- Home

- »

- Automotive & Transportation

- »

-

On-Demand Transportation Market Size, Industry Report, 2018-2025GVR Report cover

![On-Demand Transportation Market Size, Share & Trends Report]()

On-Demand Transportation Market Size, Share & Trends Analysis Report By Service Type (E-Hailing, Car Rental, Car Sharing), By Vehicle Type (Four Wheeler, Micro Mobility), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-097-2

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2015 - 2016

- Forecast Period: 2018 - 2025

- Industry: Technology

Industry Insights

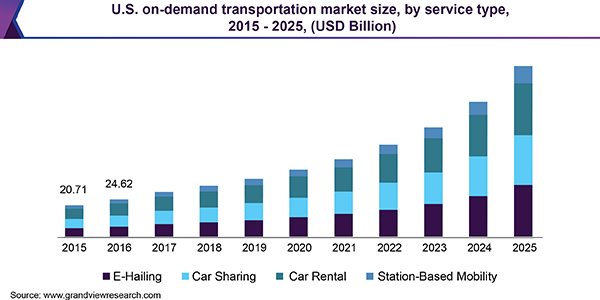

The global on-demand transportation market size was valued at USD 75.0 Billion in 2017 and is anticipated to expand at CAGR of 19.8% from 2018 to 2025. Increased problems related to traffic, growing fuel costs, and reduced parking spaces are driving market growth. Moreover, increasing penetration of smartphone and connected vehicles have elevated the adoption of on-demand transport services.

The high cost of automobiles has boosted the inclination towards on-demand services that enable users to pre-book, modify, and cancel their bookings at lower costs through applications. Surging usage of car sharing services by millennials is also expected to bolster the market growth over the forecast period.

On-demand transportation services offer the flexibility of traveling and enhanced traveling experience with practically no maintenance costs to users. Additionally, with the advent of car sharing applications; the necessity of seamless internet connectivity has become a major concern. Lack of presence of robust IT infrastructure in developing countries further hampers the progress in terms of the adoption of these services.

Car sharing applications such as Uber and Gett require seamless internet connectivity as they connect to the host server for reserving bookings of users. To enhance the customer user experience and to avoid loss of customers owing to poor internet connectivity; the service providers have developed applications that can allow the user to book a cab without internet connectivity. For instance, In October 2016, Indian e-hailing startup OLA launched OLA Offline feature that enables users to book a cab via SMS through its mobile application. Users can book a cab in a situation of no internet connection with the help of this app.

However, passenger safety has emerged as one of the most prominent restraints for the growth of the on-demand transportation market in recent years, growing passenger safety concerns have made a huge impact on market growth. The governments are concerned over such incidences and may bring in some strict regulations for passenger & driver safety. However, substandard connectivity still remains one of the prominent challenges faced by market players, especially in developing economies such as Africa, Mexico, and Middle East and Africa (MEA).

Service Type Insights

The e-hailing services is estimated to be the fastest-growing segment over the forecast period. Growing penetration of smartphones and car sharing applications are supplementing the growth. The transport development programs undertaken by several governments are expected to boost the market growth. For instance, in 2016, the government of Malaysia launched the Taxi Industry Transformation Programme (TITP), a plan that aims at modernizing and improving urban public transport.

The demand for car sharing services is anticipated to expand at CAGR of 20.0% over the forecast period. Car sharing is an economic option for daily commuters as the service allows passengers to share the total bill with co-passengers. Car rental is anticipated to gain considerable market share by 2025. All the major players are focusing on providing car rental services to gain a higher market share.

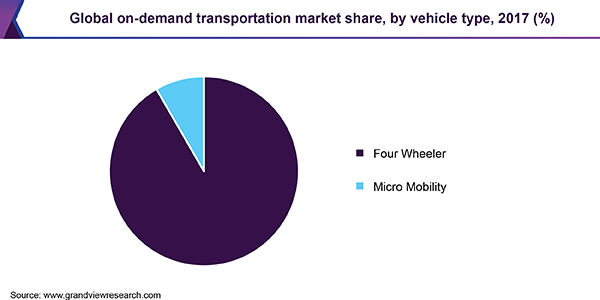

Vehicle Type Insights

Micro mobility offers numerous benefits such as reduced fuel consumption and flexible mobility. Additionally, it allows improved cost and energy efficiency, which is impelling users to opt for this vehicle type. Increasing stringency of environmental regulations coupled with growing traffic congestion is anticipated to encourage users to adopt micro-mobility over the forecast period. As a result, the segment is poised to expand at the highest CAGR from 2018 to 2025.

However, the four-wheeler segment offers benefits such as reduced noise pollution and enhanced comforting experience which proves essential in developed countries. Additionally, rising consumer disposable income in countries such as India and China are contributing to growth. Thus, the segment is projected to maintain its lead throughout the forecast period.

Regional Insights

Based on region, the market has been segmented into North America, Europe, Asia Pacific, and Rest of the World (RoW). Factors such as consumer behavior, rising disposable income, and fuel prices, and government initiatives play a pivotal role in influencing the growth across different regions. In 2017, Asia Pacific was the dominant regional segment followed by North America and Europe. The presence of major players coupled with their efforts to deliver efficient driverless shuttles across North America will continue to foster growth.

The market has observed high adoption in European countries such as France and Germany. A supportive regulatory framework is propelling the regional market. In Asia Pacific, increasing fuel prices, traffic congestions, and emission standards are supporting the growth of the market. By 2025, Asia Pacific is expected to rise to the forefront of the market.

On-Demand Transportation Market Share Insights

Prominent participants operating in the market include International Business Machines Corporation (IBM); BMW Group; Daimler Group; Ford Motor Company; General Motor Company; Gett, Inc.; and Robert Bosch GmbH. The key companies are focusing on collaborations with other players and are also making substantial investments in R&D to develop innovative solutions to gain a competitive edge over others.

However, the market leaders are facing stiff competition from emerging players, for instance, the Indian e-hailing company OLA recently expressed a strong interest in expanding its operations in Australia and New Zealand. The market players have adopted mergers and acquisitions as the key strategy to gain momentum in the market. For instance, in 2015, BMW Group, Audi AG, and Daimler Group acquired HERE, Nokia’s digital mapping and location business, for USD 3.1 Billion. The acquisition was aimed to strengthen the BMW Group’s mapping capabilities.

Report Scope

Attribute

Details

Base year for estimation

2017

Actual estimates/Historical data

2015 - 2016

Forecast period

2018 - 2025

Market representation

Revenue in USD Billion and CAGR from 2018 to 2025

Regional scope

North America, Europe, Asia Pacific, Rest of World

Country scope

U.S., Canada, Germany, France, China, Japan, South Korea

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global on-demand transportation market report on the basis of service type, vehicle type, and region:

-

Service Type Outlook (Revenue, USD Billion, 2015 - 2025)

-

E-Hailing

-

Car Sharing

-

Car Rental

-

Station-Based Mobility

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2015 - 2025)

-

Four Wheeler

-

Micro Mobility

-

-

Regional Outlook (Revenue, USD Billion, 2015 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Rest of the World

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."