Oil Refining Market Size & Trends

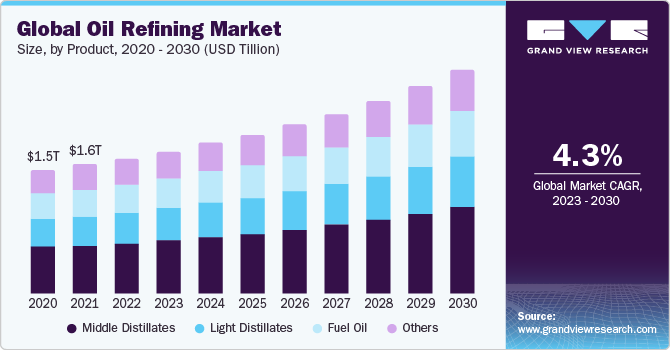

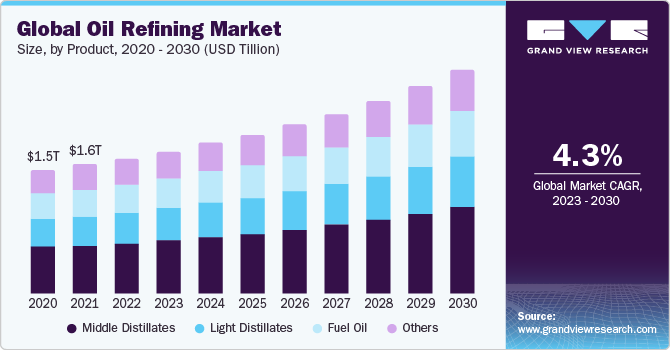

The global oil refining market was valued at USD 1,687.7 billion in 2022 and is expected to grow at a CAGR of 4.28% over the forecast period. This market is characterized by its intricate processes, vast infrastructure, and its role as a crucial link in the supply chain of energy and petrochemicals. The demand for refined petroleum products, including gasoline, diesel, jet fuel, and petrochemical feedstock, is perpetually driven by economic growth, population expansion, and industrial activities.

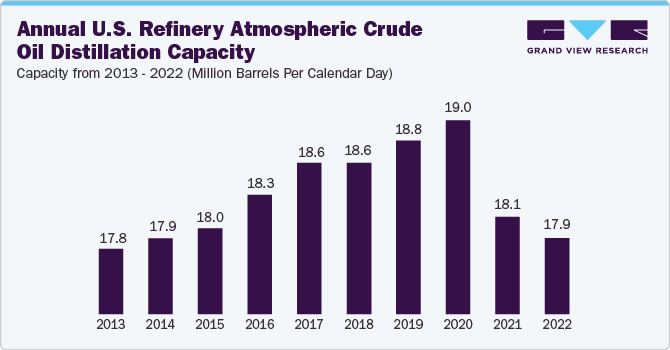

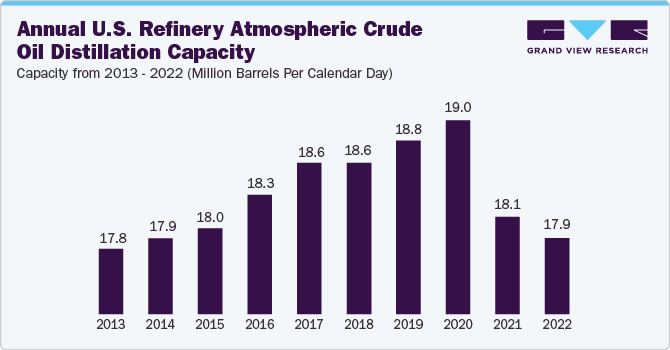

The COVID-19 pandemic unleashed a profound and multifaceted impact on the oil refining market. As the global economy grappled with lockdowns, travel restrictions, and economic contractions, the demand for refined petroleum products plummeted. This demand shock led to a severe overcapacity in the refining sector, forcing numerous refineries to curtail production or temporarily shut down altogether. Concurrently, the volatility in crude oil prices reached unprecedented levels, with some periods even witnessing negative oil prices due to storage constraints. Such extreme price fluctuations posed immense challenges for refining companies, complicating their ability to manage operations and maintain profitability.

Refining margins, which represent the profitability of the sector, were severely eroded as lower demand for refined products coincided with high crude oil inventories. Consequently, many refineries faced financial distress. Operational challenges emerged as refineries adapted to new safety protocols to protect their workforce while also adjusting production levels in response to shifting demand patterns. Capital expenditure plans aimed at improving efficiency, expanding capacity, or complying with environmental regulations were often delayed or scaled back.

One of the significant trend in oil refining market is the shift towards digitalization and automation. Refineries are adopting advanced data analytics, artificial intelligence, and IoT technologies to optimize operations, enhance energy efficiency, and reduce downtime. This digital transformation is helping refineries achieve higher levels of productivity and cost-effectiveness.

Product Insights

Based on the product, the oil refining market is segmented into fuel oil, light distillates, middle distillates, and others. The middle distilates segment held the largest market share in 2022. The middle distillates market in the oil refining industry focuses on the production and distribution of refined petroleum products with boiling points falling between those of light distillates (such as gasoline) and heavy distillates (like residual fuel oil). Key products within this market segment include diesel fuel, jet fuel (kerosene), and heating oil, each serving critical roles in various sectors of the economy.

Fuel Type Insights

On the basis of fuel type the market is segmented into gasoline, kerosene, Liquefied Petroleum Gas (LPG), gasoil, and others. Gasoline is the largest vessel type in 2022. Gasoline, also known as petrol in some regions, is a high-demand transportation fuel that powers passenger cars, trucks, motorcycles, and various other vehicles worldwide. Gasoline is a refined product derived from the processing of crude oil in oil refineries. The refining process involves distillation, blending, and the removal of impurities to produce gasoline with specific properties and performance characteristics. Gasoline is renowned for its energy density and combustibility, making it an ideal fuel for internal combustion engines.

Complexity Type Insights

Based on complexity type, the market is segmented into hydro-skimming, topping, conversion, and deep conversion. The hydro-skimming segment dominated the complexity type segmentation in 2022. One key advantage of hydro-skimming refineries is their relatively lower capital and operational costs compared to more complex refining operations. They are easier to construct and maintain, making them attractive for regions with limited resources or where demand for middle distillates is significant. Hydro-skimming refineries are particularly suited to refining heavy or sour crude oil, as their primary focus is on producing middle distillates, which are less affected by crude oil quality.

Application Insights

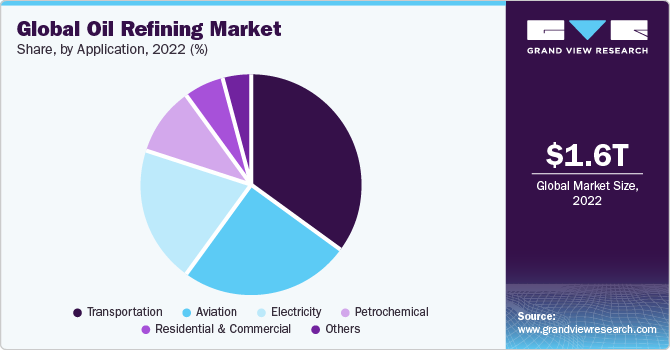

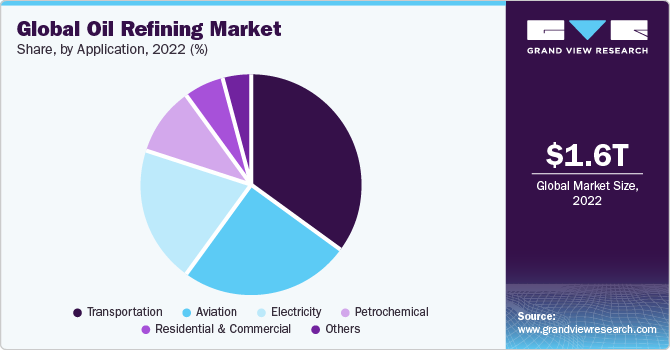

Based on end use, the oil refining market is segmented into marine bunker, transportation, aviation, petrochemical, agriculture, electricity, residential & commercial, rail & domestic waterways, and others. Transportation segment dominated the end-use segmentation in 2022. Transportation fuels produced by oil refineries include gasoline, diesel fuel, and jet fuel. Gasoline is the primary fuel for passenger vehicles, accounting for a significant portion of the global oil refining market. Diesel fuel powers various transportation modes, including trucks, buses, trains, and ships. It is essential for the movement of goods and people, making it a cornerstone of the global logistics and transportation industry. Jet fuel is specifically designed for aviation and enables the operation of aircraft for both commercial and military purposes.

Regional Insights

Asia Pacific dominated the largest market share in 2022. The oil refining market in the Asia Pacific region holds immense significance due to the region's rapid industrialization, urbanization, and economic growth. Asia Pacific has become a major hub for oil refining, with several key countries playing pivotal roles in the global petroleum industry.

China, in particular, has emerged as a dominant player in the Asia Pacific oil refining market. The country's booming economy and expanding middle class have fueled a substantial increase in demand for transportation fuels such as gasoline and diesel fuel. Consequently, China has witnessed significant investments in its refining capacity, with the construction of mega-refineries and the upgrading of existing facilities. China's refining sector plays a crucial role in supplying not only its domestic market but also exporting refined products to neighboring countries.

Key Companies & Market Share Insights

Key players operating in the market are BP PLC, Saudi Arabian Oil Co., Exxon Mobil Corporation, and Sinopec Corp.. Key competitive factors in the oil refining market is operational efficiency. Refineries aim to maximize their efficiency to reduce costs and enhance profitability. This often involves investments in advanced technologies, process optimization, and maintenance practices. Refineries that can consistently operate at high levels of efficiency tend to have a competitive advantage in terms of cost-effectiveness.

In May 2023, Rosneft, the prominent Russian energy corporation, unveiled its intentions to join forces with state-owned Indian refineries to initiate the construction of a new refinery within India. This strategic move comes in the wake of alterations made to the previously proposed USD 44-billion refinery project situated along India's western coastline, a project led by India's government-run refining entities.

In March 2023, there were advanced discussions in progress between the African Export-Import Bank (Afreximbank) and Senegal's exclusive oil refining company, Société Africaine de Raffinage (SAR), with the aim of securing USD 500 million in syndicated funding to support extensive renovations for the aging refinery.