- Home

- »

- Conventional Energy

- »

-

Oil Storage Market Size, Share, Industry Report, 2033GVR Report cover

![Oil Storage Market Size, Share & Trends Report]()

Oil Storage Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Open Top, Fixed Roof, Floating Roof), By Application, By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-1-68038-132-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oil Storage Market Summary

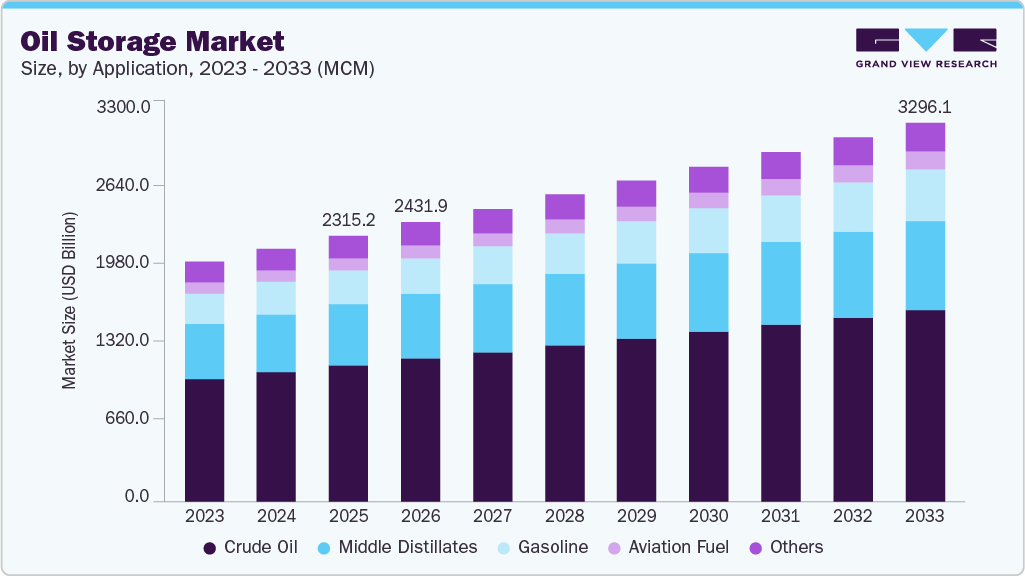

The global oil storage market size was estimated at 2315.2 MCM in 2025 and is projected to reach 3296.1 MCM by 2033, growing at a CAGR of 4.4% from 2026 to 2033. Rapid industrialization and urbanization, particularly across emerging economies, continue to drive higher consumption of energy resources, including crude oil and refined petroleum products.

Key Market Trends & Insights

- Middle East & Africa dominated the global oil storage market with the largest volume share of 34.5% in 2025.

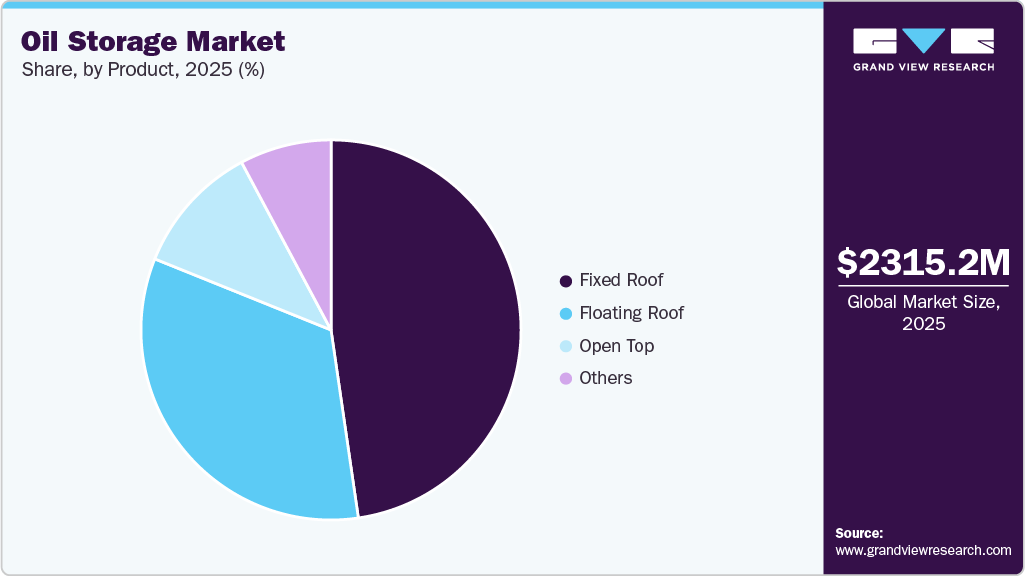

- By product, the fixed roof segment led the market with the largest volume share of 47.7% in 2025.

- By application, the crude oil segment accounted for the largest market volume share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2315.2 MCM

- 2033 Projected Market Size: USD 3296.1 MCM

- CAGR (2026-2033): 4.4%

- Middle East & Africa: Largest market in 2025

- Latin America: Fastest growing market

As nations expand transportation networks, manufacturing capacity, and urban infrastructure, the need for reliable and efficient oil storage systems becomes increasingly critical to ensure uninterrupted supply chains and inventory management. This rising demand is prompting investments in new storage terminals and the expansion of existing facilities, supporting steady market growth in terms of installed storage volume.

Oil storage infrastructure plays a vital role in supporting strategic reserves, commercial trading activities, and operational requirements across the energy value chain. Large and medium capacity storage facilities are preferred due to their ability to handle bulk volumes, improve logistical efficiency, and enhance energy security. Growing volatility in global oil prices, increasing cross-border oil trade, and government-led initiatives to strengthen strategic petroleum reserves in countries such as the U.S., China, India, and key Middle Eastern economies are further accelerating the expansion of oil storage capacity worldwide.

Drivers, Opportunities & Restraints

The global oil storage industry continues to expand, driven by rising demand for secure, flexible, and efficient storage infrastructure to support the growing consumption of crude oil and refined products across the industrial, transportation, and power generation sectors. Increasing volatility in global oil prices and trade flows has heightened the need for adequate storage capacity to balance supply and demand mismatches and support commercial trading activities. Strategic Petroleum Reserve (SPR) initiatives, particularly in countries seeking to enhance energy security, along with the ongoing expansion of refining capacity and port infrastructure, are further strengthening demand for large- and medium-scale oil storage facilities across both developed and emerging economies.

Emerging opportunities in the oil storage industry are being created by the development of integrated storage and logistics hubs that combine terminals, pipelines, and port connectivity to improve operational efficiency and turnaround times. Advancements in tank design, automation, digital inventory management, and safety monitoring systems are improving storage reliability while reducing operational risks and maintenance costs. In addition, rising cross-border oil trade, expansion of offshore and onshore exploration activities, and increasing investments in strategic and commercial storage in the Asia Pacific, the Middle East, and Africa are opening new avenues for capacity additions. However, the market faces restraints including stringent environmental and safety regulations, high capital investment requirements, land acquisition challenges, and long approval timelines. The growing policy emphasis on energy transition and reduced reliance on fossil fuels in some regions may also limit the long-term expansion of oil storage capacity.

Product Insights

The fixed roof segment led the market with the largest volume share of 47.7% in 2025, and is expected to maintain its leading position over the forecast period. Fixed roof tanks are widely used for storing crude oil and refined petroleum products due to their structural simplicity, cost-effectiveness, and suitability for large-scale onshore storage applications. Their extensive adoption across refineries, strategic petroleum reserves, terminals, and distribution depots continues to support segment growth. In addition, the ease of installation, lower capital expenditure compared to advanced tank designs, and compatibility with a wide range of storage capacities make fixed roof tanks a preferred choice, particularly in developing regions where storage infrastructure expansion is ongoing.

The floating roof segment is anticipated to register at the fastest CAGR of 5.5% during the forecast period. This growth is primarily driven by increasing regulatory emphasis on reducing evaporative losses and improving environmental safety standards. Floating roof tanks are increasingly favored for storing volatile crude oil and petroleum products, as they minimize vapor emissions and product loss, thereby enhancing storage efficiency and compliance with environmental regulations. Rising investments in modernizing storage terminals, expanding refinery capacity, and upgrading aging infrastructure, particularly in North America, Europe, and the Asia Pacific, are accelerating the adoption of floating roof systems, which supports strong long-term growth for this segment.

Application Insights

The crude oil segment led the market with the largest volume share of 51.4% in 2025, maintaining its position as the dominant application category. The large share is primarily driven by the critical role of crude oil storage in balancing upstream production with downstream refining and export activities. Increasing crude oil production, rising cross-border trade, and the expansion of strategic petroleum reserves across major economies continue to support strong demand for crude oil storage capacity. Refineries, national oil companies, and commercial traders rely on large-scale storage facilities to manage supply fluctuations, price volatility, and logistical constraints, reinforcing the importance of crude oil storage within the global oil storage industry.

The aviation fuel segment is expected to register at the fastest CAGR of 5.7% over the forecast period. Growth in this segment is supported by the steady recovery and long-term expansion of global air travel, increasing aircraft fleet sizes, and rising fuel consumption at major airports and aviation hubs. The expansion of airport infrastructure, particularly in the Asia Pacific and the Middle East, along with growing investments in dedicated aviation fuel storage terminals, is accelerating demand for specialized storage solutions. In addition, stricter fuel quality and safety standards are driving the development of modern, efficient aviation fuel storage facilities, further supporting the segment’s strong growth outlook.

Regional Insights

The oil storage market in North America is supported by well-established refining infrastructure, high levels of commercial oil trading activity, and the presence of extensive pipeline and terminal networks. The increasing production of crude oil, particularly from shale plays, along with rising demand for storage to manage supply fluctuations and seasonal demand variations, continues to drive market growth. Strategic reserve maintenance, refinery expansions, and ongoing investments in terminal modernization further strengthen the region’s oil storage capacity, making North America a key contributor to global storage volumes.

U.S. Oil Storage Market Trends

The oil storage market in the U.S. remains a critical component of the global energy supply chain, driven by large-scale crude oil production, extensive refining operations, and active domestic and international trade. The country’s Strategic Petroleum Reserve, along with significant commercial storage capacity across major hubs such as the Gulf Coast, supports supply security and price stabilization. Rising crude exports, infrastructure upgrades, and investments in storage automation and safety systems continue to reinforce the U.S. market’s importance within the global oil storage landscape.

Middle East & Africa Oil Storage Market Trends

Middle East & Africa dominated the global oil storage market with the largest revenue share of 34.5% in 2025, maintaining its position as the largest regional market. This dominance is driven by the region’s role as a major international hub for crude oil production, exports, and strategic reserves. Extensive investments in large-scale onshore and coastal storage terminals, as well as the expansion of refining capacity, and robust crude and product trade flows continue to support demand. National oil companies and governments across the Middle East are actively expanding their strategic petroleum reserves to enhance energy security and manage supply volatility. Meanwhile, Africa’s growing refining and import-export activities are further contributing to regional market strength.

Latin America Oil Storage Market Trends

The oil storage market in Latin America is expected to register at the fastest CAGR of 6.2% over the forecast period, driven by expanding oil production, increasing refining capacity, and rising regional fuel consumption. Growing investments in port infrastructure, storage terminals, and pipeline connectivity across countries such as Brazil, Mexico, and Argentina are accelerating capacity additions. Efforts to modernize aging infrastructure and support export-oriented oil trade further strengthen growth prospects, positioning Latin America as the fastest-growing regional market for oil storage.

Asia Pacific Oil Storage Market Trends

The oil storage market in Asia Pacific continues to expand steadily, driven by rising energy demand, increasing crude oil imports, and growing strategic reserve initiatives across major economies, including China, India, Japan, and South Korea. Rapid industrialization, urban growth, and expansion of refining and petrochemical capacity are increasing the need for large-scale storage infrastructure. Government-backed investments in strategic petroleum reserves and commercial storage terminals further support sustained growth across the region.

Europe Oil Storage Market Trends

The oil storage market in Europe is driven by strong demand for commercial and strategic storage to support refining, imports, and cross-border petroleum trade. Increasing focus on energy security, inventory optimization, and supply diversification has led to steady investments in storage terminals and tank farms across the region. In addition, stringent environmental and safety regulations are encouraging upgrades to existing infrastructure, supporting demand for modern storage solutions across key European energy hubs.

Key Oil Storage Company Insights

Some of the key players operating in the global oil storage industry include Koninklijke Vopak N.V. and Vitol Tank Terminals International BV (VTTI), among others.

-

Koninklijke Vopak N.V. is one of the world’s largest independent tank storage operators, providing storage and handling services for crude oil, refined petroleum products, chemicals, and gases. The company operates a global network of strategically located terminals across major energy and trading hubs in Europe, Asia Pacific, North America, the Middle East, and Africa. Vopak focuses on long-term contracts, high safety and environmental standards, and operational excellence to ensure secure and efficient storage solutions. Its strategic initiatives include expanding capacity in high-growth regions, investing in terminal modernization and automation, and aligning its portfolio with evolving energy transition trends while maintaining a strong core presence in oil storage.

-

Vitol Tank Terminals International BV (VTTI) is a leading independent energy storage provider with a strong emphasis on crude oil and petroleum product storage. Backed by Vitol, one of the world’s largest energy trading companies, VTTI operates a global network of terminals located in key import-export and trading regions. The company emphasizes flexible storage solutions, connectivity to refineries and pipelines, and high operational reliability to support global oil trade flows. VTTI’s strategic focus includes expanding terminal capacity at critical locations, enhancing digital and safety systems, and optimizing storage infrastructure to meet the needs of traders, refiners, and national oil companies in a dynamic global energy market.

Key Oil Storage Companies:

The following are the leading companies in the oil storage market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Vopak N.V.

- Vitol Tank Terminals International BV (VTTI)

- Oiltanking GmbH

- China National Petroleum Corporation (CNPC)

- China Petroleum & Chemical Corporation (Sinopec Group)

- Saudi Aramco

- Kinder Morgan, Inc.

- Buckeye Partners, L.P.

- Rosneft Oil Company

- BP plc

Recent Developments

- In July 2025, Koninklijke Vopak N.V. raised its 2025 core profit outlook after delivering strong first-half performance, reflecting resilience and growth across its global tank storage network. The Dutch oil storage company cited robust operational results and continued demand for storage services across key regions, positioning Vopak to achieve higher earnings than previously expected for the year.

Oil Storage Market Report Scope

Report Attribute

Details

Market definition

The oil storage market size represents the total global volume generated from the development, operation, and utilization of storage infrastructure for crude oil and refined petroleum products, including onshore and offshore storage terminals, tank farms and strategic petroleum.

Market size value in 2026

2431.9 MCM

Volume forecast in 2033

3296.1 MCM

Growth rate

CAGR of 4.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in MCM, and CAGR from 2026 to 2033

Report coverage

Volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Koninklijke Vopak N.V.; Vitol Tank Terminals International BV (VTTI); Oiltanking GmbH; China National Petroleum Corporation (CNPC); China Petroleum & Chemical Corporation (Sinopec Group); Saudi Aramco; Kinder Morgan, Inc.; Buckeye Partners, L.P.; Rosneft Oil Company; BP plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oil Storage Market Report Segmentation

This report forecasts volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global oil storage market report based on the product, application, and region.

-

Product Outlook (Volume, Million cubic meters, 2021 - 2033)

-

Open top

-

Fixed roof

-

Floating roof

-

Others

-

-

Application Outlook (Volume, Million cubic meters, 2021 - 2033)

-

Crude oil

-

Middle distillates

-

Gasoline

-

Aviation fuel

-

Others

-

-

Regional Outlook (Volume, Million cubic meters, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global oil storage market size was estimated at 2315.2 MCM in 2025 and is expected to reach 2431.9 MCM in 2026.

b. The global oil storage market is expected to grow at a compound annual growth rate of 4.4% from 2026 to 2033 to reach 3296.1 MCM by 2033.

b. Based on the product segment, fixed roof held the largest volume share of more than 47% in 2025.

b. Some of the key vendors operating in the global oil storage market include Koninklijke Vopak N.V., Vitol Tank Terminals International BV (VTTI), Oiltanking GmbH, China National Petroleum Corporation (CNPC), China Petroleum & Chemical Corporation (Sinopec Group), Saudi Aramco, Kinder Morgan, Inc., Buckeye Partners, L.P., Rosneft Oil Company, and BP plc, among others.

b. The key factors driving the oil storage market include rising global oil consumption, increasing volatility in crude oil prices, and the growing need to balance supply-demand mismatches across the energy value chain.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.