- Home

- »

- Communication Services

- »

-

Online Food Delivery Services Market, Industry Report, 2030GVR Report cover

![Online Food Delivery Services Market Size, Share & Trends Report]()

Online Food Delivery Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Restaurant-to-Consumer, Platform-to-Consumer), By Channel (Website/Desktop, Mobile Applications), By Payment Method, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-735-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Online Food Delivery Services Market Summary

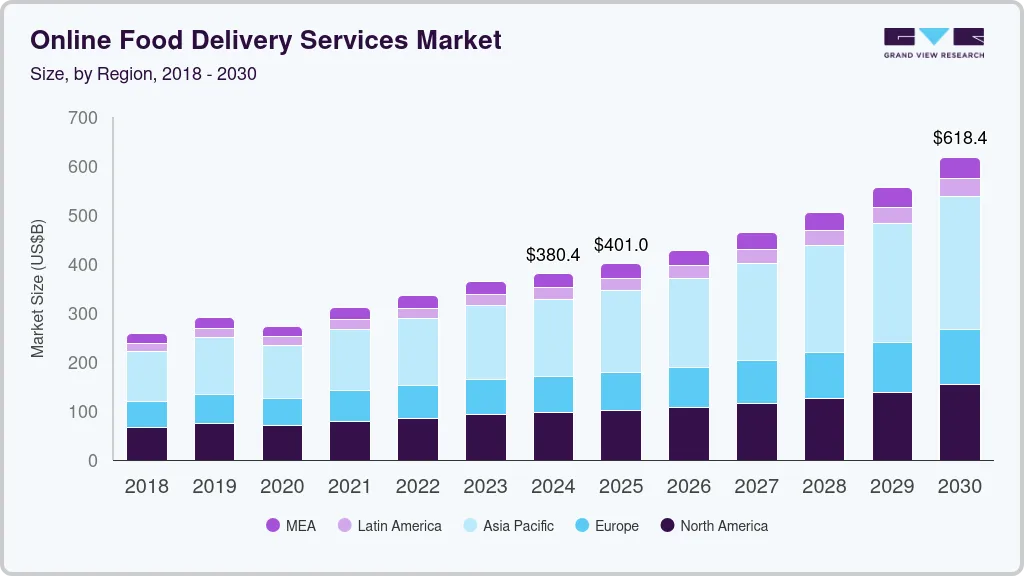

The global online food delivery services market size was estimated at USD 380.43 billion in 2024 and is projected to reach USD 618.36 billion by 2030, growing at a CAGR of 9.0% from 2025 to 2030. The growth of the market is fueled by technological advancements, urbanization, and changing consumer lifestyles.

Key Market Trends & Insights

- North America online food delivery services market held a significant share of over 25% in 2024.

- The online food delivery services market in the U.S. is expected to grow significantly from 2025 to 2030.

- By type, the platform-to-consumer segment held a market share of over 73% in 2024.

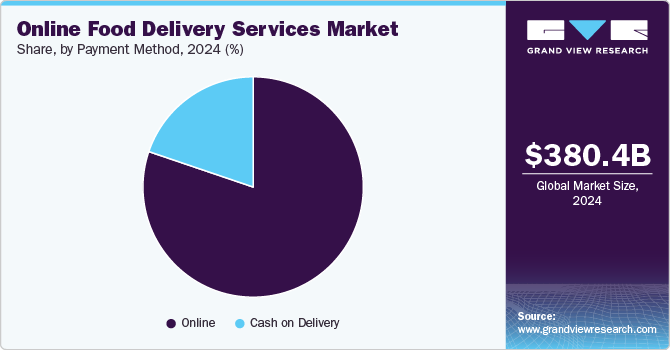

- By payment method, the online payment segment accounted for the largest market share of over 79% in 2024.

- By channel, the mobile channel segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 380.43 Billion

- 2030 Projected Market Size: USD 618.36 Billion

- CAGR (2025-2030): 9.0%

- North America: Largest market in 2024

The widespread adoption of smartphones and high-speed internet connectivity has made online ordering seamless and accessible. This convenience resonates with urban consumers who seek quick meal solutions without the hassle of cooking or dining out. In addition, the emergence of cloud kitchens, which operate without traditional dine-in spaces, has reduced operational costs and enabled restaurants to focus solely on delivery, further boosting market scalability.

Strategic partnerships between food delivery platforms and restaurants have expanded menu options, enhancing the overall customer experience. Evolving payment solutions, including digital wallets and contactless payments, have simplified transactions, encouraging more users to adopt online food delivery. The COVID-19 pandemic also played a pivotal role in accelerating this market, as consumers preferred contactless delivery due to safety concerns. Together, these factors have created a robust ecosystem that continues to attract investments and drive market growth.

The growing number of dual-income families and changing lifestyles & eating patterns are anticipated to favor market growth over the forecast period. Furthermore, the growing demand for quick access to food at affordable prices is also driving the market growth. Benefits offered by online delivery services include attractive discounts, rewards & cashback offers, doorstep delivery, and multiple payment options. Furthermore, providers of food services are setting up large warehouses to store fresh produce for offering high-quality food and encouraging the adoption of online delivery services.

Subscription models, offering benefits like free deliveries and exclusive discounts, are gaining traction as platforms focus on customer retention. The rise of "dark kitchens" or "virtual kitchens," dedicated solely to delivery operations, represents a significant shift in the restaurant industry. These models are cost-effective and cater to the growing demand for variety and convenience. The integration of AI-driven chatbots and voice assistants enables seamless ordering processes, enhancing user experience. Furthermore, gamification features, such as reward points and interactive promotions, keep customers engaged. Personalization, powered by data analytics, allows platforms to offer tailored recommendations based on user behavior. Regional cuisines and local flavors are also gaining prominence, catering to diverse customer bases.

Intense competition among key players has led to aggressive pricing strategies, pressuring profit margins. High delivery costs, including fuel expenses and driver wages, pose ongoing challenges, especially as platforms strive to maintain affordability. Regulatory hurdles, such as labor laws and taxation, add complexities to operations. Consumer concerns about food quality, packaging sustainability, and data privacy also act as potential deterrents. In addition, dependency on third-party delivery drivers raises issues of service inconsistency, impacting customer satisfaction.

Type Insights

The platform-to-consumer segment held a market share of over 73% in 2024. Consumer demand for convenience drives the growth of the Platform-to-Consumer (P2C) segment as busy lifestyles and time constraints make hassle-free meal solutions increasingly appealing. P2C platforms allow customers to order food directly to their doorsteps, eliminating the need for cooking or dining out. Urban areas, where fast-paced living is common, see particularly high adoption. These platforms offer access to a wide variety of cuisines through a single app, catering to diverse tastes and dietary preferences. The seamless experience, from browsing to delivery, resonates with consumers seeking quick, reliable, and personalized meal options, fueling the segment’s rapid expansion.

The restaurant-to-consumer segment is anticipated to grow at a significant CAGR of 5.8% during the forecast period. Managing delivery in-house enables restaurants to bypass the high commission fees charged by third-party platforms, making the Restaurant-to-Consumer (R2C) model more cost-effective. This cost-saving benefit is particularly attractive to established chains with robust delivery infrastructure. The players operating with this model offer loyalty and subscription programs to consumers to penetrate the market. Integrating several restaurant chains with aggregators such as DoorDash further drives the segment growth.

Payment Method Insights

The online payment segment accounted for the largest market share of over 79% in 2024. The global shift toward digital payment methods has played a significant role in boosting the online payment segment. With the increasing use of credit/debit cards, digital wallets (such as PayPal, Apple Pay, Google Pay), UPI, and other cashless options, consumers now find it easier to pay for food deliveries. The convenience of completing transactions quickly and securely, without the need for cash handling, has made digital payments the preferred method. As consumers are becoming more comfortable with online payments with their growing acceptance, the segment experiences ongoing expansion, offering both consumers and businesses a seamless, efficient, and secure payment experience.

The cash on delivery segment is expected to grow at a significant CAGR during the forecast period. In regions with limited digital payment adoption or consumer hesitation, Cash on Delivery (COD) offers a trusted, familiar alternative. Especially in developing countries, paying with cash upon delivery provides consumers with control over spending and eliminates concerns about online payment fraud or security risks. This payment method fosters trust, allowing customers to feel more confident in their transactions, particularly when they are unfamiliar or uncomfortable with digital payment systems.

Channel Insights

The mobile channel segment held the largest market share in 2024. The widespread adoption of smartphones has revolutionized the online food delivery industry, positioning mobile channels as the primary channel for placing orders. As smartphone penetration continues to grow globally, more people have access to the convenience of food delivery apps. Affordable internet access has further accelerated this trend, enabling seamless connectivity and accessibility for users across urban and rural areas. Consumers from various demographics rely on mobile apps for their intuitive design, speed, and reliability. These apps provide a hassle-free way to browse menus, customize orders, and complete transactions. The ease of ordering via smartphones aligns with modern lifestyles, making mobile channels indispensable in the food delivery ecosystem.

The websites/desktop segment is expected to grow at a significant rate during the forecast period. The growth of the desktop segment can be attributed to the increasing number of restaurants that are endeavoring to increase foot traffic by expanding their online presence through websites. The growth of e-commerce further fuels the adoption of the website/desktop channel for ordering food online. In addition, the integration of AI/VR in desktops/laptops is also expected to propel the segment's growth.

Regional Insights

North America online food delivery services market held a significant share of over 25% in 2024. In North America, the growing demand for convenience is a key driver of the online food delivery services industry. Urban consumers, with their hectic schedules and time constraints, increasingly seek solutions that save time and effort. The ability to order food from home or work, without having to cook or dine out aligns perfectly with the desire for convenience. With busy lifestyles, North Americans are more inclined to use on-demand services, allowing them to satisfy their food cravings effortlessly. This preference for ease and speed has contributed to the widespread popularity of online food delivery services, making them an integral part of modern living in the region.

U.S. Online Food Delivery Services Market Trends

The online food delivery services market in the U.S. is expected to grow significantly from 2025 to 2030. The growth of major food delivery platforms like DoorDash, Uber Eats, and Grubhub in the U.S. is driven by their expanding restaurant networks and delivery capabilities. Strategic partnerships with national chains and local eateries provide consumers with a wider variety of food options and enhance accessibility. This expansion allows these platforms to cater to a broader customer base, increasing demand and solidifying their dominance in the online food delivery market.

Europe Online Food Delivery Services Market Trends

The online food delivery services market in Europe is growing significantly at a CAGR of over 7.7% from 2025 to 2030. Urbanization in Europe is driving the growth of online food delivery services, as more people live in cities where demand for convenience is high. In addition, younger, tech-savvy consumers in these urban areas are more inclined to use mobile apps and digital services, making them a key demographic for food delivery platforms. This trend boosts market growth as younger generations prioritize quick, on-demand solutions for their busy lifestyles.

The UK online food delivery services market is expected to grow rapidly in the coming years. Consumers in the UK are becoming more health-conscious, with an increasing preference for healthier, sustainable food choices. Online food delivery services have responded by offering a variety of healthier options, including plant-based, gluten-free, and organic meals. This trend is attracting a larger customer base that prioritizes both convenience and health.

The online food delivery services market in Germany held a substantial market share in 2024. With a high level of urbanization and a dense population in cities like Berlin, Munich, and Hamburg, the demand for food delivery services in Germany is increasing. Urban residents are more likely to use online food delivery due to time constraints, making it easier for platforms to scale and reach a larger audience in metropolitan areas.

Asia Pacific Online Food Delivery Services Market Trends

The online food delivery services market in the Asia Pacific is growing significantly at a CAGR of over 10.1% from 2025 to 2030. Leading food delivery platforms like Foodpanda, Zomato, Uber Eats, and Deliveroo are expanding rapidly across the Asia Pacific region, forming partnerships with local restaurants and eateries to increase their reach and service offerings. This expansion enables consumers to access a broader range of food choices, enhancing their experience and encouraging frequent use. In addition, regional players such as Swiggy in India and Meituan in China have strengthened the competitive landscape, offering localized options that cater to cultural and culinary preferences. The growing competition and diverse food options available through these platforms are driving market growth as consumers benefit from enhanced convenience, variety, and accessibility.

The China online food delivery services market held a substantial revenue share in 2024. The Chinese government has been supportive of the development of the digital economy, including the online food delivery sector. Policies aimed at improving digital infrastructure, logistics, and e-commerce have helped create an environment conducive to the growth of online food delivery services.

The Japan online food delivery services market held a substantial market share in 2024. Japan has a rising number of single-person households, particularly in urban centers like Tokyo and Osaka. Many of these individuals seek convenience, and online food delivery services provide an ideal solution, allowing them to enjoy restaurant-quality meals without the need to cook. The growth of this demographic supports the expansion of the online food delivery market.

The online food delivery services market in India is growing rapidly due to increasing urbanization, with millions of people moving to cities, particularly in regions like Delhi, Mumbai, and Bangalore. These cities offer busy lifestyles, where convenience-driven services like online food delivery are in high demand. As more people live in fast-paced urban environments, the need for time-saving solutions like food delivery continues to grow.

Key Online Food Delivery Services Company Insights

Some of the key market players in the global online food delivery services industry include Deliveroo PLC, DoorDash Inc., and Delivery Hero Group. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives:

-

In December 2024, Swiggy announced the expansion of its 10-minute food delivery service, Bolt, to tier 2 and 3 cities, including Roorkee, Patna, and Nashik. This initiative aims to enhance market share by offering rapid delivery options in smaller urban areas.

-

In November 2024, Wonder completed the acquisition of Grubhub, a leading food ordering and delivery platform with over 375,000 merchants and 200,000 delivery partners across the U.S. This acquisition, valued at USD 650 million, aims to integrate Grubhub's extensive network with Wonder's innovative food hall concept, enhancing customer access to a diverse range of dining options.

Key Online Food Delivery Services Companies:

The following are the leading companies in the online food delivery services market. These companies collectively hold the largest market share and dictate industry trends.

- Deliveroo PLC

- DoorDash Inc.

- Delivery Hero Group

- Just Eat Limited

- Uber Technologies Inc.

- Swiggy

- Zomato

- Delivery.com LLC

- Yelp Inc.

- Amazon.com Inc.

- Rappi Inc.

Online Food Delivery Services Market Report Scope

Report Attribute

Details

Market size in 2025

USD 400.98 billion

Market Size forecast in 2030

USD 618.36 billion

Growth Rate

CAGR of 9.0% from 2025 to 2030

Actual data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Market size in USD billion and CAGR from 2025 to 2030

Report coverage

Market size forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, channel, payment method, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, and South Africa

Key companies profiled

Deliveroo PLC; DoorDash Inc.; Delivery Hero Group; Just Eat Limited; Uber Technologies Inc.; Swiggy; Zomato; Delivery.com LLC; Yelp Inc.; Amazon.com Inc.; Rappi Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Online Food Delivery Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global online food delivery services market report based on type, channel, payment method, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Restaurant-to-Consumer

-

Platform-to-Consumer

-

-

Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Websites/Desktop

-

Mobile Applications

-

-

Payment Method Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cash on Delivery

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.