- Home

- »

- Drilling & Extraction Equipments

- »

-

Oil Spill Management Market Size, Industry Report, 2030GVR Report cover

![Oil Spill Management Market Size, Share & Trends Report]()

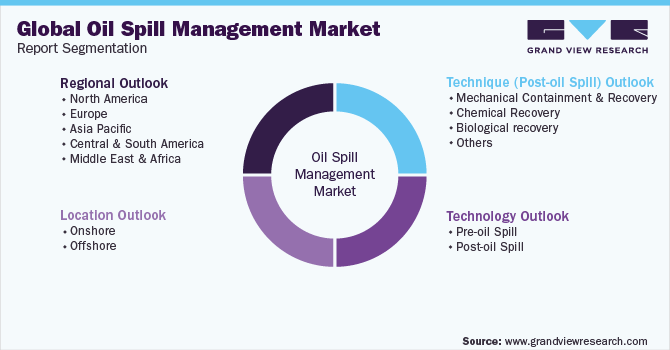

Oil Spill Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Pre-oil spill, Post-oil spill), By Location (Onshore, Offshore), By Region (North America, Asia Pacific, Europe, Latin America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-735-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oil Spill Management Market Summary

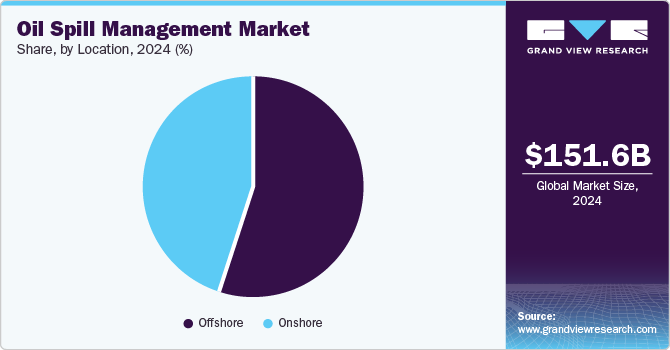

The global oil spill management market size was valued at USD 151.61 billion in 2024 and is projected to reach USD 183.50 billion by 2030, growing at a CAGR of 3.3% from 2025 to 2030. Increasing safety concerns coupled with rising oil spill incidents globally over the last few years are expected to drive the global market over the next nine years.

Key Market Trends & Insights

- North America dominated the global oil spill management market and accounted for a revenue share of 40.6% in 2023.

- The U.S. oil spill management market held the largest revenue share of regional industry.

- Based on technology, the pre-oil spill segment dominated the global industry and accounted for a revenue share of 70.1% in 2023.

- Based on location, the offshore application segment accounted for the largest revenue share of the global industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 151.61 billion

- 2030 Projected Market Size: USD 183.50 billion

- CAGR (2025-2030): 3.3%

- North America: Largest market in 2024

A significant increase in the onshore and offshore drilling activities has led to oil & gas transportation growth. Growth in oil & gas transportation through tankers and pipelines and strict government safety guidelines are anticipated to impact the global oil spill management industry positively. Major industry players invest a considerable amount in R&D. This is expected to build tremendous opportunities and expand the sector over the forecast period.

Globally, numerous initiatives have been taken by governments and safety agencies, such as the Occupational Safety and Health Administration (OSHA), to control and monitor leakages and oil spills at the source or during oil and gas transportation. Some of the key requirements include the installation of pipeline leak detection sensors and double hulling of transportation carriers. Growing concern and stringent safety norms towards preventing on-site and transportation occupational hazards in petroleum facilities are anticipated to remain the key factors contributing to implementing pre-oil spill management techniques over the forecast period.

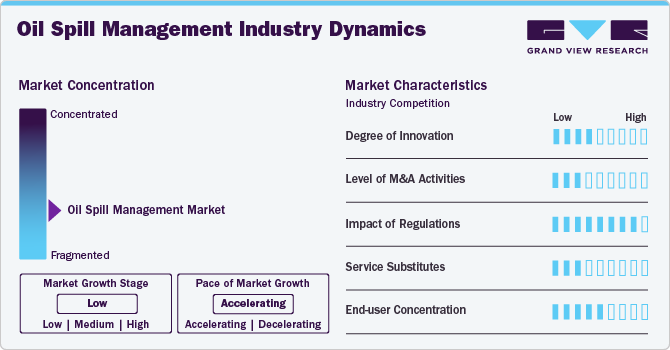

Market Concentration & Characteristics

The market growth stage is medium, and the pace of market growth is accelerating. The oil spill management market has been experiencing a moderate level of innovation. Some of the key advancements in this industry are associated with materials used for coatings, digital technology for remote monitoring, and others. Modern technologies, such as drones and satellite imaging for surveillance, are also influencing this industry. The emergence of enhanced oil recovery technologies, the use of polymer-surfactant systems, and the focus on adopting cost-effective oil recovery systems also contribute to the changing dynamics of the industry.

The level of mergers and acquisitions is medium. Recent acquisitions have helped a few market participants strengthen their market positions. For instance, in March 2024, Acteon Group, one of the major companies in the offshore energy infrastructure services market, announced it had been acquired by One Equity Partners (OEP) and Buckthorn Partners. This has provided significant investment and financial support to Acteon, enhancing its stronghold in the market.

The regulatory scenario highly influences the global oil spill management market. Oil spill incidents directly affect the maritime environment. International trade organizations, various government authorities, the International Maritime Organization (IMO), the Coast Guard agency of numerous countries, and the Bureau of Safety and Environmental Enforcement (BSEE) influence the regulatory scenario.

Technology Insights

The pre-oil spill segment dominated the global industry and accounted for a revenue share of 70.1% in 2023. In recent years, the demand for double-hull technology has significantly increased owing to marine trade, which accounts for a majority of oil and gas product transportation. The rising demand for crude oil and petroleum products from the energy industries in Europe and the Asia Pacific is anticipated to boost market growth over the forecast period. Rising concern regarding harmful environmental impacts from hull-breach incidents has urged international organizations and governments to standardize tanker design. This has also enhanced tanker protection against collisions and natural disasters. These factors are anticipated to boost the growth of double-hull technology over the forecast period.

Post oil spill segment is expected to experience a significant growth rate from 2025 to 2030. Increasing incidents of oil spills driven by catastrophic environments, accidents and others factors are primarily driving this growth. For instance, December 2024, storm-hit vessel carrying oil tanker spilled vast amount of oil in Kerch Strait. In January 2024, Russia declared emergency in the area near black sea.

This technology has multiple dynamics, including mechanical containment & recovery, chemical recovery, biological recovery, physical recovery and more. The method involves the use of containment booms, sorbents, and skimmers to clean up an oil spill. These response technologies are the most valuable practices for large-scale spills in near-shore and deep-sea areas.

The technologies involve gelling and dispersant agents, naturally enhancing oil components' breakdown. The chemical dispersants allow the water and oil to bind chemically. This prevents slicks from spreading over the water surface and increases the surface area of an oil molecule. Various biological agents for oil spills break the oil into carbon dioxide and fatty acids. This recovery process is usually used for areas where spilled oil has reached the shore. However, this process has recently been applied as test cases in river systems. Phosphorous and nitrogen-based fertilizers are used in the process. These fertilizers are dropped into the water bodies or areas to increase the growth of microorganisms, which break down the sand-bound oil.

Location Insights

The offshore application segment accounted for the largest revenue share of the global industry in 2024. The rising requirement for oil spill management technology in harsh environments, remote locations, and deep water is anticipated to drive product demand over the next nine years. Upcoming projects predominantly in the South China Sea and the Persian Gulf region and renewal of abandoned wells are anticipated to drive offshore E&P activity in upcoming years. Increased regulation, taxes, and fines related to post-oil spill containment pressurize upstream and midstream oil & gas companies to deploy safety equipment for uninterrupted operations. This equipment includes pipeline leak detection systems, blowout preventers (BOP), and other systems. Several ongoing pre-oil spill technology demands, especially in the U.S., Qatar, and Saudi Arabia, are expected to grow considerably over the forecast period.

Remote locations, such as Arctic regions, coastal islands, and others, mainly depend on the marine ecosystem for economic growth. Oil spills' increasing damage to seagrasses, feeding grounds, and coral reefs of marine species have a long-term impact on these coastal regions. Rising deep-water explorations and increasing energy demand are anticipated to boost offshore prospects in Arctic areas such as Alaska, the Russian Federation, and Norway.

Onshore oil spill management is anticipated to grow during the forecast period. Various incidents of spillages and pipeline failures, especially in the U.S., Canada, Norway, China, and Mexico, are significant attributes of the extensive market penetration over the past few years. Rising incidences, regulatory compliance requirements of multiple countries and organizations, and technological advancements adopted by companies are expected to generate higher growth for this segment.

Regional Insights

North America dominated the global oil spill management market and accounted for a revenue share of 40.6% in 2023. The region is anticipated to gain market share due to rising oil and gas E&P activities. Oil spill incidents in the area, such as Marathon Oil, Exxon Valdez, and Deepwater Horizon, have also resulted in the formulation of a stringent regulatory framework for onshore and offshore oil and gas production activities.

U.S. Oil Spill Management Market Trends

The U.S. oil spill management market held the largest revenue share of regional industry. This market is primarily driven by increasing oil and gas activities, regulations encouraging enhanced spill management practices, technological advancements, ease of availability, the entry of multiple international organizations, and rising trade in the region. According to the International Trade Centre, in 2024, the U.S. exported 238,788,357 cubic meters of petroleum oils (crude), a substantial increase from 235,677,323 in 2023.

Europe Oil Spill Management Market Trends

Europe is identified as a lucrative region for the oil spill management market in 2024. This market is primarily driven by factors such as increasing incidents of oil spills in the area, an alarming need highlighted by multiple high-profile spill incidents, stringent government regulation, and a large amount of trade running through waters associated with Europe, such as the English Channel. The market is also influenced by technological advancements adopted by the key market participants present in the region. Growing offshore oil explorations are expected to generate greater demand for this market.

Asia Pacific Oil Spill Management Market Trends

Asia Pacific oil spill management market is expected to grow at an anticipated CAGR of 4.2% from 2025 to 2030. Most oil and gas exploration and production activities in the region are centered in India, China, and South Korea. Encouraging government initiatives and regulations, such as tax benefits and other financial aid for discovering hydrocarbon reserves, is anticipated to push industry growth in these countries over the next nine years.

Some of the biggest oil spill incidents in the past few years include the Xingang Port spill in China, the ExxonMobil spill in Nigeria, the Lac-Megantic derailment in Canada, and the Trans-Israel pipeline. Stringent environmental regulations coupled with large-scale spillage are the major factors responsible for deploying post-oil spill management Technologies over the past few years.

Key Oil Spill Management Company Insights

Some key companies involved in the oil spill management market include National Oilwell Varco, Inc., Ecolab, Oil Spill Response Limited, SkimOIL, LLC, and others. To address the growing competition, key market participants in this industry have embraced strategies such as innovation-backed new product launches, enhanced R&D efforts, collaborations and partnerships with other organizations, improved customer engagements, and more.

-

Ecolab is a prominent company in the technology and services industry associated with water, hygiene, and energy. It offers multiple spill management solutions, such as a Biohazard Spill Cleanup Kit, a Biohazard Response Spill Kit, an Adv. Floor Care Grease Beater Map, and others.

-

SkimOIL, LLC, a company that specializes in designing, custom manufacturing, and distributing industrial and marine pollution control systems and equipment, offers a wide range of products, including oil skimmers and water separators. These include floating weir oil skimmers, floating drum oil skimmers, belt oil skimmers, rope mop wringer oil skimmers, tube oil skimmers, and multiple other products.

Key Oil Spill Management Companies:

The following are the leading companies in the oil spill management market. These companies collectively hold the largest market share and dictate industry trends.

- National Oilwell Varco, Inc.

- Ecolab

- Oil Spill Response Limited

- SWS Environmental Services Ltd.

- American Pipeline Solutions

- SkimOIL, LLC

- OMNI Environmental Solutions

- Cameron International Corporation (SLB)

- Sorbcontrol

- American Green Ventures (US), Inc.

- Fender & Spill Response Services L.L.C

- Osprey Spill Control

Recent Developments

-

In April 2025, Miros, a company that offers real-time ocean insights to multiple industry participants, announced the expansion of its product line with the launch of the Oil Spill Detection (OSD) Monitoring application through Miros Cloud.

-

In January 2024, Ecolab, one of the major market participants in the sustainability and operational efficiency industry, opened its brand new manufacturing facility in Ho Nai Industrial Park, near Ho Chi Minh City, Vietnam. This newly developed facility, spanning 3,000 square meters, is equipped with an advanced laboratory, warehouse, and manufacturing unit.

Oil Spill Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 155.92 billion

Revenue forecast in 2030

USD 183.50 billion

Growth rate

CAGR of 3.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Technology, location, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Norway; Russia; China; India; Australia; Malaysia; Brazil; Argentina; Saudi Arabia; UAE; Kuwait

Key companies profiled

National Oilwell Varco, Inc.; Ecolab; Oil Spill Response Limited; SWS Environmental Services Ltd.; American Pipeline Solutions; SkimOIL, LLC; OMNI Environmental Solutions; Cameron International Corporation (SLB); Sorbcontrol; American Green Ventures (US), Inc.;Fender & Spill Response Services L.L.C; Osprey Spill Control

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oil Spill Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oil spill management market report based on technology, location, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-oil spill Management

-

Double-hull

-

Pipeline leak detection

-

Blow-out preventers

-

Others

-

-

Post-oil spill Management

-

Mechanical

-

Containment booms

-

Hard booms

-

Sorbent booms

-

Fire booms

-

Others

-

-

Skimmers

-

Weir skimmers

-

Oleophilic skimmers

-

Non-oleophilic skimmers

-

Others

-

Sorbent

-

Others

-

-

-

Chemical

-

Dispersing agents

-

Gelling agents

-

Others

-

-

Biological

-

Physical

-

-

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Norway

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Australia

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.