing with conditions such as dementia, Alzheimer’s disease, and developmental dysfunctions, enabling them to regain independence in daily activities. According to a 2021 study published in The Lancet Neurology, approximately 3.4 billion people globally are living with neurological conditions. The World Health Organization (WHO) reports that 55 million people currently have dementia, with 10 million new cases each year, highlighting the critical demand for effective therapeutic solutions.

The expansion of the occupational therapy software market is further fueled by the growing geriatric population, which increasingly requires long-term medical care. This demographic shift underscores the necessity for efficient healthcare solutions that can enhance patient care, streamline operations, and improve financial performance in healthcare settings. Occupational therapy software plays a pivotal role in achieving these objectives by reducing workloads and facilitating better patient outcomes.

The rising adoption of digital solutions across the healthcare industry is anticipated to significantly boost demand for occupational therapy software. These advanced software systems integrate essential functionalities such as documentation, task management, and billing, which streamline workflow for therapists. This integration not only enhances service delivery but also optimizes patient care by ensuring all aspects of therapy management are efficiently handled.

Moreover, the increasing use of Electronic Health Records (EHRs) is propelling the adoption of occupational therapy software. The centralized availability of patient records through EHRs allows for more coordinated and comprehensive care, making therapy management more effective and responsive to patient needs.

Case Study & Insights

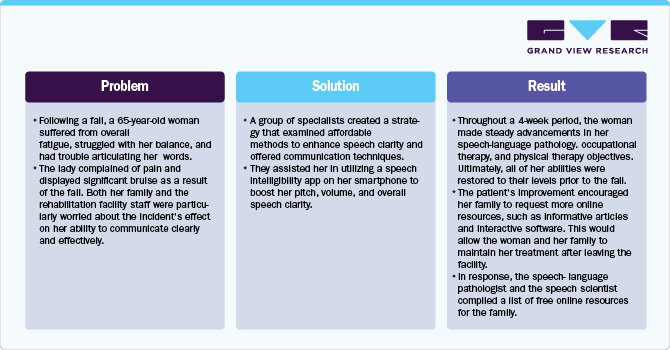

Mobile applications have become essential tools in therapy management, particularly in rehabilitative settings. This case study of a 65-year-old woman recovering from a fall illustrates the effectiveness of these digital solutions.

This case underscores the importance of a collaborative approach among healthcare professionals, including speech-language pathologists, occupational therapists, and physical therapists. By leveraging mobile applications, therapists can offer real-time feedback and customize interventions to meet individual patient needs. This case highlights a growing trend in healthcare where technology enhances traditional therapy methods, leading to improved patient outcomes and greater satisfaction for patients and their families.

The integration of mobile applications in therapy not only supports the rehabilitation process but also empowers patients and their families to actively participate in ongoing care, demonstrating the transformative potential of digital solutions in healthcare.

Market Concentration & Characteristics

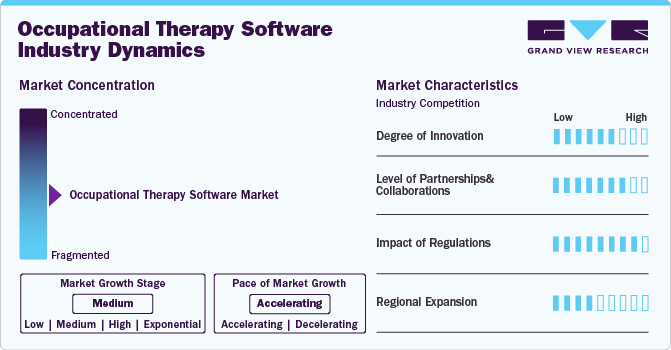

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. The x-axis shows the level of industry concentration, ranging from low to high. The y-axis represents various market characteristics, such as degree of innovation, impact of regulations, industry competition, service and expansion, level of partnerships and collaboration activities, and regional expansion.

The industry is experiencing a high degree of innovation. As the focus on delivering better and more efficient care increases, the demand for software is expected to grow significantly, contributing to the overall advancement of the healthcare industry. In September 2024, OccuPro launched Functional Capacity Evaluation (FCE) 4.0 software. The software is featured with an enhanced user interface, advanced reporting tools, and a voice-to-text dictation ability.

The occupational therapy software industry is experiencing a high level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in August 2019, Warburg Pincus acquired a majority stake in WebPT. This investment is likely to aid cloud-based EHR and practice management tool for therapists to amplify their product offerings.

The industry is witnessing high regulatory impact. These software must adhere to various regulatory standards to protect patient information, ensure documentation accuracy, and adequately handle billing processes. The use of personal health data necessitates strict adherence to privacy regulations such as HIPAA in the U.S. and GDPR in Europe. Regulatory bodies such as the FDA in the U.S. and the EMA in Europe are actively developing guidelines and frameworks to ensure the safety, efficacy, and ethical use of AI technologies in healthcare.

The industry is witnessing moderate regional expansion, driven by an increasing customer base for software. The increased healthcare expenditure in emerging markets creates new opportunities for these platforms. Countries with developing healthcare infrastructures are increasingly investing in digitalization and technological advancements. Furthermore, as scientific awareness of artificial intelligence and machine learning continues to grow globally and access to these technologies improves in emerging markets, major market players are expected to enhance their regional expansion efforts.

Delivery Mode Insights

The cloud-based segment held the largest revenue share of over 57% in 2024, owing to the multiple advantages offered by the cloud-based delivery mode. This mode aids in better data management, easy accessibility of the data, and cost-efficiency. In addition, the cloud-based solution offers centralized data storage helping in better accessibility, thereby fueling segment growth. The segment is also expected to witness growth at the fastest CAGR during the forecast period. This growth can further be attributed to factors such as the availability of cloud-based practice management, EHR platforms, and billing software. Moreover, through cloud-based services, therapists can access real-time patient data, thereby increasing the productivity and workflow efficiency of healthcare providers.

The web-based segment is expected to grow at a significant CAGR during the forecast period. The growing demand for accessibility and flexibility in healthcare management is expected to boost the web-based segment. Web-based solutions offer unparalleled access to patient information and care plans from any location, anytime, provided there is internet connectivity. This flexibility is particularly crucial in healthcare settings, where care teams often operate across multiple locations and require real-time access to patient records to make swift, informed decisions.

Interface Insights

The mobile/tablet segment held the largest revenue share over 59% in 2024. High smart phone penetration across the globe is one of the major factors contributing to market growth. In addition, the increased availability of these software on mobile/tablet is fuelling the segment's growth. For instance, MidexPRO, Planetrehab, etc., are some of the occupational therapy apps available on mobile. These apps help assist medical practice and are integrated with features that assist daily functions.

Moreover, rising penetration of the internet across the globe and increased government initiatives are expected to drive segment growth. For instance, in June 2023, the Biden-Harris Government in the U.S announced a robust investment of over USD 40 billion in the ‘Internet for All’ initiative that aims to provide affordable, reliable, and high-speed internet to everyone in the U.S. This is anticipated to boost the adoption of mobile-based software during the forecast period.

End Use Insights

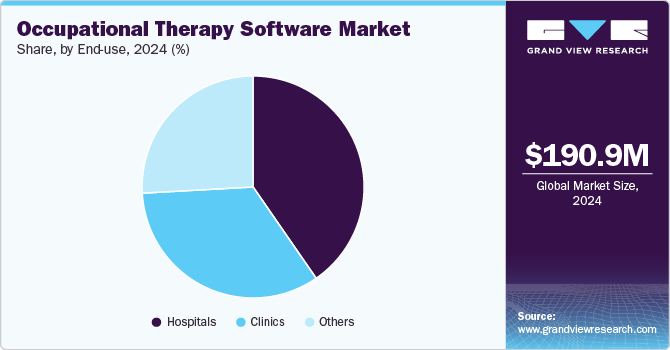

The hospital segment held the largest revenue share over 40% in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. Occupational therapy helps patients gain independence in daily living activities. Therapy is beneficial for pediatric care, neuromuscular rehabilitation, disability evaluation, and orthopedic care. The rising demand for occupational therapy software by healthcare providers to manage patient data is a key factor driving segment growth. For instance, WebPT Occupational Therapy Software helps to store patient data, provides telehealth services, and manages patient intake.

Moreover, the increasing number of hospital admissions and rising number of outpatient facilities providing occupational therapies harness the segment’s growth. The availability of software for outpatient settings is anticipated to boost its adoption. For instance, Net Health Therapy for Hospital Outpatient is cloud-based software, which helps in scheduling, documentation, and practice management services that are designed for hospital outpatient settings.

The clinics segment is anticipated to grow at a significant CAGR during the forecast period. Clinics utilize occupational therapy software to enhance patient care and streamline administrative processes. In addition, many occupational therapy software platforms offer telehealth capabilities, allowing therapists to conduct remote sessions. Such factors are expected to fuel market growth.

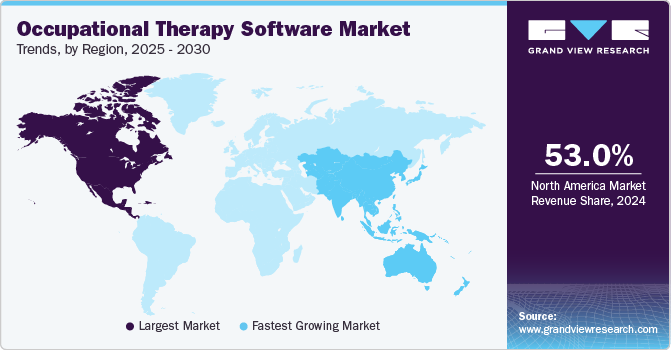

Regional Insights

North America dominated the occupational therapy software market with the largest revenue share over 53% in 2024. Rising focus on improving patient care, and robust healthcare infrastructure are some of the factors driving market growth. In addition, growing geriatric population and rising prevalence of neurodegenerative diseases further contribute to market growth.

U.S. Occupational Therapy Software Market Trends

The market in the U.S. held the largest revenue share in 2024 due to the rising prevalence of chronic diseases and the increasing demand for efficient and personalized healthcare solutions and established healthcare infrastructure. Furthermore, the rising demand for occupational therapists in the country is anticipated to boost demand for occupational therapy software. For instance, according to the U.S. Bureau of Labor Statistics, occupational therapists' employment is anticipated to increase by 11.0% from 2023 to 2033.

Europe Occupational Therapy Software Market Trends

Europe occupational therapy software market observed lucrative growth in 2024. Increasing adoption of teletherapy and technological advancements are factors driving market growth. In addition, an increase in the number of initiatives supporting eHealth is expected to drive the regional market over the forecast period. Moreover, EU policymakers are promoting various digital health programs, which are expected to boost market growth during the forecast period.

The Germany occupational therapy software industry held the largest share in 2024 in Europe. The growing geriatric population, the rising prevalence of chronic diseases, and the significant presence of healthcare facilities across the country are factors fueling market growth. In addition, Germany’s healthcare market is rapidly adopting digitalization and creating significant new opportunities for established companies & emerging start-ups, thereby creating lucrative opportunities for occupational therapy software solutions.

The occupational therapy software industry in the UK is expected to grow over the forecast period. High healthcare expenditures, availability of advanced technological solutions, and the rising prevalence of chronic disorders have led to an increase in the adoption of telehealth in the UK, thereby propelling market growth.

Asia Pacific Occupational Therapy Software Market Trends

The Asia Pacific market is anticipated to grow at the fastest CAGR of 11.60% from 2025 to 2030 due to growing healthcare digitalization, rising healthcare expenditure, and technological advancements. Moreover, the rising prevalence of chronic diseases and growing geriatric population further fuel market growth.

The Japan occupational therapy software market is expected to grow significantly over the forecast period, owing to the advancing digital infrastructure and the growing geriatric population. Moreover, robust healthcare infrastructure has led to the rapid adoption of telehealth services and reducing the burden on healthcare providers to achieve better patient treatment outcomes. In addition, growing government support and initiatives for promoting digital health technologies encourage innovation in the sector.

The occupational therapy software market in China held the largest revenue share in 2024, owing to the growing geriatric population coupled with the rising incidences of chronic disease. In addition, technological advancements, including innovations such as telehealth platforms, artificial intelligence (AI), and data analytics are expected to drive market growth.

Latin America Occupational Therapy Software Market Trends

Latin America occupational therapy software industry is anticipated to grow at a significant CAGR over the forecast period. This can be attributed to the increasing adoption of technology in healthcare, growing awareness about AI technologies, increasing government spending, and collaboration activities.

Middle East and Africa Occupational Therapy Software Market Trends

Middle East and Africa market is expected to grow at a significant CAGR over the forecast period. This can be attributed to technological advancements, rising healthcare expenditures, and favorable government policies. In addition, promoting telehealth services, and integrating smart technologies to develop health capacities, are factors harnessing market growth.

Key Occupational Therapy Software Company Insights

Key players operating in the occupational therapy software industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Occupational Therapy Software Companies:

The following are the leading companies in the occupational therapy software market. These companies collectively hold the largest market share and dictate industry trends.

- WebPT

- Simple Practice LLC

- Practice Pro

- Clinic Source

- Net Health

- Planetrehab Inc.

- HENO

- Fusion Web Clinic

- Care Patron

- Axxes

- Advanced MD

- Oracle Cerner

Recent Developments

-

In August 2024, SimplePractice launched specialized software for occupational therapy practices, which helps in scheduling, billing, and documentation.

-

In September 2023, NextGen Healthcare Inc. partnered with Athletico Physical Therapy (Athletico) to integrate its software solutions into Athletico’s therapy centers. Through this partnership, Athletico plans to optimize clinical and financial performance at its clinics in Colombia.

-

In January 2022, Rethink First, a behavioral health technology company, acquired Total Therapy, a company that offers practice management software solutions.

Occupational Therapy Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 210.38 million

Revenue forecast in 2030

USD 358.79 million

Growth rate

CAGR of 11.27% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Delivery mode, interface, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

WebPT; Simple Practice LLC; Practice Pro; Clinic Source; Net Health; Planetrehab Inc.; HENO; Fusion Web Clinic; Care Patron; Axxes; Advanced MD; Oracle (formerly Cerner Corporation)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Occupational Therapy Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global occupational therapy software market report based on delivery mode, interface, end use, and region:

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

Web-based

-

-

Interface Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile/Tablets

-

Desktops/Laptops

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global occupational therapy software market size was estimated at USD 190.86 million in 2024 and is expected to reach USD 210.38 million in 2025.

b. The global occupational therapy software market is expected to grow at a compound annual growth rate of 11.27% from 2025 to 2030 to reach USD 358.79 million by 2030.

b. North America dominated the occupational therapy software market with a share of over 53% in 2024. Increasing adoption of automation and digital solutions in healthcare facilities across the region are some of the key factors driving the growth of market.

b. Some prominent players in the global occupational therapy software market include WebPT; Simple Practice LLC; Practice Pro; Clinic Source; Net Health; Planetrehab Inc.; HENO; Fusion Web Clinic; Care Patron; Axxes; Advanced MD; Oracle (formerly Cerner Corporation)

b. Rising prevalence of people suffering from disorders such as dementia, Alzheimer’s disease, and amputations is expected to drive the demand for the these software solutions during the forecast period. Moreover, globally rising geriatric population is anticipated to drive the market due to the higher prevalence of medical conditions in this population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.