- Home

- »

- Pharmaceuticals

- »

-

Omics Lab Services Market Size & Share Analysis Report, 2030GVR Report cover

![Omics Lab Services Market Size, Share & Trends Report]()

Omics Lab Services Market Size, Share & Trends Analysis Report By Services (Genomics, Proteomics), Business (Hospitals), Frequency Of Service (One-off), By Product, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-014-8

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global omics lab services market size was estimated at USD 69,381.85 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 13.72% by 2030. The omics lab services market is witnessing growth due to the factors such as increasing demand/adoption for the services and increasing participation of the different companies. For instance, in October 2022, Illumina, Inc. entered into strategic partnership with AstraZeneca to accelerate drug target discovery using AI-based genomic analysis.

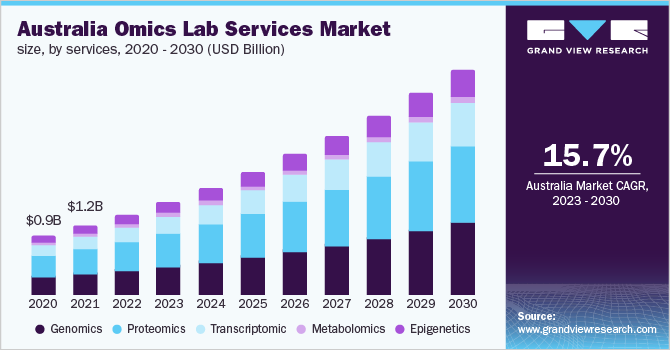

The Australia market is expected to expand at a compound annual growth rate (CAGR) of 15.74% from 2022 to 2030. Amid the pandemic, a substantial number of players are engaged in commercializing diagnostic and serological (antibody) tests for COVID-19 testing & screening, directly to the consumers. These tests can be directly purchased by the consumers, typically through the company’s website. More than a dozen companies have received EUA for their DTC kits for diagnostic purposes in response to rapidly increasing COVID-19 cases.

The COVID-19 pandemic has drawn attention to the utility and significance of genomics in healthcare. Strong collaborations between the NHS, industry, and government in the UK have made it possible to quickly apply genomics.

Moreover, growth of the genomic data pool from research activities has enabled biologists, physicians, and patients to further investigate the genetic predisposition to certain diseases. Clinical application of this data pool is expected to transform the healthcare system with respect to the provision of more accurate, effective, and reliable disease management solutions. Although clinical use of genomic data is still in nascent stage, efforts are being made by the industrial and healthcare communities to successfully incorporate genetic data into clinical workflows.

The field of oncology has benefited most from the omics research, and one newly developed use of NGS clinical tests is for the quantification of circulating tumor DNA (ctDNA) from plasma. Numerous NGS technologies, such as Cancer Personalized Profiling by deep Sequencing, may be used. High-throughput RNA sequencing developments have brought light the importance of transcriptomics in biological and clinical research. RNA sequencing using NGS technologies or microarrays is two ways to perform transcriptomics.

Omics labs have emerged as an essential tool for the prognosis, diagnosis, and treatment of a wide range of disease; however, lack of skilled professionals who have the ability to handle samples, supply chain, and logistics play a significant role in the sample sent to omics labs. Omics databases contain tens of thousands to millions of measurements at the molecular level.

Investigators typically start by performing feature selection, which involves choosing a subset of the measurements that seem to be related to the characteristic or result or that are assumed physiologically relevant, based on the past knowledge. A fully specified computational model may be created to predict the clinical outcome based on the omics measurements, using only this subset of the measurements.

Services Insights

Proteomics segment held the largest share in 2021. The growth of the omics lab services market is due to the high frequency of target diseases combined with variables, including the rising demand for the tailored medicines and better diagnostics in the treatment of targeted diseases. In addition, the market’s growth is supported by growing emphasis on the product usage in medication creation, biomarker research, and clinical diagnostics for the detection & treatment of the diseases.

The protein research being carried out to treat COVID-19 patients is also favorable for the market growth. For instance, in June 2022, scientists at the Indian Institute of Science, Bangalore, developed a unique class of synthetic peptides or miniproteins, and the researchers claim that it had the potential to neutralize viruses like SARS-CoV-2.

Epigenetics segment is expected to show the fastest growth throughout the forecast period. The growth of the segment can be attributed to the future potential offered by the epigenetic analysis. The companies operating in the omics lab services market are focusing on undertaking endeavors to broaden their product and services portfolios for this segment. For instance, in January 2022, Eisbach Bio and MD Anderson entered into a strategic collaboration for the development of medicine targeting epigenetics in oncology.

Moreover, several advancements and innovations in epigenetics is further driving the segment growth. For instance, in April 2022, PacBio announced the release of a transformative capability that could detect DNA methylation using Sequel II Systems and Sequel II. This would further enhance access to epigenetics and support gene therapy applications as well as accelerate sample preparation.

Business Insights

Diagnostic labs segment dominated the omics lab services market in 2021and is expected to expand at the fastest growth rate during the forecast period. The growth of the segment is owing to increased testing and availability of the resources for performing tests. There has been an improved reliance of the hospitals on diagnostic laboratories for testing & evaluation, which further leads to accelerated growth of the segment.

Increase in awareness about personalized medicine, rise in demand for the affordable services, and technological advancements are some of the key factors expected to boost growth of the diagnostic laboratory segment. Rise in initiatives undertaken by the government to provide various facilities, such as compensation for the diagnostic tests, is another major factor anticipated to drive the omics lab services market. Many diagnostic laboratories are working with healthcare institutes to integrate different clinical tests, such as microbiology testing.

Hospitals segment is anticipated to expand at a lucrative growth rate during the forecast period. Hospitals are an optimal healthcare setting for the diagnosis and treatment of a large spectrum of the diseases. Diagnostic centers often operate in collaboration with hospitals; hence, hospitals have an in-house diagnostic setup. Furthermore, ongoing development of the healthcare infrastructure is anticipated to enhance existing hospital facilities. Such initiatives are advantageous for the hospitals as most of the systems are installed in hospital settings, thereby reducing the time needed to send the samples to a laboratory for reference.

Frequency Of Service Insights

Continuous segment dominated the omics lab services market in 2021. The growing application of genetic technologies spans all stages of life, including the posthumous stage and old age. The application of genetic technology in healthcare raises special ethical problems that put established methods of providing treatment in jeopardy. These difficulties include the various ways that genetic information's value is defined.

Genomic tests are generally continuous, as with genetic therapy, genomic technology has a growing potential to provide revolutionary new medicines. With increasing need for the development of precision medicine, the aid of genomic testing is also growing. This was recently proven in a laboratory environment by the treatment of three fetuses with X-linked hypohidrotic ectodermal dysplasia. Prenatal intervention was used in this investigation to successfully obtain a recombinant form of the missing protein.

One-off the segment is anticipated to develop at the fastest growth rate during the forecast period. Genetic testing has become increasingly popular because the human genome was fully mapped only 15 years ago. A significant portion of this trend can be attributed to the crucial role genetic testing plays in precision medicine—a disease treatment and prevention strategy that aims to maximize effectiveness by taking individual variability in genes, environment, and lifestyle into account as well as improve next-generation sequencing methods & concurrent drops in sequencing costs.

Some genetic tests are developed to be used only once in a particular scenario. For instance, NGS technology is used by Noninvasive Prenatal Testing (NIPT). The test offers advantages over other NIPT approaches, such as targeted sequencing and array-based assays, because it evaluates cfDNA fragments across the entire genome.

Product Insights

Hardware equipment segment dominated the omics lab services market in 2021 and is anticipated to expand at the fastest growth rate during the forecast period. Miniaturization of the instruments, used in genomic applications, is expected to serve as a catalyst for the market growth. The advantages offered by miniaturized instruments are specificity, sensitivity, and automation in the development of point-of-care diagnostics.

With growing maturity in development of the micro fabrication technology, microfluidics systems are observed to be useful for the detection of different genomes. Rapid technological advancements in genomics and transcriptomics through the development of the products for human genome sequencing and single-cell sequencing have driven the segment. The instruments segment includes standard instrumentation, already used in most of the laboratories as well as novel robust tools.

Testing/Lab (Services) segment is anticipated to expand at a lucrative growth rate. The high cost of products, demand expertise required for genomics, and focus on core operations by the end users are the major factors driving the services segment. NGS-based genomics services are on a rise owing to the rapid adoption of Whole Genome Sequencing (WGS) and applications of sequence databases for disorder screening & prognosis.

However, data processing and interpretation, rather than data production, has become need for the current development and application. With NGS and other high-throughput technologies revolutionizing healthcare research and genomics, computational services are expected to witness lucrative growth during the coming years. Genomic NGS services providers, such as Eurofins Scientific, have installed different sequencing systems to offer customized services.

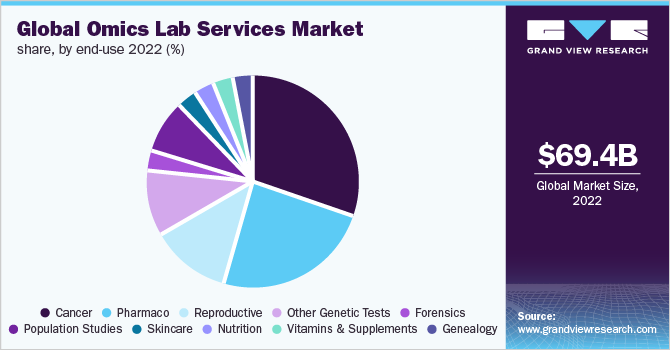

End-Use Insights

Cancer segment dominated the omics lab services market in 2021. Using multiomics methods offers a special chance to pinpoint the molecular and clinical characteristics of the cancer patients. Disentangling discrepancies in post-translational modifications or diversity in expression profiles because of the involvement of mRNA transcripts in cancer development is an example of incompatibility in linked biological processes, which has to be resolved in genomics and transcriptomics. Proteogenomic approaches can link genomic data with proteomics and knowledge of post-translational changes owing to recent developments in proteomics made possible by the maturation of various mass spectrometry techniques.

Skincare segment is anticipated to develop at the fastest growth rate during the forecast period. Omics breakthroughs, genomics, epigenetics, proteomics, metabolomics, and others are recalibrating researchers' understanding of human health, disease, and aging. Based on lifestyle and omics data, these findings could lead to more personalized skin profile & care treatments.

Although now, the use of omics in personal care and beauty products is restricted, there are tremendous prospects, notably in the area of hydration.While genetics has dominated the beauty and grooming debate in recent years, breakthroughs in genome sequencing and other Omics methods are allowing biologists to change their focus from examining isolated elements of a biological system to "mapping" the entire system.

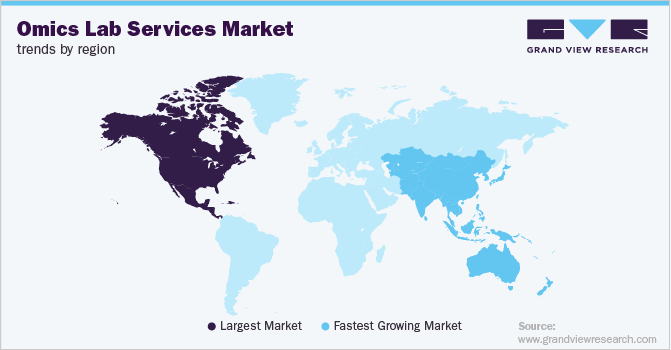

Regional Insights

North America dominated the overall omics lab services market in 2021 which can be attributed to the increasing adoption of genetic testing due to its high accuracy, sensitivity, and specificity. The increasing need for genetic testing in clinical trials related to personalized healthcare in disease areas, such as diabetes & cancer, is expected to drive market growth.The growing demand for personalized medicine, rising incidence of cancer, and the availability of cutting-edge diagnostic methods are the factors that contribute to the regional omics lab services market growth.

The requirement for creating novel therapeutics has increased as a result of the rising morbidity and mortality due to the cancer and other metabolic, autoimmune, and inflammatory disorders. For instance, according to American Cancer Society, by 2040, the global burden of cancer is expected to grow to 27.5 million, causing 16.3 million deaths, which would be aided by the increasing aging population.

Asia Pacific is estimated to show the fastest growth throughout the forecast period. The growth of the market in the region is due to increasing adoption of omics lab services. Asia Pacific is a high-potential emerging market for genomics and is anticipated to grow at the fastest CAGR during the forecast period. The need for biomarkers intended for diagnostic purposes has grown with the development of infrastructure in the region.

The market is expected to expand further as more genomics technologies are adopted and identified in developing countries, like China & India, for the treatment, diagnosis, and prognosis of various genetic illnesses, including cancer & diabetes.Moreover, growth of the region can also be attributed to the increasing incidence of chronic diseases such as diabetes, cancer, rheumatoid arthritis, and Alzheimer’s & other neurological disorders.

Asia Pacific has 50.0% of the world’s new cancer cases every year and the death rate is expected to increase by 36.0% by 2030. Besides, more than 60.0% of the people live with diabetes in Asia, with majority of the cases in India and China. This number is expected to rise to 201.8 million by 2035.

Key Companies & Market Share Insights

The key players operating in the field of omics lab services is constantly focusing on changing, introducing new technologies that enhance patient outcomes and significantly increasing the effectiveness and efficiency of the healthcare. For Instance, in October 2022, BGI-Research in collaboration with the Maternal and Child Health Hospital of Hubei Province published WGS research result, exhibiting WGS’s enhanced detection technique for the fetal CNS anomalies. Some of the key players in global Omics Lab Services Market include:

-

Agilent Technologies, Inc.

-

Beijing Genomics Institute (BGI)

-

Q2 Solutions

-

Spectrus

-

Flomics Biotech

-

PhenoSwitch Bioscience

-

QIAGEN

-

Quest Diagnostics Incorporated

-

Thermo Fisher Scientific, Inc.

-

Illumina, Inc.

Omics Lab Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 79,904.95 million

Revenue forecast in 2030

USD 194.04 billion

Growth rate

CAGR of 13.72% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in (USD million), CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Services, business, frequency of service, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Agilent Technologies, Inc.; Beijing Genomics Institute (BGI); Q2 Solutions; Spectrus; Flomics Biotech; PhenoSwitch Bioscience; QIAGEN; Quest Diagnostics Incorporated; Thermo Fisher Scientific, Inc.; Illumina, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Omics Lab Services Market Segmentation

This report forecasts revenue growth at the global, regional, & country levels along with provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global Omics Lab Services Market report based on the services, business, frequency of services, product, end-use, and region.

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Genomics

-

Proteomics

-

Transcriptomic

-

Metabolomics

-

Epigenetics

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware Equipment (Instrument, Kits, Chips)

-

Testing / Lab (Services)

-

Analytics / Interpretation (Personalization and Interpretation)

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

One-off

-

Repeat

-

Continuous

-

-

Frequency of Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Research Institutes

-

Diagnostic Labs

-

-

Business Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Pharmaco

-

Prescription

-

Non-Prescription

-

-

Reproductive

-

Other Genetic Tests

-

Forensics

-

Population Studies

-

Skincare

-

Nutrition

-

Vitamins and Supplements

-

Genealogy

-

Other Categories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East and Africa

-

-

Frequently Asked Questions About This Report

b. The global omics lab services market size was estimated at USD 69,381.85 million in 2022 and is expected to reach USD 79,904.95 million in 2023

b. The global omics lab services market is expected to grow at a compound annual growth rate of 13.72% from 2023 to 2030 to reach USD 194.04 billion by 2030.

b. North America dominated the omics lab services market with a share of 43.99% in 2021. This is attributable to the increasing adoption of genetic testing due to its high accuracy, sensitivity, and specificity.

b. Some key players operating in the omics lab services market include Agilent Technologies, Inc., Beijing Genomics Institute (BGI), Q2 Solutions, Spectrus, Flomics Biotech, PhenoSwitch Bioscience, QIAGEN, Quest Diagnostics Incorporated, Thermo Fisher Scientific, Inc., Illumina, Inc.

b. Key factors that are driving the market growth include increasing demand/adoption for services, increasing participation of different companies, and growing integration of genomics data into clinical workflow aided with rising adoption of direct-to-consumer omics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."