- Home

- »

- Digital Media

- »

-

Online On-demand Home Services Market Size Report, 2030GVR Report cover

![Online On-demand Home Services Market Size, Share & Trends Report]()

Online On-demand Home Services Market Size, Share & Trends Analysis Report By Platform (Web, Mobile), By Type (Home Cleaning, Repairs & Maintenance, Health & Wellness), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-001-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

Report Overview

The global online on-demand home services market size was estimated at USD 3.71 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 16.7% from 2022 to 2030. Online on-demand home services contain all digital market places that offer timely access to a broad range of home facilities. The worldwide requirement for these types of facilities is rising owing to the ease of accessibility and convenience provided by these facilities. Similarly, these platforms link consumers with service providers and manage payment and billing transactions, which makes the payment process easier for customers. The rising number of advertising and marketing campaigns is a trend that will contribute to market growth.

Presently, vendors in the global market are launching advertisement campaigns through different platforms to generate customer awareness and retain a solid customer base. They have started using multiple strategic marketing tools to gain customers' attention. For example, companies like TATA, Amazon Home Services, Angi Inc., etc. ensure the quality of assistance under their Happiness Guarantee scheme. The company pays an amount as compensation if they fail to deliver quality service. Thus, the emphasis on casting new advertisement campaigns by retailers is expected to move the growth of the global market during the forecast period.

In August 2022, Amazon planned to add mental health support to its primary-care service. Amazon Care, Amazon's primary-care service, intended to add behavioral health aid to its growing list of medical partners and offerings with Ginger, a mental health care provider. This facility will deliver Amazon Care users online access to mental health professionals, like licensed psychiatrists or therapists. The move would observe the latest expansion of Amazon's nascent primary-care business, which shows on-demand virtual care with the help of an app, uniting people with physicians for immediate care demand. In July 2022, the company announced plans to acquire One Medical for USD 3.9 billion.

The industry has remarkably evolved across the U.S. and Europe owing to the easy accessibility of products and services and quick payment options, which have been crucial factors affecting the market positively. The Asia Pacific is another important region that is also expanding rapidly compared to other global markets. India, China, and Korea are a few crucial countries contributing to the growth in the market. Rising internet penetration and the evolution of technologically progressive apps to deliver timely services have been key factors fueling the requirement for these facilities in the Asia Pacific market.

COVID-19 Impact on the Online On-demand Home Services Market

The recent outbreak of COVID-19 had an immense effect on the online on-demand home services market. Even though the epidemic damaged the world economy, demand for cloud computing increased due to the pandemic. As a result, significant players took full benefit of the crisis to create ways to reform their business models. There was the rapid growth of the e-commerce platform, which essentially aided the boost in market growth. Further, during the pandemic, a large population was inclined towards digitalization and essentially adopted smartphones, which resulted in high internet penetration. Thus, the market witnessed a heightening requirement even during the pandemic. Hence, the increased demand during the lockdown restrictions has primarily helped the market gain traction.

Urban Company, an unorganized local services industry in India, reported that the COVID-19 pandemic has positively affected the demand for on-demand services in the UAE. The pandemic has catalyzed the need for high-quality professional and hygienic home services at affordable prices across the world. In the UAE, the industry is nascent, but its growth revved during the pandemic due to increased concern for health and hygiene. There was a high demand for part-time cleaners, salons, and wellness services in the UAE during the pandemic.

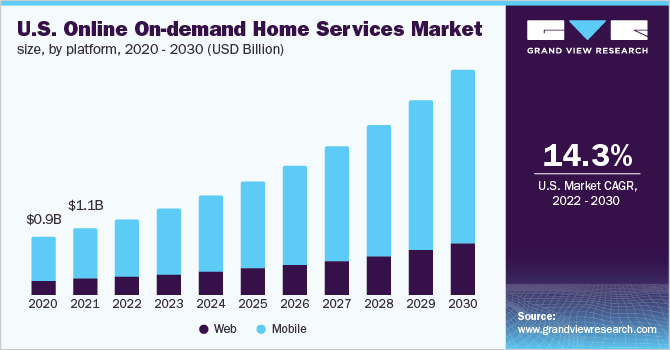

Platform Insights

The mobile segment dominated the overall market, gaining a market share of 72.0% in 2021 and witnessing a CAGR of 17.1% during the forecast period. The increasing usage of smartphones and their increasing demand and applications has also played a significant part in enhancing the demand for this market. It is expected that the rising demand for more comfortable accessibility of products is possible to pave the way for more opportunities in the near future. An on-demand home service app helps people in organizing their busy lives. These mobile applications allow people to hire someone to handle their household or daily chores where they need constant help. It could include plumbing, cleaning, moving, painting, and organization.

On-demand service websites enable people to hire someone to manage household chores and tedious tasks, including plumbing, cleaning, moving and storage, and painting. On the other hand, it also delivers a source of constant and high revenue to on-demand website development companies. Companies like Zimmber and Timesaverz offer facilities like pest control, plumbing, carpentry, sofa cleaning and cleaning, laundry, home spa, electrical repairs, etc., through their websites.

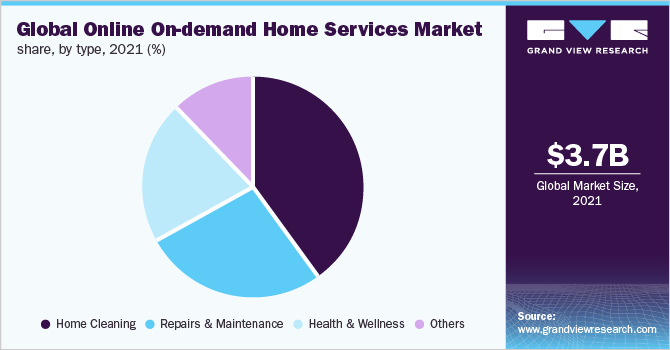

Type Insights

The home cleaning type segment is expected to dominate in 2021, gaining a market share of 40%. It is expected to witness the fastest CAGR of 16.8% throughout the forecast period. Online on-demand home cleaning is dominating the home services market. Users need to use the app to book a cleaning, which has opened up the doors for cleaners. The cleaners can now register with the app to find a new pool of opportunities to make high revenue.

The health and welfare segment is anticipated to witness a considerable CAGR of 17.7% throughout the forecast period. The demand for healthcare on-demand will increase in recent years. Healthcare apps enable people to hire on-demand fitness and yoga trainer who can provide them with fitness and yoga training in person. In August 2022, Amazon planned to add mental health support to its primary-care service. Amazon Care, Amazon's primary-care service, intended to add behavioral health aid to its growing list of medical partners and offerings with Ginger, a mental health care provider. This service will deliver Amazon Care users on-demand access to mental health professionals, like licensed psychiatrists or therapists.

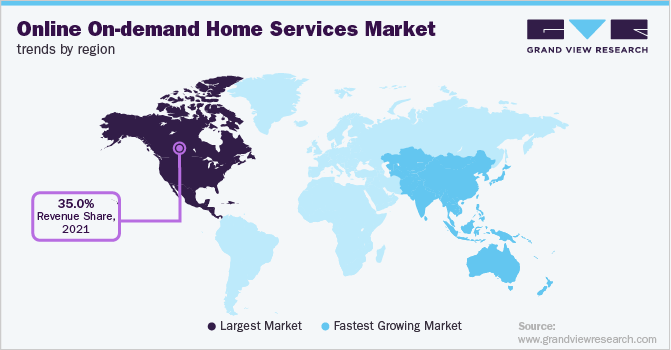

Regional Insights

North America led the overall market and accounted for a revenue share of 35.0% in 2021. Easier accessibility of products and services and quick payment options have been crucial factors to affect the market positively. Home services span various industrial needs, such as upgrades, servicing, and restoration, home renovation, etc. If the number of facilities offered by the home services sector rises, the scope also thus rises. Home services contain various intangible assets that are supplied by businesses for homes. With technological growth, both mobile and online booking platforms are growing. Home services are a more streamlined and convenient way of arranging and purchasing skilled services. Today's generation is the largest consumer of internet services, which has widened the home services business scope. Customers' busy lifestyle is causing them to choose providers on demand, which has broadened the bandwidth in the industry's growth for the upcoming years.

Asia Pacific is expected to develop substantially by the projection period and witness a CAGR of 19.2%. India, China, and South Korea are a few essential countries contributing to the increase in market demand. Rising internet penetration and the development of technologically developed apps to deliver timely services have fueled the demand for online on-demand home services in the Asia Pacific market. Factors such as the increasing inclination of the present generation toward exploring new career possibilities and the growth in urbanization have mainly contributed to their busy lifestyle, especially in metro cities across Asian countries. Professional stress leaves individuals with a short time to take care of household work such as repairing, cleaning, and maintenance operations or a family outing. This has subsequently increased the demand for online on-demand home services in Asian countries.

Key Companies & Market Share Insights

The market is fragmented and is anticipated to witness increased competition due to the presence of a large number of players. Major players are spending heavily on research and development activities to increase their efficiency in the various on-demand home services, which has intensified the competition among them. These players are focusing on offering good home services at a cheaper rate. For example, Amazon Home Services ensures its quality of assistance under the Happiness Guarantee. The company pays an amount as compensation if they fail to deliver quality service. Some of the prominent players in the global online on-demand home services market include:

-

Amazon.com, Inc.

-

Angi Inc.

-

Handy

-

Helpling

-

HomeAdvisor

-

HouseJoy

-

Task Easy

-

TaskRabbit

-

Thumbtack

-

Urban Company

Online On-demand Home Services Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4,300.1 million

Revenue forecast in 2030

USD 14.7 billion

Growth rate

CAGR of 16.7% from 2022 to 2030

Base Year

2021

Historic year

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Mexico

Key companies profiled

Amazon.com, Inc.; Angi Inc.; Handy; Helpling, HomeAdvisor; HouseJoy; Task Easy; TaskRabbit; Thumbtack; Urban Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

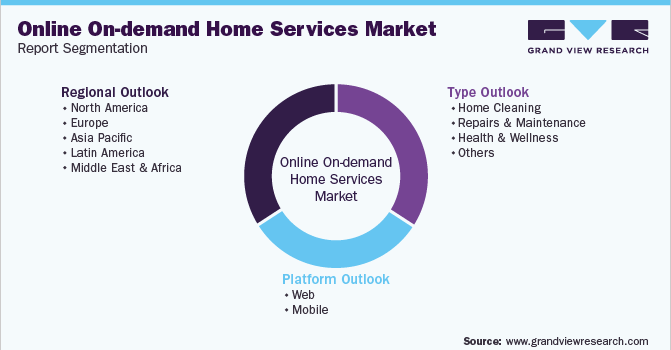

Global Online On-demand Home Services Market Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global online on-demand home services market report based on platform, type, and region:

-

Platform Outlook (Revenue, USD Million, 2017 - 2030)

-

Web

-

Mobile

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Home Cleaning

-

Garden and Lawn Mowing

-

Maids

-

Laundry

-

Car Wash

-

Pest Control

-

Others

-

-

Repairs and Maintenance

-

Plumbing

-

Electrical

-

Carpentry

-

Laptop Repair

-

Mobile Repair

-

Others

-

-

Health and Wellness

-

Beauty/Salon Services

-

Fitness Coach

-

Physiotherapy

-

Others

-

-

Others

-

Babysitting

-

Pet Care

-

Packing and Moving

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global Online On-demand Home Services market size was estimated at USD 3,708.6 million in 2021 and is expected to reach USD 4,300.1 million in 2022.

b. The global Online On-demand Home Services market is expected to grow at a compound annual growth rate of 16.7% from 2022 to 2030 to reach USD 14.7 billion by 2030.

b. North America dominated the Online On-demand Home Services market with a share of 35.4% in 2021. This is attributable to the easier accessibility of products & services and quick payment options.

b. Some key players operating in the Online On-demand Home Services market include Amazon.com, Inc., Angi Inc., Handy, Helpling, HomeAdvisor, HouseJoy, Task Easy, TaskRabbit, Thumbtack, and Urban Company, among others.

b. Key factors that are driving the Online On-demand Home Services market growth include the ease of accessibility and convenience provided by these facilities. Similarly, these platforms link consumers with service providers and manage payment and billing transactions, which makes the payment process easier for customers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."