- Home

- »

- Medical Devices

- »

-

U.S. Office-based Labs Market Size & Share Report, 2030GVR Report cover

![U.S. Office-based Labs Market Size, Share & Trends Report]()

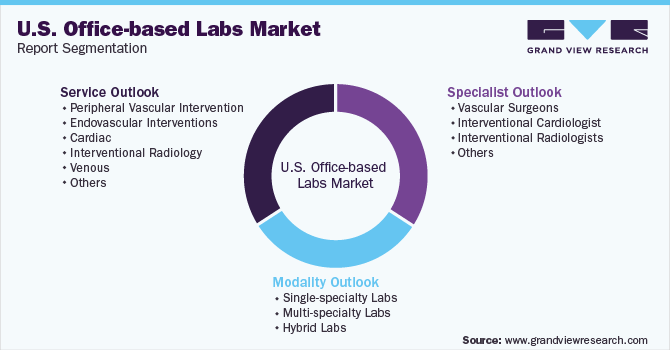

U.S. Office-based Labs Market Size, Share & Trends Analysis Report By Modality (Hybrid Labs, Multi-specialty Labs), By Service (Cardiac, Endovascular Intervention, Venous, Interventional Radiology), By Specialist, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-900-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

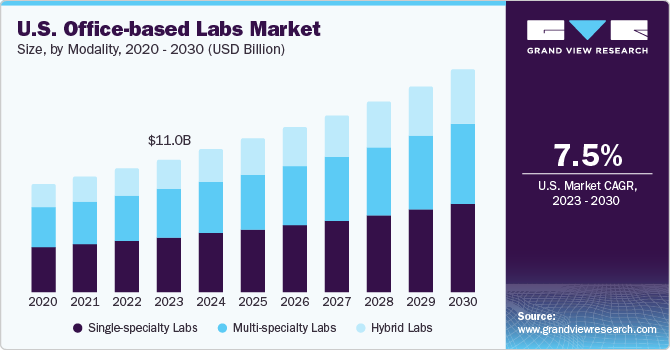

The U.S. office-based labs market size was valued at USD 11.0 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.52% from 2024 to 2030. The growing trend of surgical procedures being performed in outpatient settings and the rising incidence of various vascular diseases are among the major factors driving the demand for office-based labs (OBL) in the U.S. Additionally, high patient satisfaction with a focused and dedicated team of doctors is expected to boost the market growth.

The prevalence of these diseases has significantly increased over the past decade and is expected to continue growing at an exponential rate. The U.S. witnessed a growth of 13% in the number of individuals suffering from Peripheral Artery Disease (PAD) in the past decade. PAD increases the risk of stroke and heart attack and often lead to ischemic amputations. Thus, increasing the demand for vascular surgical procedures. Many service providers, such as National Cardiovascular Partners, Envision Healthcare, and Surgery Partners are/ providing office-based surgical solutions and services to patients at an affordable cost.

Furthermore, key manufacturers, such as Philips Healthcare and Siemens Healthineers, have been entering into partnerships with physicians to set up OBLs, equipping laboratories with required devices and providing complete solutions from start to end, which is expected to propel the market growth. The changing reimbursement policies for surgical procedures are boosting the scope of surgical procedures in office-based settings. In 2021, the Centers for Medicare and Medicaid Services proposed new standards for reimbursed procedures conducted in ASCs and broadened the scope of surgical procedures payable when performed in outpatient settings.

This policy change also positively affected peripheral vascular interventions. After changes were made in federal reimbursement policy, peripheral vascular interventions have been categorized under outpatient settings. This is comparatively less expensive than in inpatient settings. As compared to Hospital Outpatient (HO) settings, establishing an OBL is beneficial for physicians in terms of reimbursements. The operating cost of an ambulatory center is higher than that of an OBL due to high patient safety standards and stringent regulatory scenarios. In some states of the U.S., conversion of an ambulatory center requires a certificate of need, which is a time-consuming procedure. This is creating an opportunity for physicians to convert to OBL settings.

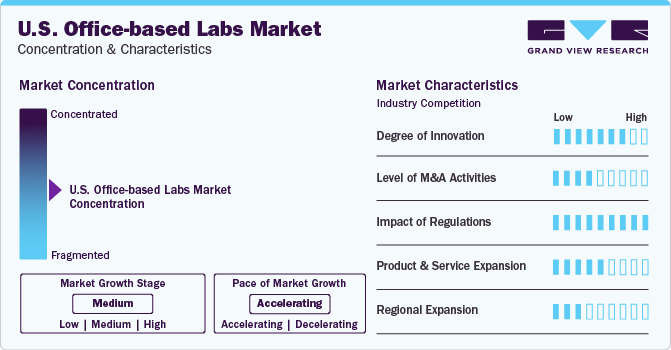

Market Concentration & Characteristics

Degree of Innovation: The degree of innovation in the market is high. With the advent of new technologies and the growing demand for more efficient and accurate diagnostic testing, companies are investing heavily in R&D to develop innovative solutions. The introduction of innovative surgical techniques and technologies, along with advancements in anesthesia, has significantly expanded the types of surgical procedures performed in OBLs. Greater scheduling flexibility, consistent staffing, and faster turnaround time further contribute to market growth. For instance, in June 2023, Koninklijke Philips N.V. and BIOTRONIK partnered to expand cardiovascular device offerings for Philips SymphonySuite customers and improve offerings for patients with endovascular and cardiovascular diseases.

Impact of Regulations: The impact of regulations is high on the market owing to presence of stringent regulations in the market. Laboratory tests performed at the physician’s office/Office-based Labs (OBLs) are controlled by the government regulations—Clinical Laboratory Improvement Act (CLIA). All the healthcare facilities in the U.S. performing tests in the laboratory should be CLIA certified. The most common CLIA certificate for OBLs in the U.S. is Certificate of Waiver (CoW) to perform tests waived by the U.S. FDA, including simple urinalysis, urine pregnancy tests, rapid strep tests, some hemoglobin tests, and certain cholesterol & glucose testing methods.

Level of M&A Activities: The level of mergers and acquisitions (M&A) in the OBL market in the U.S. has been significant in recent years. With the increasing demand for outpatient services and the rising number of patients seeking non-hospital-based care, many healthcare providers have turned to OBLs as a more cost-effective and convenient alternative to traditional hospital settings. This trend has led to a surge in M&A activity in the OBL market, as healthcare organizations look to expand their reach and capabilities through strategic partnerships and acquisitions. For instance, in December 2021, TH Medical’s subsidiary USPI acquired SurgCenter Development (SCD) and its ownership of 92 ambulatory surgical centers and other related services.

Service Expansion: The level of service expansion in the market is expected to remain moderate. With the changes in reimbursement policies in the country, many service providers are expanding their service capabilities to cater the underserved population. For instance, peripheral vascular interventions have been categorized under the outpatient settings in the U.S. This is expected to create opportunities for OBLs to include peripheral vascular interventions in the service portfolios.

Regional Expansion: The level of regional expansion is low in the market. Many providers are shifting towards a hybrid model owing to increasing reimbursement rates for outpatient facilities such as Ambulatory Surgery Centers (ASCs). Moreover, many OBLs are integrating with ASCs to avoid the additional costs and regulatory burdens associated with meeting the high standards.

Modality Insights

Based on modality, the market is categorized into single specialty, multi-specialty, and hybrid labs. The single specialty modality segment dominated the market in 2023 and accounted for a revenue share of 41.77%. Single specialty centers are growing at a significant rate due to their investment-friendly model and importance in specified specialties, such as ophthalmology, urology, plastics, and gastroenterology. Single specialty clinics are more cost-efficient in comparison with multi-specialty hospitals that require many resources to support multiple service lines, leading to an increase in operational costs.

The hybrid labs segment is expected to register the fastest CAGR during the forecast period owing to technological advancements, an increase in reimbursement rates, and a rise in the number of minimally invasive procedures. In addition, improvements in technology, providing high-quality and convenient solutions for patients, are projected to support the growth of this segment. The hybrid lab operates as an OBL for a few days of the week and as an ASC on other days. Thus, hybrid labs increase the volume of procedures & reimbursement for providers and significantly enhance the efficiency and utilization of OBL/ASC.

Service Insights

Based on services, the OBLs market has been categorized into peripheral vascular intervention, endovascular intervention, cardiac, interventional radiology, venous, and others. The peripheral vascular intervention segment dominated the market in 2023 on account of the increased prevalence of PAD, favorable reimbursement, and technological advancements in minimally invasive vascular procedures.

Industry players are trying to strengthen their peripheral intervention product offerings to commercialize the growing opportunities in OBL settings. In March 2021, Cardiovascular Systems, Inc. acquired WavePoint Medical’s line of peripheral support catheters, which are used in peripheral vascular intervention. Under this acquisition agreement, WavePoint Medical would develop a specialty catheter portfolio used in complex percutaneous coronary intervention and chronic total occlusions for Cardiovascular Systems, Inc.

The interventional radiology segment is estimated to register the fastest CAGR over the forecast period. Interventional radiology is beginning to play a vital role in the adoption of value-based healthcare models. Interventional radiology helps diagnose and treat patients using the least invasive techniques that are less expensive, cause minimum pain, and need less recovery time in comparison with traditional surgery. It utilizes image-guided procedures, such as MRI, CT, and ultrasound, to guide minimally invasive procedures to diagnose and treat diseases in every organ system. According to Cardiovascular Disease Management Annual Symposium, around 12% of interventional radiologists performed office-based interventions in the U.S.

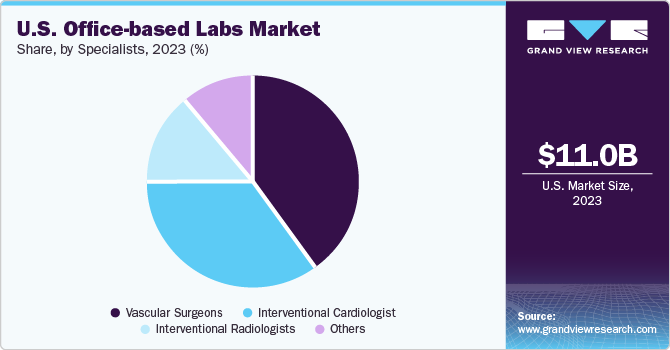

Specialist Insights

Based on specialists, the market has been further classified into vascular surgeons, interventional cardiologists, interventional radiologists, and others. The vascular surgeon segment dominated the market in 2023 owing to the advancements in medical technology, an increase in the demand for specialists, and a shift in preference from hospital settings to OBLs for better & more efficient care.

The interventional radiologist segment is expected to grow at the fastest growth rate during the forecast period on account of the increasing use of minimally invasive image-guided techniques for the diagnosis and treatment of diseases. Advancements in medical technology, increasing preference for better & efficient care, and patient demographics are factors expected to fuel the demand for vascular specialists.

Currently, there is a shortage of physicians for vascular surgery. According to the Society for Vascular Surgery, 100 million people in the U.S. are at risk of vascular disease. The office-based labs are the top preference of vascular surgeons, as performing surgeries at office-based facilities has financial benefits for them, with all the excess margin for surgical procedures going to the surgeon directly & indirectly. Moreover, interventional radiology reduces cost, recovery time, pain, and risk to patients.

Key Companies & Market Share Insights

The vendor landscape of this market can be divided into three different sectors: medical imaging device manufacturers, vascular intervention device manufacturers, and service providers who offer end-to-end services to physicians for setting up labs. Among medical imaging device manufacturers, Philips Healthcare, Siemens Healthineers, and GE Healthcare are the key providers of equipment required in setting up OBLs. Key vascular intervention device manufacturers include Abbott; Medtronic; Boston Scientific; and Cardiovascular System, Inc.

The service providers are focused on enhancing their range of services and undertake initiatives, such as partnerships & mergers, and acquisitions, to achieve this. For instance, in May 2021, Surgery Partners entered into a strategic partnership with UCI Health to develop & expand access to outpatient surgical facilities and enhance the quality of life of patients.

Key U.S. Office-based Labs Companies:

- Manufacturers

- Koninklijke Philips N.V

- GE Healthcare

- Siemens Healthineers AG

- Medtronic PLC

- Boston Scientific Corp.

- Abbott

- Cardiovascular Systems, Inc.

- Service Providers

- Envision Healthcare

- Surgery Care Associates, Inc. (SCA)

- Surgery Partners

- National Cardiovascular Partners

- Cardiovascular Coalition

- TH Medical

Recent Developments

-

In July 2023, Siemens Healthineers announced the launch of a compact testing system -Atellica CI Analyzer, for addressing operational challenges in labs. The analyzer delivers workflow advancements to alleviate reporting burdens, attain more predictable turnaround times, and refocus staff attention on critical lab operations.

-

In June 2023, Philips announced that it had entered into a strategic collaboration with Polarean to reinforce hyperpolarized Xenon MRI for respiratory illness in patients. This technology can be leveraged in office-based labs where clinicians require advanced imaging capabilities for respiratory assessment and disease management.

-

In May 2023, Siemens Healthineers, along with CommonSpirit Health announced plans to acquire Block Imaging. This was aimed at providing more sustainable options and meeting the proliferating demand from U.S. hospitals, health systems, and other care sites, including office-based labs for multi-vendor imaging parts and services.

-

In April 2023, Abbott announced the completion of the acquisition of Cardiovascular Systems, Inc. This acquisition was aimed at providing Abbott with a complementary solution for treating vascular diseases and enhancing the company’s vascular portfolio, thereby enabling them to more efficiently care for patients with peripheral and coronary artery diseases.

-

In April 2023, Philips introduced the all-new Ultrasound Compact System 5000 series, a portable ultrasound solution with cutting-edge features, including AI-powered automation tools, purposed to bring quality ultrasound to patients. Office-based labs can also benefit from such advanced diagnostic technologies, as they focus on delivering medical care services in an outpatient setting.

-

In November 2022, Boston Scientific Corporation announced plans to acquire Apollo Endosurgery, Inc. This acquisition was aimed at empowering Boston Scientific to expand its global capabilities in endoluminal surgery and progressively tap into the endobariatric market.

-

In October 2022, GE Healthcare entered into a collaboration with Tribun Health to offer digital pathology solutions that enable healthcare providers to access a more all-inclusive view of patient records. This collaboration aimed to streamline and enhance pathology & diagnostic processes, which are critical components of healthcare services provided in diverse medical settings, including office-based labs.

-

In April 2022, Medtronic announced a strategic collaboration with GE Healthcare to meet the escalating need for outpatient care in office-based labs (OBLs) and Ambulatory Surgery Centers (ASCs) applications. The objective of this deal was to deliver a full range of technologies and solutions, including products, equipment, and services, to back the growth of ASCs and OBLs and improve patient care in these settings.

U.S. Office-based Labs Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.0 billion

Revenue forecast in 2030

USD 18.3 billion

Growth Rate

CAGR of 7.52% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, services, specialists

Country scope

U.S.

Key companies profiled

Koninklijke Philips N.V., GE Healthcare, Siemens Healthineers AG, Medtronic PLC, Boston Scientific Corporation, Abbott, Cardiovascular Systems, Inc., Envision Healthcare, Surgery Care Associate, Inc (SCA); Surgery Partners, National Cardiovascular Partners, Cardiovascular Collation; TH Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Office-based Labs Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented U.S. office-based labs market report on the basis of modality, service, and specialist:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-specialty Labs

-

Multi-specialty Labs

-

Hybrid Labs

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Peripheral Vascular Intervention

-

Endovascular Interventions

-

Cardiac,

-

Interventional Radiology

-

Venous

-

Others

-

-

Specialist Outlook (Revenue, USD Million, 2018 - 2030)

-

Vascular Surgeons

-

Interventional Cardiologist

-

Interventional Radiologists

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. office-based labs market size was estimated at USD 10.3 billion in 2022 and is expected to reach USD 11.0 billion in 2023.

b. The U.S. office-based labs market is expected to grow at a compound annual growth rate of 7.52% from 2023 to 2030 to reach USD 18.3 billion by 2030.

b. Single specialty OBLs spearheaded the U.S. office-based labs market in 2022 whereas hybrid laboratories are anticipated to witness high growth during the forecast period.

b. Among medical imaging device manufacturers, Philips Healthcare, Siemens Healthineers, and GE Healthcare are the key providers of equipment required in setting up OBLs.Many service providers are available in the U.S., such as National Cardiovascular Partners and Envision Healthcare and Surgery Partners.

b. The increasing trend of surgical procedures being performed in outpatient settings and the rising incidence of various vascular diseases are among the major factors driving the OBL market in the U.S.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation

1.2. Market Definitions

1.2.1. Modality

1.2.2. Service

1.2.3. Specialist

1.3. Estimates and Forecast Timeline

1.4. Research Methodology

1.4.1. Information procurement

1.4.2. Purchased Database

1.4.3. GVR's Internal Database

1.4.4. Secondary Sources

1.4.5. Primary Research

1.4.6. Details of Primary Research

1.5. Information or Data Analysis

1.5.1. Data Analysis Models

1.6. Market Formulation & Validation

1.6.1. Commodity Flow Analysis

1.7. List of Secondary Sources

1.8. List of Abbreviations

1.9. Research Objectives

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.2.1. Modality

2.2.2. Service

2.2.3. Specialist

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.2. Market Segmentation

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.1.1. Increasing prevalence of target diseases

3.3.1.2. Preference to minimally invasive procedures

3.3.2. Market Restraint Analysis

3.3.2.1. High risk option for severe cases

3.3.2.2. Lack of technical training for the MIS procedure

3.3.3. Industry Opportunity Analysis

3.3.3.1. Approval of endovascular procedures in office-based labs

3.3.3.2. Flexibility for physicians to convert to OBLs

3.4. Regulatory Framework & Reimbursement Scenario

3.4.1. Regulatory Framework

3.4.2. Reimbursement Scenario

3.5. Industry Analysis Tools

3.5.1. Porter's Five Forces Analysis

3.5.2. PESTLE Analysis

Chapter 4. U.S. Office-Based Labs Market: Modality Analysis

4.1. U.S. Office-based Labs (OBLs): Modality Market Share Analysis, 2023 & 2030

4.2. Segment Dashboard

4.3. U.S. Office-based Labs (OBLs) Market, by Modality, 2018 - 2030

4.4. Market Size and Forecasts and Trend Analysis, 2018 - 2030 for the Modality

4.4.1. Single Specialty Labs

4.4.1.1. Single specialty labs market, 2018 - 2030 (USD Million)

4.4.2. Multi-Specialty Labs

4.4.2.1. Multi-specialty labs market, 2018 - 2030 (USD Million)

4.4.3. Hybrid Labs

4.4.3.1. Hybrid labs market, 2018 - 2030 (USD Million)

Chapter 5. U.S. Office-Based Labs Market: Service Analysis

5.1. U.S. Office-based Labs (OBLs): Service Market Share Analysis, 2023 & 2030

5.2. Segment Dashboard

5.3. U.S. Office-based Labs (OBLs) Market, by Modality, 2018 - 2030

5.4. Market Size and Forecasts and Trend Analysis, 2018 - 2030 for the Service

5.4.1. Peripheral Vascular Intervention

5.4.1.1. Peripheral vascular intervention market, 2018 - 2030 (USD Million)

5.4.2. Cardiac

5.4.2.1. Cardiac market, 2018 - 2030 (USD Million)

5.4.3. Interventional Radiology

5.4.3.1. Interventional radiology market, 2018 - 2030 (USD Million)

5.4.4. Venous

5.4.4.1. Venous market, 2018 - 2030 (USD Million)

5.4.5. Endovascular Interventions

5.4.5.1. Endovascular interventions market, 2018 - 2030 (USD Million)

5.4.6. Others

5.4.6.1. Others market, 2018 - 2030 (USD Million)

Chapter 6. U.S. Office-Based Labs Market: Specialist Analysis

6.1. U.S. Office-based Labs (OBLs): Specialist Market Share Analysis, 2023 & 2030

6.2. Segment Dashboard

6.3. U.S. Office-based Labs (OBLs) Market, by Modality, 2018 - 2030

6.4. Market Size and Forecasts and Trend Analysis, 2018 - 2030 for the Specialist

6.4.1. Vascular Surgeons

6.4.1.1. Vascular surgeons market, 2018 - 2030 (USD Million)

6.4.2. Interventional Cardiologists

6.4.2.1. Interventional cardiologists market, 2018 - 2030 (USD Million)

6.4.3. Interventional Radiologists

6.4.3.1. Interventional radiologists market, 2018 - 2030 (USD Million)

6.4.4. Other Specialists

6.4.4.1. Other specialists market, 2018 - 2030 (USD Million)

Chapter 7. U.S. Office-Based Labs Market: Regional Analysis

7.1. U.S. Office-Based Labs (OBLs) Market, 2018 - 2030 (USD Million)

7.2. U.S Office-Based Labs (OBLs) Market: Top 5 States

7.2.1. Penetration Analysis: Top 5 states 2022

7.3. Pricing Analysis

7.3.1. Average cost of major procedures performed in office-based labs

7.3.2. Average cost of major devices used in office-based labs

7.3.3. Average cost of setting up an office-based labs

Chapter 8. Competitive Analysis

8.1. Company Profiles

8.1.1. Suppliers

8.1.1.1. Koninklijke Philips N.V

8.1.1.1.1. Overview

8.1.1.1.2. Financial Performance

8.1.1.1.3. Product Benchmarking

8.1.1.1.4. Strategic Initiatives

8.1.1.2. GE Healthcare

8.1.1.2.1. Overview

8.1.1.2.2. Financial Performance

8.1.1.2.3. Product Benchmarking

8.1.1.2.4. Strategic Initiatives

8.1.1.3. Siemens Healthineers AG

8.1.1.3.1. Overview

8.1.1.3.2. Financial Performance

8.1.1.3.3. Product Benchmarking

8.1.1.3.4. Strategic Initiatives

8.1.1.4. Medtronic PLC

8.1.1.4.1. Overview

8.1.1.4.2. Financial Performance

8.1.1.4.3. Product Benchmarking

8.1.1.4.4. Strategic Initiatives

8.1.1.5. Boston Scientific Corporation

8.1.1.5.1. Overview

8.1.1.5.2. Financial Performance

8.1.1.5.3. Product Benchmarking

8.1.1.5.4. Strategic Initiatives

8.1.1.6. Abbott

8.1.1.6.1. Overview

8.1.1.6.2. Financial Performance

8.1.1.6.3. Product Benchmarking

8.1.1.6.4. Strategic Initiatives

8.1.1.7. Cardiovascular Systems, Inc.

8.1.1.7.1. Overview

8.1.1.7.2. Financial Performance

8.1.1.7.3. Product Benchmarking

8.1.1.7.4. Strategic Initiatives

8.1.2. Service Providers

8.1.2.1. Envision Healthcare Corporation

8.1.2.1.1. Overview

8.1.2.1.2. Financial Performance

8.1.2.1.3. Service Benchmarking

8.1.2.1.4. Strategic Initiatives

8.1.2.2. Surgical Care Affiliates (SCA)

8.1.2.2.1. Overview

8.1.2.2.2. Financial Performance

8.1.2.2.3. Service Benchmarking

8.1.2.2.4. Strategic Initiatives

8.1.2.3. Fresenius Medical Car

8.1.2.3.1. Overview

8.1.2.3.2. Financial Performance

8.1.2.3.3. Service Benchmarking

8.1.2.3.4. Strategic Initiatives

8.1.2.4. Cardiovascular Coalition

8.1.2.4.1. Overview

8.1.2.4.2. Financial Performance

8.1.2.4.3. Service Benchmarking

8.1.2.4.4. Strategic Initiatives

8.1.2.5. Surgery Partners

8.1.2.5.1. Overview

8.1.2.5.2. Financial Performance

8.1.2.5.3. Service Benchmarking

8.1.2.5.4. Strategic Initiatives

8.1.2.6. TH Medical

8.1.2.6.1. Overview

8.1.2.6.2. Financial Performance

8.1.2.6.3. Service Benchmarking

8.1.2.6.4. Strategic Initiatives

8.2. Company Categorization: Suppliers

8.3. Company Categorization: Service Providers

8.4. Company Market Position Analysis: Suppliers

8.5. Company Market Position Analysis: Service Providers

8.6. Company Market Position Analysis: Imaging Devices Manufacturer

8.7. Company Market Position Analysis: Vascular Intervention Devices

8.8. Strategy Mapping

Chapter 9. KOL Comments & Recommendations

List of Table s

Table 1. List of Secondary Sources

Table 2. List of Abbreviation

Table 3. Procedure codes and physician reimbursement, 2022

Table 4. Shifting trends from the inpatient facility to the outpatient facility

Table 5. U.S. Office-Based Labs Market, by Modality, 2018 - 2030 (USD Million)

Table 6. U.S. Office-Based Labs Market, by Services, 2018 - 2030 (USD Million)

Table 7. U.S. Office-Based Labs Market, by Specialists, 2018 - 2030 (USD Million)

List of Figures

Fig 1. Market research process

Fig 2. Information procurement

Fig 3. Primary research pattern

Fig 4. Market research approaches

Fig 5. Value chain-based sizing & forecasting

Fig 6. Market formulation & validation

Fig 7. U.S. office-based labs market segmentation

Fig 8. Market snapshot, 2023

Fig 9. Segment snapshot

Fig 10. Competitive landscape snapshot

Fig 11. Market trends & outlook

Fig 12. Market driver relevance analysis (current & future impact)

Fig 13. Market restraint relevance analysis (current & future impact)

Fig 14. PESTLE analysis

Fig 15. Porter’s five forces analysis

Fig 16. U.S. Office-Based Labs (OBLs) market: Modality outlook and key takeaways

Fig 17. U.S. Office-Based Labs (OBLs) market: Modality movement analysis

Fig 18. Single specialty labs market revenue, 2018 - 2030 (USD Million)

Fig 19. Multi-specialty labs market revenue, 2018 - 2030 (USD Million)

Fig 20. Hybrid labs media market revenue, 2018 - 2030 (USD Million)

Fig 21. U.S. Office-Based Labs (OBLs) market: Service outlook and key takeaways

Fig 22. U.S. Office-Based Labs (OBLs) market: Service movement analysis

Fig 23. Peripheral vascular intervention market revenue, 2018 - 2030 (USD Million)

Fig 24. Cardiac market revenue, 2018 - 2030 (USD Million)

Fig 25. Interventional radiology market revenue, 2018 - 2030 (USD Million)

Fig 26. Venous market revenue, 2018 - 2030 (USD Million)

Fig 27. Endovascular interventions market revenue, 2018 - 2030 (USD Million)

Fig 28. Other services market revenue, 2018 - 2030 (USD Million)

Fig 29. U.S. Office-Based Labs (OBLs) market: Specialists outlook and key takeaways

Fig 30. U.S. Office-Based Labs (OBLs) market: Specialists movement analysis

Fig 31. Vascular surgeons market revenue, 2018 - 2030 (USD Million)

Fig 32. Interventional cardiologists market revenue, 2018 - 2030 (USD Million)

Fig 33. Interventional radiologists market revenue, 2018 - 2030 (USD Million)

Fig 34. Other specialists market revenue, 2018 - 2030 (USD Million)

Fig 35. Penetration analysis: Top 5 states 2022

Fig 36. Company competition categorization: Suppliers

Fig 37. Company competition categorization: Service providers

Fig 38. Company market position analysis: Suppliers

Fig 39. Company market position analysis (Imaging devices manufacturer)

Fig 40. Company market position analysis (Vascular intervention devices)

Fig 41. Company market position analysis: Service providersWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- U.S. Office-Based Labs Modality Outlook (Revenue, USD Million, 2018 - 2030)

- Single-specialty Labs

- Multi-Specialty Labs

- Hybrid labs

- U.S. Office-Based Labs Service Outlook (Revenue, USD Million, 2018 - 2030)

- Peripheral Vascular Intervention

- Endovascular Interventions

- Cardiac

- Interventional Radiology

- Venous

- Others

- U.S. Office-Based Labs Specialist Outlook (Revenue, USD Million, 2018 - 2030)

- Vascular Surgeons

- Interventional Cardiologist

- Interventional Radiologists

- Others

U.S. Office-based Labs Market Dynamics

Driver: Increasing Prevalence of Target Diseases

More than 250 million people worldwide suffer from Peripheral Artery Diseases (PADs). As per an AHA article published in June 2021, the prevalence of PAD was 7%, affecting approximately 8.5 million adults in the U.S. The prevalence of these diseases has significantly increased over the past decade and is expected to continue growing at an exponential rate. High-income countries, such as the U.S., witnessed growth of 13% in the number of individuals suffering from PADs in the past decade. PADs increase the risk of stroke and heart attack and often lead to ischemic amputations. According to an estimation, ~150,000 cases of ischemic amputation are recorded per year in the U.S. alone. Risk factors, such as smoking, high blood pressure, diabetes, & high cholesterol, and the rising geriatric population are among the factors expected to increase the prevalence of PADs. This is expected to lead to exponential growth in the number of procedures for the treatment of these diseases during the forecast period.

Driver: Preference to Minimally Invasive Procedures

The demand for Minimally Invasive Surgeries (MIS) and procedures is rising. MIS is witnessing a dramatic increase in demand and is rapidly replacing conventional open surgeries, owing to lesser postoperative complications, shortened hospitalization, quicker recovery time, decreased blood loss & collateral tissue damage, and minimized risk of infection. The development of robot-assisted devices and advanced surgical visualization systems is driving the adoption of MIS. Research results published by manufacturers suggest that MIS are rapidly replacing open/invasive surgeries, owing to factors, such as higher patient satisfaction owing to lesser incision wounds, a relatively small number of hospital stays, making them economically viable, and a lesser number of postsurgical complications & lower mortality rates. The procedures conducted in office-based labs are usually minimally invasive; therefore, growing demand for MIS is expected to drive market growth.

Restraint: High-risk Option for Severe Cases

Office-based settings are not equipped to handle severe and emergency cases. Moreover, safety concerns due to limited anesthetic techniques and resources put patient safety at risk. Regulatory practices in day-to-day operations in office-based labs are not strictly monitored, which further compromises the safety of severe cases. Some OBLs deliver care out of their scope known as practice drift. However, the out-of-scope procedures performed in office-based labs are not recognized by hospitals and OBLs are not capable of handling complications. These procedures carried out in OBLs may result in health complications and difficulty, requiring further treatment due to non-recognition by hospitals. According to the National Library of Medicine, office-based facilities have a high risk for severe cases, with more than 44,000 reported deaths in the U.S. due to preventable medical errors. There is a 10-fold risk of injury, death, and fatal complications for procedures performed in office-based settings compared to ambulatory surgery centers or hospitals.

What Does This Report Include?

This section will provide insights into the contents included in this U.S. office-based labs market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

U.S. office-based labs market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

U.S. office-based labs market quantitative analysis

-

Market size, estimates, and forecast from 2017 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the U.S. office-based labs market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for U.S. office-based labs market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of U.S. office-based labs market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

U.S. Office-based Labs Market Categorization:

The U.S. office-based labs market was categorized into three segments, namely modality (Single-specialty Labs, Multi-specialty Labs, Hybrid Labs), services (Peripheral Vascular Intervention, Endovascular Interventions, Cardiac, Interventional Radiology, Venous), and specialists (Vascular Surgeons, Interventional Cardiologist, Interventional Radiologists).

Segment Market Methodology:

The U.S. office-based labs market was segmented into modalities, services, and specialists. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The U.S. office-based labs market was analyzed at a regional level. This region is further divided into one country, namely, the U.S.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

U.S. office-based labs market companies & financials:

The U.S. office-based labs market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Koninklijke Philips N.V. - Koninklijke Philips N.V. is a diversified health and well-being company. The company operates across four main business areas: personal health, diagnosis & treatment, connected care, and health informatics. Out of this, the company’s diagnosis & treatment business partnered with physicians and provides a complete range of products & end-to-end solutions for establishing an office-based laboratory. The company markets its product across growth geographies-Latin America, the Middle East, and Central & Eastern Europe as well as & Turkey & China-and across mature geographies-Western Europe & North America. Philips is present in more than 75 countries globally, with key manufacturing and R&D sites in the Americas, Asia, and Europe.

-

GE Healthcare - GE Healthcare provides medical technologies and services to the healthcare industry. The company offers a wide range of products and services, including performance improvement solutions, biopharmaceuticals, manufacturing technologies, patient monitoring & diagnostic solutions, and medical imaging systems. It is an operating segment of General Electric, and its products are sold worldwide to hospitals, pharmaceutical & biotechnology companies, the life sciences research market, and medical facilities. The company has branches worldwide, with technology centers located in Belgium, China, California, Japan, Texas, and Minnesota.

-

Siemens Healthineers AG - Siemens Healthineers AG is the wholly owned subsidiary of Siemens Aktiengesellschaft. The company is a worldwide manufacturer of 3D medical imaging, clinical diagnostics, and therapeutic systems. The company’s key offerings include molecular test systems, immunoassays, blood tests, diabetes tests, blood gas monitoring systems, automation systems, integrated & routine chemistry, and urinalysis, as well as data management solutions for early detection, diagnosis & prevention. In addition, it provides Siemens Healthineers Digital Ecosystem, which is a digital platform for healthcare and solution providers to club applications & services within one framework. The company provides its products and services through a network of partners and distributors globally.

-

Medtronic PLC - Medtronic PLC is a successor of Medtronic, Inc., a Minnesota Corporation. Medtronic is one of the largest providers of medical technology, solutions, and services for relieving pain & health restoration. The company focuses on three main aspects of business: therapy innovation; global presence, especially targeting emerging markets; and providing economic value with cost-effective treatment options. The company mainly targets hospitals, clinics, institutes, healthcare providers, distributors, and government healthcare programs, as well as group purchase organizations. The company operates through four business units: cardiac & vascular group, minimally invasive therapies, restoration therapies, and diabetes; out of which, the cardiac & vascular group offers a broad product line for aortic aneurysm repair.

-

Abbott - Abbott is a pharmaceutical and healthcare products company that designs, manufactures, and markets medical devices, diagnostic assays, nutritional products, animal health products, and pharmaceutical products. In 1973, the company added another division-diagnostics-that combined its diagnostic products and services. The company operates in four business segments: nutritionals, diagnostics, branded generic pharmaceuticals, and cardiovascular & neuromodulation services. It provides in vitro diagnostics and tests for blood banks, hospitals, physician offices, and clinics & nursing homes. The cardiovascular and neuromodulation products sell various products globally-rhythm management, electrophysiology, heart failure, vascular, and structural heart & neuromodulation products.

-

Envision Healthcare Corporation (KKR) - Envision Healthcare Corporation is a leading provider of physician-led services, post-acute care, and ambulatory surgery services. Medical services outsourcing giant Envision Healthcare was created in late 2016 from the merger of an ambulatory surgery center operator-AmSurg-with an emergency room staffing firm & private ambulance service provider-Envision Healthcare Holdings. The company delivers physician services, primarily in the areas of emergency & hospitalist services, anesthesiology services, radiology/teleradiology services, and pediatric care to more than 1,800 clinical departments in healthcare facilities in 45 states and the District of Columbia.

-

Surgical Care Affiliates (SCA) - Surgical Care Affiliates (SCA) is one of the leading providers of outpatient surgery services in the U.S. The company partners with physicians, hospitals, & health systems to develop and operate ambulatory surgery centers & surgical hospitals in more than 35 states across the country. As of 2021, SCA owns and/or provides management services to 260 surgical hospitals, ambulatory surgery centers, and hospital surgery departments. Approximately 8,500 physicians help provide these services in affiliation with 110 health systems, serving 1 million patients per year. The company’s service line growth strategies, benchmarking processes, clinical systems, and efficiency programs further enhance the service quality for surgical facilities availing them. Since March 2017, the company has been operating as a part of Optum.

-

Fresenius Medical Care - The National Cardiovascular Partners, LP is a subsidiary of Fresenius Medical Care. The company operates and manages outpatient cardiac catheterization and vascular facilities. It also partners with physicians to develop and manage hospital-based cardiovascular programs as well as outpatient cardiac catheterization labs. Some of the services offered by the company are site selection, managed care contract negotiations & contracting, physician partner recruitment, day-to-day management, equipment & supplies purchasing, management information systems, and recruitment of staff.

-

Cardiovascular Coalition - Cardiovascular Coalition specializes in support and care for patients suffering from Peripheral Artery Disease (PAD). It has partnerships with companies, such as Philips; Vascular Access Centers; Lifeline Vascular Care; Cardiovascular Institute of the South; Cardiovascular Systems, Inc.; and American Vascular Centers. It has 255 Cardiovascular Centers (CVCs) across 36 states in the U.S.

-

TH Medical - TH Medical is a diversified healthcare services company. At a regional level, the company focuses on integrated healthcare delivery networks in the U.S. As of December 2021, the company operated 60 hospitals and 550 other healthcare facilities, which include urgent care centers, ambulatory surgery centers, surgical hospitals, and micro-hospitals in the U.S. In the UK, it operates nine facilities through its subsidiaries, partnerships, and joint ventures, including USPI Holding Company, Inc. (USPI joint venture). Its subsidiary Conifer Holdings, Inc. (Conifer) provides healthcare business process services in the field of hospital & physician revenue cycle management and value-based care solutions to healthcare systems, as well as individual hospitals, physician practices, & other entities. The company operates in three business segments: hospital operations, ambulatory care, and Conifer.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

U.S. Office-based Labs Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2017 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

U.S. Office-based Labs Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."